MH Daily Bulletin: September 20

News relevant to the plastics industry:

At M. Holland

- M. Holland’s Puerto Rico office is closed this week due to the impact of Hurricane Fiona.

- M. Holland is a Gold Sponsor of the SPE Automotive TPO Engineered Polyolefins Global Conference on Oct 2-5 in Troy, Michigan. If you’re planning to attend, please stop by M. Holland’s booth to meet our Automotive team!

- We are exhibiting during MAPP’s Benchmarking & Best Practices Conference in Indianapolis on Oct. 5-7! If you’re planning to attend, don’t forget to stop by M. Holland’s booth and tune in for our session featuring Debbie Prenatt, Market Manager, Sustainability. Click here to read more.

Supply

- Oil rose less than a percent Monday as worries of tight supplies won out in a day of volatile trading.

- In mid-morning trading today, WTI futures were down 2.2% at $83.89/bbl, Brent was down 1.4% at $90.72/bbl, and U.S. natural gas was down 0.4% at $7.72/MMBtu.

- The U.S. Energy Department will release up to 10 million more barrels of oil from the Strategic Petroleum Reserve for November delivery.

- The average U.S. gasoline price fell 3.9 cents the past week to $3.64 a gallon on Monday, marking the longest downward streak — 14 weeks — since 2015. Still, U.S. road travel is down as gas prices remain well above year-ago levels.

- OPEC+ fell short of its production target by 3.6 million bpd in August, larger than July’s underproduction of 2.9 million bpd.

- The UAE’s national oil company is accelerating its plan to boost production to 5 million bpd, moving its target date from 2030 to 2025.

- Oil and gas permitting in the U.S. eased in August compared with July but remained 27% higher than in August 2021.

- Chevron is marketing its interest in more than 2,000 oil and gas wells in Alaska, which could spell the oil major’s second exit from Alaskan production in three decades.

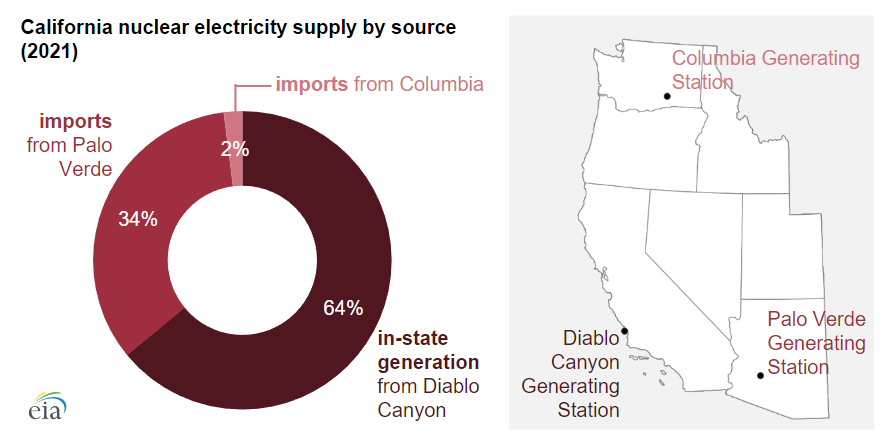

- Three nuclear plants supplied about 10% of California’s electricity last year:

- More oil news related to the war in Europe:

- On Monday, European natural gas prices fell 8.8% to their lowest level in two months as nations intensify efforts to source LNG and plan new measures to conserve energy this winter.

- German buyers on Monday reserved capacity to receive Russia gas via the idle Nord Stream 1 pipeline, although no gas ended up flowing.

- Russian oil exports are set to plunge by 2.4 million bpd next year after the EU’s embargo takes effect this December, analysts say.

- Germany’s Isar 2 nuclear plant in Bavaria will shut down in October for unexpected repairs, adding to the nation’s energy crunch.

- Gas storage sites in Germany, now 90% full, will only be able to cover two and a half months of consumption this winter if Russia completely suspends deliveries, analysts say.

Supply Chain

- In the latest natural disaster news:

- Hurricane Fiona churned north Monday evening after bringing torrential rain and powerful winds to the Dominican Republic. The entirety of Puerto Rico remains without power and 60% is without water in the wake of the storm, which has strengthened to a level 3 hurricane.

- A magnitude 7.6 earthquake struck southwestern Mexico on Monday and was felt in Mexico City, less than an hour after a public commemoration of the devastating earthquakes in 1985 and 2017.

- Typhoon Nanmadol, one of the biggest storms to hit Japan in years, brought high winds and record rainfall to the country’s western region Monday, causing transport disruptions and forcing manufacturers to suspend operations.

- India’s monsoons should begin to recede in the next two days after vigorous rains at the tail end of the four-month monsoon season.

- Shipping officials fear labor talks between tens of thousands of West Coast dockworkers and their employers could take months to resolve, raising the chance of smaller work disputes that could escalate into major disruption.

- The Cass Freight Index, a measure of monthly freight activity in North America, rose 6.6% from July to August for the highest reading since May 2018.

- The Port of Savannah handled 575,513 TEUs in August, its busiest month on record and up 18.5% from last year.

- Spot market rates for bulk shipping’s largest vessels shot up 45% in a single day last week on impacts from bad weather in the North China Sea.

- The head of the Port of Long Beach, which together with its sibling Port of Los Angeles handles 40% of U.S. container imports from Asia, sees demand cooling after two consecutive months of lower container traffic.

- Maersk and MSC have canceled several China-to-Europe sailings this fall, signaling expectations for lower container freight demand, Alphaliner says.

- Europe-based companies could be forced to prioritize production of key products and stockpile goods under a new proposal that would give the EU emergency powers to tackle supply chain crises, a response to bottlenecks caused by the pandemic and Russia’s invasion of Ukraine.

- China’s state-owned Cosco Shipping plans to spend $4.9 billion to add 32 container ships in a renewed quest to become the world’s biggest container line.

- Big ocean shippers are turning to the once shunned market of airfreight as ongoing supply snarls make the expensive but reliable mode of transport more attractive. Airfreight shipping grew 21% from 2020 to 2021 and will likely grow another 4.4% this year.

- Major U.S. shippers that overinvested during the pandemic may have delivery capacity that is 18 million packages per day higher than demand this holiday season, consultants say.

- Amazon halted building new warehouses in Spain until at least 2024 as the pandemic-driven boom in online shopping slows down.

- In the latest auto news:

- Inflation could cost Ford $1 billion in extra costs this quarter and leave tens of thousands of vehicles only partially built while waiting for parts.

- Kia is expected to produce electric vehicles in the U.S. starting in 2024, according to reports out of South Korea.

- Volkswagen no longer sees computer chip shortages ending in 2023 as the automaker prepares for a “new normal” of supply chain disruptions.

- Daimler Truck’s deliveries could have been higher by a “five-digit figure” the past two years without supply chain problems, its chief executive said.

- Tesla has completed an expansion project for its plant in Shanghai, which could soon start producing up to 22,000 Model 3 and Model Y units per week.

- Mercedes-Benz plans to build a wind farm in northwest Germany by 2025 that could power 15% of the automaker’s annual demand in the country.

- Italy’s Iveco unveiled a prototype of a hydrogen-powered large van it developed with Hyundai, the first tangible outcome of a recently announced partnership between the two automakers.

- The difficulties posed by fully autonomous driving technology could indefinitely preserve the need for a human backup operator to remain behind the wheel, some experts say.

- German truck-maker Traton’s MAN Truck & Bus and Scania subsidiaries are selling off their Russian operations.

- Chrysler’s Ram unit is discontinuing its 1500 EcoDiesel light duty truck, the most fuel efficient pickup on the market, as it shifts to electric vehicles.

- USA Truck shareholders approved the truckload carrier’s sale to freight forwarder DB Schenker for $435 million.

- Investment firm BlackRock acquired a more than 5% stake in dry-bulk operator Golden Ocean.

- About 1,200 workers went on strike at timber company Weyerhaeuser’s operations in Oregon and Washington state.

- Spanish clothing retailer Zara is buying five logistics properties in the U.S. for a total of $722 million.

Domestic Markets

- The U.S. reported 54,831 new COVID-19 infections and 360 virus fatalities Monday.

- Between 15,000 and 18,000 Americans were getting their first COVID-19 vaccine doses each day in August, the latest data shows.

- U.S. office use hit 47.5% of early 2020 levels last week, the highest rate since the pandemic forced most offices to close in March 2020.

- The dollar rose against major currencies on Monday ahead of a slew of central bank meetings this week, including the U.S. Federal Reserve. Some investors are betting the Fed could raise rates by a larger-than-expected 100 basis points rather than the 75 basis points widely predicted.

- The two-year Treasury yield approached 4% yesterday and the 10-year hit 3.5%, the highest levels in over a decade, reflecting investor pessimism about the economy.

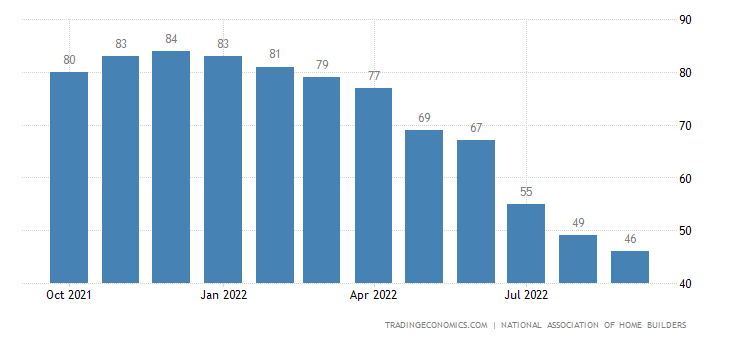

- Confidence among U.S. single-family homebuilders fell for the ninth straight month, the longest decline on record, as rising mortgage rates and high material prices weigh on sales to first-time buyers.

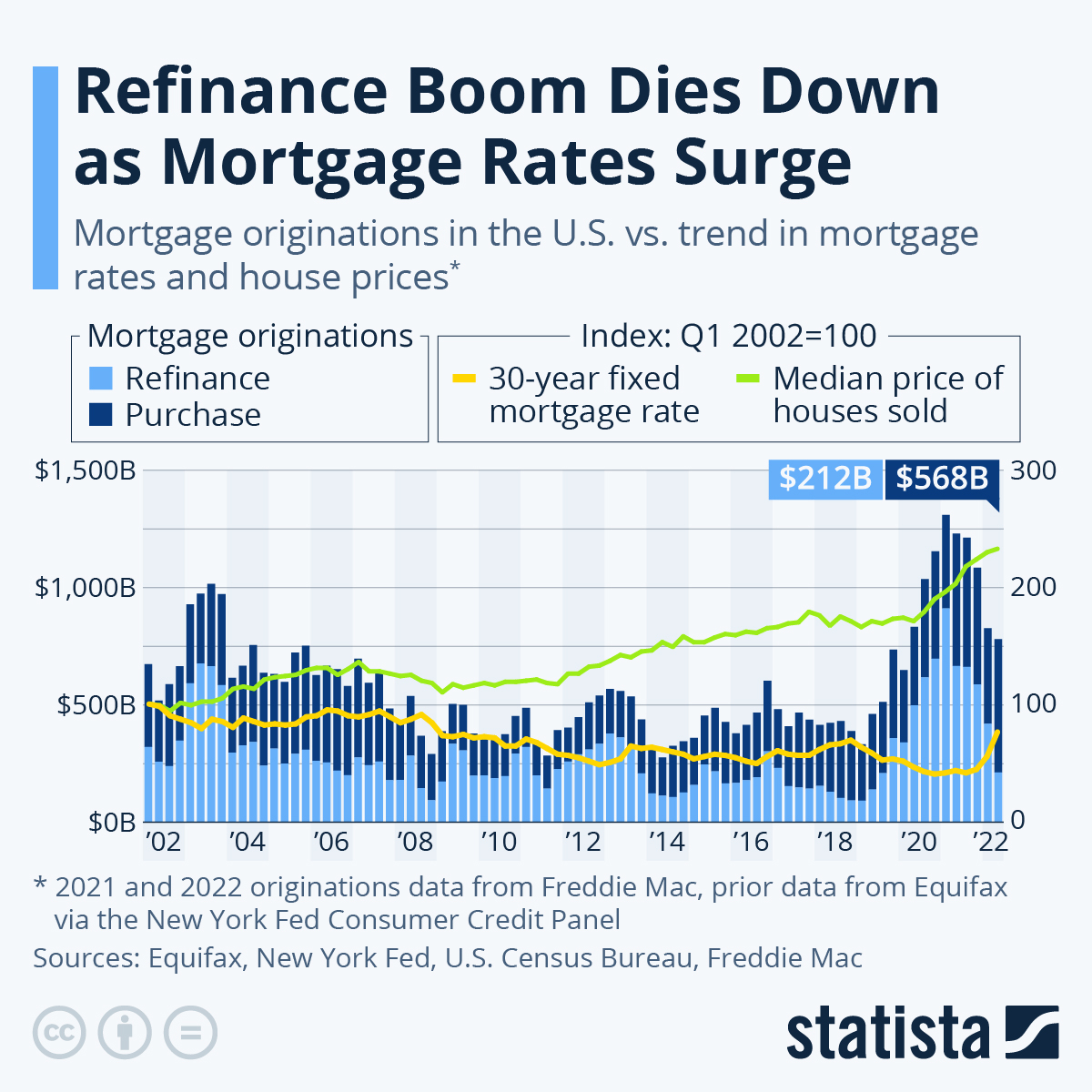

- The average U.S. mortgage rate is at its highest level since 2008.

- Meanwhile, mortgage refinancings have fallen 75% from their peak in the first quarter of 2021:

- Opendoor Technologies, a pioneer of data-driven home-flipping known as iBuying, lost money on 42% of its transactions in August, reminiscent of the pricing problems that doomed Zillow Group’s iBuying business last year.

- A U.S. judge on Monday denied the Justice Department’s bid to stop UnitedHealth Group from buying Change Healthcare in an $8 billion deal that rose antitrust concerns with regulators.

- U.S. regulators denied a request by regional airline Republic Airways to reduce the number of hours needed to train co-pilots, what was proposed as a way to cope with pilot shortages.

- American Express is hiring around 1,500 people for technology roles, shrugging off fears of an economic slowdown that has prompted other banks to cut jobs in recent months.

- Marriott International is banking on a new $600 million high-rise headquarters in Washington, D.C., to entice workers back to the office after two years spent working mostly from home.

- U.S. traffic-crash fatalities fell 4.9% in the second quarter after seven straight quarterly increases that started in the summer of 2020.

International Markets

- China’s government proposed new rules that would make it easier for some tourists to enter the country at the border, what would be one of its first relaxations of travel restrictions since 2020.

- China’s central bank kept its benchmark lending rates unchanged at a monthly meeting yesterday, in line with expectations. The nation’s state planner says it will quicken funding to expedite construction and boost domestic consumption, a response to a larger-than-expected slowdown in the second quarter.

- Sweden’s central bank raised its interest rate by a higher-than-expected full percentage point yesterday.

- The world’s central bank umbrella body, the Switzerland-based Bank for International Settlements, urged major economies to forge ahead with interest-rate hikes despite growing risks of recession. Interest-rate hikes are likely to come from the U.S. Federal Reserve, Bank of England and Swiss National Bank this week, while Japan is expected to remain one of the world’s last holdouts in negative-rate territory.

- Norway’s central bank is poised to raise its benchmark interest rate again this month by 50 basis points, bringing rates to the highest level in a decade.

- Japan’s annual inflation rate quickened to 3% in August, the fastest pace in eight years.

- Japan plans to spend $24.31 billion of its budget reserves to continue its response to COVID-19 and cope with ongoing price hikes.

- Mexico’s inflation rate likely eased to 8.71% in the first half of September, slightly down from the 8.77% pace recorded in August.

- The IMF tentatively agreed to a $44 billion extended fund facility for Argentina that should unlock nearly $4 billion for the embattled South American country to build reserves and tamp down spiraling inflation.

- The price of bread rose by almost 20% in the EU last month as Russia’s invasion of Ukraine choked off Eastern Europe’s normally plentiful supplies.

- The EU plans to raise its Paris Agreement targets to tackle climate change beyond the 55% reduction from 1990 levels it already pledged to meet by 2030.

Some sources linked are subscription services.