MH Daily Bulletin: September 22

News relevant to the plastics industry:

At M. Holland

- M. Holland’s Puerto Rico office is closed this week due to the impact of Hurricane Fiona.

- M. Holland is a Gold Sponsor of the SPE Automotive TPO Engineered Polyolefins Global Conference on Oct. 2-5 in Troy, Michigan. If you’re planning to attend, please stop by M. Holland’s booth to meet our Automotive team!

- We are sponsoring MAPP’s Benchmarking & Best Practices Conference in Indianapolis on Oct. 5-7! If you’re planning to attend, don’t forget to stop by M. Holland’s booth and tune in for our session featuring Debbie Prenatt, Market Manager, Sustainability. Click here to read more.

Supply

- Oil fell 1% to a two-week low Wednesday after the U.S. Federal Reserve delivered another hefty rate hike to quell inflation.

- In mid-morning trading today, WTI futures were up 0.9% at $83.70/bbl, Brent was up 1.0% at $90.72/bbl, and U.S. natural gas was down 1.7% at $7.65/MMBtu.

- The average U.S. gasoline price rose slightly on Wednesday to $3.681 a gallon, the first gain in several months. Gasoline demand over the past month fell to 8.5 million bpd, the lowest since February.

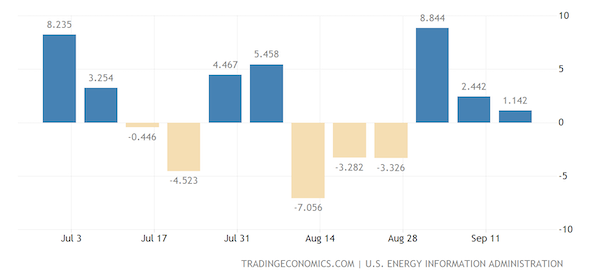

- U.S. crude stocks rose by a lower-than-expected 1.1 million barrels last week, the EIA said.

- Valero and Marathon took more than half the crude offered from the latest release of 180 million barrels of U.S. strategic reserves.

- Major Chinese refiners are poised to boost runs by up to 10% next month on a possible surge in export activity if the government raises fuel export quotas.

- Abu Dhabi National Oil is considering a deal to buy all or part of commodity trading house Gunvor Group in one of the industry’s biggest deals in years.

- More oil news related to the war in Europe:

- Germany on Wednesday agreed to nationalize Uniper SE, raising the government’s bill to rescue the energy giant to almost $30 billion. The move follows France’s takeover of European utility EDF last week.

- European nations have put a collective $500 billion the past year into cushioning households and businesses from soaring energy prices.

- The U.K. will cap wholesale electricity and gas costs for businesses at less than half the market rate starting in October, a bid to prevent widespread closures.

- German natural gas import costs rose 164% between January and July despite a 25.5% decline in volumes.

- Algeria’s natural gas exports to Italy could climb by 20% this year as nations rush to find new suppliers.

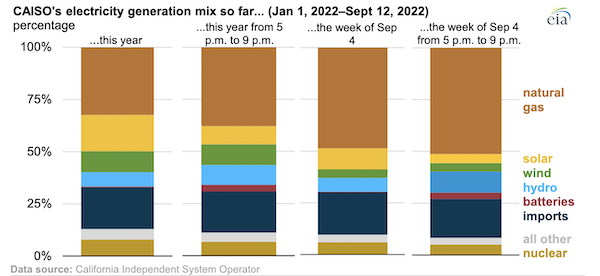

- California almost doubled its historical natural gas usage during an extreme heat wave earlier this month, when power demand set a record.

- Top U.S. LNG exporter Cheniere Energy plans to repair and replace equipment at its Louisiana refining terminal after it failed a pollution test.

- Construction of a half-completed $3.6 billion gas site in Australia will be halted after indigenous groups won a court battle over the project’s local impact.

- Paris and New York City joined a coalition of local authorities suing TotalEnergies for failing to adequately fight climate change.

- Repsol is investing over $100 million to reduce emissions at its 186,000-bpd Tarragona refinery in Spain, which begins two months of maintenance this week.

- Occidental Petroleum announced a new goal to achieve net-zero carbon emissions by 2050, largely through its expanding carbon-capture business.

- Amazon announced plans to add 2.7 GW of clean energy capacity through 71 new renewable projects, part of its goal to use 100% renewables across its business by 2025.

Supply Chain

- Hurricane Fiona intensified into this year’s strongest Atlantic storm, a Category 4, as it moves north to threaten Bermuda and eastern Canada. Over 1 million people are still without power in Puerto Rico after the storm’s devastating touchdown earlier this week.

- Clashes between cargo workers and management have been rising across the globe this year, making logistics planning more difficult and exacerbating strains caused by COVID-era supply-chain shocks.

- More European manufacturers are considering moving operations to the U.S., attracted by stable energy prices and significant green-energy support.

- Some experts suggest the U.S. is poised for a manufacturing renaissance led by advanced 3D printing and boosted by federal incentives to encourage the use of additive technology.

- Container rates from Asia to the U.S. West Coast are 80% below the year-ago level, according to the Freightos Baltic Index.

- Container ship charter rates dropped by 20% the past week amid fears that some carriers may default on payments due to weakening demand.

- The Suez Canal is raising fees for tankers by 15% next year and boosting the price for bulk-vessel transits by 10%.

- Maersk says feeder services in parts of Latin America and the Caribbean are being delayed due to congestion.

- Honolulu-based carrier Matson closed its seasonal China-California Express loop ahead of peak season after spot rates on the trade lane collapsed.

- Shares of corrugated cardboard manufacturers International Paper, Packaging Corp. of America and WestRock each fell over 10% after FedEx lowered its demand projections for the rest of the year.

- China’s monthly semiconductor output fell in August at the steepest pace in records dating back to 1997.

- Airbus is quietly relaxing pressure on suppliers to hit the plane maker’s mid-decade output targets as logistics snarls show no sign of easing.

- Amazon’s freighter flights are up just 3.8% since March, the smallest increase of the pandemic.

- In the latest news from the auto industry:

- Earnings for car-carrying ships have surged to $80,000 a day, the most since at least 2000, as shipment demand outpaces the size of the global fleet.

- Analysts predict electric vehicles will make up 52% of U.S. car sales by 2030.

- Chinese electric vehicle maker Gotion plans to build a $3.6 billion factory in Big Rapids, Michigan, eventually employing over 2,000 people.

- The U.S. EPA is considering stricter emissions rules for heavy trucks after Congress passed new incentives to speed the adoption of zero-emissions vehicles.

- Suppliers to the U.S. auto industry signaled they have raised prices on parts between 7% and 20% on average, according to an informal survey.

- Chinese electric vehicle firm Nio plans to build 1,000 battery swapping stations outside China by 2025, mostly in Europe.

- More Norwegian firms are planning new investments in the country’s rich supply of key minerals for electric vehicle batteries.

- Electric vehicles are selling “like never before” in Europe amid the current energy crisis, a Belgian battery firm said.

- U.S. electric vehicle startup ev Transportation Services (evTS) is planning an initial public offering to back its commercial delivery van business.

- Over a dozen automakers including Toyota and Nissan have signed up with an independent platform for patent licenses from 51 tech firms, aiming to simplify access to emerging technology.

- Combined inventories at Chinese home appliance manufacturers have doubled in the COVID-19 era, swelling to their breaking point.

- U.S. apparel retailers are preparing steep markdowns to clear excess inventory ahead of the holidays.

- A textile-industry survey showed business expectations for the sector have turned negative for the first time since early 2020.

Domestic Markets

- The U.S. averaged 55,332 new COVID-19 infections and 356 virus fatalities over the past seven days.

- Omicron-tailored COVID-19 boosters will likely be available for children aged 5-11 by mid-October, the CDC said.

- A new Omicron variant, BF.7, has caught the attention of scientists for its rapid spread among a crowded field of competing variants.

- Federal officials are recommending the FDA revise its guidelines for emergency-use authorizations to ensure better availability of medicine during future disease outbreaks.

- First-time jobless claims rose by a modest 5,000 last week to 213,000, indicating the labor market remains tight.

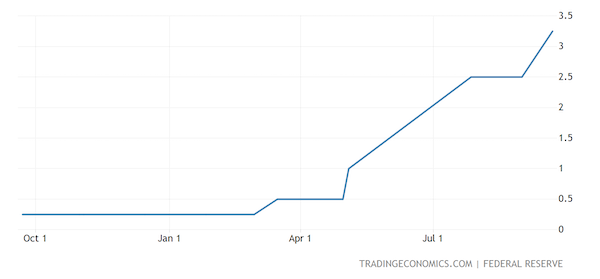

- On Wednesday, the Fed raised its benchmark interest rate by 75 basis points to a 3.00%-3.25% range and signaled more large increases would come. Risk assets like stocks and oil fell on the news, while the dollar rallied to a two-decade high. Wednesday marked the Fed’s third straight three-quarter-point increase, pushing borrowing costs to their highest level since 2008:

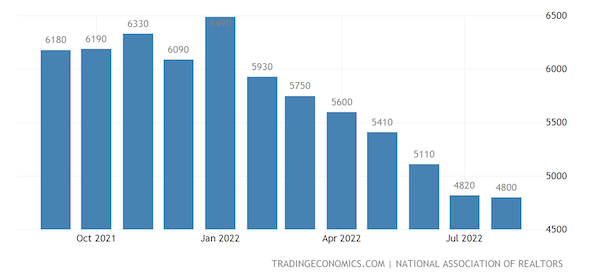

- U.S. existing home sales dropped for a seventh month to an annual rate of 4.8 million in August, a 0.4% decline from July, as affordability deteriorated further and homeowners became increasingly reluctant to sell out of extremely low interest rates secured during the pandemic. Last week, the average U.S. mortgage rate rose to 6.25% for its fifth week of gains.

- The median U.S. rent price hit $1,037 in August, about 10% higher than pre-pandemic levels, according to the Census Bureau.

- Homebuilder Lennar posted better-than-expected third-quarter profit on the back of record-high property prices and continued high demand.

- Walmart’s seasonal hiring will slow to just 40,000 jobs this year, less than a third of last year’s level, signaling a cautious note about holiday retail sales.

- Facebook parent Meta is looking to trim costs by 10% in the coming months, including staff layoffs, as the social-media giant faces stalling growth and rising competition.

- General Mills’ latest quarterly sales rose 4% to $4.72 billion as more consumers eat at home in response to higher prices, prompting the firm to raise its full-year forecast.

- U.S. sales at discount grocer Aldi rose in the double digits the past 12 months as rampant inflation pushed consumers to find cheaper deals.

- On Wednesday, the U.S. Senate voted to join in a 1987 treaty that would commit the country to reducing hydrofluorocarbons, refrigerant chemicals that contribute to climate change.

International Markets

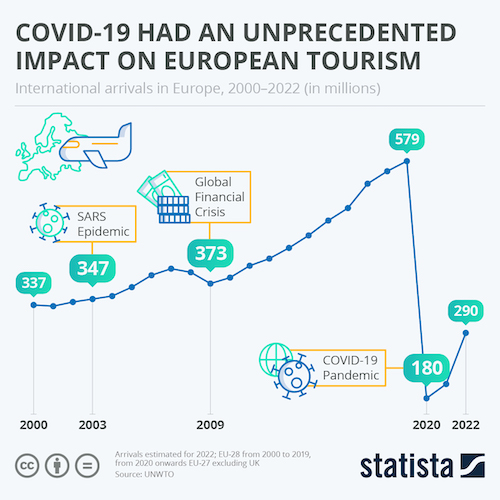

- The number of foreign visitors to Japan topped 100,000 for the fifth month in August following the relaxation of strict border controls. Tourism visits to Europe, meanwhile, remain significantly below pre-pandemic levels:

- Today is “Super Thursday” for central bank actions following yesterday’s U.S. rate hike:

- Japan intervened in the foreign exchange market to buy yen for the first time since 1998, an attempt to shore up its battered currency after the Bank of Japan maintained ultra-low interest rates this week.

- The Bank of England is poised to raise interest rates by at least half a percentage point today in a bid to tame near 40-year-high inflation.

- Brazil’s central bank kept its benchmark interest rate unchanged Wednesday, pausing an aggressive monetary tightening cycle after 12 consecutive increases.

- Hong Kong raised its benchmark interest rate by 75 basis points to 3.5% Wednesday.

- Gulf central banks including Saudi Arabia, Qatar and the UAE followed the U.S. by raising their key interest rates Wednesday.

- British manufacturers expect the biggest drop in production since the start of 2021 over the next three months as uncertainty grows around demand and energy prices.

- United Airlines faces potential disruption at one of its most lucrative overseas markets as 300 workers at London’s Heathrow airport begin voting in a strike ballot over pay.

- Hong Kong has lost its position as a global aviation hub due to China’s zero-COVID policy, the head of airlines group IATA said.

- One-way flights out of Russia skyrocketed in price Wednesday after the nation’s government ordered an immediate call-up of 300,000 reservists to continue its invasion of Ukraine.

- As many as 5.2 million people across the globe became millionaires last year, with nearly half in the U.S., according to Credit Suisse. The ranks of ultra-high net-worth people rose by 46,000 on widespread stock market and home-price gains.

- The White House announced $2.9 billion in fresh assistance to address global food insecurity brought by Russia’s invasion of Ukraine.

Some sources linked are subscription services.