MH Daily Bulletin: September 21

News relevant to the plastics industry:

At M. Holland

- M. Holland’s Puerto Rico office is closed this week due to the impact of Hurricane Fiona.

- M. Holland is a Gold Sponsor of the SPE Automotive TPO Engineered Polyolefins Global Conference on Oct 2-5 in Troy, Michigan. If you’re planning to attend, please stop by M. Holland’s booth to meet our Automotive team!

- We are sponsoring MAPP’s Benchmarking & Best Practices Conference in Indianapolis on Oct. 5-7! If you’re planning to attend, don’t forget to stop by M. Holland’s booth and tune in for our session featuring Debbie Prenatt, Market Manager, Sustainability. Click here to read more.

Supply

- Oil fell 1.5% Tuesday, putting Brent and WTI on track for their worst quarterly percentage drop since the start of the pandemic.

- In mid-morning trading today, WTI futures were up 0.5% at $84.34/bbl, Brent was up 0.6% at $91.18/bbl, and U.S. natural gas was up 0.2% at $7.74/MMBtu.

- U.S. crude stocks rose a smaller-than-expected 1.035 million barrels last week, according to the American Petroleum Institute. Government data is due today.

- A major fire shut down a BP-operated refinery in Toledo, Ohio, yesterday.

- Officials in Monterey County, California, advised residents to shelter in place after a Tesla Megapack, a large industrial battery system, caught fire, spewing toxic smoke and forcing road closures.

- Benchmark Canadian heavy oil prices will likely rise soon as U.S. refiners return to the market when releases from U.S. reserves end.

- Texas added a robust 2,600 new oil and gas jobs in the upstream sector last month, building on over 44,000 job gains the past two years.

- Haiti is seeing massive social unrest after the government moved to raise fuel prices Tuesday.

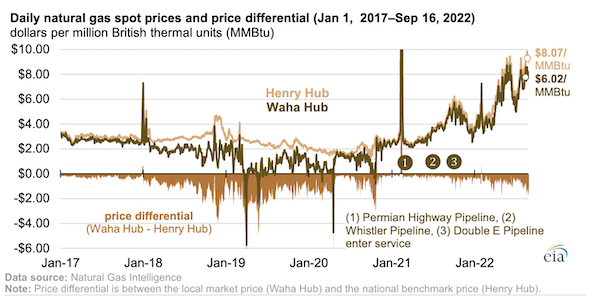

- The spread between natural gas prices from the Waha Hub in West Texas — near the prolific Permian Basin — and Louisiana’s benchmark Henry Hub price has widened this year due to pipeline maintenance constraints in the Permian basin and production levels:

- More oil news related to the war in Europe:

- Germany could announce plans to nationalize energy giant Uniper SE as early as this week.

- Russia’s war is forcing fuel-laden vessels to take longer routes from non-traditional trading partners, sparking a rally in LNG freight rates. Oil tanker earnings recently topped $50,000 a day for the first time in two years.

- U.S. senators are lobbying for support of a new bill that would impose secondary sanctions on Russian crude by punishing banks and brokers that trade in the nation’s oil above a certain price.

- Europe is on track to import 1.65 million bpd of Russian diesel this month, 190,000 bpd over August as nations stock up on the fuel ahead of a February ban.

- Coal power plants may soon be merged into the EU’s plan to restrict producer revenues to help bring down energy bills.

Supply Chain

- Some 80% of Puerto Rican homes and businesses still lack power from the impact of Hurricane Fiona, now bearing down on more Caribbean archipelagos as a Category 3 storm. U.S. officials are calling for an investigation into Puerto Rico’s grid operator as billions of dollars in aid have failed to prevent widespread outages.

- At least nine people died Tuesday after a warehouse near Brazil’s largest city of Sao Paulo collapsed.

- With an index of spot container rates down 44% over the past six months, freight liner executives predict a further, gradual decline in rates

- Revenue at FedEx’s ground unit is currently $300 million below forecasts, in line with the firm’s prediction of a slowdown in e-commerce shipments.

- The Atlantic has overtaken trans-Pacific trade as the most lucrative market for container lines, according to Alphaliner.

- Taiwan’s export orders, a bellwether for global tech demand, unexpectedly rose by 2% in August on strong demand for consumer electronics.

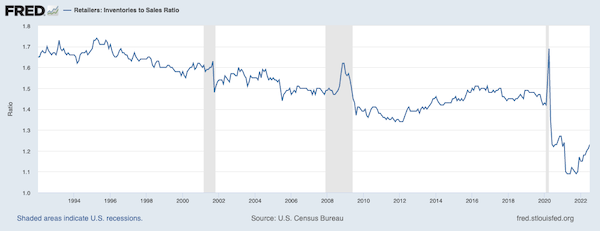

- U.S. retailers’ inventory-to-sales ratio rose from 1.21 in June to 1.23 in July, the highest level since February 2021.

- In the latest auto news:

- Rental car company Hertz plans to order up to 175,000 GM electric vehicles over the next five years.

- GM now supports tougher federal emissions standards that would require half of new cars sold by 2030 to be zero-emission.

- U.S. chip maker Nvidia is pushing further into the automotive market with a new computing platform meant to centralize a car’s digital functions, including self-driving.

- Infinium, maker of fossil-based fuel alternatives created with carbon waste and renewable power, plans to supply low-carbon electro fuels for Amazon’s giant trucking fleet starting next year.

- Stellantis chose Italy’s historic car-making city of Turin to boost low-emission car output and ramp up car and parts recycling.

- A unit of German auto parts supplier Bosch will build a plant in central Mexico to supply U.S. customers.

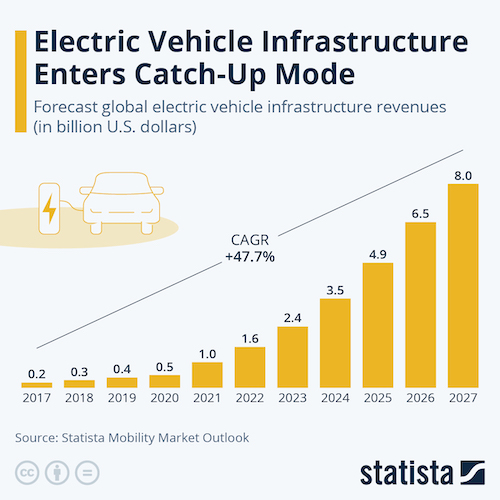

- Statista predicts a 47.7% compounded annual growth rate for global electric-vehicle infrastructure revenues.

- Lithium prices are up nearly four-fold over the past year, threatening the pace of electric vehicle adoption.

- The White House named a team of advisers to oversee $52.7 billion in government funding to boost semiconductor manufacturing and research.

- Nvidia is tapping Taiwan Semiconductor Manufacturing to make the processors for its new flagship video game chips.

- DHL Supply Chain is adding 12 million square feet of warehouse space in India under a $500 million expansion plan.

- DHL North America expects to deploy 2,000 collaborative robots this year, up from 1,500 last year, while GXO Logistics expects to use more than 5,800 robots globally this year, up from 3,800 last year.

- Schneider Electric is nearing agreement to buy out minority shareholders of Aveva Group in a deal valuing the industrial software developer at about $10.6 billion, according to reports.

Domestic Markets

- The U.S. averaged 54,152 new COVID-19 infections and 355 virus fatalities over the past seven days. New infections are up 3% the past month.

- California scrapped its COVID-19 testing rules for unvaccinated workers at schools and healthcare sites.

- Effective Nov. 1, New York City will end its vaccine mandate for private employers, among its last COVID-19 restrictions.

- Health experts say COVID-19 could indefinitely cause up to 188,000 deaths a year, putting the illness on par with Alzheimer’s, lower respiratory diseases and stroke.

- A growing drought of reliable data about U.S. COVID-19 infections has complicated regulatory decisions on authorizing new shots, experts say.

- Only 34.9% of eligible Americans over age 5 have received a COVID-19 booster shot since the first batch was made available last year. For children under 5 years old, just 325,000 have received both standard shots.

- The federal government will soon release millions of Moderna COVID-19 booster shots that were held up by safety inspections at an Indiana packaging plant.

- The Justice Department charged 47 people associated with a Minnesota nonprofit for stealing $250 million in pandemic aid, the largest theft uncovered to date.

- A recent Gallup poll found that 1 in 3 U.S. workers are “very” or “moderately” concerned about catching COVID-19 after returning to work.

- The U.S. Federal Reserve is likely to raise interest rates by another 75 basis points today to rein in inflation. Expectations for higher rates have bolstered the U.S. dollar, which remained near a two-decade high against peers on Tuesday.

- U.S. firms that spent recent years accumulating cheap debt are now struggling to combat higher borrowing costs as banks across the globe tighten lending policies.

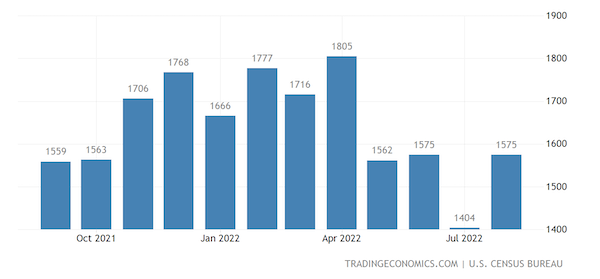

- U.S. homebuilding surged to an annualized rate of 1,575 million units in August, led by a 36-year high in the construction of multifamily properties. Lumber futures rebounded from a one-year low on the news.

- Higher rents are emerging as a major driver of overall U.S. inflation, remaining elevated when prices for many other products and services are starting to ease. Rents for single-family homes were up 12.6% in July compared with the year-ago period.

- Pandemic staffing shortages at U.S. restaurants are easing, industry leaders say.

- Walgreens Boots Alliance plans to buy the remaining 29% stake it does not already own in specialty pharmacy Shields Health Solutions for $1.37 billion as the firm diversifies beyond standard drugstores.

- Nordstrom adopted a “poison pill” to prevent outsiders from boosting their stake in the business after a Mexican company acquired a 9.9% stake in the upscale U.S. retailer.

- Federal antitrust enforcers are giving greater scrutiny to Amazon’s proposal to buy Roomba maker iRobot for $1.7 billion.

- Gap announced plans to cut 500 corporate jobs Tuesday, just a month after withdrawing its annual performance forecast due to an inventory glut and weak sales.

- Boeing is cutting 150 finance jobs in the U.S., some of which will be offshored to India.

- United Airlines was forced to cancel some flights and remove 25 jets from service Monday and Tuesday after realizing it had failed to perform required inspections on them.

International Markets

- There were 19.4 million new COVID-19 cases reported the past month, with the largest increases in Japan (+29%), Taiwan (+20%) and Hong Kong (+19%).

- Hong Kong will soon end its controversial hotel quarantine policy for arrivals, officials signaled.

- The Dutch government removed all COVID-19 entry restrictions on travelers this week.

- Up to 20% of COVID-infected Europeans have long-COVID symptoms, new research shows.

- Chinese researchers have developed a mask that lets wearers know if they’ve been exposed to COVID-19 or the flu.

- Regulators in China and India have approved the first use of COVID-19 vaccines that can be inhaled or taken as a nasal spray.

- Shanghai officials announced $257 billion of new infrastructure projects Tuesday, a bid to kickstart the regional economy after its GDP shrank 13.75% in the second quarter.

- Canada’s inflation rate came in at a lower-than-expected 7% last month, led by falling gasoline prices. Grocery prices, on the other hand, rose at their fastest pace since 1981.

- Canadian home prices fell a record 2.4% from July to August in response to fast-rising interest rates.

- The Asian Development Bank cut its growth forecast for developing Asia to 4.3% this year, slower than its 5.2% prediction from April.

- Barclays says investment banks will see a revenue shake-up next year as rebounding banking and advisory fees offset a fall in trading income.

- The chief executive of Amsterdam Airport Schiphol resigned over flight disruptions there.

- British brewers are facing tenfold price increases for the CO2 used to carbonate and package beers.

- PepsiCo has stopped making Pepsi, 7UP and Mountain Dew in Russia nearly six months after the U.S. company said it would suspend sales and production there due to Russia’s invasion of Ukraine.

Some sources linked are subscription services.