COVID-19 Bulletin: December 8

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- U.S. benchmark WTI extended gains Tuesday, rising 3.2% as demand concerns over the COVID-19 Omicron variant continued to fade. Crude futures were modestly lower in late morning trading, with WTI down 0.3% at $71.84/bbl and Brent off 0.3% at $75.24/bbl. U.S. natural gas futures were 3.6% higher at $3.84/MMBtu.

- The U.S. saw a surprise draw in crude inventories last week, figures show.

- The U.S. Energy Information Administration lowered its 2022 crude price estimates by $2/bbl, citing increased travel restrictions from the COVID-19 Omicron variant.

- After seven years of underinvestment, the world may be headed into a period of oil scarcity, U.S. oilfield provider Halliburton said.

- The U.S. administration proposed scaling back the amount of biofuels U.S. refiners have been required to blend into their fuel mix during the pandemic, striking a balance between demands from the oil industry and producers of corn-based ethanol.

- Elevated oil prices have spurred Latin American countries to boost investments in fossil fuels, moving the oil-dependent region further away from goals outlined in the Paris Climate Agreement.

- Japan’s largest power generator is retiring or replacing old LNG-fired stations around Tokyo with the goal of reducing emissions 30% by 2023.

- Britain’s top court heard arguments Tuesday on a lawsuit aiming to halt the government’s $1.15 billion in financing for an LNG project in Mozambique.

- Goldman Sachs has partnered with a Chinese think tank to launch a green finance working group it hopes will foster dialogue on climate action in the investment world.

Supply Chain

- Recent congestion at the Port of Savannah will continue to decline as the port opens 1.6 million shipping units of yard capacity over the next six months.

- Ad hoc charters from Asia to Northern Europe are picking up as Asian exporters scramble to book capacity after being dropped by Maersk’s new strategic booking system.

- Shipbroker Braemar ACM is forecasting lower dry-bulk shipping rates next year.

- Supply chain analysts expect China’s container terminals to raise handling fees next year.

- The 10 largest ocean container lines will earn up to a combined $120 billion in operating profits this year, according to new forecasts.

- A passenger bridge at the U.S.-Mexico border crossing in Hidalgo County, Texas, will be expanded to allow for commercial traffic.

- A server outage at Amazon wreaked havoc on the firm’s logistics network for much of Tuesday, forcing thousands of drivers to suspend deliveries.

- Small U.S. merchants have been ordering double or triple their usual volumes to ensure delivery of goods by the holidays, while at the same time running the risk of overbuying and getting stuck with excess or outdated inventory.

- Lease renewal prices for industrial properties are up an average of 25% this year, new data shows.

- Aging European nuclear reactors near their end of life could soon prompt a shortage of key radioactive materials used in medical imaging and treatments, officials say.

- Southeast Asian manufacturers are unlikely to face great disruption from potential surges of the COVID-19 Omicron variant after building resilience to previous waves of the Delta strain.

- Wisconsin’s Fincantieri Bay Shipbuilding made delivery of the U.S.’s largest LNG bunker vessel to date, a 340-foot barge that will service ships along Florida’s eastern coast.

- Shipping companies ordered another 17 LNG-powered vessels in November, bringing the full-year total to 238.

- Toyota has not shied away from using scratched or blemished parts to assemble vehicles amid continued production disruption, company leaders said.

- Nissan’s chief executive expects auto industry disruption caused by shipping congestion and semiconductor shortages to persist through the middle of next year.

- The West African nation of Mali has suspended grain exports over mounting concerns of regional food scarcity.

- Dutch dredging company Royal Boskalis is part of a consortium that has secured a $27 million grant for research on the use of green methanol to lower emissions in the shipping industry.

- Danish logistics firm DSV launched a new service allowing customers to track their supply-chain emissions and pinpoint potential areas for cuts.

- U.S.-based shipper Crowley announced plans to reduce overall emissions by 4.2 million metric tons per year in a bid to reach net-zero emissions companywide by 2050.

Domestic Markets

- The U.S. reported 192,917 new COVID-19 infections and 1,382 virus fatalities Tuesday.

- Over 30 states are experiencing rising COVID-19 hospitalizations, with six states comprising the majority of them — Illinois, Indiana, Michigan, Ohio, New York and Pennsylvania.

- The COVID-19 Omicron variant has spread to 19 states, most recently Texas and Florida.

- Washington, D.C., has started offering COVID-19 vaccines to children as young as age 5 at library walk-up sites and pop-up clinics.

- A federal judge in Georgia has indicated the White House’s COVID-19 vaccine mandate for employees of federal contractors will likely not pass legal muster.

- Pfizer/BioNTech said a three-dose regimen of their COVID-19 vaccine is effective against the Omicron variant.

- The CDC recommends Americans use widely available over-the-counter COVID-19 tests before gathering indoors with other households this holiday season.

- Google and Uber will indefinitely delay January return-to-office plans due to uncertainty caused by the COVID-19 Omicron variant. In a similar move, Facebook will allow employees to delay returning to the office until next June.

- The U.S. has raised its total commitments to COVID-19 vaccine availability in low-income nations by $400 million to $1.6 billion.

- U.S. lawmakers agreed on a plan to raise the government’s debt ceiling likely through next year, a last-minute measure to stave off defaulting on the nation’s debt.

- The U.S. trade deficit narrowed sharply in October, falling 17.6% from September on higher energy and agriculture exports.

- Some 4.2 million Americans left their jobs in October as the “big quit” continued, leaving 11 million job openings at month end compared with 6.9 unemployed people seeking work.

- The price of labor per single unit of output in the U.S. rose at a surprise 9.6% yearly rate in the third quarter, indicating higher inflation than previous forecasts. U.S. firms have set aside an average of 3.9% of total payroll for wage increases next year, the highest level since 2008.

- Consumer retail spending on American Express cards is up 30% this quarter compared to pre-pandemic levels.

- Excess savings among many working- and middle-class households could be exhausted as soon as early next year, Moody’s Analytics said, causing a sharp drop in consumer demand.

- U.S. worker shortages could extend for several years amid a pattern of increasing consumer demand and more people retiring, JPMorgan Chase predicts.

- A new poll estimates 37% of office desks in the U.S. will remain empty once the pandemic wanes, with more Americans preferring the flexibility of working from home.

- GM will invest over $50 million in boosting electric vehicle production at a plant in Indiana, part of the automaker’s goal to launch 30 EV models globally by 2025.

- Ford is partnering with cloud-based software provider Salesforce to launch a new subscription service that will digitize paperwork for contractors, repair technicians and other trade professionals.

- California electric-vehicle startup Lucid is the latest to draw scrutiny from federal regulators concerned about the deal that took the company public earlier this year.

- The FAA unveiled new restrictions on flying aimed at preventing interference from the broad rollout of 5G cellular networks next year.

- The U.S. administration released a rare public health advisory on mental health issues in young Americans, a growing challenge exacerbated by the pandemic.

International Markets

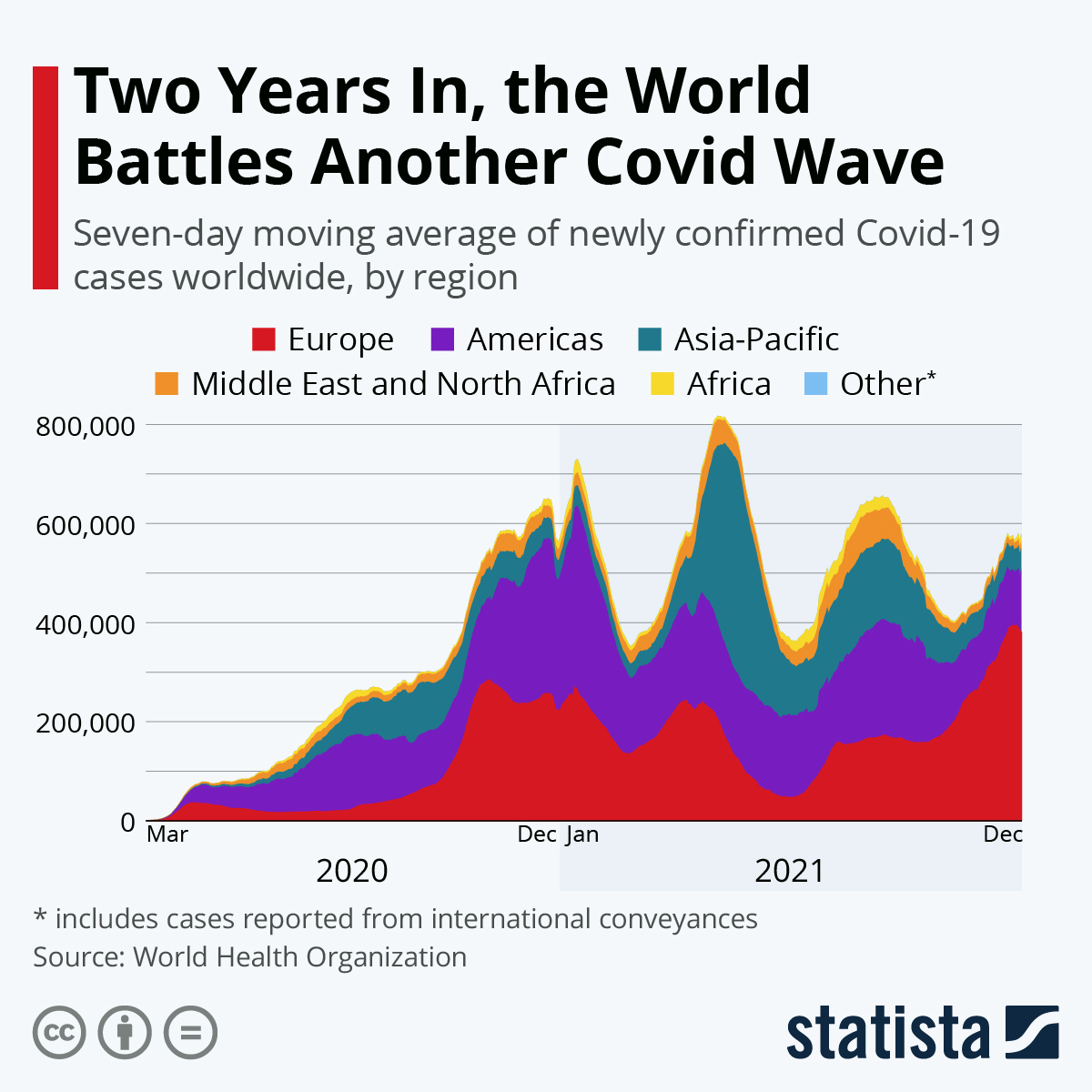

- The Omicron variant of COVID-19 has spread to 57 countries. One in 10 people in Europe and Central Asia will have been infected with COVID-19 by the end of the year, the World Health Organization predicts.

- COVID-19 Omicron cases in the U.K. rose by 101 to 437 yesterday, with health officials indicating the strain may be more transmissible than Delta. The nation tightened testing requirements for incoming travelers, while Scotland reimposed work-from-home recommendations.

- New South African lab results give the first scientific indication that the COVID-19 Omicron variant is better able to evade current vaccines but may not cause more severe illness.

- European officials are warning of a likely increase in COVID-19 hospitalizations, with virus transmission rates broadly outpacing current vaccine rates. Some researchers expect the Omicron variant to become the dominant strain in parts of the EU over the next several weeks.

- Denmark registered an additional 137 cases of the COVID-19 Omicron variant Tuesday, bringing its total to 398.

- Sweden and Norway are bringing back pandemic restrictions in a response to recent surges of COVID-19.

- Israel is considering giving fourth COVID-19 vaccine doses to people with weakened immune systems.

- COVID-19 infections in South Korea topped 7,000 yesterday, a record. International travelers could be barred from the bulk of indoor venues in the nation due to its strict vaccination requirements.

- Ontario, Canada, suspended plans to lift restrictions on restaurants and bars due to increasing daily cases of COVID-19.

- Slovakian lawmakers are proposing $337 payments to seniors who are fully vaccinated against COVID-19.

- U.S. officials are warning against travel to Andorra, Cyprus, France, Liechtenstein and Portugal due to rising COVID-19 cases.

- China’s new data security laws will make it harder for foreign companies and investors to get information, including about supplies and financial statements.

- South Africa’s economy reversed its recovery in the third quarter, shrinking 1.5% in the face of pandemic restrictions and social unrest.

- Starting Jan. 1, the UAE will move its weekend to Saturday and Sunday and adopt a 4.5-day work week, breaking with the rest of the Gulf and repositioning itself as a global hub for business activity.

- Stellantis announced ambitious plans to reach $22.54 billion in annual revenue by the end of the decade from vehicle software and services, a bid to take on Tesla as the leader in vehicle electronics.

- Israeli lawmakers proposed new legislation that would allow 400 autonomous electric vehicle taxis to operate on the nation’s roads as soon as next year.

- Uber will be forced to revamp its ride-hailing business model in London following a ruling from Britain’s top court Tuesday.

- Swedish firm Oatly, a producer of milk alternatives, announced plans to open three new facilities in the U.S., U.K. and China by 2023 to accommodate surging demand.

- European officials agreed on cutting some taxes on climate-friendly goods and services while proposing a phase-out of lower rates on fossil fuels products by 2030.

- New data shows this year’s wildfire season emitted 1.76 billion tonnes of carbon across the globe, with record emissions in parts of the U.S., Turkey and Siberia.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.