COVID-19 Bulletin: December 10

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell roughly 2% Thursday ahead of much-awaited U.S. inflation data to be released today. Energy futures were higher in morning trading, with WTI up 1.2% at $71.80/bbl and Brent up 1.0% at $75.13/bbl. U.S. natural gas was 1.2% higher at $3.86/MMBtu.

- Average U.S. gasoline prices have fallen to $3.34 per gallon from $3.42 a month ago, with oil prices 16% lower than late October peaks.

- Canada’s energy regulator forecasts the nation’s oil output to rise over the next decade to a peak of 5.8 million bpd in 2032, up from 5 million bpd in 2021.

- The number of futures, forwards and swaps in European diesel contracts have fallen by one-third since October to the lowest level since 2015, a response to recent price volatility that has also spurred exits from oil trading.

- Poland will receive nearly $300 million from the World Bank to replace household coal heating systems, one of the major drivers of the nation’s deadly air pollution.

- South Africans will likely face much larger power bills next year after state-owned utility Eskrom applied for a 20.5% rate increase, citing a carbon tax and higher coal procurement costs.

- Australia’s energy regulator says the nation should phase out coal-fired power by 2043 in a bid to reach net-zero emissions by 2050.

- The European Commission expects the EU’s shift away from fossil fuels will cause palm oil imports to plunge and its biofuel consumption to fall 24% by 2031.

Supply Chain

- A large Pacific storm is forecast to hit California this weekend, bringing a foot of snow to the Sierra Nevada mountains and two inches of rain to the Sacramento region. The precipitation would be much-needed relief in the drought-stricken state.

- Eight Texas power generators missed their deadline for filing winter readiness reports, a laggard response to new rules adopted to avoid future energy emergencies like last February’s freeze.

- Backlogs and service disruptions are rampant as rail lines slowly resume services in flood-battered British Columbia.

- Only about 30 vessels sat within sight of the ports of Los Angeles and Long Beach this week, while more than 60 others remained in waters farther out to sea, the result of a new safety system in place for impending winter weather.

- Shipping lines are increasingly canceling or skipping sailings through some Asian and U.S. ports to stay on schedule.

- Global container volumes fell 2% year over year in October, new data shows.

- Asia-U.S. air freight rates hit record highs the past few weeks as more shippers and importers look to deliver goods by holiday deadlines.

- The British trucking industry had 44,000 fewer drivers in the third quarter than the same time in 2019, bringing the nation’s total shortage to some 120,000 drivers.

- Colorado State University’s Logistics Manager’s Index remained above 70 for the 10th consecutive month, indicating continued rapid expansion.

- The latest forecasts from ratings agency Moody’s include a cooldown in container and dry bulk markets next year after record-high growth in 2021.

- U.S. House lawmakers Wednesday passed legislation aimed at revamping regulatory oversight of ocean carriers, the first major update to federal regulations for the global ocean shipping industry in over 20 years.

- China merged several large transport and logistics operators into a single state-owned China Logistics Group, with operations spanning five continents and including at least 3 million vehicles.

- Norwegian freight platform Xeneta and Swiss financier Compass Financial unveiled a new daily container freight index they claim is the most accurate and transparent sector index available.

- German regulators launched an investigation into the planned sale of Maersk’s refrigerated container manufacturing unit to China International Marine Containers.

- Toyota temporarily halted production at two Japanese plants due to supply shortages, dashing the automaker’s goal of returning to normal production for the first time in seven months in December.

- Cummins’ CEO said navigating supply chain issues is a game of “whack-a-mole” for the giant engine maker, with computer chips just one of many parts and materials shortages.

- Chevron’s shipping unit has joined the Sea Cargo Charter, an initiative launched last year that aims to track emissions and lower the maritime industry’s carbon footprint.

Domestic Markets

- The U.S. reported 117,619 new COVID-19 infections and 1,419 virus fatalities Thursday.

- Seven-day COVID-19 infections are up at least 50% over the past two weeks in at least 12 states, with the largest increases in Connecticut and New Jersey.

- Three-quarters of the U.S.’s 40 confirmed COVID-19 Omicron cases have been breakthrough infections with mild symptoms. The variant has now been detected in at least 21 states, with the most in Houston.

- More than 55,000 Americans are currently hospitalized with COVID-19, a 20% increase from two weeks ago. Virus hospitalizations are on the rise in 37 states.

- Maine, New York and New Hampshire have deployed National Guard troops to hospitals to help manage a surge in COVID-19 infections.

- Rhode Island is considering “all options” to mitigate a surge in COVID-19 cases and hospitalizations, with the highest number of new cases among children under 18.

- Missouri’s COVID-19 hospitalizations have increased 76% from a month ago.

- Vermont saw record total COVID-19 hospitalizations Wednesday, alongside the second highest per capita case rate in the nation. Three-quarters of the state’s population is vaccinated.

- Free at-home rapid COVID-19 tests are seeing record demand in hard-hit states.

- The Los Angeles Unified School District, the second largest in the U.S., fired 500 employees this week over failure to meet a COVID-19 vaccine mandate.

- Ride-hailing app Lyft will make in-office work optional for all corporate employees for the entirety of 2022.

- GE and rail lines Union Pacific, BNSF and Norfolk Southern suspended their COVID-19 vaccine mandates as numerous lawsuits against the federally imposed measure move through the legal system.

- Amtrak expects to temporarily cut some services in January due to a shrinking workforce it blames on COVID-19 vaccine mandates.

- Health officials are warning against complacency over recent news that the COVID-19 Omicron strain may bring only mild symptoms, as the strain could easily mutate into a more severe variant.

- The U.S. has now fully vaccinated more than 200 million Americans against COVID-19, accounting for 60% of the population.

- The FDA authorized Pfizer’s COVID-19 booster shot for 16- and 17-year-olds.

- New research shows that COVID-19 can more easily infect both fat cells and certain immune cells within body fat.

- The annualized U.S. inflation rate hit a higher-than-expected 6.8% in November, the highest since 1982.

- Manhattan rents soared to their highest levels on record in November, with the median price rising to $3,369, a 23% jump from 2020.

- U.S. online retail prices surged 3.5% in November compared to a year earlier, the 18th consecutive monthly increase.

- Starbucks employees at a location in Buffalo, New York, voted to unionize Thursday, the first company-owned store in the nation to do so.

- While higher than last year, U.S. issues of immigrant visas are still down 21% this year from 2019.

- A boost in travel demand and fares has prompted Southwest Airlines to reverse fourth-quarter loss forecasts.

- GM has inked supply deals with U.S.-based MP Materials and Vacuumschmelze to source rare earth magnets for its future electric vehicles.

International Markets

- COVID-19 cases rose 255% in South Africa the past week, with concerning increases among children under 12. Less than one-third of the nation’s hospital patients with the Omicron variant are suffering from severe illness, however.

- Africa accounts for nearly half of global cases of the Omicron COVID-19 variant.

- The U.K. reported 50,867 new COVID-19 infections Thursday and 148 virus fatalities, a day after lawmakers reimposed tighter pandemic restrictions.

- Scottish officials are calling for people to cancel Christmas plans over rising cases of the COVID-19 Omicron variant, now at 109.

- COVID-19 cases in several European hotspots appear to be declining amid the latest round of restrictions and vaccine mandates.

- German regulators suggested some children as young as age 5 should get vaccinated against COVID-19.

- Any Austrian over the age of 14 who is not vaccinated against COVID-19 by Feb. 1 will face a fine of more than $4,000.

- South Korea has dropped plans to bar foreign residents who received COVID-19 vaccines abroad from the bulk of indoor venues following multiple complaints from diplomatic missions.

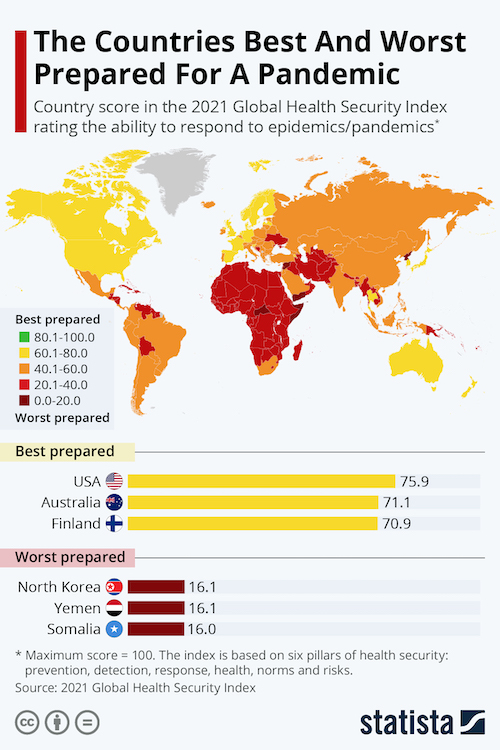

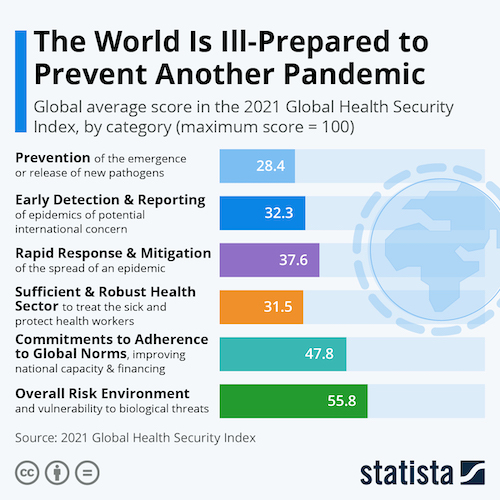

- No country reached the highest category of preparedness for future health emergencies like the pandemic, new research shows…

…as over 100 countries have been found to pay “little to no attention” to diseases transmitted from animals to humans:

- The World Economic Forum set for next month in Davos, Switzerland, will go ahead as planned despite increasing border restrictions over the COVID-19 Omicron variant.

- EU member countries are expected to agree on a nine-month validity limit for domestic COVID-19 travel passes.

- China granted approval for its first COVID-19 antibody treatment.

- European health officials say COVID-19 booster doses are safe to administer as soon as three months after a second dose.

- The emergence of the COVID-19 Omicron variant has crushed South Africa’s hopes for a tourism revival after visitors to the nation fell 71% last year.

- More than 1.6 billion children were locked out of schools across 188 nations during the first year of the pandemic, data show. The United Nations Children’s Fund says it is the biggest threat to economic and social gains for children in 75 years.

- The inflation rate in Mexico jumped over 1.1% month over month in November to 7.4% annualized, the highest rate in 20 years.

- German exports rose 4.1% in October, the strongest rate of increase in a year, while imports also jumped a surprising 5% for the month.

- China’s exports rose 22% in November from a year ago, while shipments to the U.S. were up 5.3%.

- Just 14% of European workers want to return to a pre-pandemic 9-to-5 office routine, with more than half of survey respondents saying they are more productive working from home.

- Germany has given the all-clear to Mercedes-Benz’s semi-autonomous driving system, which will roll out domestically in the first half of next year before going international.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.