COVID-19 Bulletin: February 10

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices reversed declines and ended slightly higher Wednesday after the Energy Information Administration reported that U.S. crude stockpiles fell to their lowest level since October 2018 last week amid record demand for refined product. Futures extended their gains in mid-morning trading, with WTI up 1.2% at $90.71/bbl and Brent up 0.9% at $92.41/bbl. U.S. natural gas was 1.8% lower at $3.94/MMBtu.

- The largest U.S. shale drillers could remain profitable for the next two decades by keeping output flat, though prime locations will likely tap out in the next few years, new research shows.

- New York’s state pension fund will sell $238 million worth of stock and debt it holds across 21 shale companies, half its shale portfolio, due to their weak environmental commitments.

- High oil prices are eating into corporate bottom lines, with expenses increasingly passed on to consumers.

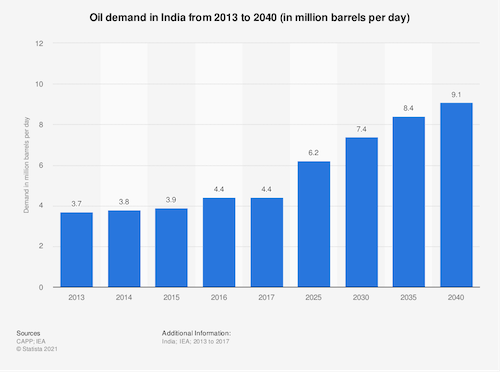

- Most of India’s 23 refineries operated at capacity in January and are scrambling to secure supply on the spot market amid surging demand for crude.

- Japan’s biggest oil and gas explorer will invest up to $38 billion in growth the next nine years, about a quarter of which will go toward decarbonization areas such as hydrogen and ammonia.

- Some U.S. lawmakers are proposing a suspension of the federal gas tax in a bid to lower prices for consumers.

- France’s TotalEnergies will pay 100-euro vouchers to low-income households to help with rising energy bills.

- Greece plans to add to the $2 billion it has spent since last September in subsidizing customer electricity and gas bills.

- The Texas Railroad Commission approved $3.4 billion in financing for exorbitant energy prices racked up by customers during 2021’s Winter Storm Uri.

- Norway will invite its first ever bids for offshore wind projects in the North Sea this year, with hopes to build at least 1.5 GWs of capacity by the end of the decade.

- British scientists claim to have produced a record amount of energy from a short nuclear fusion test, a potential advancement in harnessing the ultra-powerful energy source.

Supply Chain

- Protests against vaccine mandates in the trucking industry crowded the Ambassador Bridge between Detroit and Canada for a second straight day Wednesday and are set to continue today, blocking the route that carries 25% of all traded goods between the two nations. Meanwhile, more than 500 heavy-duty trucks remained parked in Canada’s capital, clogging traffic and services in the city’s core. Stellantis warned of production halts at its Windsor assembly plant in southwest Ontario.

- Officials are warning that a trucker protest could disrupt transportation services in Los Angeles during this Sunday’s Super Bowl.

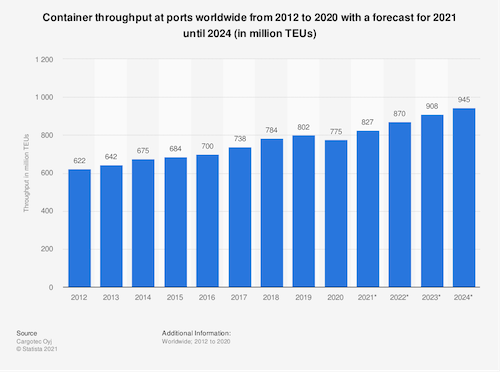

- Ocean shipping should start to normalize in the second half of this year, according to officials at the Port of Los Angeles and executives at Maersk.

- Maersk, which handles almost one-fifth of the world’s container traffic, recorded an all-time high $18.7 billion in profit last year. The carrier sees a 2%-4% expansion in the global ocean shipping market this year, and is continuing on its path of acquiring overland logistics providers, including last-mile delivery firms.

- A global spending spree on LNG-fueled vessels continued last month with orders for 40 more of the ships.

- Freight rates for large bulk carriers are 90% lower than last year’s peak due to lower demand for iron ore in China, the world’s largest steel producer.

- New orders for Class 8 heavy-duty trucks fell 8% from December to January to 21,400 orders, according to FTR.

- The average weekly revenue per truck at Schneider National hit $4,521 in Q4, up 18% from the same time last year as fewer trucks were on the road.

- Trucker Yellow will triple capital spending this year after reporting strong Q4 results and plans to open two new driver academies in Atlanta and Cincinnati.

- The White House said its $5 billion plan to create a national network of electric vehicle charging stations would build rapid chargers on interstate highways before expanding into remote rural and crowded urban areas.

- Roughly one-fifth of grocers’ candy isles are bare as top U.S. confectioners battle labor shortages and diminishing factory capacity.

- Paper mill labor shortages are hampering supplies of disposable cups.

- Pitney Bowes’ Q4 parcel volumes fell 20% below expectations as supply chain issues limited customer inventories for e-commerce orders.

- Canada’s western Port of Prince Rupert, its most northerly deep-sea port, plans to expand capacity by 200,000 containers in the next two years.

- Semiconductor supplies in the Mexican auto industry should return to pre-pandemic levels by the second half of this year, an industry group said.

- Toyota cut its 2022 production target by half a million vehicles due to chip shortages after the automaker’s profit fell 21% in the most recent quarter. Honda saw similar profit declines but maintained production forecasts for this year despite shrinking chip inventories.

- Computer chip shortages spurred Nintendo to lower sales estimates for its popular handheld Switch device this quarter, the second quarter in a row.

- U.S. lawmakers made changes to Postal Service employee benefits in a bid to improve the agency’s financial condition.

Domestic Markets

- The U.S. reported 215,748 new COVID-19 infections and 3,435 virus fatalities Wednesday. The CDC predicts up to 61,000 more virus fatalities over the next month.

- Total U.S. COVID-19 hospitalizations fell below 100,000 for the first time in a month on Wednesday, a 38% drop from January’s peak.

- The CDC urged states to reconsider dropping mask mandates in schools as Massachusetts, Rhode Island and Nevada became the latest states to relax mask restrictions.

- Norwegian Cruise Line will scrap an on-board mask requirement starting March 1.

- Alabama remains the lowest-vaccinated state in the nation, with fewer than 50% of its population fully vaccinated against COVID-19.

- The CDC is prepping states to receive COVID-19 vaccine doses for children between six months and 4-years-old by Feb. 21.

- First-time unemployment claims fell by 16,000 last week to 223,000, the third weekly decline.

- U.S. inflation jumped 7.5% year over year in January, more than economists expected and the highest rate since February 1982.

- Some economists predict higher-than-expected inflation could prompt the Federal Reserve to raise interest rates by as much as 50 basis points next month, which would be the largest rate hike in more than two decades.

- U.S. corporate bankruptcies have fallen to their lowest level in more than 15 years.

- Fourth-quarter revenue at CVS rose 10% to $76.6 billion on high demand for COVID-19 services. The firm’s stock slumped over 5% after it predicted falling demand for vaccinations and testing this year.

- AstraZeneca warned that sales and profits could decline due to lower sales of COVID-19 products.

- Toy maker Mattel reported better-than-expected quarterly results and expects sales to rise 10% this year, up from its previous view for a mid-single digit gain.

- Walt Disney crushed quarterly expectations on rebounding visits to its theme parks and higher-than-expected subscriber growth on its budding streaming service.

- Uber’s revenue climbed 83% in Q4 on a surge in ride-hailing activity and continued demand for food deliveries, with its total number of active customers rising to a record 118 million.

- Consumer goods giant Unilever reported a 4.9% gain in quarterly sales driven entirely by higher prices, as volumes remained flat.

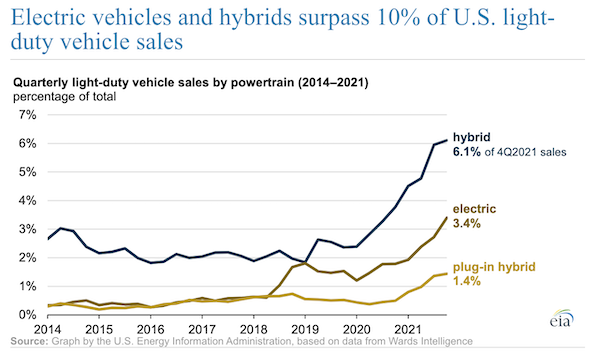

- Hybrid and electric vehicles accounted for 11% of U.S. light-duty vehicle sales last quarter:

- General Motors said it would raise production of electric trucks and SUVs by sixfold over initial targets for the next two years. The automaker also is expected to soon resume production of its recalled Bolt EV model.

- Shyft Group, a U.S. electric-vehicle startup, aims to launch its first electric delivery van for fleet customers by mid-2023.

- Fourth-quarter profit at engine maker Cummins fell 21% to $394 million on declining North American sales and supply chain snarls.

- Car insurance premiums are sharply rising due to inflation-boosted costs of repairs, replacements and rentals.

International Markets

- The world has seen more than 130 million COVID-19 cases and 500,000 virus fatalities since the onset of Omicron in November.

- Global COVID-19 fatalities rose 7% last week, while cases declined.

- South Korea saw a record 49,567 new COVID-19 cases Wednesday, an increase of nearly 13,000 from the day before.

- Japan extended pandemic restrictions in 13 prefectures by three weeks as the nation continues to break daily records for COVID-19 cases.

- New COVID-19 cases in Hong Kong nearly doubled yesterday to 1,161, smashing a previous record, as the city-state reported its first three virus deaths since September.

- Slovakia reported 20,582 new COVID-19 infections Wednesday, a record.

- Sweden is curtailing wide-scale testing, even for those exhibiting COVID-19 symptoms.

- Britain’s prime minister plans to end self-isolation requirements for COVID-positive people by the end of the month as part of a revamped strategy of living with the virus.

- French anti-restriction protesters crowded into Paris Wednesday, mimicking efforts in Canada and New Zealand.

- The Czech Republic is dropping its COVID-19 health pass barring entry to indoor public establishments for the unvaccinated.

- International delegates met yesterday on an EU proposal that would ban wildlife markets — the likely source of COVID-19 — and incentivize nations for reporting new viruses and variants.

- Growth forecasts for China’s economy this year and next have fallen from around 8% to around 5%, weighing on the price of commodities and making it harder for some firms to grow business there.

- Flight bookings at European budget airline Ryanair have risen sharply over the past two weeks amid a broad easing of pandemic restrictions across the continent.

- Samsung’s newly unveiled Galaxy S22 smartphone uses recycled material sourced from ocean plastic in discarded fishing nets, a material it plans to use across its whole product lineup in the future.

At M. Holland

- Plastics News reported that M. Holland earned a Bronze rating from EcoVadis, a trusted provider of business sustainability ratings. The article reports that our improved annual score for 2021 is due to progress in our diversity and inclusion program, wellness benefits, career development and more.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.