COVID-19 Bulletin: April 5

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

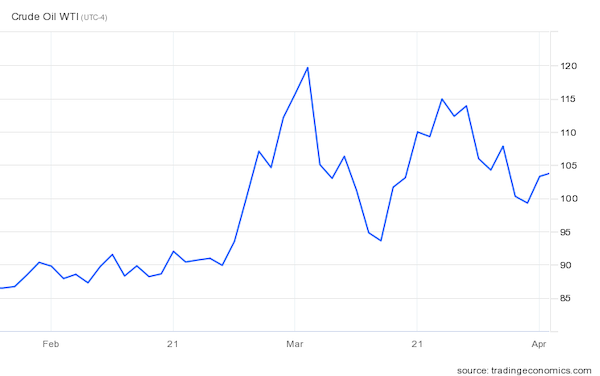

- Oil prices rose 3%-4% Monday as mounting civilian deaths in Ukraine raised pressure on Europe to ban Russian energy. Upward pressure also came from stalled talks to revive an Iran nuclear deal, which would allow a lifting of sanctions on Iranian oil.

- In late-morning trading today, WTI futures were down 0.5% at $102.80/bbl, Brent was off 0.4% at $107.10/bbl, and U.S. natural gas was up 7.3% at $6.11/MMBtu.

- A truce was negotiated for the first time in the seven-year conflict between Saudi Arabia and Yemen, potentially spelling an end to escalating attacks that most recently led to damage to Saudi oil facilities.

- Saudi Aramco raised its May selling price to Asia for its flagship Arab Light crude to a record premium, a move that could drain comparatively cheaper oil supplies from the U.S.

- Foreign demand for U.S. coal is surging as nations look to combat energy shortages, with prices rising 9% last week to their highest level since the mid-2000s.

- Exxon Mobil expects to see its highest profit since 2008 in the first quarter, with total earnings nearing $10 billion. The firm also said it will invest $10 billion in its fourth and largest project off the coast of Guyana, one of its top bets for future production growth.

- New York could become the first state to ban natural gas and other fossil fuels in new construction under a budget proposal from the state’s governor.

- More oil news related to the war in Europe:Multiple signs suggest Russian oil and gas output is faltering as Western sanctions block exporters from placing some barrels. Suspicions heightened after the nation’s official provider of monthly output data failed to release a scheduled report on April 2, while other reports suggest Baltic Sea loadings are down sharply.

- Germany will temporarily take control of a domestic unit of Gazprom as it seeks to safeguard gas supplies. The nation reaffirmed its stance against cutting off Russian gas imports, while Deutsche Bank’s chief executive warned of a recession if the move is taken.

- Russia’s invasion has accelerated plans to switch to green energy in many nations, primarily in Europe, but also forcing a reality check on how quickly the world can replace fossil fuels.

Supply Chain

- Container throughput in Shanghai is down 33% from a month ago, new data shows, as the government’s move to indefinitely prolong the city’s lockdown casts more uncertainty on global supply chains.

- Ships would pay 8% more on average to traverse the Panama Canal under a new pricing system proposed by canal authorities.

- At least 14 ships shut down after receiving tainted fuel from the world’s largest marine refueling hub in Singapore.

- The vessel newbuild market is haywire, with containership orders rising 300% last year; LNG carrier orders hitting a record 86; newbuild prices rising at their fastest pace in two decades; and delivery times stretching to almost three years.

- A broad group of logistics stakeholders is suing the Oakland Athletics over the proposed construction of a baseball stadium at the city’s port.

- BNSF Railway paid almost $50 million last week for a 3,500-acre stretch of land in Phoenix, the site of its planned Western intermodal and logistics hub.

- Three months after launching its dedicated freighter service with a single airplane, Air Canada, encouraged by promising cargo margins, is looking to buy at least seven more cargo jets by the end of 2023.

- Maersk Drilling received over $107 million in recent contracts to provide ships to Shell for multiple drilling projects across the globe.

- A coalition of global maritime operators aims to build two very large crude carriers that can operate on green ammonia by 2026.

- A Singaporean chemical transporter claims to have technology that would eliminate the need for entry into cargo tanks during vessel cleanings, potentially cutting down on “wall wash” inspection times.

- More supply chain news related to the war in Europe:The EU plans to announce new sanctions on Russia, including bans on Russian coal and restrictions on Russian trucking and shipping carriers.

- All of Russia’s waters are now designated “high risk” by London marine insurers, a move that will raise the cost of shipping and add to logistical pressures on Russia.

- An unusually large number of Russian-flagged commercial vessels switched their flags to other countries in March, possibly to conceal their ties to Moscow and avoid sanctions.

- Airbus will likely push back its monthly production targets for A350 widebody jets over complications from Western sanctions on Russia and as Qatar Airways continues to cancel orders.

- Disappointing sales numbers at Ford — 17% lower in the first quarter and 26% lower in March — point to a wider slump in the auto industry caused by continued shortages of key materials, including semiconductors.

- Production in Michigan of Ford’s Mustang and Chevrolet’s Camaro will shut down this week due to supply shortages, the automakers announced.

- Canada’s budget proposal, set to be unveiled later this week, will likely include at least $1.6 billion to boost production of minerals needed for the electric-vehicle battery supply chain.

- Spain announced plans to invest over $12 billion in boosting semiconductor production.

- Advanced Micro Devices will purchase Pensando Systems for $1.9 billion to add to its services in the data-center market, which has grown sharply as companies embrace digital tools.

- Chipotle’s plan to sell only humanely raised chicken by the end of this year has been put on hold due to supply shortages.

- BJ’s Wholesale Club is the first wholesale retailer to partner with third-party deliverer DoorDash.

Domestic Markets

- The U.S. reported 23,892 new COVID-19 infections and 455 virus fatalities Monday.

- The Omicron BA.2 “stealth” variant of COVID-19 now accounts for nearly three-fourths of infections in the U.S.

- New COVID-19 cases are up 40% over the past two weeks in New Jersey, New York, Massachusetts and Connecticut, while smaller upturns have been noted in at least five other states.

- Led by the BA.2 subvariant of Omicron, COVID-19 cases are up 50% in Philadelphia over the past 10 days, prompting officials to recommend people return to wearing masks indoors.

- Citing rising COVID-19 cases, New York City officials will leave in place a school mask mandate for children under age 5.

- Congressional lawmakers reached agreement yesterday on more than $10 billion in additional pandemic funding to expand purchases of antiviral pills and boost testing and vaccine manufacturing, among other provisions.

- The FDA is meeting later this week to discuss potential guidelines for expanding second COVID-19 booster doses.

- The CDC will undergo an agency-wide revamp after facing criticism for its handling of the pandemic response.

- COVID-19 fatalities at nursing homes have dropped to their lowest levels of the pandemic, new data shows.

- Recent studies suggest up to 40% of all COVID-19 fatalities in the U.S. occurred among people with diabetes.

- The pandemic has had a disproportionate impact on poor communities. Death rates in the nation’s poorest counties during the Delta variant surge were up to four-and-half times higher than the death rate in the richest counties, and the death rate in poor counties during the Omicron wave was up to three times higher.

- The high quit rates during the “Great Resignation” of the pandemic may be more common throughout U.S. history than many have suggested, economists say.

- Office availability in Manhattan reached a record-high 17.4% in February, while barely one-third of the Midtown office workforce has returned.

- Orders for U.S.-manufactured goods fell 0.5% in February, the Commerce Department said Monday, the first decline in 10 months.

- American consumers are buying staples in smaller quantities, switching to cheaper store-name brands and more rigorously hunting for deals as rising inflation permeates every part of the economy.

- The average U.S. mortgage rate hit 5.45% this week, up more than a percentage-point from just a month ago. Real estate employment continues to boom despite the rise in rates, with 14,000 jobs added in March, higher than the 11,000 monthly average over the past year.

- New leadership at Starbucks went to work immediately to halt share repurchases in favor of expanding operations, sending the firm’s stock price down on Wall Street.

- Hertz is expanding its lineup of plug-in electric vehicles with a 65,000-vehicle order from Swedish auto maker Polestar.

- GM and Honda will jointly develop a series of new “affordable” electric vehicles for the global market.

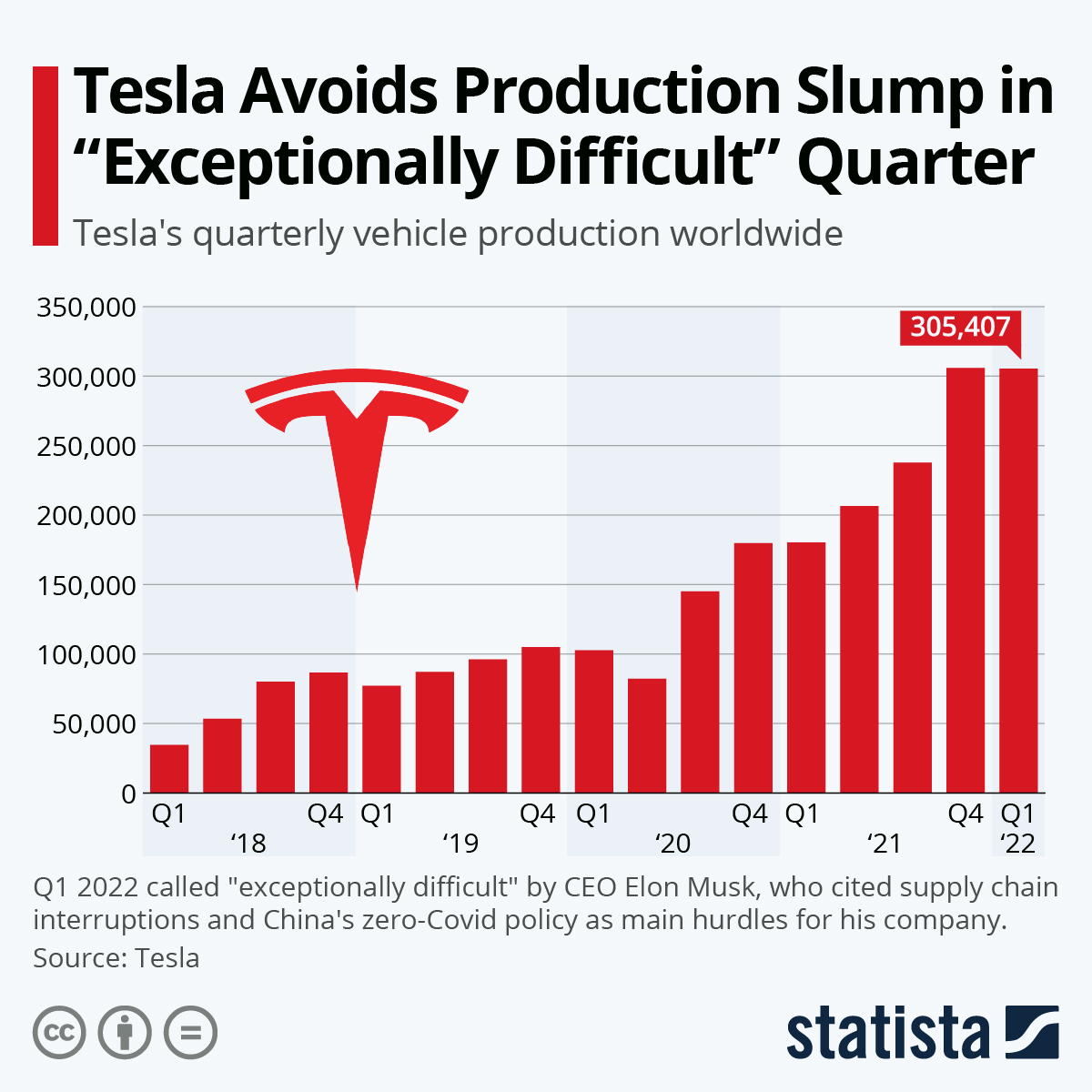

- Tesla appears certain to pass 1 million vehicles produced this year after narrowly missing the target by 70,000 vehicles last year:

- A growing number of startups are attempting to turn captured carbon into fuel for a variety of uses, most notably in aviation.

International Markets

- Shanghai’s lockdown was extended to all 26 million residents yesterday as more than 38,000 medical personnel were deployed for a round of mass testing, the nation’s largest medical operation since the shutdown of Wuhan in early 2020. The tests revealed more than 13,000 COVID-19 cases, prompting officials to extend the city’s lockdown indefinitely.

- Daily COVID-19 cases in South Korea continue to swing wildly as the nation’s most recent virus wave slows down.

- Taiwan is easing pandemic restrictions, despite a rising outbreak of the virus, in a bid to loosen pressure on the nation’s medical services.

- Germany dropped its indoor mask mandate for businesses and made quarantine periods following infection voluntary.

- South Africa ended its two-year national state of disaster, which lifted remaining pandemic restrictions.

- More international news related to the war in Europe:

- JPMorgan Chase’s annual shareholder letter warns that Russia’s invasion could collide with rising inflation to slow the pandemic recovery and alter global alliances for decades to come.

- The U.S. blocked the Russian government from paying holders of its sovereign debt from reserves held at U.S. banks, a move meant to eat into Moscow’s U.S. currency reserves and curtail its ability to fund the war without risking default.

- Companies on alert about the risk of Russian hacking must also watch out for cyber retaliation from anti-Russia activists, as evidenced by an attack on Nestle by hackers protesting its continued business in Russia.

- Turkey’s monthly trade deficit more than doubled in the past year.

- Low-cost British airline EasyJet canceled dozens of flights yesterday on a sharp rise in employee infections with the BA.2 subvariant of Omicron. Hundreds of more flight cancellations are expected for this week at EasyJet and potentially other British airlines.

- The United Nations says countries must halve their 2019 levels of emissions by the end of the decade if Paris-accord climate targets are to be met, an increasingly unlikely achievement.

- GM is getting over $400 million from the Canadian government to help fund multi-billion-dollar investments at its two plants in Ontario, including one that will produce electric vehicles.

- BYD, China’s largest electric-vehicle maker, almost completely stopped production of combustion engines for its vehicles in favor of fully electric models.

At M. Holland

- M. Holland has launched a new Healthcare Packaging line card to meet the product needs of medical device and pharmaceutical packaging manufacturers.

- M. Holland’s Color & Compounding experts shared insight on the current pigment shortage and how it’s impacting the industry.

- M. Holland will be exhibiting at MD&M West in Anaheim, California, from April 12-14. MD&M West is the largest medtech conference in the U.S. If you’re attending, please stop by Booth #4111 to meet our Healthcare experts!

- In case you missed it, watch M. Holland’s Plastics Reflections webinar about the current and future state of the North American plastics industry. Click here to access the recording.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.