COVID-19 Bulletin: April 9

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude futures were mixed in mid-day trading today, with the WTI down 0.4% at $59.37/bbl, Brent 0.4% lower at $62.98/bbl and natural gas up 0.6% at $2.54/MMBtu.

- Tanker owners expect a rebound from the lowest rates in more than 10 years after Middle East clean and dirty exports shrank 9% in the first quarter.

- While most oil majors are cutting capital spending on fossil fuels, Total is poised to move forward with a $5 billion production and pipeline project in Uganda.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- General Motors is halting production at three North American factories for up to two weeks and extending shutdowns at others due to the worsening global semiconductor shortage. Ford also announced a week-long production halt at its Chicago, Flat Rock and Kansas City assembly plants, while Porsche signaled it will soon have to implement some production cuts.

- Toyota has largely remained free of production issues caused by the global semiconductor shortage, a result of the company’s exhaustive monitoring of small suppliers.

- Renesas Electronics will resume production of semiconductor chips by April 19 at its Japanese factory that suffered a fire last month, although production is not expected to reach pre-fire levels until late June.

- Monthly imports into major U.S. ports are expected to remain above 2 million TEUs through the summer.

- Egypt won’t release the massive container ship that blocked the Suez Canal until its owners agree to pay as much as $1 billion in compensation. Disruptions in the global supply chain caused by the blockage are expected to last for several months, industry officials predict.

- Rates for multipurpose cargo and container ships are surging. Top container shipping lines recorded nearly $16 billion in net profits during 2020.

- A second ship ran aground in the Suez Canal, causing some delays to the northbound convoy of vessels before tugboats pulled the mid-size tanker free.

- A second California court ruled in favor of a state law that would restrict trucking’s independent contract driver model.

- Knight-Swift Transportation joined a growing number of trucking companies raising driver pay.

- High demand and rising wood and steel costs are driving up wooden shipping pallet prices, which could rise as much as two-thirds this year, creating a share-shift opportunity for more expensive and more durable plastic pallets.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

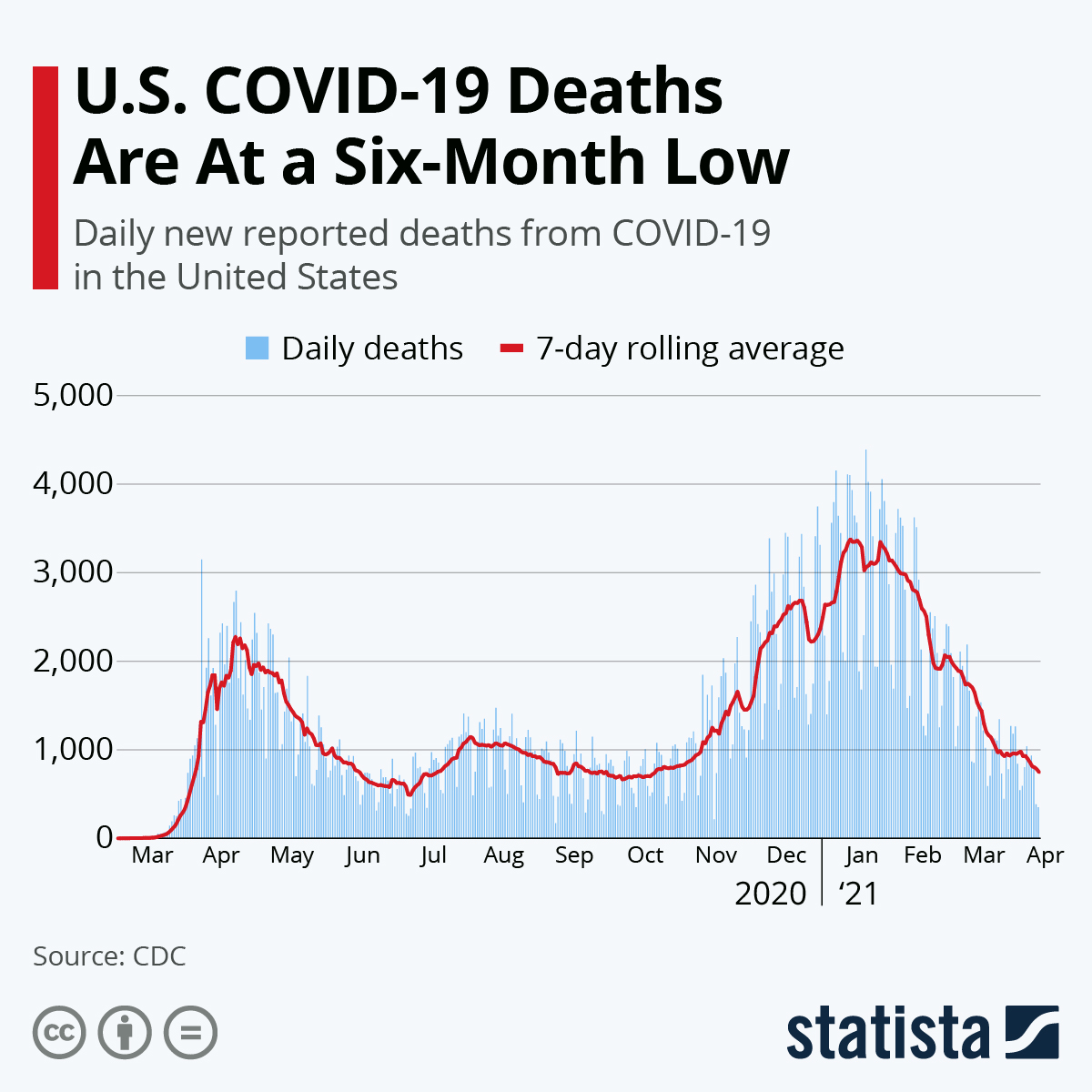

- New COVID-19 cases in the U.S. rose to 79,878 yesterday, with 1,000 deaths. Over 174 million vaccine doses have been administered, with 18.7% of the population fully vaccinated.

- Michigan reported more than 8,000 COVID-19 infections and 30 deaths on Wednesday, with new cases on pace to surpass December records in the coming days.

- Florida posted 7,939 COVID-19 cases yesterday, the most since early February.

- COVID-19 cases are on the rise in Ohio, largely due to virulent mutations of the virus.

- Wisconsin reported 1,046 new cases of COVID-19 Thursday, the largest total since Feb. 11.

- More than 50 COVID-19 cases were reported at The University of Chicago, prompting a strict stay-at-home order for students, among other restrictions.

- Two mass-vaccination sites in North Carolina and Colorado closed temporarily this week after reporting adverse effects in some patients who received Johnson & Johnson’s single-shot COVID-19 vaccine.

- Travel-nurse wages rose 25% since last April as COVID-19 surged and hospitals required more temporary help.

- U.S. nursing home occupancy reached a record low in the first quarter after a year’s worth of COVID-19 made the facilities among the most dangerous for elderly people.

- Many cruise lines, fed up with waiting, are ditching the U.S. entirely and moving to offshore ports around the Caribbean to prepare for an expectedly busy summer season. Florida, normally a hub of cruise operations, is suing U.S. health authorities to force the restart of sailings.

- The world’s largest online travel agency is pushing for vaccine passports, arguing the passes would make it safer and easier to travel as the spread of virus mutations quickens.

- Three major U.S. air carriers, Southwest Airlines, American Airlines and United Airlines, will ground some of their 737 Max jets after Boeing cited a wiring issue affecting the planes.

- Southwest Airlines recalled over 2,700 furloughed flight attendants in preparation for a busy summer travel season.

- Airbus reported slightly higher deliveries of 125 aircraft in the first quarter.

- The S&P 500 closed at a record high on Thursday after the Federal Reserve signaled continued support for the U.S. economy. The news also pushed European stocks to record highs.

- The central bank’s chairman warned that slow vaccine rollouts outside the U.S. pose a key threat to the nation’s economic outlook.

- Global spending on information technology is expected to rise 8.4% to $4.1 trillion this year, with many businesses bolstering their videoconferencing and digital collaboration tools.

- Global aluminum prices are off to their best start in four years, as the U.S. recovery drives demand for a range of goods that require the lightweight metal.

- The White House is prepping to issue a new directive that will require some businesses to provide climate disclosures, a move that is expected to decrease investment in companies that are not considering long-term environmental risks.

- Netflix has reached a multiyear agreement with Sony Pictures for domestic streaming rights to the studio’s movies, a significant development in the shift toward streaming and home entertainment.

International

- Brazil recorded 4,249 COVID-19 deaths on Thursday, a record, as the nation’s overwhelmed hospitals run low on supplies and lawmakers begin a probe into the nation’s response to the pandemic.

- In France, the number of people in ICUs with COVID-19 fell yesterday for the first time in eight days, declining by 24 to 5,705.

- Indian lawmakers rejected calls to offer COVID-19 vaccinations to younger people to help contain a record surge in cases.

- Federal and state authorities in Germany will meet next week to consider implementing a strict, three-week nationwide lockdown.

- Japan is putting Tokyo under a month-long “quasi-emergency” state to combat rising COVID-19 infections.

- South Korea reported 700 new COVID-19 cases yesterday, its highest number since early January.

- A COVID-19 outbreak in Bangkok, Thailand, could take more than two months to contain, authorities said.

- The U.K.’s speedy rollout of COVID-19 vaccines prevented more than 10,000 deaths of people aged 60 and older by the end of March, according to a study. The nation announced plans to use a tri-color country ranking system when international travel can resume.

- Canada’s COVID-19 vaccine rollout has been among the slowest of major economies, with one or more doses provided to about 16% of its population compared to 32% in the U.S., 47% in the U.K. and 61% in Israel.

- Restrictions on AstraZeneca’s beleaguered COVID-19 vaccine are piling up as more data emerges about extremely rare blood-clotting side effects.

- Australia is guiding against giving the shot to people under the age of 50, while the nation doubled its order of Pfizer/BioNTech vaccines to make up for the loss.

- Portugal and The Netherlands will only use the shots on those over age 60, while Spain will only vaccinate those between ages 60-69.

- The Philippines limited use of the shots to people over age 60, while the African Union dropped plans to buy the shot.

- Costa Rica became one of the only countries to allow use of the shots without restrictions.

- China’s ambitious plan to vaccinate 40% of its population — roughly 560 million people — by the end of June is being threatened by supply shortages, leaving many people unable to book their second shots.

- The Serum Institute of India will resume exports of AstraZeneca’s COVID-19 vaccine in June if domestic cases decline.

- HSBC and the Asian Development Bank will provide $300 million in financing to help Asian supply chains boost manufacturing of COVID-19 vaccines.

- The international vaccine-sharing group COVAX has delivered nearly 38.4 million doses to 102 countries and economies across six continents.

- The resurgent U.S. economy contrasts sharply with the prospects for many low- and middle-income countries, which are not set to receive large vaccine shipments until next year at the earliest. The pandemic has deepened global inequality, fueled political polarization in many countries and served as a pretext for authoritarian regimes to crack down on political opposition, trends confirmed by the U.S. government in a recent intelligence report.

- COVID-19 surges and associated lockdowns caused unexpected declines in industrial activity in France and Germany in February.

- Mexican inflation rose 4.67% through March, well above the central bank’s target rate of 3%, largely due to an increase in fuel prices.

- China’s producer price index rose 4.4% in March from a year earlier, the steepest climb since July 2018 as commodity costs surged and the economy’s recovery strengthened.

- Euro zone producer prices increased slightly in February from the year-ago period due to surges for energy and intermediate goods.

- In Latin America, 1 in every 6 people aged 18-29 has left the labor market since the pandemic began.

- Canadian finance officials are calling for measures to boost the supply of homes to cool a red-hot housing market.

- The International Monetary Fund is preparing to roll out “green debt swaps” by November to spur quicker action on climate change in developing countries.

- Bank of America said it will deploy $1 trillion by 2030 to invest in green projects.

- A comprehensive study of the electric vehicle market by consulting company KPMG predicts that sales of electric vehicles will represent between 24%-37% of the auto market by 2030.

- Plug-in electric vehicles in Germany reached a 22.5% market share in March, up from 9.2% last year.

- Polestar, the electric vehicle maker owned by Volvo, announced plans to create a climate-neutral car by 2030.

Our Operations

- Our next Plastics Reflections Web Series is Tuesday, April 20 at 1:00 pm CT. This webinar focused on Driving Sustainability Action in the Plastics Industry will feature panelists from Business Publishing International (BPI), Danimer Scientific, Coca-Cola and M. Holland. Click here to learn more and register.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.