COVID-19 Bulletin: December 7

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- U.S. benchmark WTI settled 5% higher Monday on reduced fears of the COVID-19 Omicron variant’s impact on global demand. Futures continued their rise in late morning trading, with WTI up 4.6% at $72.71/bbl and Brent up 4.0% at $75.99/bbl.

- More than 4,000 records were set in the U.S. for higher-than-normal temperatures the past seven days. Paired with warm forecasts for next week, U.S. natural gas futures fell 12% Monday to $3.66/MMBtu, extending losses from the commodity’s worst decline since 2014 last week. Early data shows stockpiles rising, dampening fears of high heating bills this winter. Futures were up 2.4% to $3.75/MMBtu in late morning trading.

- Winning bids for the U.S. government’s first batch of 32 million oil barrels from strategic reserves will be announced Dec. 14. At least two international refiners have expressed interest in a deal.

- European natural gas futures rose from a two-week low Monday on concerns over unusually low inventories and the potential indefinite delay on flows from Russia’s Nord Stream 2 pipeline following resistance from German regulators.

- BP joined calls to include the WTI Midland light sweet crude price to the group of grades comprising the Dated Brent benchmark, which underlies Brent futures contracts. The addition could boost the benchmark’s utility as production from large North Sea oil fields drops.

- Despite pressures to invest in low-carbon projects, the world’s biggest banks underwrote nearly $250 billion in oil and gas industry bonds this year, broadly matching average fundraising since 2016.

- Oil majors booked a combined $174 billion in profits the first nine months of the year. On Monday, industry leaders shared projections that demand would remain strong for years to come.

- Saudi Aramco has agreed to sell a 49% stake in its natural-gas pipeline business for $15.5 billion, the latest in a string of moves to pull cash from its energy infrastructure.

- Eight energy ministers from some of the world’s top oil-producing nations backed out of the World Petroleum Conference in Houston, which began Monday, over fears of spreading the COVID-19 Omicron variant.

- Sweden put a backup oil-fired power plant online to help ease a 1,700-MW power shortage in neighboring Poland.

- French insurer Crédit Agricole Assurances is planning to buy a 49% stake in the renewable energy unit of Italian energy company Edison and will help fund the growth of its wind and solar capacity to 4 GW by 2030.

- Exxon Mobil announced plans to reach net-zero air pollution from its Permian Basin wells by 2030.

Supply Chain

- Canadian National resumed operations on its Kamloops-Vancouver corridor Monday, a critical rail link to the Port of Vancouver, after severe flooding and landslides forced a shutdown three weeks ago.

- A new counting method has tallied the number of ships waiting to berth at Southern California ports at 96, a record. The average wait for ships was 20.8 days as of Friday, almost a week longer than a month ago.

- The Port of Savannah saw its busiest month on record in October, handling a total of 504,350 TEUs, an 8.7% increase from the same time last year.

- Maryland broke ground on a $466 million expansion of the Howard Street Tunnel to allow double stacking of containers through the Port of Baltimore, a boon for intermodal traffic.

- Supply chain stakeholders are offering more incentives to quickly move containers through Southern California ports, including credits for timely pickups and fee suspensions for nighttime traffic.

- Starting in January, the Port of Los Angeles’ APM Terminals will impose fees on truckers who miss appointments for containers.

- New Class 8 truck orders fell 41% from October to November and 82% from a year ago on shortages of raw materials and supply chain congestion.

- Mexican auto production fell 20.25% year over year in November to 248,960 vehicles, the fifth straight month of declines largely on continued effects of the global semiconductor shortage.

- Subaru is facing a 45,000-vehicle order backlog in the U.S. with 10,000 more coming each month, as the automaker’s inventories are down ninefold from normal levels to a five-day supply.

- Trucks carried 71% of all U.S.-Mexico cargo moved in September, up 13% from the same time last year.

- Monday was likely FedEx’s busiest day of the holiday season, the company said, with shipment volumes expected to be up 10% over last year’s record levels. Separately, the shipper announced a new service selling capacity in empty containers it sources from China for its domestic LTL business, bypassing major port congestion and cutting up to 20 days from shipping times.

- Hapag-Lloyd was forced to divert a South Korea-bound vessel to Mexico after three of its crew members tested positive for COVID-19.

- China is set to reinforce its dominance in the rare earths market, the critical supply for battery and tech components, through the creation of one of the world’s largest mining companies as soon as this month.

- Tin prices are up nearly 100% from a year ago, their biggest annual rise in three decades.

Domestic Markets

- The U.S. reported 192,917 new COVID-19 infections and 1,382 virus fatalities Monday.

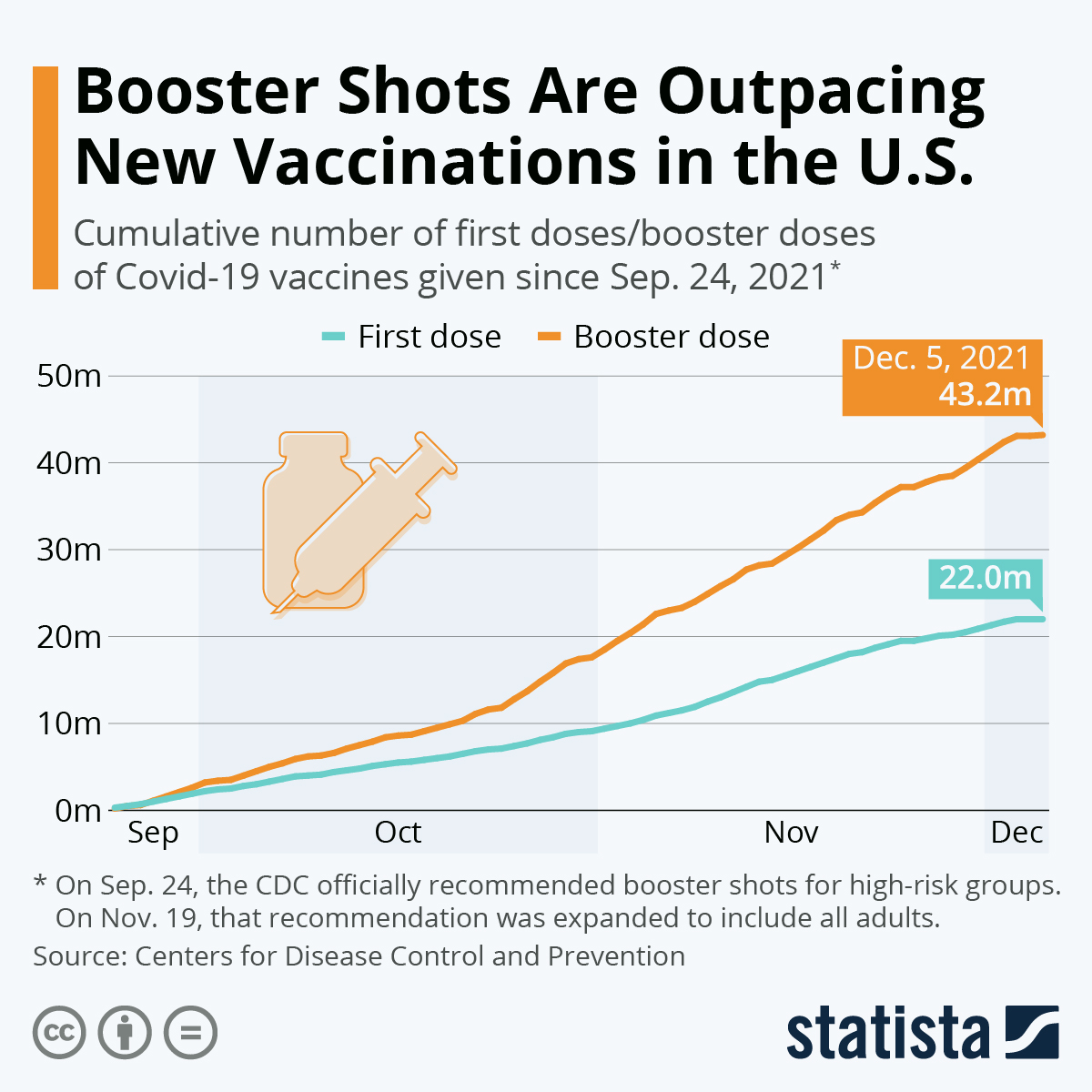

- Early data suggests just 0.2% of people who get COVID-19 booster shots will become reinfected with the virus. Post-booster breakthrough infections also carry significantly lower risks of hospitalization or death.

- New York’s governor issued an executive order temporarily banning elective surgeries in more than 30 hospitals as the state experiences its highest COVID-19 transmission rate since April 2020.

- New York City will impose a COVID-19 vaccine mandate for all private employers starting Dec. 27, a national first. The move has drawn sharp criticism from influential business groups and could be reversed when a new mayor takes office in January. The current mayor also extended the city’s vaccine mandate to enter indoor spaces to children aged 5 through 11.

- Mississippi became the 17th state to report its first case of the COVID-19 Omicron variant.

- At least 221,300 people are currently infected with COVID-19 in Michigan, a record.

- New Jersey’s COVID-19 hospitalizations topped 1,200 for the first time since May.

- COVID-19 hospitalizations in Maine rose to a pandemic high Monday, fueled by a surge in transmissions from the Thanksgiving holiday.

- Vermont reported 641 new COVID-19 cases Sunday and 25 virus ICU patients, both records.

- Oklahoma surpassed 12,000 COVID-19 fatalities since the start of the pandemic as early signs of a new virus wave appear.

- COVID-19 cases in Montana have declined 43% in recent weeks.

- Nevada will charge unvaccinated state workers $55 extra per month on health insurance plans, the first state to impose such a measure.

- A large Massachusetts healthcare system fired 200 employees last week for failing to meet a COVID-19 vaccination deadline.

- Johnson & Johnson’s single-shot COVID-19 vaccine provided strong immune responses as a booster dose to Pfizer’s shot, new studies show. Europe’s drug regulator today endorsed “heterologous vaccination,” i.e., the mixing of different vaccines to fight COVID-19.

- Biotech firm Gilead Sciences recalled some 55,000 remdesivir COVID-19 treatments after potentially irritating particulates were found in some medicine vials.

- Ford will delay its return-to-office plans from January to March due to the emergence of the COVID-19 Omicron variant.

- Activity in the U.S. services sector rose to the highest level in more than a year in November.

- U.S. traffic congestion is up from last year while still below pre-pandemic levels, suggesting more workers are returning to the office.

- A new study found a substantial increase in the blood pressure readings of Americans in 2020 compared to 2019, highlighting long-reaching impacts the pandemic has had on public health.

- Lawyers and financial advisers are seeing an uptick in younger people looking to get their affairs in order, with roughly 27% of 18- to 34-year-olds now having a living will, compared to 18% in 2019.

- Toyota announced plans to build a $1.3 billion electric vehicle battery plant near Greensboro, North Carolina, to begin production in 2025.

- Tyson Foods will pay a combined $50 million in year-end bonuses to 86,000 frontline and hourly meatpacking workers starting this month, a bid to attract and retain talent.

International Markets

- Ninety cases of the COVID-19 Omicron variant were reported in the U.K. Monday, bringing the nation’s total to 336. So far, none of the cases have led to hospitalization, while the nation reported 51,746 total new infections and 46 fatalities Monday.

- Amid continued high infection levels, German lawmakers will debate a proposal today that would expand COVID-19 vaccine mandates to more workers.

- France will close nighttime venues, enact stricter distancing requirements and impose mask mandates in schools amid a fifth COVID-19 wave, which included at least 25 new cases of the Omicron variant yesterday.

- Tunisia, Japan and Thailand reported their first cases of the COVID-19 Omicron variant.

- Australia reported its first community transmission of the COVID-19 Omicron variant. The nation plans to start administering vaccines to children as young as age 5 in January.

- Hong Kong will require three-week quarantines for travelers from 30 nations over fears of spreading the COVID-19 Omicron variant. Half of the island’s residents do not plan on getting shots despite the city’s transition away from a “Covid zero” strategy, survey results show.

- The EU could reverse travel bans on South African nations first imposed over fears of the COVID-19 Omicron variant.

- Slovakia will likely extend a strict nationwide lockdown for another week to Dec. 16.

- The Czech Republic will mandate COVID-19 vaccines for all seniors, police officers, soldiers and healthcare workers.

- South Korea will require all teens over age 12 to be vaccinated against COVID-19 by February for entry to many indoor public spaces.

- Japan reported just six COVID-19 fatalities last week, the lowest since July 2020.

- Roughly 80% of London’s financial district workers were back in offices last week, the highest percentage since the beginning of the pandemic.

- Some public schools in the Philippines reopened Monday for the first time in two years.

- Pandemic-induced disruptions in medical services caused global deaths from malaria to swell in 2020.

- British drugmaker GlaxoSmithKline said its COVID-19 antibody treatment was effective against the Omicron variant in recent studies.

- South African drugmaker Biovac will begin manufacturing doses of the Pfizer/BioNTech COVID-19 vaccine in early 2022.

- European regulators are recommending extended adoption of an arthritis treatment for off-label use against severe COVID-19 cases in adults.

- Manufacturing and pricing issues are likely to delay deliveries of new COVID-19 antiviral treatments to low- and middle-income nations.

- Household spending in Japan, the world’s third largest economy, declined for the third straight month in October.

- China’s Evergrande failed to make a critical interest payment yesterday, possibly setting the giant property developer up for a default on its more than $300 billion in liabilities.

- A British research group unveiled a new liquid hydrogen-powered 279-seat plane concept capable of flying from London to San Francisco without producing any carbon emissions.

- International patents for electric vehicle technology have grown 59% in volume since 2016, compared to a 19% decline for fossil fuel vehicles.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.