COVID-19 Bulletin: April 30

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices ended Thursday at their highest levels in six weeks on encouraging U.S. earnings reports. Crude futures were lower in mid-day trading today, with the WTI down 2.1% at $63.62/bbl and Brent 1.8% lower at $67.31/bbl. Natural gas was 0.8% higher at $2.93/MMBtu.

- Last year saw the lowest annual American crude oil imports from OPEC since 1973, the Energy Information Administration said.

- European oil majors benefited from a rebound in oil prices, posting big increases in first-quarter earnings:

- BP posted a quarterly profit of $2.6 billion, higher than the $2.4 billion reported in 2019 and nearly 200% higher than the same period in 2020.

- Total saw quarterly profits increase 69% from the same time last year and 9% from 2019.

- Norway’s Equinor reported profits of $5.5 billion, up from its pre-pandemic level of $4.2 billion.

- Royal Dutch Shell beat analyst estimates but was the only European oil major to post a decline in quarterly profit from pre-pandemic levels, despite a 13% increase from 2020. The company also raised its dividend for the second time in six months.

- Chevron reported a 30% year over year drop in first quarter earnings per share (EPS), in line with analyst estimates, but its best free cashflow of the pandemic thanks to expense and capital spending cuts.

- Egypt will invest $7.5 billion to build the largest petrochemicals project in the region with capacity to produce polyethylene, polystyrene, polyester and feedstocks.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Global auto makers are cautioning that semiconductors will remain scarce for many months, with the largest causes of disruption being February’s Texas storm and a fire at Japan’s Renesas chip manufacturing facility.

- Semiconductor shortages contributed to an unexpected drop in China’s manufacturing activity, with a key index falling to 51.1 in April from 51.9 in March, suggesting the country’s economy is slowing down.

- After posting its highest first-quarter operating profit in three years, Samsung expects chip profits to rise in the second quarter as customers seek to secure stock amid the global shortage.

- BMW is suspending production at two factories in the U.K. and Germany due to the global chip shortage.

- The EU is mulling the creation of a semiconductor alliance that would make it easier for member nations to provide funding for manufacturing, part of the bloc’s plan to double its market share in semiconductors to 20% by 2030.

- The Port of Singapore has cleared a backlog of 45 container ships that had built up due to the Suez Canal blockage.

- U.S. importers are looking to lessen the impact of rising container freight rates by locking in multiyear service contracts.

- Daimler and Volvo are pairing up to cut the costs of hydrogen fuel cells by five- to-six-fold from current levels by 2027, a move they hope will make the zero-emission technology viable for long-haul trucking.

- An appeals court reversed an injunction shielding trucking companies from enforcing California’s gig-economy law that gives employee status to 70,000 drivers in the state.

- Norfolk Southern posted a record 61.5% quarterly operating ratio, an efficiency measure comparing revenue to expenses, as operating revenue rose on a gain in freight rail volumes.

- Full-year profit at Cargolux provides evidence of soaring air freight rates, rising 40% despite an only marginal growth in airfreight volumes.

- While the first concrete proposal for a global CO2 tax is in the works at the International Maritime Organization, industry leaders say it will be several years before such a tax is introduced.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- New U.S. coronavirus cases fell by roughly 16% over the past week. There were 58,199 new COVID-19 cases and 854 deaths in the U.S. yesterday.

- The U.S. has fully vaccinated more than 30% of its adult population.

- The number of COVID-19 vaccine shots given in the U.S. each day is slowing, largely due to reluctance among rural populations.

- Michigan could become the first state to tie its rollback of pandemic restrictions to specific vaccination levels across the state.

- Skipping a required second COVID-19 vaccine could significantly prolong the pandemic, public health officials warn.

- Despite the risk of extremely rare side effects, many Americans are choosing to receive Johnson & Johnson’s COVID-19 vaccine, showing a preference for the “one and done” shot that does not require a return to the clinic.

- Moderna said its COVID-19 vaccine can be stored at refrigerator temperatures for up to three months, easing logistical challenges of maintaining super cold temperatures for shots.

- A hospital in Florida became the first in the U.S. to employ a COVID-19 sniffing dog.

- Cases of the flu reported to the World Health Organization are almost non-existent, a result of public health measures to contain COVID-19.

- Roughly 63% of employers will require proof of vaccination before employees can return to the office, according to a survey.

- The White House’s top labor official indicated U.S. gig workers should be classified as “employees” deserving of benefits, a potentially significant blow for companies that depend on contractors, including ride-hailing and third-party delivery services.

- Economists expect that household income in the U.S. rose more than 20% in March compared to February, the largest monthly increase for government records dating back to 1959.

- Government data shows that roughly 2.7 million Americans aged 55 and older are considering retiring earlier than originally planned because of the pandemic.

- Fewer routine doctor visits, procedures and screenings for cancer and other diseases caused setbacks for pharmaceutical companies in the first quarter:

- Sales at Merck dropped 3%, as roughly two-thirds of its products are administered at hospitals whose resources were often shifted to COVID-19 patients.

- Sales and profit fell at U.S. biotech company Amgen largely due to a 7% drop in its net drug prices during the pandemic.

- Bristol Myers Squibb posted lower-than-expected profit on a slip in sales of its cancer drugs Revlimid and Opdivo.

- The U.S. is beginning to run low on its supply of chicken, its most popular meat, after Popeyes introduced a fried chicken sandwich in 2019 that went viral and sold out in weeks, leading many other fast-food companies to follow suit. The cost of feeding chickens is pushing up prices for food staples across the world.

- The Federal Communications Commission is launching a $3.2 billion program on May 12 to provide lower-income Americans with discounts on monthly internet service and on purchasing laptops or tablets.

- Cruise operators could restart sailings out of the U.S. by mid-July, the CDC said.

- Thursday was the busiest day of the first-quarter earnings season so far:

- Amazon headlined the reports, as the e-commerce giant’s sales hit a quarterly record $108 billion, up 44% from the year-ago period. The company’s outlook for next quarter was also higher than expected, as it is on track to surpass Walmart as the largest U.S. retailer by 2025.

- Twitter posted better-than-expected earnings but warned about lackluster growth in new users for the rest of the year, sending shares down.

- American industrial conglomerate Textron beat Wall Street earnings expectations on a rebound in jet deliveries driven by demand for private corporate travel.

- Earnings at packaged food maker Kraft Heinz rose 24.1% from the same time last year, driven by a year-long surge in demand for consumables.

- Logitech, a maker of keyboards, mice, headsets and webcams, posted a 76% rise in annual sales as customers bought more of its products for remote work and play.

- McDonald’s cited new menu items that helped it beat sales expectations in the U.S., while shifting COVID-19 restrictions caused mixed results in other countries.

- Comcast saw a 55% gain in first-quarter profit on an influx of new broadband customers during pandemic lockdowns.

- General Motors will invest $1 billion at a plant in Mexico to produce electric vehicles, drawing a rebuke from the UAW.

- Worldwide sales of electric vehicles jumped by 41% last year while total global car sales fell.

International

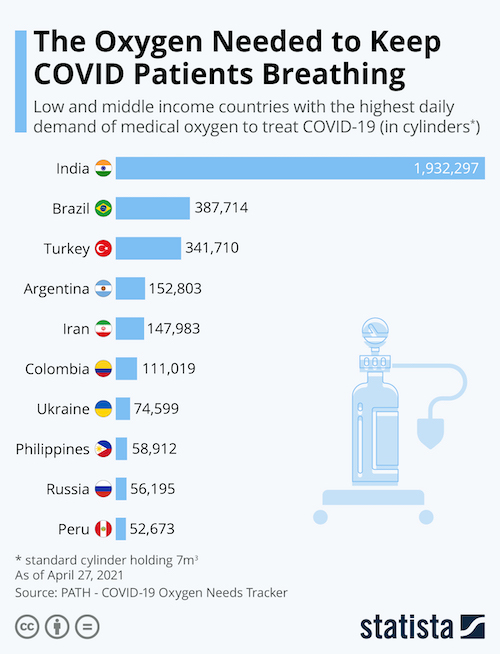

- India’s catastrophic COVID-19 outbreak accelerated, with new infections setting another daily record: 386,555. Total reported cases are approaching 19 million.

- Gravediggers are working around the clock to bury the dead, while India’s crematoriums are overwhelmed, with a more than ten-fold increase in demand and funeral pyres burning throughout New Delhi, where firewood is in short supply.

- More than 40 countries have pledged to send shipments of medical oxygen to India. The U.S. will send medical supplies worth more than $100 million to the nation.

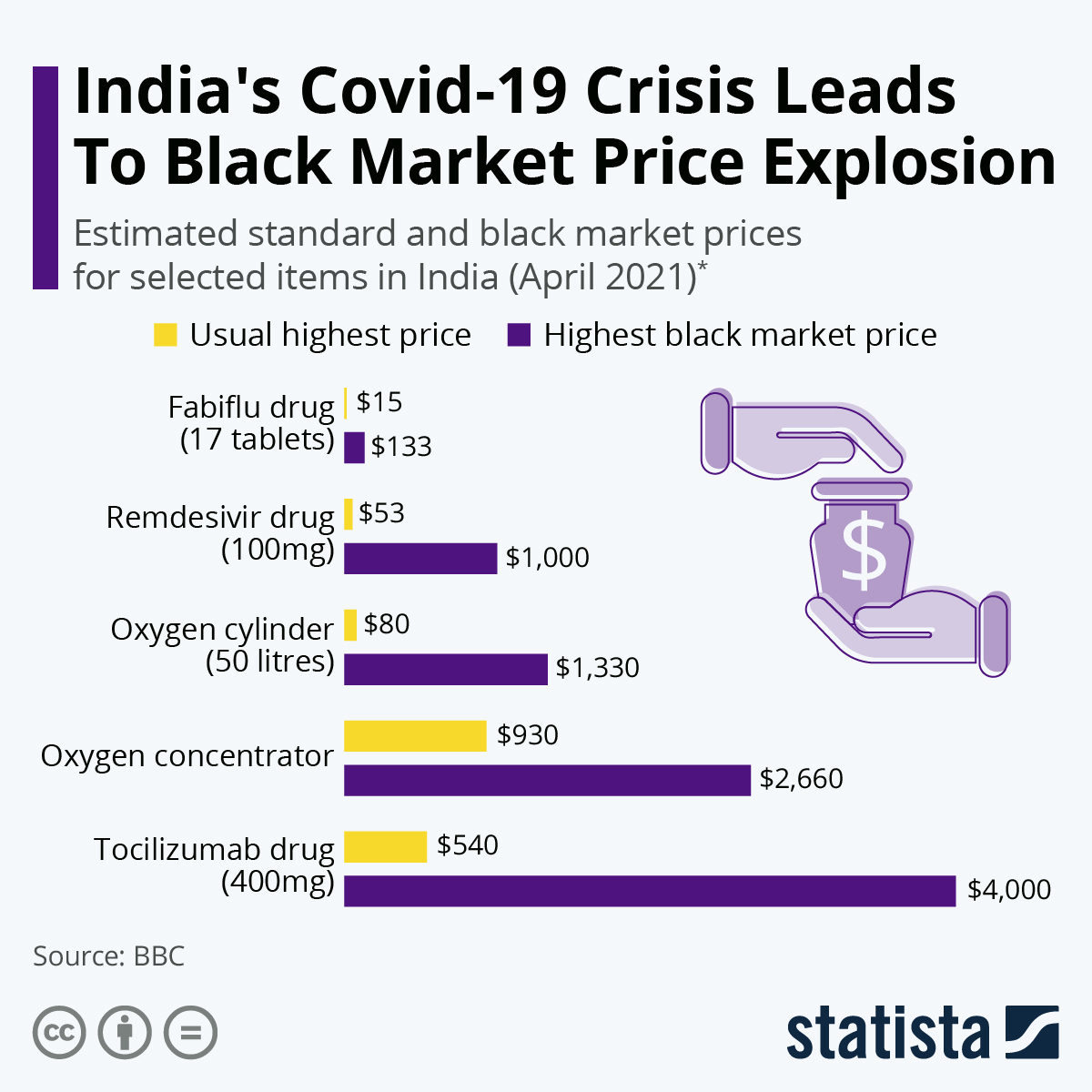

- With government and healthcare resources overtaxed, India’s citizens are left on their own in combating COVID-19, creating a black market for healthcare supplies.

- With government and healthcare resources overtaxed, India’s citizens are left on their own in combating COVID-19, creating a black market for healthcare supplies.

- Airlines and charter services are increasing flights from India for foreigners seeking to return home.

- Twenty-three people tested positive for COVID-19 after traveling on a flight from India to Rome.

- France will begin relaxing its most recent nationwide pandemic lockdown on May 19, easing curfews and allowing bars, cafes and restaurants to resume outside service.

- Germany administered a record 1.1 million COVID-19 vaccine doses in a single day, a number equal to about 1% of its population, as infections in the nation begin to decline.

- Alberta, Canada, home to the country’s oil sands industry, is now the epicenter of the nation’s COVID-19 surge, with daily infections topping 2,000 for the first time yesterday. Ontario, Canada, will expand COVID-19 vaccine eligibility to all adults by the end of May.

- Costa Rica will close non-essential businesses and impose travel restrictions beginning May 3 to combat a surge in COVID-19 infections.

- Makers of the Pfizer/BioNTech COVID-19 vaccine are asking the EU to approve its use in children aged 12-15.

- European lawmakers approved the creation of an EU-wide COVID-19 health certificate in a plan to help revive summer tourism. About 3 in 4 adults across the world say that vaccine passports should be required to enter their country.

- Ireland will reopen all retail stores, personal services and non-residential construction in May.

- Countries across the globe are expected to spend $157 billion on COVID-19 vaccines through 2025.

- Botswana, a nation of just over 2.3 million, is set to become the first African country to fully vaccinate its entire adult population.

- Euro zone GDP shrank 1.8% year over year in the first quarter, a second consecutive quarterly contraction that officially marks the region’s descent into a double-dip recession during the pandemic. Euro zone economic sentiment surged in April, with survey results showing a measure of optimism rising to 110.3 points from 100.9 in March.

- Women have taken the brunt of Latin American job losses caused by the pandemic, setting their pre-pandemic goal of roughly 70% labor force participation back by at least a decade.

- Airbus announced plans to raise production of its most popular jets, a bet on the industry’s expected recovery this summer.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.