COVID-19 Bulletin: December 9

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose slightly Wednesday, a muted reaction to new data showing a drop in crude inventories last week. Crude futures retreated in late morning trading, with WTI down 0.8% at $71.81/bbl and Brent down 0.8% at $75.25/bbl. U.S. natural gas futures were 0.9% higher at $3.85/MMBtu.

- Global benchmark Brent has regained two-thirds of value lost following news of the COVID-19 Omicron variant, rising 10% since Dec. 1.

- U.S. product supplied by refineries, a proxy for oil demand, hit 20.9 million bpd over the past month, exceeding pre-pandemic volumes.

- U.S. coal stockpiles fell in September to their lowest level since at least 2001, a result of high natural gas prices driving increased use of coal for power generation.

- ConocoPhillips is doubling down on expanding production onshore in the U.S. and in Australia, with the firm recently selling some or all assets in Indonesia, Canada, Britain’s North Sea and offshore U.S.

- Severe winter storms in western Russia have disrupted oil exports headed to the Mediterranean Sea.

- The Russian government could permit the nation’s largest oil producer, Rosneft, to begin exporting natural gas to gas-starved Europe via pipeline.

- Reports indicate Venezuela has more than doubled its crude production the past year despite heavy sanctions from the U.S.

- Iceland’s largest utility cut power to some industrial activities and data centers Wednesday amid a shortage in hydroelectric production, the nation’s largest source of energy, due to a power station fault and high demand.

- Swiss commodities trader Trafigura reported a record $3.1 billion profit for its 2021 financial year, nearly double its profit in 2020.

- The benchmark rate for carbon in Europe’s emissions trading system rose to $113/tonne Wednesday, a record.

- The White House announced sweeping plans Wednesday for a climate-focused overhaul of federal operations, including relying entirely on carbon-free electricity by 2030 and halting purchases of gas-powered vehicles by 2035.

- Germany’s natural gas industry is seeking $900 million in funding for “turquoise” hydrogen development, an emerging technology that separates natural gas into hydrogen and solid carbon, which has several industrial uses.

- TotalEnergies and Plastic Omnium announced a strategic partnership to develop recycled polypropylene materials for automotive applications.

Supply Chain

- More than 40 small- and medium-sized earthquakes were detected offshore Oregon Tuesday, sparking concerns of potentially larger seismic activity in one of North America’s most earthquake-prone areas.

- Congestion at the Port of Los Angeles will extend through next year and peak around February, the port’s director said.

- Smaller container ships could face wait times weeks longer than larger vessels in some cases at Southern California ports.

- Even if container rates dropped 40% next year, as some traders predict, prices would still far exceed pre-pandemic levels. Spot rates for 40-foot containers on China-to-U.S. routes hit $14,294 Wednesday, three times higher than at the start of the year.

- South Carolina ports handled a record 250,711 TEUs in November, 21% more than last year.

- Cargo theft is up 42% year over year, spurred by record numbers of idle containers across logistics networks.

- Australian officials are starting an inquiry into the nation’s overstretched supply chains.

- Top executives in tech, retail and professional services markets predict global supply disruptions to persist through 2023.

- Spot prices for emissions-lowering diesel exhaust fluid have surged 162% year to date.

- Amazon’s efforts to ramp up its U.S. trucker-contractor program are being hampered by the nation’s record driver shortage, as the company fights to maintain its status as a trendsetter in logistics wages and benefits.

- CMA CGM will shell out $3 billion to acquire Ingram Micro’s logistics outsourcing unit, expanding the shipping line’s reach into port infrastructure and non-maritime logistics services.

- Less-than-truckload carrier Old Dominion Freight Line posted a near-30% increase in November revenue from the same time last year.

- Australia’s Qantas Airways began converting some passenger planes to freighters to support mounting cargo volumes.

- German chipmaker INOVA and U.S.-based GlobalFoundries have inked a new deal with BMW to supply the carmaker with several million semiconductors per year.

- Trucker Knight-Swift Transportation is buying less-than-truckload carrier Midwest Motor Express for $150 million.

- Maersk unveiled the designs for eight new 16,000-TEU green methanol-powered container ships it ordered from Hyundai Heavy Industries, with deliveries set to begin in early 2024.

Domestic Markets

- The U.S. reported 192,917 new COVID-19 infections and 1,382 virus fatalities Wednesday.

- The seven-day average for new COVID-19 infections in New Jersey is up 200% from a month ago.

- Michigan reported 4,638 patients hospitalized with COVID-19 Monday, a record, alongside the highest per capita case rate in the nation.

- California will start sequencing positive COVID-19 tests from schoolchildren in a bid to better track movement of virus strains.

- Virginia cited a lack of legal authority in declining to mandate COVID-19 vaccines for students and school employees.

- A New York judge temporarily blocked New York City’s COVID-19 vaccine mandate for municipal workers.

- The U.S. Senate passed a bill to block the White House’s COVID-19 vaccine mandate on private employers, a measure that will likely face a presidential veto if it passes in the House of Representatives.

- Nearly 50% of Americans over age 65 have received a booster dose of the COVID-19 vaccine.

- Roughly 18% of children aged 5 to 11 got their first shot of a COVID-19 vaccine in the five weeks it has been available, a slow start compared to other segments of the population.

- Pfizer could have an updated COVID-19 vaccine tailored to the Omicron variant by March of next year. The drugmaker said the strain is likely resilient against two vaccine doses but would not survive a third dose, while research suggests other available vaccines provide better immunity to the strain.

- The FDA granted emergency use authorization to AstraZeneca’s COVID-19 antibody cocktail after trials showed the treatment halved the risk of developing severe illness or death from mild or moderate infection.

- U.S. officials are warning of severe strains on the nation’s healthcare system this winter due to lower-than-normal inoculations against the flu.

- Last year, death benefit payments in the U.S. were up by the highest amount since 1918’s influenza epidemic, rising 15.4% to a total of $90.43 billion.

- U.S. investment firm Jefferies Financial Group canceled most of its global travel plans and renewed calls for employees to work from home.

- U.S. employers are revamping office spaces in a bid to lure workers away from remote work.

- First-time jobless claims fell to 184,000 last week, the lowest since 1969.

- More than 11 million U.S. jobs were unfilled in November, the most since July’s record of 11.1 million, as employers sought to beef up hiring for seasonal work.

- New U.S. vehicle sales are estimated to have dropped 12.6% in November from a year ago, largely a result of constrained inventories.

- Roughly a quarter of young adults want to retire before age 55, new survey results show, as daily stress among workers reached a record high during the pandemic:

- McDonald’s will offer $250 million in low-interest loans to new franchisees over the next five years in a bid to increase diversity of restaurant ownership.

- One in six Americans earn money doing household chores and running errands through online apps and websites, new survey results show, with 60% of them saying the money has been essential for meeting basic needs.

International Markets

- South Africa reported 19,842 new COVID-19 infections Wednesday, the most since the Omicron variant was first discovered last month, with the nation’s test positivity rate surging to 26.8%. Authorities granted approval for Pfizer booster doses yesterday.

- The COVID-19 Omicron variant could be four times more transmissible in its early stage than Delta, Japanese researchers warn.

- Germany recorded 527 COVID-19 fatalities Wednesday, the most in a single day since February.

- The U.K. reimposed work-from-home orders, mask mandates and stricter vaccine passport requirements amid a new wave of COVID-19.

- France’s seven-day moving average for new COVID-19 cases rose to 44,500 Tuesday, a 2021 record, as officials consider recommending a fourth vaccine dose.

- Switzerland reported 12,598 new COVID-19 cases Wednesday, a record.

- Strict nationwide restrictions for unvaccinated Austrians will remain when the nation ends its three-week pandemic lockdown this Sunday.

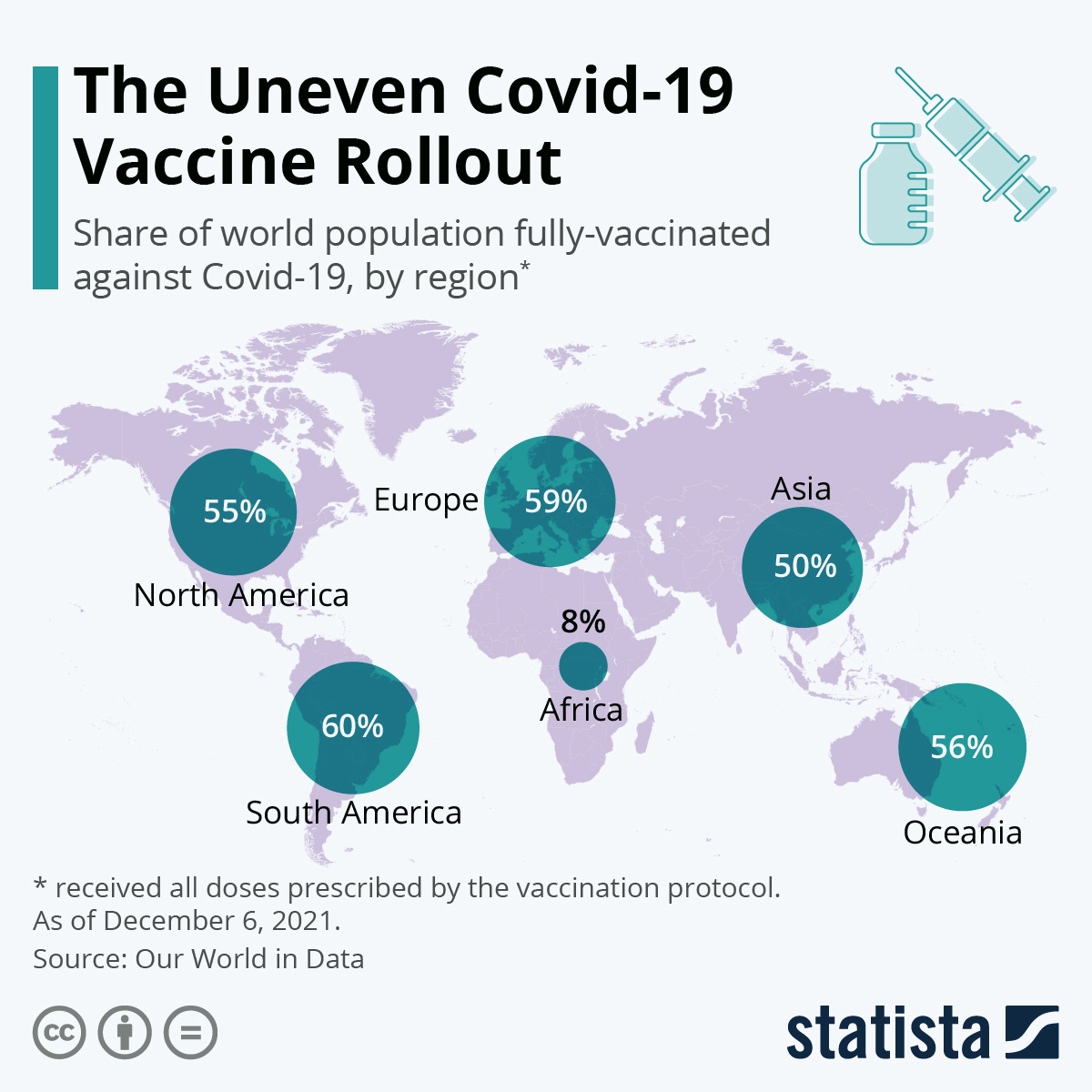

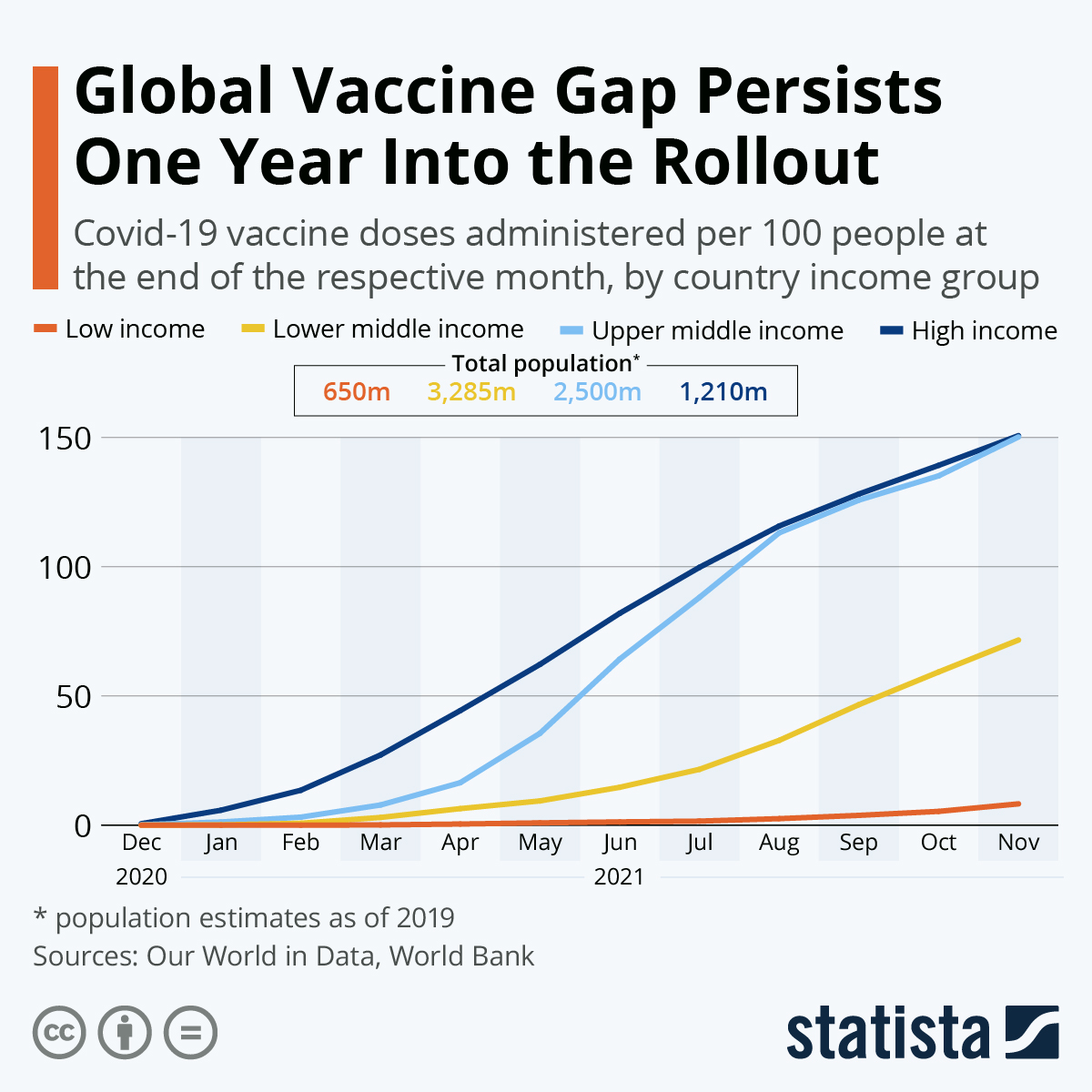

- One million COVID-19 vaccine doses in Nigeria expired without use last month, a troubling statistic for a nation with just 4% of its population vaccinated. COVID-19 inequity persists across regions…

…and income levels

- Singapore will stop covering COVID-19 medical bills for unvaccinated patients, breaking from more common measures adopted by other nations to boost inoculation rates.

- The EU expects its vaccine manufacturing plants to produce 3.6 billion COVID-19 vaccine shots in 2022, up from 3 billion in 2021.

- JPMorgan Chase predicts 2022 will mark the end of the COVID-19 pandemic, citing increased global vaccination rates and a broader array of therapeutic medicines.

- Canada’s central bank warned that high inflation will persist in 2023 but chose to keep its key interest rate unchanged at 0.25%, with economists pointing to next April for a possible first rate hike of the pandemic.

- China’s Evergrande property group has officially been labeled a defaulter for the first time, the latest milestone in a months-long financial crisis that could end in the restructuring of one of the world’s most indebted developers. A smaller Chinese property developer also defaulted after failing to repay a $400 million bond this week.

- China’s central bank announced it would ease banks’ reserve requirements, making more cash available for lending in a reversal of recent policy signals. November data showed a lower-than-expected gain in loans.

- American Airlines is shrinking its schedule for international flights next summer due to delays by Boeing in delivering new 787 Dreamliner jets.

- A new Australian budget airline could become a big purchaser of Boeing 737 MAX jets, with current plans to fly eight of the aircraft in its first year of operations.

- Lego plans to invest $1 billion in a new factory in Vietnam amid record demand for its products across Asia.

- Chinese automaker SAIC and Beijing-based startup Momenta have begun offering autonomous robotaxi rides to the public in Shanghai, with plans to expand to a second city next year.

- Tesla is leading its Chinese competitors in electric vehicle deliveries, selling 52,850 units in November despite a broad decline in passenger car sales in the nation from a year ago.

- Volkswagen is ramping up investments in vehicle battery sourcing and capacity upgrades.

- Ford will invest $900 million to double the number of robots at Thai manufacturing sites amid a broader expansion in the region.

- Indian automaker Mahindra is partnering with BP on a spate of new projects for electric-vehicle services and infrastructure.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.