MH Daily Bulletin: September 29

News relevant to the plastics industry:

At M. Holland

- M. Holland is a Gold Sponsor of the SPE Automotive TPO Engineered Polyolefins Global Conference on Oct. 2-5 in Troy, Michigan. If you’re planning to attend, please stop by M. Holland’s booth to meet our Automotive team!

- We are sponsoring MAPP’s Benchmarking & Best Practices Conference in Indianapolis on Oct. 5-7! If you’re planning to attend, don’t forget to stop by M. Holland’s booth and tune in for our session featuring Debbie Prenatt, Market Manager, Sustainability. Click here to read more.

- Come see us at the IWCS Cable & Connectivity Industry Forum in Providence, Rhode Island, on Oct. 10-13! M. Holland is a Gold Sponsor. If you are attending, please stop by Booth #113 to discuss our materials and offerings serving the wire and cable market.

- At our Plastics Reflections Web Series event on Oct. 13, M. Holland will host panelists from Maersk and Bank of America to discuss the macroeconomic factors influencing global and domestic economies, including impacts on the plastics industry. Click here to register.

- M. Holland Company, a leading international distributor of thermoplastic resins and ancillary materials, is offering up to 100% PCR content resin that helps brands utilize sustainable innovation in the plastics industry. Click here to read the full press release.

Supply

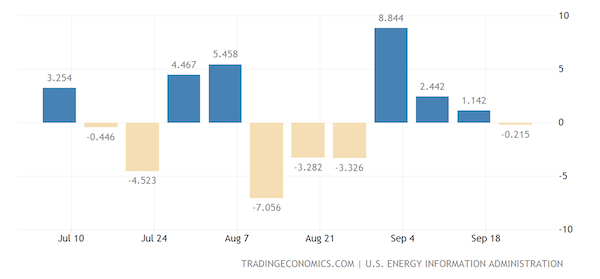

- Oil rose for a second day Wednesday, gaining over 3.5% on a decline in U.S. inventories, a sign of rebounding demand.

- Crude futures were marginally lower in mid-morning trading today, with WTI futures at $82.03/bbl and Brent at $89.12/bbl. U.S. natural gas was down 3.5% at $6.72/MMBtu.

- U.S. crude stocks unexpectedly fell by 200,000 barrels last week, mirroring draws in gasoline and middle distillates, according to the EIA.

- U.S. refinery utilization rates could top 90% next quarter for the third consecutive quarter in what would be a seasonal anomaly.

- The Dallas Fed’s oil and gas outlook index plummeted in the latest quarter while its index of uncertainty rose, reflecting U.S. energy executives’ fears of recession.

- BP laid off most contractors at its 160,000-bpd refinery in Toledo, Ohio, indicating that the plant will see a prolonged shutdown following an explosion and fire last week.

- Exxon Mobil issued a temporary “stand-down” order across its U.S. shale operations last week following back-to-back worker injuries in West Texas.

- Brookfield Asset Management, one of the world’s biggest clean-energy investors, is buying a pair of U.S. renewable developers for $1.5 billion, adding to a flood of cash in the renewables market.

- Oil and gas industry parts supplier Smiths Group is seeing record demand as energy companies seek new sources outside Russia.

- Ohio-based specialty polymer manufacturer Avient Corp. lowered its earnings forecast due to weakening demand, changes in its business portfolio and negative foreign currency translations.

- China may extend its fuel export quotas into next year as it balances the benefits of higher exports with tight domestic supplies.

- The Australian government withdrew its threat of gas export curbs after large producers agreed to offer supplies to domestic buyers first.

- OPEC’s crude exports averaged 21.65 million bpd for most of September, roughly 166,000 bpd lower than in August.

- More oil news related to the war in Europe:

- The United Nations Security Council will convene Friday to discuss damage to the Nord Stream pipelines, believed by Western nations to be acts of sabotage to further disrupt energy security. The leakages themselves could start to slow this weekend, according to Baltic authorities, as European governments race to safeguard their energy assets.

- The EU executive warned that a broad cap on gas prices could be too complex to launch, bringing uncertainty to the bloc’s future moves on the issue. France, Belgium and 13 other member nations have stepped up calls for the plan, which is opposed by Germany.

- In addition to a cap on gas prices, the EU is considering adding restrictions on European ships that transport Russian oil sold above a certain price.

- One of the last functioning Russian gas supply routes to Europe could be shut if Moscow moves forward with sanctions on Ukrainian energy firm Naftogaz.

- Germany extended operations of two large coal-fired power plants to 2024 and restarted other idled coal capacity in a bid to spare natural gas supply.

- The Russian government proposed more than $60 billion in tax increases for the oil and gas industry by 2025, a record.

- Chevron sold its headquarters in California as it continues to relocate employees to Texas.

- TotalEnergies is looking to spin off its Canadian oil sands operations and list the new company on the Toronto Stock Exchange because the assets do not fit with the firm’s low-emissions strategy.

- Australia’s top coal-producing state of Queensland will convert its coal-fired power plants to renewable hubs by 2035 at a cost of around $40 billion.

- Shell will buy African solar provider Daystar Power, its first power acquisition on the continent.

Supply Chain

- In extreme weather news:

- Category 4 Hurricane Ian slammed into Florida’s Gulf Coast Wednesday afternoon with 150+ mph winds, making it one of the most powerful storms on record to hit the U.S. Millions are without power in southwest Florida, while storm surges as high as 18 feet threaten much of the state’s western coast.

- Hurricane Ian prompted firms across a wide swath of industries to halt operations in the U.S. South, including major names in logistics, retail and energy. Florida’s largest seaports have shut down entirely.

- Cuba restored power to some of its 11 million people after Hurricane Ian caused the country’s grid to completely collapse on Tuesday.

- The U.S. administration waived shipping rules to address Puerto Rico’s immediate energy and other essential needs in the wake of Hurricane Fiona.

- Container lines are canceling sailings from Asia to Europe as demand slumps, putting downward pressure on spot rates that have already fallen 58% year to date.

- Prices for the bulk sector’s largest vessels are picking up on growing demand from China’s construction industry, although iron ore demand remains below historical norms.

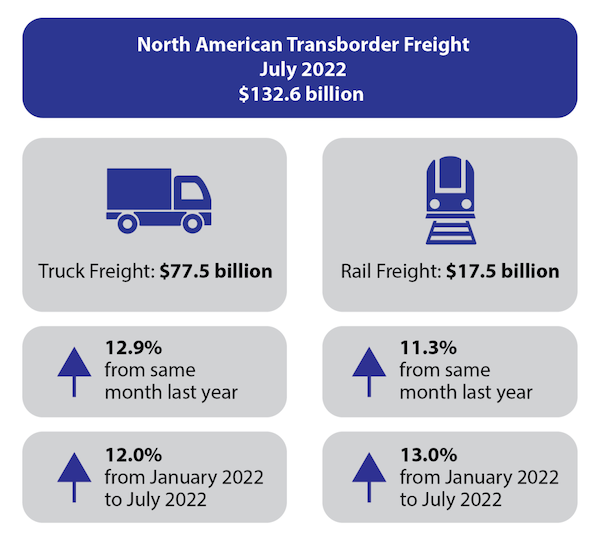

- The total value of North American transborder freight moved by truck hit $77.5 billion in July, up 12.9% from a year ago.

- Total inventories held by S&P 500 companies hit $1.17 trillion in the second quarter, up 19% from a year ago. U.S. wholesale inventories rose 1.3% in August, their 25th straight monthly gain.

- The market for microfulfillment centers, which expanded during the pandemic as online retail sales demand grew and companies looked for new ways to ship goods, is now shrinking as merchants focus on in-store automated fulfillment and other distribution strategies.

- Costco expects supplier wage increases to perpetuate high product prices even as commodity and other supply-chain costs ease. The retailer’s comparable sales jumped 14% last quarter.

- Amazon is raising pay for warehouse and transportation workers while planning to close several U.S. call centers in a move toward remote working.

- In the latest news from the auto industry:

- Ford delayed deliveries of some vehicles due to a shortage of blue oval badges for the front end.

- GM is investing $760 million to prepare an Ohio plant for production of drive units for electric vehicles.

- U.S. new vehicle sales are poised to hit almost 960,000 units this month, a 5.4% increase from the same time last year in what would be a new September record.

- Tata Motors launched India’s lowest priced electric vehicle (EV) at a little over $10,000 this week, cementing its hold on the nascent Indian EV market.

- Volkswagen priced the initial public offering of Porsche at the top end of its targeted range, putting the IPO on track to become one of Europe’s largest in more than a decade at roughly $73 billion.

- Five major firms including Ikea, Unilever and Maersk pledged to phase out their use of gas-powered trucks in China and India by 2040.

- Peru is forming plans to produce more lithium batteries domestically, joining other Latin American nations with ambitions to take advantage of surging demand for electric vehicles.

- Cotton prices fell 25% the past month as concerns over slow demand overshadow a potentially poor U.S. harvest.

Domestic Markets

- The U.S. reported 86,496 new COVID-19 infections and 1,260 virus fatalities Tuesday.

- COVID-19 cases rose by 8% in New York state last week, led by an increase in cases outside New York City.

- First-time jobless claims fell to 193,000 last week, a five-month low and well below the 215,000 expected by economists, indicating continuing tightness in labor markets.

- The average office occupancy rate in 10 major U.S. cities remained mostly unchanged at 47.3% last week.

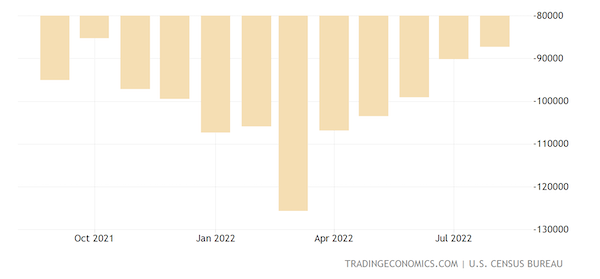

- The U.S. trade deficit in goods narrowed for a fifth month in August amid a decline in imports.

- Federal Reserve officials signaled another 75-basis-point rate hike could come this November as the central bank works to hit an interest-rate plateau by early next year.

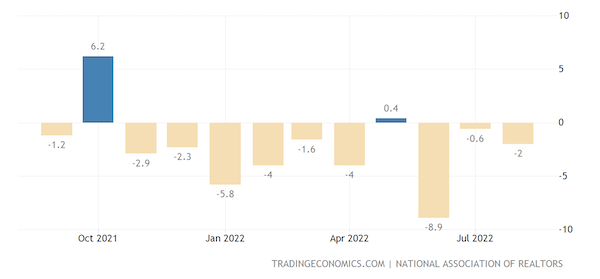

- U.S. pending home sales fell 2.2% in August, the third month of declines in response to soaring mortgage rates and high home prices. Pending sales have declined in nine of the last 10 months.

- U.S. mortgage rates hit 6.7%, the highest level since 2007.

- U.S. mortgage applications fell 3.7% week over week while refinancing applications plummeted 10.9%.

- Lyft will freeze hiring in the U.S. until 2023 amid economic uncertainty that has hammered the ride-hailing firm’s stock price.

- Apple shares fell 4% Wednesday following a report that the tech giant was ditching plans to boost production of the latest iPhone due to unexpectedly low demand.

- Apple retail workers in Oklahoma City are slated to vote next month on whether to make their store the second unionized U.S. location.

- Grocery-delivery company Instacart is cutting staff, slowing hiring and curbing other expenses as it prepares for a public listing.

- American meat giant Tyson Foods is overhauling its leadership as costs rise and sales slow after two years of soaring margins.

- Quarterly forecasts for Nike are being widely downgraded as inflation-hit U.S. consumers cut discretionary spending.

- Lehman Brothers’ brokerage unit has been fully liquidated 14 years after its parent’s bankruptcy helped trigger the 2008 financial crisis.

International Markets

- Reported COVID-19 cases fell 11% globally last week while virus fatalities dropped 18%.

- Travel during China’s Golden Week holiday, which begins this weekend, is poised to hit its lowest level in years as authorities urge people to stay at home to protect against the spread of COVID-19.

- Economists expect Germany’s inflation rate to hit 9.5% in September, up from the 7.9% pace of August.

- Consumer sentiment was down across the euro zone’s three largest economies of Germany, France and Italy in September, the latest in a string of monthly declines.

- The European Central Bank could raise interest rates by another 75 basis points at its October meeting, adding to its fastest pace of policy tightening on record.

- Italian officials slashed the country’s 2023 growth forecast from 2.4% to just 0.6% due to sky-high energy costs.

- On Wednesday, China’s currency dropped to its lowest level against the U.S. dollar since 2008, pressured by expectations of more U.S. rate hikes.

- The U.S. began its first-ever summit with 12 Pacific Island leaders this week, an effort to expand economic cooperation in the region.

- The U.S. and EU will in the coming days propose new economic sanctions on Moscow in response to its escalating annexation schemes in Ukraine.

- Taiwan’s China Airlines finalized a $4.6 billion order for 16 Boeing 787 Dreamliner jets with an option for eight more.

- Lego saw its first-half revenue rise 17% on a surge in store openings and robust demand for its toys despite rising inflation.

Some sources linked are subscription services.