COVID-19 Bulletin: August 18

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell for the fourth straight day Tuesday, the longest losing streak since March, to about 10% below this year’s highs.

- Energy futures were higher in mid-day trading, with WTI up 0.3% at $66.81/bbl and Brent up 0.5% at $69.40/bbl. Natural gas was 0.7% higher at $3.86/MMBtu.

- U.S. shale output is forecast to rise to 8.1 million bpd in September, the highest since April 2020, led by increased activity in the Permian Basin.

- The White House filed an appeal against a federal court ruling that blocked the suspension of new oil and gas leases on federal land and waters.

- Higher global gas prices are prompting British energy retailers to significantly raise consumer surcharges, with recent price hikes of around 13% from multiple suppliers.

- The U.S. solar industry could provide more than 40% of the nation’s power generation by 2035 with better policies for energy projects and component factories, the U.S. Department of Energy said.

- The U.K. government will invest more than $1.25 billion into new hydrogen projects, aiming to replace up to a fifth of the nation’s natural gas production by 2030.

- Finnish energy company Fortum is accelerating the closure of roughly 40% of its coal-fired generating capacity globally as part of boosted efforts to combat climate change.

- Texas gas company Howard Energy Partners is teaming up with the Port of Corpus Christi to convert a natural gas refinery along the Gulf of Mexico into a carbon-neutral hydrogen production facility.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- The death toll from Haiti’s 7.2-magnitude earthquake on Saturday rose to nearly 2,000, with another 10,000 people injured and more than 60,000 homes destroyed. Tropical Storm Grace drenched the nation with more than 15 inches of rain yesterday before striking Jamaica and the Cayman Islands in the evening. The storm could strengthen into a hurricane as it approaches Mexico’s Yucatan Peninsula today, prompting hurricane warnings.

- Tropical Depression Fred dropped heavy rain in southeastern U.S. states Tuesday and prompted tornado warnings in Georgia. Fred’s effects are expected to stretch up the mid-Atlantic to the interior northeast today.

- California’s Dixie Fire grew to more than 600,000 acres Tuesday with an unchanged 31% containment, prompting additional evacuations in Northern California. State utility PG&E cut off power to 51,000 people to reduce the risk of sparking new blazes.

- Washington state officials declared a state of emergency for Lake Chelan, where the “Twenty Five Mile Fire” has grown to more than 4,000 acres.

- Minnesota’s Greenwood Fire, one of three major blazes in the state, doubled in size to 2,000 acres over the last 24 hours.

- The U.S. government declared a first-ever water shortage for the Colorado River, triggering mandatory cutbacks that will reduce water allotments for Arizona, Nevada, California and parts of Mexico.

- Thirty-seven container ships were anchored off the ports of Los Angeles and Long Beach in recent days, the most since a backlog of 40 ships in February as congestion shows signs of returning to Southern California waterways.

- The Baltic Dry Index, which tracks rates for ships carrying dry bulk commodities, rose for a sixth straight session to its highest measure in more than a decade on Tuesday.

- China’s “zero-tolerance” COVID-19 policy, which caused the partial shutdown of the world’s third-busiest port of Ningbo last week after a single virus infection was reported, could exacerbate congestion in the region’s already overstrained container terminals.

- Hyundai will cut vehicle production at an Alabama plant until Friday over a shortage of semiconductor chips, the company said.

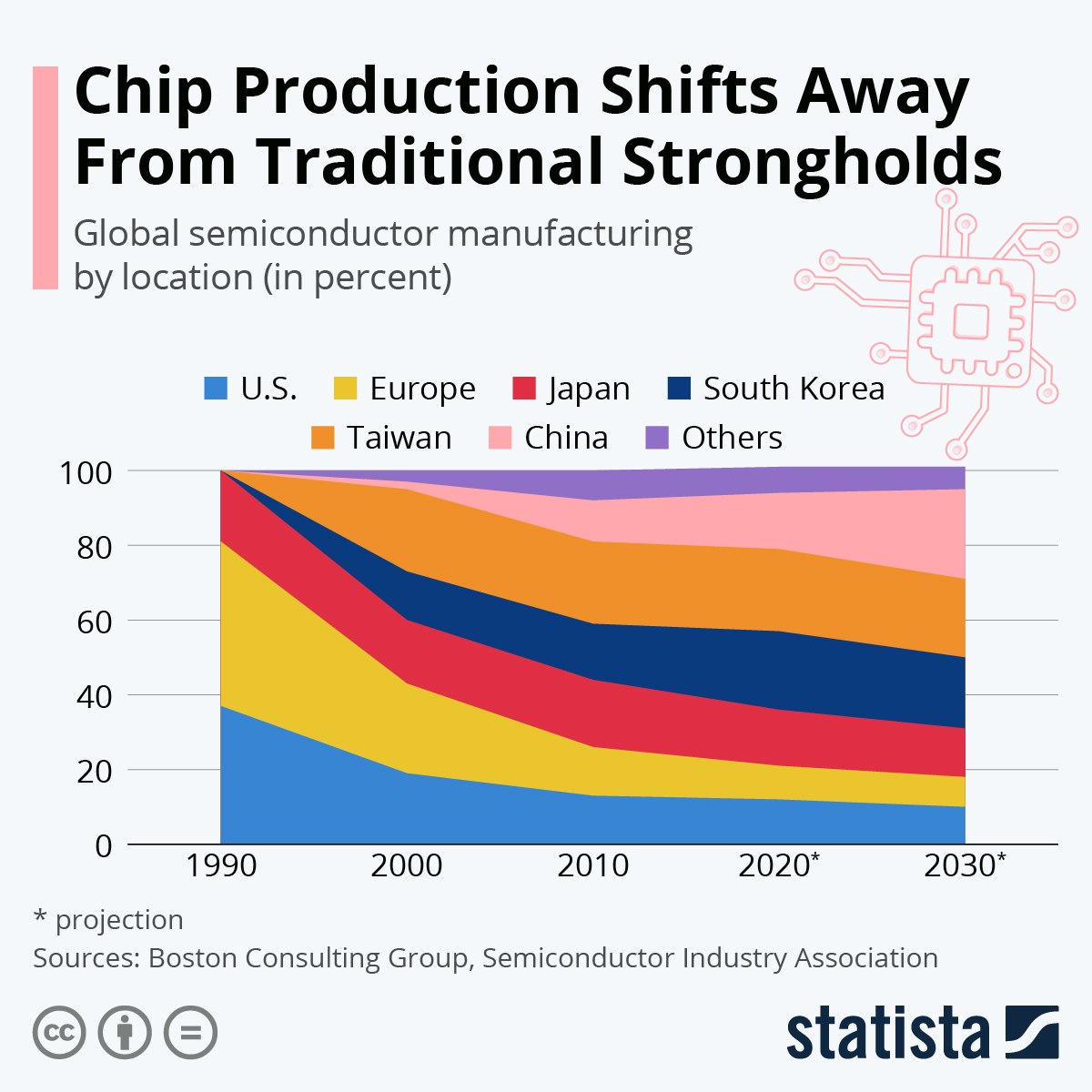

- China’s semiconductor output was up over 41% in July from the prior-year period.

- The Port of Virginia handled more than 293,000 TEUs last month, its best July on record, representing a roughly 33% year-over-year increase in volume.

- Georgia’s Port of Savannah handled 450,000 TEUs in July, a 25% increase from a year earlier, fueled by increased demand for consumer goods and capacity enhancements.

- Wholesale U.S. beef prices were 40% higher in July compared to the same time last year.

- The Seafarers International Relief Fund exceeded its goal of raising $1 million for financial relief to seaferers and their families who were affected by the pandemic.

Domestic Markets

- The U.S. added more than 900,000 new COVID-19 infections last week, the highest weekly amount since January. On Tuesday, the nation reported 128,902 new infections and 1,001 virus deaths, as daily fatalities approach mid-April levels.

- One of every five ICU units in U.S. hospitals are reported to be at least 95% full, as the COVID-19 Delta variant spreads rapidly among unvaccinated people.

- Breakthrough COVID-19 infections have occurred in just 0.1% of 136 million fully vaccinated Americans, new data shows.

- ICU patients in Alabama outnumber available ICU beds, forcing treatment on some patients on gurneys in hospital corridors.

- About 20,000 Mississippi children — roughly 5% of the state’s public school population — are currently quarantined following exposure to COVID-19. In Tennessee, cases of COVID-19 among school-aged children have risen almost 1,000% over the past month.

- San Antonio’s school system became the first major district in Texas to require teachers and staff to be vaccinated against COVID-19, further igniting a legal battle with the state’s governor over the power of local governments to impose pandemic restrictions. Following weeks of opposing local mask mandates, Texas’ governor has tested positive for COVID-19.

- Florida’s seven-day average for new COVID-19 cases rose to 21,614, up from 6,510 last month. A growing number of the state’s school districts are imposing mask mandates, defying the governor’s recent order banning the measure.

- Louisiana reported 98 new COVID-19 deaths Tuesday, the most since January.

- Hawaii officials warn the state could go into another pandemic lockdown amid rising COVID-19 cases.

- Wyoming’s governor firmly rejected the idea of imposing new mask or vaccine requirements in the state despite rising COVID-19 infections.

- Roughly 500,000 Americans are getting vaccinated against COVID-19 each day, a rate not seen since May.

- The rise in COVID-19 cases in California is starting to slow, with the state averaging 11,800 new cases per day, a 7% increase from last week but below the 30% spike the week prior.

- The Las Vegas Raiders will require fans to be vaccinated against COVID-19 to attend games this NFL season, while the city’s January Consumer Electronics Show also will require attendees to be fully vaccinated, the latest large-scale event to require shots.

- The National Park Service is requiring all visitors and employees to wear masks inside its buildings, facilities and crowded outdoor spaces, regardless of vaccination status.

- Morgan Stanley will require proof of COVID-19 vaccination by Oct. 1, reversing course from a previous directive only asking employees to attest to their inoculation status.

- The U.S. administration is preparing to extend a mask mandate for airplanes, trains and buses through Jan. 18.

- The U.S. is preparing to send 488,000 COVID-19 vaccines to Rwanda as part of the COVAX vaccine sharing program.

- Apparel-maker Hanesbrands is requiring that all U.S. employees be vaccinated by Oct. 15.

- At least 30% of millennial and Gen Z Americans report having cut ties with a friend, family member or acquaintance due to differences in views on COVID-19 vaccination.

- Airline cancellations are rising along with the spread of the Delta variant of COVID-19 as the TSA is extending its mask mandate through January 2022.

- An index of U.S. homebuilding sentiment dropped to its lowest level since July 2020, falling five points to 75, as buyers encounter sticker shock over high construction costs.

- A new survey shows that Americans are spending an average $765 more per month compared to the same time last year, fueled by restaurant visits, vacations, and the reopening of offices and schools.

- Home Depot same-store sales rose just 3.4% in the second quarter, the company’s smallest increase in two years as consumers ease back on DIY projects amid an easing of pandemic restrictions.

- Walmart saw rising sales in the second quarter as a return to in-store shopping offset slower e-commerce activity.

International Markets

- The U.K. reported 26,852 new COVID-19 cases and 170 virus deaths Tuesday, its highest daily death toll since March.

- Greece reported 4,205 new COVID-19 infections Tuesday, its biggest daily jump since April.

- Health authorities in Sydney are warning of a significant rise in COVID-19 cases over the next several weeks, after the New South Wales state saw 452 new infections Tuesday, its third-largest single-day jump since the start of the pandemic.

- New Zealand recorded four new COVID-19 cases Tuesday after logging its first infection in over six months Monday, as the country remains under a strict snap lockdown.

- Singapore is holding talks with Germany, Australia, Canada and South Korea to allow vaccinated business travelers to enter the city-state with controlled business itineraries. Meanwhile, state officials recently revamped their strategy to combat COVID-19, focusing on reducing future outbreaks instead of eliminating the virus through herd immunity.

- The U.K. has approved Moderna’s COVID-19 vaccine for use in children as young as 12, while the country also donated nearly 300,000 doses of AstraZeneca’s shot to Egypt as part of the COVAX vaccine sharing program.

- Germany will begin administering COVID-19 shots to children as young as 12.

- Japan’s exports grew by double-digit percentages for the fifth straight month in July, boosted by shipments of automobiles to the U.S.

- Online grocery sales in the U.K. fell 20% the last three months to the lowest level since October 2020, as more customers return to in-person shopping amid loosened pandemic restrictions.

- A number of U.S. solar manufacturers are requesting formal investigations into Chinese firms they say are circumventing tariffs by manufacturing their products in other countries.

- IKEA will begin selling renewable energy to households in Sweden starting in September through Svea Solar, which produces solar panels for the company.

At M. Holland

- Matt Zessin, our Automotive Market Manager, was interviewed about materials trends for electric vehicles on the Automotive News Daily Drive podcast, accessible here.

- What’s the outlook for plastics supply and the global supply chain? Join us for our next Plastics Reflections Web Series. Our distinguished panel will include guests from Business Publishing International, MTS Logistics and LyondellBasell. Register here for the event on Thursday, Aug. 26 at 1:00 pm CT/2:00 pm ET.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.