COVID-19 Bulletin: December 21

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices suffered their biggest loss in a month Monday, with U.S. benchmark WTI falling nearly 4%. Futures were higher in late morning trading, with WTI up 2.5% at $70.31/bbl and Brent up 2.2% at $73.06/bbl. U.S. natural gas was 1.0% higher at $3.91/MMBtu.

- Libya declared force majeure on oil exports after losing more than 300,000 bpd of production over shut-ins by a group tasked with guarding the nation’s major oil fields.

- Russia is limiting volumes on a key gas pipeline to Europe this week as domestic demand surges with the onset of colder weather. European gas prices rose as much as 11% to a record high Monday.

- OPEC+ likely missed production targets by 650,000 bpd last month, slightly smaller than October’s miss, on continued output slumps in Nigeria and Angola.

- The U.S. administration raised the fleet mileage standard for passenger cars and light trucks from 43 mpg in 2026 to 55 mpg, prompting automakers to say they’ll need government help to comply.

- Exxon Mobil is in talks to sell 5,000 gas wells in the Fayetteville Shale in Arkansas, part of the company’s drive to raise cash by shedding unwanted assets.

- Equinor is set to drill 25 exploration wells off Norway’s coast next year, an affirmation of the producer’s long-term plans to stick with oil and gas despite a global shift toward renewables.

- India launched its biggest ever oil and gas tender, with 75 blocks up for grabs both onshore and offshore.

- Compared to its 1 gigawatt (GW) of battery storage capacity last year, the U.S. is on pace to add 6 GW of storage this year and another 9 GW next year as renewables transform the electricity industry.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- November U.S.-bound containerized freight imports — totaling 2.85 million TEUs — were down 4.7% compared to October’s record while up 6.3% from the same time last year.

- The Port of Los Angeles is set to move 10.8 million TEUs by year’s end, the most ever.

- Seventy-five container ships called on the Port of Oakland in November, the most in six months.

- Container lines canceled more than 28% of trips from Asia to the U.S. West Coast at the end of October, new data shows.

- Bids for next year’s 40-foot container contracts from China to Northern Europe are already averaging $11,900, up from $3,807/FEU this time last year.

- U.S. rail carloads were up 6.8% and intermodal units were up 5.6% through the first 48 weeks of 2021 compared to the same time last year.

- An index of conditions in the U.S. trucking industry came in at its lowest level in more than a year in October, largely a result of higher fuel prices.

- 2021 spending on newbuild and secondhand vessels stood at a combined $147 billion last Friday, more than double the same time last year and on pace to smash a previous record set after the 2008 financial crisis.

- Emirati DP World is building the first deep seaport in the Democratic Republic of the Congo.

- South Korean bulk carrier SW Shipping will start container operations next year on intra-Asia trade routes. Freight forwarders are also increasingly jumping into container shipping operations.

- Walmart is building two new million-square-foot online fulfillment centers in Salt Lake City, Utah, and Lebanon, Tennessee.

- American semiconductor giant Micron Technology forecasts better-than-expected revenue for the latest quarter on continued effects of the global chip shortage, which it expects to ease over the coming year.

- FedEx received its first 500 all-electric vans from GM-backed BrightDrop, with plans to roll out the 250-mile-per-charge vehicles in Los Angeles next year.

- U.S. lawmakers are raising security concerns over the rapid expansion of China’s data gathering on global logistics flows.

Domestic Markets

- The U.S. reported 70,815 new COVID-19 infections and 137 virus fatalities Sunday. Top government officials forecast record infections and hospitalizations this winter, but are not expecting reimposed lockdowns.

- New York state reported more than 22,000 new COVID-19 cases Friday, a record and up over 150% from last week.

- Total COVID-19 hospitalizations in California are up 12% from two weeks ago, with surges of 30% or more in southern cities including Los Angeles.

- New COVID-19 cases in Florida have risen to their highest level since the tail end of a Delta variant surge in September.

- Michigan is running out of COVID-19 antibody treatments due to surging demand.

- The U.S. reported 253,954 new COVID-19 infections and 1,513 virus fatalities Monday. Cases and hospitalizations are both up about 50% over the past month, with new restrictions largely coming from states in the Northeast and Midwest.

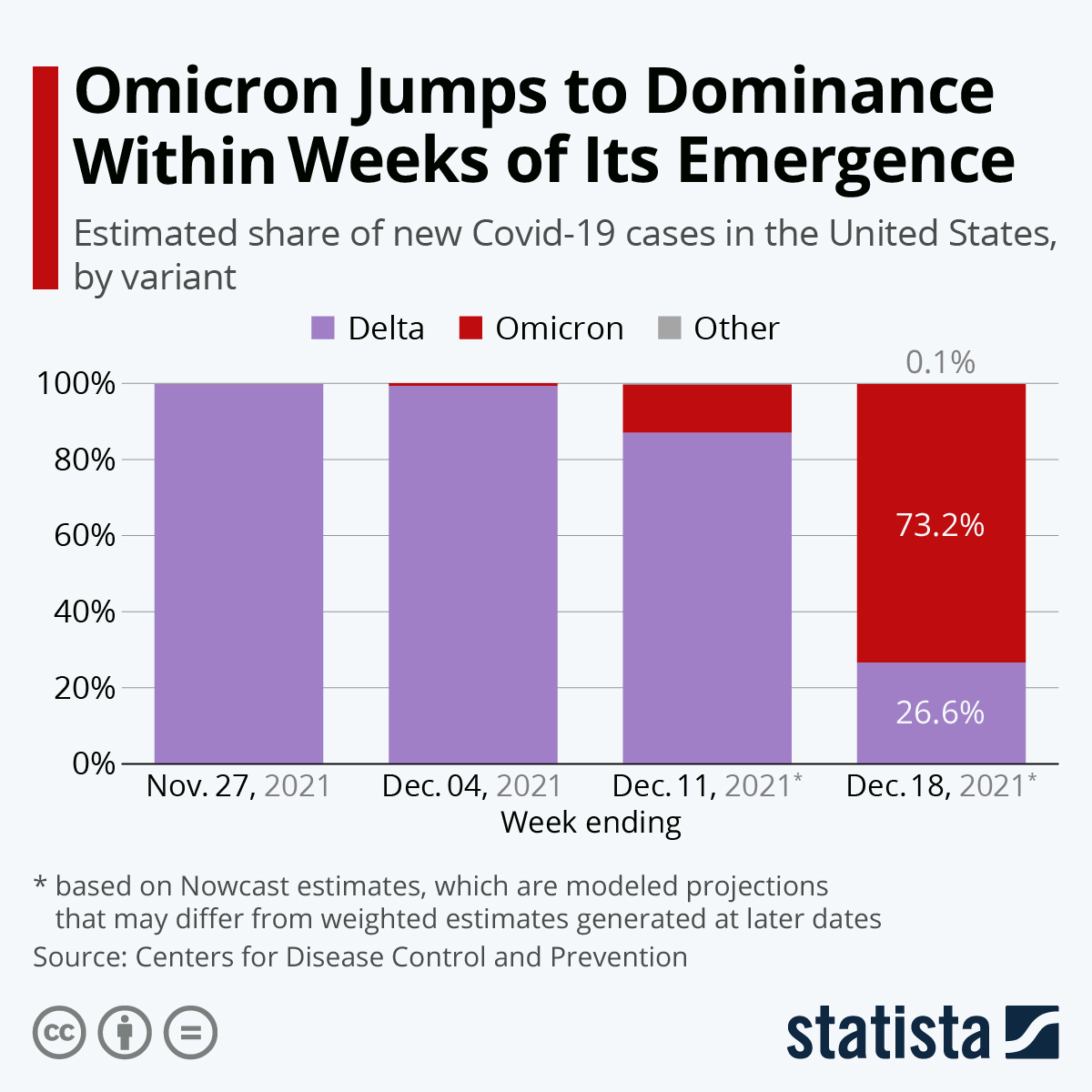

- U.S. infections with the COVID-19 Omicron variant surged sixfold last week, now accounting for nearly three-quarters of all new cases and more than 90% of cases in the New York area, the Southeast, the industrial Midwest and the Pacific Northwest. More than 80% of virus patients at a Houston-area hospital had the strain.

- Texas confirmed the nation’s first COVID-19 death from the Omicron variant.

- The Omicron variant of COVID-19 has overtaken the Delta variant in Florida’s Miami-Dade County, as the state’s average seven-day COVID-19 infection rate rose to its highest in three months.

- The White House will deploy military personnel to many of the nation’s most overburdened hospitals and send out 500 million free at-home COVID-19 tests to households this winter, part of recently announced plans to mitigate an expected virus wave.

- New York state reported 23,391 new COVID-19 cases Monday, the fourth consecutive daily record.

- COVID-19 cases in New Jersey rose 80% last week to an 11-month high.

- Boston imposed new proof-of-vaccine requirements for restaurants and other public indoor venues.

- Washington, D.C. and Newark, New Jersey, reimposed their indoor mask mandates.

- North Carolina is bracing for record COVID-19 infections and hospitalizations over the coming weeks but will not impose new restrictions, the governor said.

- Tennessee now has the nation’s fourth highest COVID-19 death rate, while unvaccinated people account for 99% of new infections.

- The U.S. administration delayed enforcement of its COVID-19 vaccine mandate for large businesses by a month to February as lawsuits continue moving through the legal system.

- After Moderna announced its COVID-19 booster shot produced significant protection against the Omicron variant, there is a growing opinion among health experts that three shots of any approved vaccine will be required to successfully ward off infection.

- SpaceX is experiencing the largest COVID-19 outbreak among workplaces in Los Angeles, with 132 active cases at its headquarters.

- Bank of America is letting New York employees work from home over the holidays, the latest in a string of protective measures imposed by U.S. financial giants.

- Duke University is the latest U.S. college to require all students and employees to get COVID-19 booster shots before returning from winter break.

- U.S. school closings were up 82% last week, with many districts now planning to resume remote classes in January.

- The NFL was forced to overhaul its COVID-19 protocols after record numbers of new cases among players threatened to shut down the season. Meanwhile, the NHL has postponed games until Saturday over rising cases.

- Four in 10 people infected with COVID-19 will not have any symptoms, a likely source of higher virus transmissions this winter, health experts say.

- U.S. economic output is set to expand by more than 7% annualized in the final three months of the year, the Federal Reserve predicted, nearly double the growth rate of China and quadruple that of the eurozone.

- U.S. roadway traffic was up 7.1% in October from last year as more people returned to offices and resumed leisure trips. Bad driving has increased, however, with traffic fatalities up 18% this year from last.

- U.S. airlines predict passenger volumes to be even higher this weekend than the record-setting numbers over Thanksgiving, as airports saw more than 2 million travelers over the last several days.

- Boeing and Airbus are lobbying to halt the U.S.’s rollout of new 5G wireless networks in January, citing the potential for widespread aircraft interference.

- Nike posted higher-than-expected earnings and revenue for the quarter ended Nov. 30, boosted by a 12% gain in North American sales despite factory closures trimming growth in China, Asia and Latin America.

- An Australian battery-maker is accelerating plans to open a U.S. manufacturing plant to meet surging demand for fast-charging batteries in the world’s third-largest electric vehicle market.

International Markets

- The COVID-19 Omicron variant is stronger and causing more breakthrough infections than initially thought, the World Health Organization warned.

- Britain’s prime minister warned the nation could see more COVID-19 restrictions after Christmas if cases of the Omicron variant continue rising. New infections were just shy of all-time highs Monday at 91,743, including 8,044 of the Omicron strain.

- Germany is considering new restrictions after Christmas to contain the Omicron variant but is unlikely to impose a full lockdown. The nation will require all British passengers to quarantine for two weeks upon arrival.

- The Netherlands began a fourth pandemic lockdown Monday.

- New Zealand halted plans to reopen borders until the end of February, citing the rapid global spread of the COVID-19 Omicron variant.

- Australian officials said there would be no more COVID-19 lockdowns despite new cases in the nation topping 4,600 the past 24 hours, a pandemic record.

- Record COVID-19 cases in Quebec, Canada, prompted officials to shutter bars, gyms and casinos and impose new work-from-home requirements Monday.

- Ten percent of passengers on a recent flight from Miami to Tel Aviv were infected with COVID-19, prompting the Israeli government to ban travel to the U.S. and Canada.

- Spain is among eight countries added to the CDC’s “Level 4: Covid-19 Very High” risk category, its highest.

- The latest surge of the COVID-19 Omicron variant in South Africa is causing significantly fewer hospital admissions than previous Delta waves. The nation’s new infections have also dropped to their lowest level in two weeks.

- Many countries are shortening the minimum wait time required to get a COVID-19 booster dose.

- London, Paris and Rome are among the European cities canceling New Year’s Eve events due to health concerns.

- The World Economic Forum canceled its in-person gathering in Davos, Switzerland, in mid-January.

- Global mergers and acquisitions surged 63% this year to a record $5.63 trillion amid an abundance of capital and sky-high company valuations.

- Central London consumer traffic has plunged since the onset of the COVID-19 Omicron variant, new data shows.

- Britain signed its first new trade deal since Brexit in a pact with Australia. Business confidence in the nation held steady in November and was well above its long-run average.

- European banking officials are warning that rising eurozone inflation will not be as temporary as once thought, with rates likely to remain above 3% well into 2022.

- Demand soared this year for European luxuries including Champagne and fine art.

- Europe will adopt rules as soon as next year for labeling gas and nuclear energy projects as “climate-friendly,” officials say.

- Vast ice sheets across the Himalayas shrank 10 times faster in the past four decades than the previous seven centuries, new research shows.

At M. Holland

- M. Holland will be closed Friday, Dec. 24, for the Christmas holiday. We will be closed Friday, Dec. 31, for New Year’s Eve.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.