COVID-19 Bulletin: December 3

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- After a volatile day of trading, oil prices rose about 1% Thursday even as OPEC+ surprised markets by keeping plans to release 400,000 bpd of crude in January. Futures continued rising in late morning trading, with WTI up 1.6% at $67.53/bbl and Brent up 2.1% at $71.10/bbl. U.S. natural gas was 3.5% higher at $4.20/MMBtu.

- OPEC added 350,000 bpd to its output in November, roughly 40% more than planned, driven by an excess of production in Iraq and a recovery in Nigeria. The output was higher than indicated by an earlier survey of OPEC members.

- The U.S. and other nations may delay recently announced releases of crude from their strategic oil reserves depending on oil prices.

- Goldman Sachs forecast Brent crude to average $85/bbl in 2023.

- In a bid to avoid another “Texas Freeze,” state utilities must prioritize key natural gas facilities that supply fuel to electric generators during emergencies, Texas’ energy regulator ruled.

- The value of the U.S.-Canada energy trade fell 31% in 2020, driven by demand drops and lower commodity prices during the first year of the pandemic.

- European energy majors have doubled planned spending on low-carbon energy over the last two years, led by Spain’s Repsol.

- Prices for European carbon futures rose above $90/ton Friday, almost tripling so far this year to a new record.

- BP has agreed to more than $500,000 in fines for emissions violations at an Indiana facility.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- A benchmark index of contracted container freight rates grew 16.3% in November for a year-over-year gain of 121.2%.

- Ocean freight rates from Asia to both U.S. coasts have fallen to their lowest levels since July, declining a respective 3.8% and 4.9% for routes to Los Angeles and New York last week.

- Port freight feeders in Southern China plan to extend their Chinese New Year suspensions by six weeks under state-mandated COVID-19 quarantine measures, potentially further disrupting global supply chains.

- Maersk had 84 vessels waiting an average of 18 days outside ports at the end of last week, led by backups on the U.S. West Coast.

- Some seafarers are being forced to get several COVID-19 vaccinations to meet differing country rules.

- Trucking experts say California’s efforts to raise truck weight limits will do little to remedy shipping backlogs.

- Airfreight volumes fell a surprising 1.2% in November, largely due to ground handling congestion, while rates rose 8% for the period.

- Global shipping lines are on track to pull in $100 billion in operating profit this year, already doubling profit in just three quarters of 2021 compared to the entirety of the previous decade.

- Mediterranean Shipping Company surpassed Maersk as the world’s largest shipping line, fueled by its record acquisition of 125 used vessels during the pandemic.

- The U.S. administration sued to block Nvidia’s proposed landmark takeover of semiconductor designer Arm Holdings, citing antitrust concerns.

- Chipmaker GlobalFoundries swung to third-quarter profit on a 56% rise in revenue from last year.

- The long-awaited abandonment of 25% U.S. tariffs on British steel and aluminum is being delayed over suspected political issues.

- Airbus is unlikely to meet its goal of delivering 600 jets this year over supply chain snags at facilities in Hamburg, Germany.

- Sustainable apparel retailer Allbirds managed to boost inventories 55% heading into the holiday season, citing a combination of supplier diversification and dual sourcing of products.

- Business is booming for cargo salvage companies amid record amounts of abandoned goods at ports.

- Singapore-based Samudera Shipping Line opened a new freight shuttle service with India, with plans to transport 3,800 TEUs weekly.

- Singapore carrier X-Press Feeders has commissioned eight 1,170-TEU ships capable of running on conventional fuel or green methanol.

- Supply chain snarls dampened third-quarter profit at grocery giant Kroger, despite rising sales year over year.

- Ashley Furniture’s transport unit will expand operations in the western U.S. with the acquisition of Missouri-based Wilson Logistics.

- Siemens’ rail unit is testing hydrogen-powered trains as a potential replacement for battery-only locomotives with significantly shorter ranges.

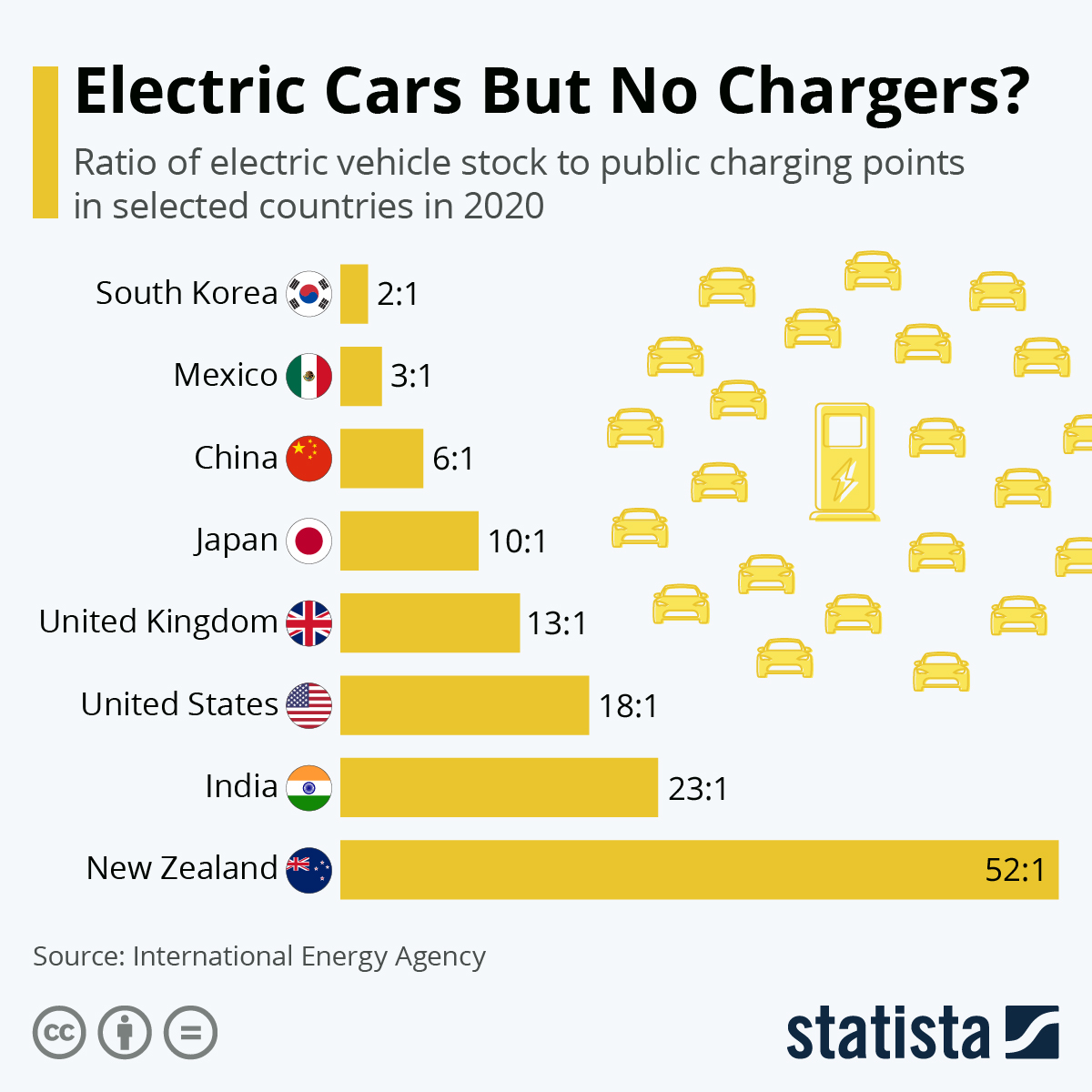

- South Korea leads the world in electric vehicle infrastructure, with two public charging points for every one vehicle:

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The U.S. reported 140,875 new COVID-19 infections and 3,800 virus fatalities Thursday.

- COVID-19 vaccine demand in the U.S. is rising at a double-digit pace, straining short-staffed pharmacies that administer the shots.

- Minnesota and Colorado reported their first cases of the COVID-19 Omicron variant Thursday.

- New York and Illinois reported their highest single-day COVID-19 infection counts since January.

- A third military medical team has been dispatched to Michigan to help the state’s hospitals manage a surge in COVID-19 patients, over 75% of whom are unvaccinated.

- COVID-19 patients fill more than 25% of Ohio’s ICU beds, the highest level since January.

- California’s governor is holding off on imposing more pandemic restrictions in the wake of the state’s first case of the COVID-19 Omicron variant Wednesday. The state recorded its second Omicron infection yesterday.

- Hospitals in Alaska have stopped rationing care for the first time in two months amid a drop in COVID-19 cases.

- COVID-19 cases in the five least vaccinated states have dropped sharply in the past two weeks.

- U.S. health experts are renewing calls for all adult Americans to get COVID-19 booster shots, as the White House aims to boost advertising and make the shots more available.

- Pending further data, the U.S. administration has indicated uncertainty over what effects the COVID-19 Omicron variant will have on inflation, supply chains and global economic growth. The White House is urging Americans to keep their end-of-year holiday plans despite the emergence of the new variant.

- Pfizer’s chief executive predicts annual COVID-19 vaccines will be needed for several years to help populations maintain high levels of virus protection.

- A U.S. research group backed by $200 million in grants will focus on creating COVID-19 vaccines that can target multiple variants at one time.

- A new study shows that mRNA-based COVID-19 vaccines prevented infection in most cancer patients.

- More than 18,000 U.S. Navy personnel face potential expulsion after missing the federal government’s COVID-19 vaccine deadline Sunday.

- Google is indefinitely delaying return-to-office plans originally set for Jan. 10.

- Congressional lawmakers passed a stopgap spending bill Thursday night to keep the government funded through February.

- The U.S. added 210,000 jobs in November, well below predictions, as the unemployment level fell to 4.2%.

- The U.S. economy grew at a “modest to moderate” pace this fall amid continued supply chain disruptions and labor shortages, the Federal Reserve said.

- Almost half of American households said rising inflation is causing some degree of financial hardship, survey results show.

- Americans’ reluctance to dip into record savings piled away during the pandemic could pose near-term problems for an economy in which consumer spending makes up more than two-thirds of GDP, economists say.

- A lack of inventory was behind the sharp decline in suburban New York City home purchases in November.

- Ford is the only major automaker to report increasing sales in November, led by record demand for SUVs.

- Business jet flying is up 40% year over year as demand for used jets skyrockets.

- States are being asked to submit five-year plans for expanding broadband internet to receive a share of the federal government’s $42.5 billion in funding.

International Markets

- The COVID-19 Omicron variant could be three times more likely than other variants to reinfect, according to researchers in South Africa, where new infections doubled in a single day yesterday and tripled over the past three days. Omicron is spreading in Gauteng Province, the epicenter of the outbreak, faster than any prior variant.

- European researchers predict the COVID-19 Omicron variant will make up more than half of the continent’s new infections within several months.

- France and Spain recorded their first cases of the COVID-19 Omicron variant Thursday. They were joined by Greece, Finland, Singapore and Norway, which reported at least 50 cases.

- The U.K. reported 53,945 new COVID-19 cases Thursday, the most in four months, including seven more cases of the Omicron variant. The nation purchased more than 100 million doses of vaccines for the next two years.

- Germany imposed a nationwide lockdown exclusively on unvaccinated people, barring them from all but essential businesses such as groceries and pharmacies. Lawmakers continue to push for a COVID-19 vaccine mandate for the general population.

- Croatia will impose fines on local government leaders who fail to enforce proof-of-vaccine requirements.

- Slovakia will pay $570 to seniors who get their first COVID-19 vaccination or a booster dose.

- South Korea reported 5,266 COVID-19 cases Thursday, its second daily record in a row.

- China’s latest COVID-19 outbreak grew by 53 cases Thursday. Beijing approved plans to resume quarantine-free travel with Hong Kong later this month.

- The United Nations’ ask for global humanitarian aid has ballooned more than 40% during the pandemic.

- India’s economy grew a lower-than-expected 8.4% in October on a weak rebound in consumer spending.

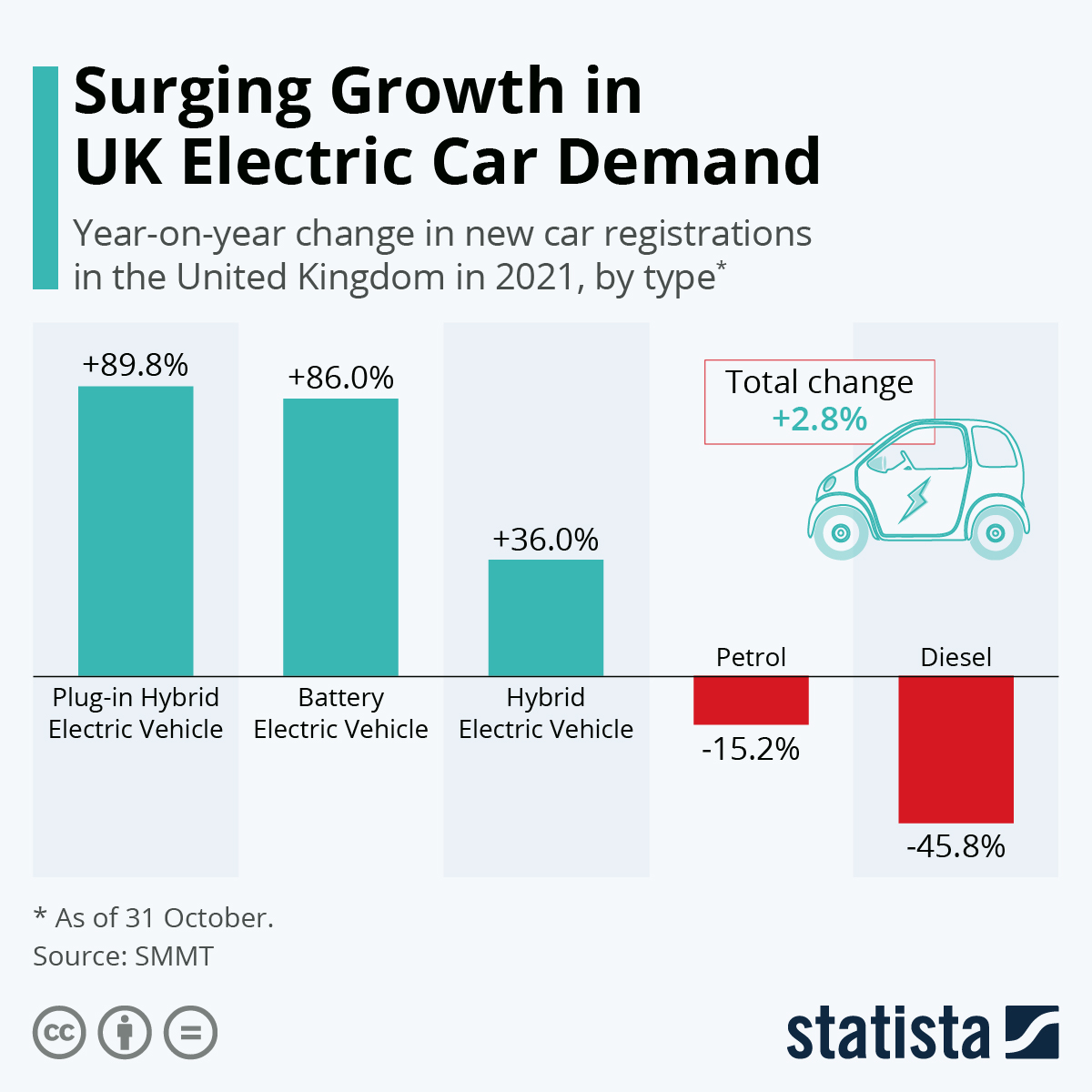

- British demand for fully electric vehicles grew 86% in 2021 from the previous year:

- Shares of Boeing rose 7.5% Thursday after China outlined new safety regulations for Boeing 737 MAX jets to resume flying.

- India’s Jet Airways is in talks with Boeing and Airbus to purchase more than 100 narrow body jets in a projected $12 billion deal.

- Aerospace manufacturer Pratt & Whitney unveiled its new engine for a line of Airbus jets capable of boosting fuel efficiency by 1% and thrust by 4% when it rolls out in 2024.

- China’s Chengtun Mining Group will invest $245 million for its second nickel manufacturing site in Indonesia, a bid to start producing the key electric vehicle battery metal at scale.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.