COVID-19 Bulletin: April 28

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude futures were higher in mid-day trading today, with the WTI up 2.0% at $64.21/bbl and Brent 1.7% higher at $67.57/bbl. Natural gas was 1.0% higher at $2.90/MMBtu.

- OPEC, Russia and allies are expected to stick to plans for a phased easing of oil production restrictions from May to July.

- Fuel consumption worldwide is set to increase about 6% this year from 2020, boosting gas prices in the U.S., China and the U.K.

- Saudi Arabia is preparing to sell a 1% stake in state-controlled oil giant Aramco to an unnamed foreign company.

- A tanker carrying roughly 1 million barrels of oil collided with a bulk vessel near the Chinese port city of Qingdao, spilling oil into the Yellow Sea.

- Exxon Mobil may have missed out on profit during last year’s volatile oil market after pulling most of its speculative trading capital and limiting traders’ activities.

- Grocer chain Kroger announced the expansion of its mail-in recycling program, where consumers can recycle certain plastics and packaging from its house brands that are not currently accepted by curbside programs.

- Nova Chemicals’ Sarnia, Ontario, ethylene unit went down, forcing a force majeure declaration on all products produced there, including low density and high density grades.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Volkswagen’s Mexico unit will curtail production of its Tiguan and Jetta models next month due to the global semiconductor shortage.

- In a Senate subcommittee hearing yesterday, major U.S. automakers pressed Congress again to address the global shortage of computer chips through implementing tax incentives and government subsidies.

- Nearly half of German manufacturers reported disruption to the supply of parts or materials in the past month.

- A shortage of tanker truck drivers could drive up gasoline prices in the U.S. this summer.

- Shoppers across the globe are expected to spend 20% more online in 2021 than they did last year, according to transaction data from over 80 countries gathered by Adobe.

- Despite disruptions due to the Texas winter storm and port backlogs, United Parcel Service posted a 27% increase in first-quarter revenue on higher volumes from small and midsize businesses. The company plans to increase its weekend deliveries in the coming months, with pricing set to remain unchanged.

- Old Dominion Freight Line will invest $605 million in new tractors, technology and possibly service centers this year.

- Maersk raised its 2021 earnings outlook after early reports showed strong growth in first-quarter revenue and operating earnings.

- DSV Panalpina has acquired the logistics division of Kuwait’s Agility Public Warehousing for $4.1 billion, creating the world’s third-largest freight forwarder.

- California officials have directed Nestle to stop siphoning millions of gallons of water out of the San Bernardino forest for use in retail bottles, as drought conditions worsen across the state.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 50,856 new COVID-19 cases and 641 deaths in the U.S. yesterday. Over 232 million vaccine doses have been administered, with 27.12% of the population fully vaccinated.

- A “double mutation” variant of COVID-19 first discovered in India has made its way to the U.S., although scientists are unsure whether the strain is more infectious than others.

- Mass vaccination sites in New York State will open to walk-in appointments starting Thursday. COVID-19 cases have dropped 34% over the past week in New York City, easing fears about new variants of the virus amid higher vaccinations.

- Los Angeles County could widely reopen as early as next week after reaching the lowest threshold on the state’s COVID-19 risk assessment scale.

- Pfizer is beginning early tests on a possible home cure for COVID-19 in the form of a pill.

- Walmart will resume administering Johnson & Johnson’s single-shot COVID-19 vaccine after clearance for use by the FDA and CDC.

- The NBA’s Milwaukee Bucks will offer COVID-19 vaccinations to anyone 16 and older who attends its game this Sunday.

- The Massachusetts state university system is requiring all students returning this fall to be vaccinated against COVID-19. The state’s governor lifted an outdoor mask mandate alongside many other pandemic restrictions.

- Tennessee’s governor ended a statewide mask mandate and declared COVID-19 to no longer be a statewide public health emergency.

- West Virginia will give a $100 savings bond to each resident aged 16-35 who receives a COVID-19 vaccine.

- The federal government has pushed back its requirements for air travelers to have the more secure “Real ID” by more than a year and a half.

- Public health officials have become the face of government authority during the pandemic, bringing a wave of aggression, attacks and security threats that have upended their lives as they seek to implement state and federal coronavirus restrictions.

- A new study shows that back-to-front boarding on airplanes, a policy adopted by Delta Air Lines during COVID-19, actually increases the infection risk by 50%.

- U.S. consumer confidence jumped to a 14-month high in April amid increased vaccination levels and fiscal stimulus.

- Home price growth accelerated 12% to a 15-year-high in February, up from an 11.2% annual rate the prior month, index data show.

- JPMorgan Chase will bring all its U.S. staff back to the office on a rotational basis in July.

- As the pandemic eases, Deutsche Bank is developing a hybrid work model for its employees, allowing staff to work from home up to three days a week.

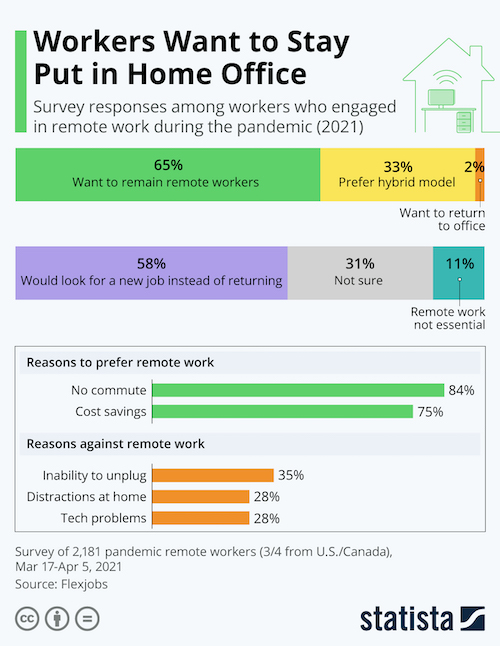

- In a recent survey, most workers said they want to continue working remotely after the pandemic and would look for alternate employment if forced to return to the office:

- The rollout of roughly $47 billion in U.S. rent relief is coming much slower than expected, putting property owners in danger of losing buildings or being forced to sell to wealthy investors.

- Dense core counties of major U.S. metro areas saw a net decrease in migration in 2020, as more people moved to the suburbs.

- DoorDash lowered some fees for restaurants using its third-party delivery service after many have struggled to stay in business during the pandemic.

- The pandemic played a part in the quarterly performance of many reporting corporations:

- Google-parent Alphabet reported a 34% year over year increase in revenues, as the reopening economy prompted a surge in digital ad spending.

- Microsoft posted a 19% increase in sales to about $41.7 billion, continuing a pandemic-fueled run of stronger-than-expected quarterly earnings.

- General Electric’s revenues shrunk 12% to $17.1 billion, reflecting a 28% decline in its aviation unit and a 9% drop in its healthcare unit after selling off part of the business.

- Revenue at Tesla jumped 74% from the same time last year, driving record quarterly profit despite supply disruptions caused by the global semiconductor shortage.

- Grocer Albertsons saw a 12% increase in same-store sales as consumers continued to cook and eat at home.

- Hasbro reported a 14% rise in sales in its consumer products unit, as families spent more on toys to keep children entertained while stuck at home.

- U.S. conglomerate 3M posted better than expected first-quarter results but warned that higher material costs and supply chain issues could impact full-year results by up to 50 cents a share.

- Eli Lilly reported lower-than-expected first-quarter profit as demand waned for its COVID-19 antibody therapies with the U.S. vaccine rollout picking up speed.

- Visa said it is seeing the “beginning of the end” of the consumer spending decline as it posted better-than-expected results on a 31% rise in volume on its U.S. debit cards, with cardholders energized by $800 billion in federal stimulus checks.

- Global banking giant HSBC nearly doubled its quarterly net profit as rebounding economies allowed the bank to free up funds previously set aside to offset pandemic losses that never came.

International

- India set another daily record for new COVID-19 infections, with 360,927 reported cases yesterday.

- Medical supply donations from other countries and the World Health Organization began pouring into India yesterday as the nation approached 200,000 total COVID-19 deaths.

- Only about 1 in 30 COVID-19 infections are being reported in India, a think tank suggests, boosting the country’s real number of infected people into the hundreds of millions from its official figure of just under 18 million.

- Despite a surge in cases, India will allow the Amarnath pilgrimage to take place, preparing facilities for up to 600,000 people.

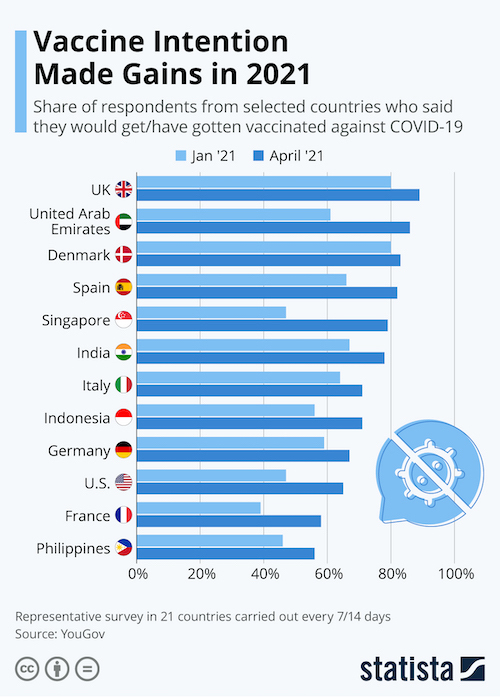

- Vaccine hesitancy is declining around the world:

- Poland announced that it will ease some of its COVID-19 restrictions as cases across the country fall, allowing hotels, restaurants and shopping malls to reopen as well as allowing students to return to school in May.

- Iceland announced a conditional four-step plan to lift all COVID-19 restrictions in June once 75% of the country has received at least one dose of a COVID-19 vaccine.

- There has been “no sign” of coronavirus infection among 5,000 unvaccinated people who took part in an indoor trial concert last month in Barcelona, an effort to see how optimized ventilation, antigen tests and mask-wearing could create safe venues.

- Fifty-eight people were caught with fake coronavirus test result certificates at Brussels Airport in one week.

- Brazilian health regulators rejected the use of Russia’s Sputnik V COVID-19 vaccine after highlighting “inherent risks” and “serious” defects with the shots.

- Vietnam reported its first domestic case of COVID-19 since March 25.

- China is set to post its first population decline in five decades, a pandemic-driven result that could have lasting impacts on the nation’s economy.

- March profits at China’s industrial firms were lower than in January and February but up 92.3% from the same period a year ago when the nation’s economy nearly shut down due to the pandemic.

- Many cities in Japan are withdrawing from participation as Olympics host cities for athletes and sports venues due to rising COVID-19 infections.

- The Bank of Japan predicted inflation will fail to reach its 2% target through 2023, as fresh pandemic restrictions limit the economic boost from growth in global demand.

- British retailers reported the sharpest upturn in sales in April since 2018 as non-essential shops began to reopen after months of closure.

- Germany announced plans to spend 90% of its more than $34 billion in EU recovery dollars on climate protection and digitalization.

- Scientists report a massive gap — equal to about what the U.S. emits annually — between the amount of carbon emissions that countries report and the amount that independent models say reaches the atmosphere.

- Japan-based Mitsui Chemicals will begin work on a resource circulation platform that uses blockchain technology to ensure the traceability of materials through the life cycle of a product.

- British sports car maker Lotus will invest roughly $3 billion in switching to a full lineup of electric vehicles by 2028.

Our Operations

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates & Masterbatch Virtual Summit on April 26-29. For registered attendees, stop by M. Holland’s virtual booth to speak with our experts.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.