MH Daily Bulletin: September 19

News relevant to the plastics industry:

At M. Holland

- M. Holland’s Puerto Rico office is closed this week due to the impact of Hurricane Fiona.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil rose slightly on Friday but ended the week down 2%. Futures have fallen about 20% so far this quarter, the biggest decline since the beginning of the pandemic.

- In mid-morning trading today, WTI futures were down 0.5% at $84.59/bbl, Brent was down 0.5% at $90.86/bbl, and U.S. natural gas was up 0.7% at $7.82/MMBtu.

- U.S. crude supply is headed for an increase after energy firms added oil and gas drilling rigs for the first time in three weeks, Baker Hughes said.

- Private producers in the Permian Basin are expected to scale back their torrid production growth, lacking capital and scale after tapping their best drilling locations.

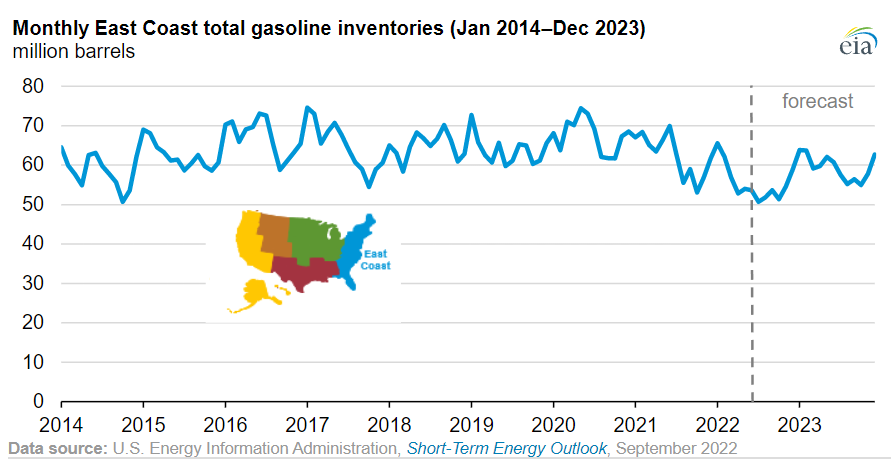

- U.S. gasoline inventories on the East Coast fell to the lowest in eight years this summer due largely to greater competition for fuel from foreign buyers.

- Oil exports from Iraq’s 3.3-million-bpd Basra terminal are gradually resuming after being halted late last week due to a spillage.

- A massive oil field in Kazakhstan will not resume full production until at least October after a gas leak forced a shutdown in early August.

- Refinery throughput in China, the world’s top crude importer, slumped 6.5% in August to one of the lowest levels of the pandemic on the impacts of facility outages and lower margins. The nation’s gasoline exports, however, almost doubled from a year ago as domestic demand faltered.

- More oil news related to the war in Europe:

- Russia’s economic campaign to weaken Western support for Ukraine is faltering as energy prices ease and it appears Europe will make it through winter without running out of natural gas.

- France’s grid operator issued a “red” alert indicating power supplies are at their limit and may soon need to be rationed.

- Russia could find new markets for about half of the crude exports that will be banned by the EU beginning in December, according to data firm Kpler.

- Hungary extended price caps on fuels and basic foodstuff by three months until the end of the year to shield households from soaring costs.

- One of four main power lines at the Russian-held Zaporizhzhia nuclear plant is supplying Ukraine’s grid with electricity for the first time in two weeks after being repaired from shelling damage.

- California scrapped a rule allowing utilities to bill customers for the cost of extending natural gas lines to new buildings, a change meant to speed progress toward the state’s climate goals.

- Delta Air Lines’ Monroe refinery in Pennsylvania is preparing to process biofuels from renewable feedstocks at its Pennsylvania refinery, which could save the airline hundreds of millions of dollars in required Renewable Fuel Standard credit spending.

- A judge in Louisiana vacated air permits for Formosa’s planned $9 billion petrochemicals complex in St. James Parish, a win for environmental and community groups opposed to the project.

Supply Chain

- Puerto Rico is under a federal emergency declaration after Hurricane Fiona struck on Sunday, cutting power to the entire island of 3.1 million people.

- Japan issued its highest disaster alert, Level 5, and ordered 8 million residents to evacuate in advance of Typhoon Nanmadol, expected to be the region’s most destructive storm in decades.

- A magnitude 6.8 earthquake struck southeastern Taiwan on Sunday, causing building damage, derailing a train and triggering concerns of a tsunami.

- The key issue that almost triggered a U.S. railroad strike last week was sick leave, not wages, highlighting broadening worker demands in a historically tight labor market.

- With a U.S. rail strike likely averted, looming contract negotiations for some 700,000 workers in other industries could prove disruptive, including 350,000 at UPS, about 200,000 airline employees and 150,000 auto workers.

- Dockworkers at the U.K.’s Port of Felixstowe overwhelmingly rejected a new contract offer, setting the stage for another walkout as soon as Sept. 27.

- The Port of Long Beach moved more cargo than Los Angeles in its second busiest August on record, with total volume hitting 806,940 TEUs. Los Angeles moved roughly 806,000 TEUs, 15% less than the same time last year on a 17% decline in container imports.

- Spot rates for outbound trucks at U.S. ports dropped rapidly in August.

- Shares of FedEx fell as much as 24% on Friday after the firm pulled its full-year forecast and said it is experiencing a global demand slowdown.

- The global ship finance market expanded last year for the first time since 2010 as demand surged across all shipping sectors apart from tankers.

- With 21 orders for LNG carriers in August, South Korea’s Daewoo Shipbuilding has already committed 92% of its annual order target of $8.9 billion.

- Boeing is considering replacing its aging 767 freighter with a new cargo version of its 787 Dreamliner on strong forward prospects for the air freight market.

- 3M opened a freight hub near South Carolina’s Port of Charleston to consolidate goods for export to Asia.

- In the latest news from the auto industry:

- Stellantis and Renault will partly halt production at plants in Spain in the coming days due to computer chip shortages.

- U.S. sales of electric vehicles tripled to 6% of total car sales in the last two years, while sales of other types of vehicles all declined, according to Motor Intelligence.

- Europe’s new-car market returned to growth in August for the first time in 13 months, with registrations rising 3.4%, including a sharp gain for Mercedes.

- Tesla plans to double vehicle sales in Germany this year to around 80,000 units.

- Lithium prices tripled the past year to an all-time high of $71,400 a ton, spurred by strong demand for electric vehicles and lower production in China.

- Audi says it is unable to keep up with customer demand for its electric vehicles due to supply chain challenges.

- Big freight truck-makers like Daimler Truck and Volvo are investing heavily in hydrogen fuel cells as batteries weigh too much to make electric trucks viable. Challenges are also posed by the lack of electric-vehicle charging infrastructure and production capacity.

- Volkswagen could make $400 million in trading profits as it offloads a massive purchase of natural gas back into the German market.

- BMW says it will use recycled marine plastics for interior and exterior trims in some vehicles by 2025.

- Bridgestone Americas will invest $42 million by 2030 to scale production of a rubber alternative sourced from latex-rich desert shrubs.

- Tata Group is in talks with a Taiwanese supplier to Apple to build an electronics manufacturing joint venture in India.

- Ad spending in the U.S. auto industry fell 4% the first seven months of 2022 as inventory shortages crimped sales.

- A unit of China’s top lithium producer Ganfeng Lithium is raising prices for small batteries used in consumer electronics, citing a large increase in raw material costs.

- Swedish home-appliance manufacturer Electrolux is making steep cost cuts that will target its supply chain and production following a warning of a sharp drop in demand for washers and dryers.

- Up to 33% of British firms that exported goods to the EU were driven out of business between 2020 and 2021 by Brexit, economists estimate.

- China’s installations of industrial robots surged 45% last year to more than 243,000, almost as many as the rest of the world combined.

- A total of 165 grain-laden ships have left Ukraine under a deal brokered by the UN several weeks ago, officials said.

Domestic Markets

- The U.S. reported 60,831 new COVID-19 infections and 391 virus fatalities Sunday.

- Over 3.7 million people rode on public transit in New York City last Wednesday, the highest of the pandemic.

- More than half of U.S. hospitals expect to lose money this year due to labor shortages and sharply higher costs, experts say.

- The Federal Reserve is widely expected to raise its benchmark overnight interest rate by 75 basis points at a two-day meeting that kicks off Tuesday.

- Goldman Sachs cut its 2023 growth projection for U.S. GDP to 1.1% from its previous 1.5% forecast.

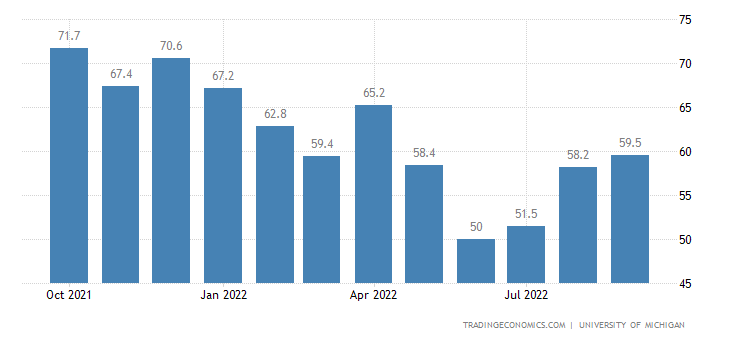

- U.S. consumer sentiment rose over a point to a five-month high of 59.5 in September, according to the University of Michigan’s widely tracked index.

- U.S. fund managers increased their average cash balances to 6.1% in September, the highest level in more than two decades as market woes lead investors to seek refuge in cash.

- U.S. banking regulators are considering new rules that would require big regional banks to add financial cushions for times of crisis.

- U.S. business-class airfares have risen 45% this year, with some ticket prices more than doubling from pre-pandemic levels as demand remains strong.

- U.S. travel spending by foreign tourists recovered to $7.4 billion in July, roughly 65% of pre-pandemic levels, according to the Commerce Department.

- U.S. sales at electronics and appliance stores fell 5.7% year over year in August as the cooling housing market hit demand for appliances.

International Markets

- COVID-19 infection rates in France spiked 12% last week as health officials warned of a resurgence in cases.

- The southwestern Chinese city of Chengdu will resume production and services starting today after more than two weeks of COVID-19 lockdowns.

- Japan is prepping to join other top Asia-Pacific destinations in fully reopening to tourism in the coming weeks.

- Two of the pandemic’s earliest COVID-19 antiviral treatments are no longer recommended by the WTO as new virus strains render them obsolete.

- Few industries or regions of the world are exempt from soaring inflation.

- Economists expect the European Central Bank to raise interest rates into next year as the bloc’s inflation approaches double-digit territory.

- The U.S. dollar’s surging value threatens to make worse a global economic slowdown led by rising interest rates, economists say. Last week, the British pound fell to a 37-year low against the dollar while the Canadian dollar weakened to its lowest level in nearly two years.

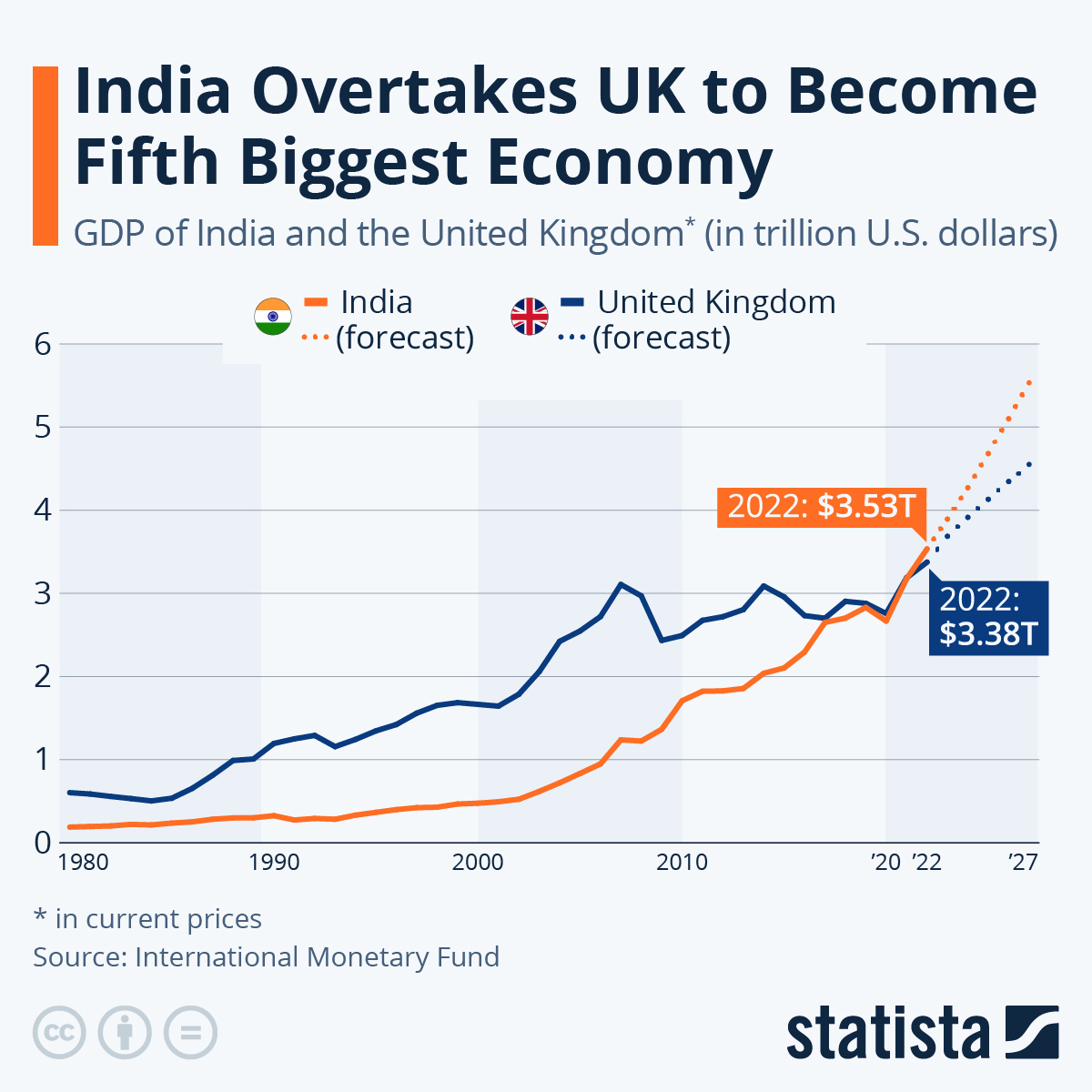

- Reeling from a cost-of-living crisis, Britain’s economy was recently overtaken by India as the fifth-largest in the world.

- China’s commitment to zero-COVID is draining local government coffers already reeling from falling land sales.

- Home prices in Hong Kong, the world’s most expensive housing market, are set to drop to a five-year low as surging borrowing costs reduce demand.

- Cathay Pacific Airways expects to fly one-third of its pre-pandemic capacity by the end of the year as Hong Kong gradually loosens restrictions on travel and quarantining. The carrier operated at as little as 2% of pre-pandemic levels for much of the past two years.

- Amsterdam’s Schiphol airport will cut its daily passenger flow by 18% through October due to worker shortages.

- Air India plans to refurbish its fleet with five Boeing 777 jets and 25 Airbus narrow-body aircraft over the next 15 months.

- Volkswagen is looking to raise as much as $9.4 billion from the initial public offering of its iconic sports-car-maker Porsche in what could be Europe’s largest listing in more than a decade.

Some sources linked are subscription services.