COVID-19 Bulletin: December 15

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell nearly 1% Tuesday after the International Energy Agency warned the COVID-19 Omicron variant could dent global demand. Crude futures were lower in morning trading ahead of the Federal Reserve’s policy announcement, with WTI down 1.0% at $70.06/bbl and Brent down 0.7% at $73.18/bbl. U.S. natural gas was 3.3% higher at $3.87/MMBtu.

- The American Petroleum Institute predicts the U.S. probably saw a lower-than-expected crude draw of 815,000 barrels this week.

- Forecasts from the U.S. administration and the International Energy Agency are sharply diverging from OPEC’s predictions about higher oil demand in the first quarter of 2022.

- Europe’s gas storages are expected to hit record lows by the end of winter due to early onset cold weather and lower imports from Russia. Bloc officials also announced an intention to end long-term gas supply contracts favored by Russia as the EU pursues green energy goals.

- Mexico’s administration is considering further tax cuts for state producer Pemex.

- Norway’s Equinor plans to drill 25 exploration wells in 2022, up from 16 in 2021, mostly concentrated near existing Norwegian fields and platforms.

- Norway’s $1.4 trillion government pension fund, the world’s largest sovereign wealth fund, is pre-screening companies for sustainability risks and divesting from scores of companies without sustainable business models.

- China’s state-owned Sinopec added 104.88 billion cubic meters of proven natural gas reserves at a field in the Sichuan basin, which now accounts for some 34% of the nation’s total proven shale gas reserves.

- Shell announced plans to buy U.S.-based solar and energy storage developer Savion as it continues its expansion into renewable energy with a goal of reaching net-zero emissions by 2050.

- U.K.-based Sembcorp Industries plans to build a 360 MW battery storage facility, Europe’s largest, on the northeast coast of England as the country pushes toward a long-term net-zero goal.

Supply Chain

- A powerful storm system along the West Coast is dropping heavy snow in the Sierra Nevada mountains and Cascade Range while bringing substantial wind and rain at lower elevations from the Pacific Northwest to Southern California.

- Spread out across 1,000 miles of coastline, 101 container ships are now awaiting entry to the Ports of Los Angeles and Long Beach, with some voyages taking longer than 45 days to berth.

- Container spot rates on the Shanghai Containerized Freight Index were up 1.8% to 4,811 points last Friday, an all-time high.

- Intra-continental freight shipments across North America rose 4.5% year over year in November while freight expenditures rose 44%, according to the latest Cass Freight Index.

- Pandemic restrictions have been tightened on truckers serving China’s Ningbo port, the world’s third-largest.

- The Port of New Orleans took delivery of four new 250-foot cranes for handling the largest container ships, part of a spate of recent port upgrades and expansions.

- Average spot rates for capesize bulkers fell 15.1% Tuesday to $32,838 per day, with analysts pointing to typical market volatility.

- Pakistan is planning to buy another four large vessels to expand its shipping fleet to 15, as officials seek to capitalize on the nation’s geographic position.

- Some U.S. lawmakers are working to exempt Canadian truck drivers from COVID-19 requirements on crossing borders into the U.S.

- Toyota has lost production of at least 14,000 vehicles due to recent work stoppages at Japanese plants caused by component shortages, the automaker said.

- Some 80% of firms report passing on rising labor and supply chain costs to consumers, survey results show.

- Rising commodity prices have slowed years-long declines in the price of battery packs for electric vehicles:

- UPS and FedEx have shipped a combined 1.3 billion COVID-19 vaccine doses since deliveries began one year ago, the firms announced.

- Walmart announced plans to open its first fulfillment center in Tennessee, a 925,000 square-foot facility that will help the retailer build out its budding e-commerce distribution network.

Domestic Markets

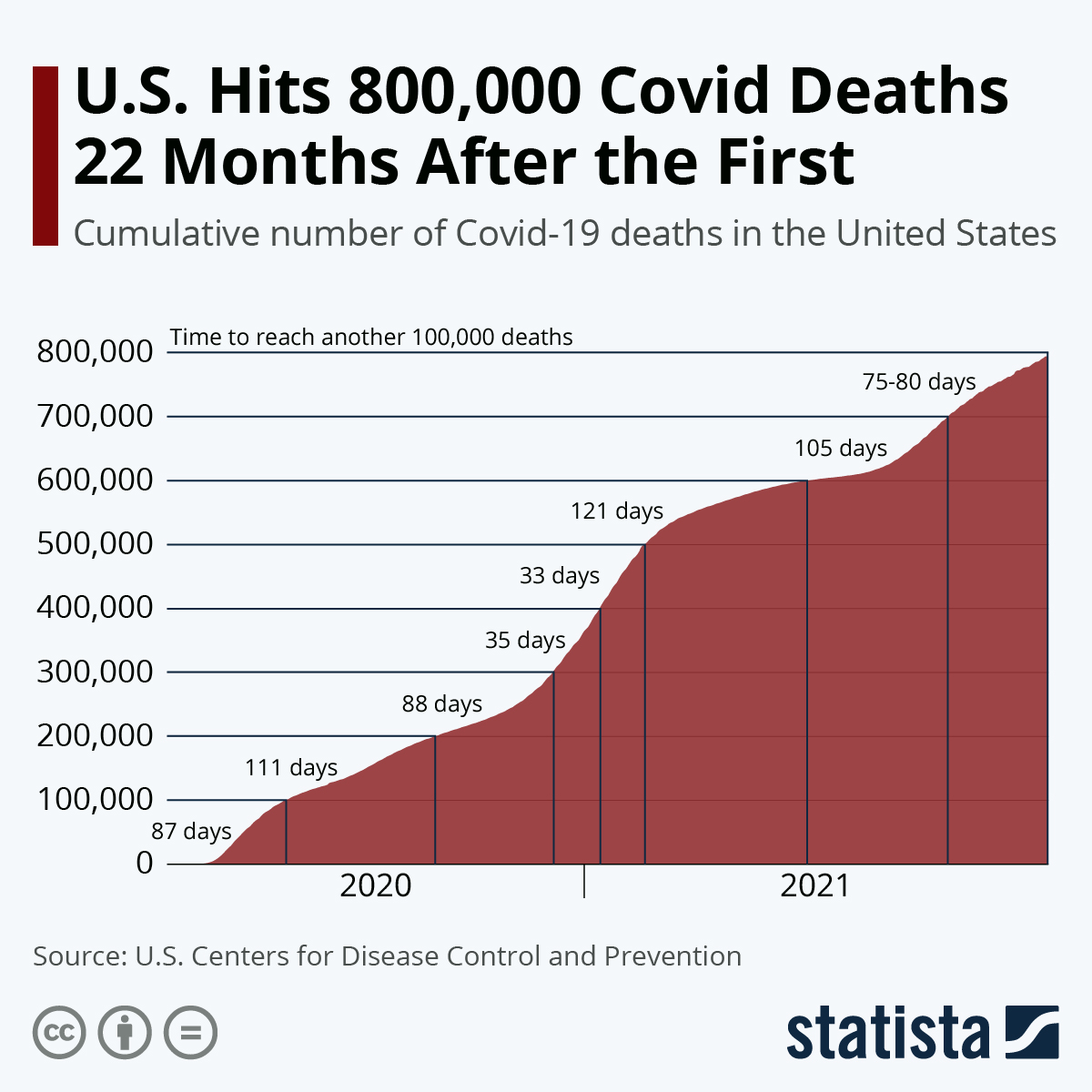

- The U.S. reported 113,749 new COVID-19 infections and 1,629 virus fatalities Tuesday.

- The U.S. administration is bracing for a surge of new COVID-19 infections in the coming weeks. Early data suggests an Omicron-led virus wave would be less severe with fewer hospitalizations than previous waves of Delta. The variant now accounts for 3% of all new cases in the U.S.

- New COVID-19 cases in Florida have risen 185% over the past two weeks, the fastest rise in the nation.

- New York’s COVID-19 cases and hospitalizations have risen a respective 58% and 70% since Thanksgiving.

- California tightened rules on domestic travelers, requiring anyone returning from out-of-state trips to test for COVID-19 within five days of arrival. The state health department has begun using trained dogs for virus detection in public places.

- More than 90% of North Carolina’s COVID-19 fatalities in 2021 were among unvaccinated people, the latest data shows.

- Cornell shut down its Ithaca, New York, campus after more than 500 COVID-19 cases were recently reported among students and staff.

- Apple reimposed mask requirements and capacity limits at U.S. retail stores due to rising COVID-19 infections throughout the nation.

- JPMorgan Chase will require COVID-19 vaccinations for employees who seek to return to Manhattan offices.

- Uber, Google and Ford are the latest large U.S. businesses to delay return-to-office plans amid rising COVID-19 cases. Google has also warned staff of reduced pay and potential firings if they do not get vaccinated.

- Amtrak reversed plans to cut some services in January after changing its vaccine rules to allow employees to take regular COVID-19 tests as an alternative to vaccination.

- The NFL will require all coaches and staff to get a COVID-19 booster dose after a record 37 players tested positive for the virus early this week.

- The Senate completed Congress’ approval of a measure raising the government’s borrowing limit by $2.5 trillion, averting chances of a shutdown through next November once the president signs it into law.

- U.S. wholesale prices rose an annual 9.6% in November, a record dating back to 2010. Prices for goods excluding food and energy rose a larger-than-expected 0.8% month over month, also a record from 2010.

- Retail sales rose a weaker-than-expected 0.3% in November, down from the torrid 1.8% growth in October.

- Credit card spending in November rose by double-digit percentages from the same time in 2019 and 2020, JPMorgan Chase reported.

- Defying expectations, millennials now account for well over half of all home purchase loan applications in the U.S., a shift quickened by the onset of the pandemic.

- Cancelations are up 35% on hotel booking site Trivago since the emergence of the COVID-19 Omicron variant.

- Sixty percent of 4,800 U.S. restaurants surveyed trimmed their menus this year, the fallout of continued labor shortages and high food costs.

- Starbucks workers at two Boston locations are seeking to unionize following the first successful unionization at a location in Buffalo, New York, last week.

- California is losing more than twice as many people to domestic migration as it was before the pandemic, new data shows.

- New offshore wind leases in the U.S. could generate up to $4.5 billion in federal revenue over the next several decades, according to new forecasts.

International Markets

- The COVID-19 Omicron variant is spreading faster than any previous strain of the virus, the World Health Organization says.

- The U.K. reported nearly 60,000 new COVID-19 cases over the past 24 hours, the most since January. Parliamentary lawmakers rejected calls to increase pandemic curbs Tuesday, with the latest data showing the Omicron variant is responsible for just 10 hospitalizations nationwide. The nation eliminated its “red list” requiring quarantine for travelers from high risk countries because it was ineffective, while 13 countries banned travelers from Great Britain due to its high infection rates.

- Denmark reported a record 1,098 new COVID-19 infections Tuesday. The nation’s Scandinavian neighbors are predicting huge surges in infections caused by the COVID-19 Omicron variant.

- Schools in the Netherlands are closing a week early for the holidays amid rising COVID-19 cases.

- The U.S. added Italy to its highest-risk category for international travel after its case rates climbed to 500 per 100,000 people. The nation tightened restrictions for intra-Europe travelers ahead of the holidays, requiring negative virus tests and 5-day quarantines upon arrival.

- Quebec is recommending people return to working from home due to a pre-holiday spike in COVID-19.

- South Africa’s total COVID-19 hospitalizations are up to nearly 7,000, with 6.8% of patients in ICUs.

- COVID-19 cases in the African continent have surged 83% over the past week, the fastest rise this year.

- Indonesia began vaccinating children as young as age 6 against COVID-19 Tuesday, one of the first Asian nations to begin mass inoculations for young children.

- Austria is expected to approve COVID-19 booster shots for all children over age 12.

- Up to 40% of people infected with COVID-19 experience no symptoms, a new global study shows.

- Infection with COVID-19 is significantly more likely to cause heart problems than getting a vaccine, new British research shows.

- COVID-19 antiviral treatments made by Eli Lilly and Regeneron were shown to lose most of their effectiveness against the Omicron variant, German researchers say.

- Germany’s GDP is forecast to shrink slightly in Q4 and remain largely stagnant in Q1 of 2022, with supply chain logjams and rising COVID-19 cases continuing to hamper economic activity.

- Several leading Chinese economic indicators, including fixed-asset investments and retail sales, grew at substantially lower paces in November than the rest of the year, new data shows. The nation’s property slump also continued, with home prices dropping for the third straight month alongside a decline in sales.

- GM began placing workers at its southwestern Ontario assembly plant on leave over the weekend because they did not meet the automaker’s COVID-19 vaccine deadline.

- A first-of-its-kind global study of plastic-degrading bacteria found that microbes in oceans and soils across the globe are evolving to eat plastic, potentially paving the way for advancements in recycling technology.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.