COVID-19 Bulletin: February 11

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices extended their longest winning streak in two years for a ninth straight day yesterday, supported by producer cuts and global vaccine rollouts.

- Crude prices eased in early trading today, with the WTI down 0.6% at $58.31/bbl and Brent down 0.7% at $61.03/bbl. Natural gas was 2.2% higher at $2.97/MMBtu.

- Crude prices in North Dakota’s Bakken shale region hit their highest levels in six months, a result of producers reigning in output amid the uncertain future of the Dakota Access Pipeline.

- The Energy Information Administration upped its average price forecast for WTI crude spot prices to $50.21 in 2021 and $51.56 next year.

- A recent report calculates that oil producing nations face a $9 trillion income decline as the world shifts to renewable energy, prompting a warning for oil-dependent countries to diversify their economies.

- Brookfield Infrastructure made a $5.6 billion unsolicited offer to acquire Canadian midstream giant Inter Pipeline, which manages 4,300 miles of pipelines, 5 million barrels of oil storage in western Canada, and a PDH/PP complex under construction in Alberta.

- In a strategy update yesterday, Royal Dutch Shell said its oil production has peaked and will decline by 1% to 2% annually moving forward, with its production of “traditional fuels” down 55% by the end of the decade. The company also said it will freeze salaries and eliminate bonuses this year to preserve cash.

- Baystar, a joint venture between Total and Borealis, will start its new Port Arthur, Texas, ethane cracker by the end of March with over a million-tonnes-per-year capacity, while a new 625,000-tonne-per-year polyethylene unit in Pasadena will start by March 2022.

- Despite slashing its capital expenditures for 2021, ExxonMobil plans to complete a new ethane cracker, polyethylene and mono-ethylene glycol chemical complex in Corpus Christi by the end of the year, several months ahead of schedule.

- Braskem is forecasting a tight market for North American polypropylene in early 2021 due to low inventories and non-pandemic-related maintenance issues.

- Renewable energy such as wind and solar power is expected to surpass natural gas as the predominant source of U.S. electricity generation by 2030. Around the same time, U.S. crude production is expected to level off as Wall Street investment shifts away from fossil fuels.

Supply Chain

- A 7.7 magnitude earthquake struck the South Pacific region yesterday, triggering tsunami warnings.

- The impacts of a global computer chip shortage are spreading:

- General Motors posted a $2.8 billion profit in the fourth quarter, but warned that global semiconductor shortages could cause a $2 billion hit to profits in 2021.

- Toyota, raising 2021 earnings forecasts by more than 50%, said it has a four-month stockpile of chips and is not expecting production hits.

- Volkswagen’s Mexico unit, meanwhile, is slowing production of Jettas until March 5 due to the shortage.

- The chip shortage has broader implications than just the auto industry, notably causing production delays that have stripped supplies of Sony’s new PlayStation 5.

- The U.S. Postal Service registered a profit in the fiscal first quarter on an 11% rise in revenue.

- Shipping giant Maersk, hurt by pandemic-induced supply chain disruptions, posted a lower-than-expected $1.3 billion profit in the fourth quarter.

- A surge in e-commerce warehouse construction in Houston the last few years is creating a glut of space, driving vacancies up and rents down.

- Hapag-Lloyd raised nearly $900 million in green financing to support building six new 23,500-teu liquified natural gas-powered box ships, early evidence of an expected surge in newbuild ship orders placed this year and next.

- Vietnam port container volumes rose by 8.5% in 2020.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 94,704 new COVID-19 infections in the U.S. yesterday and 3,364 fatalities.

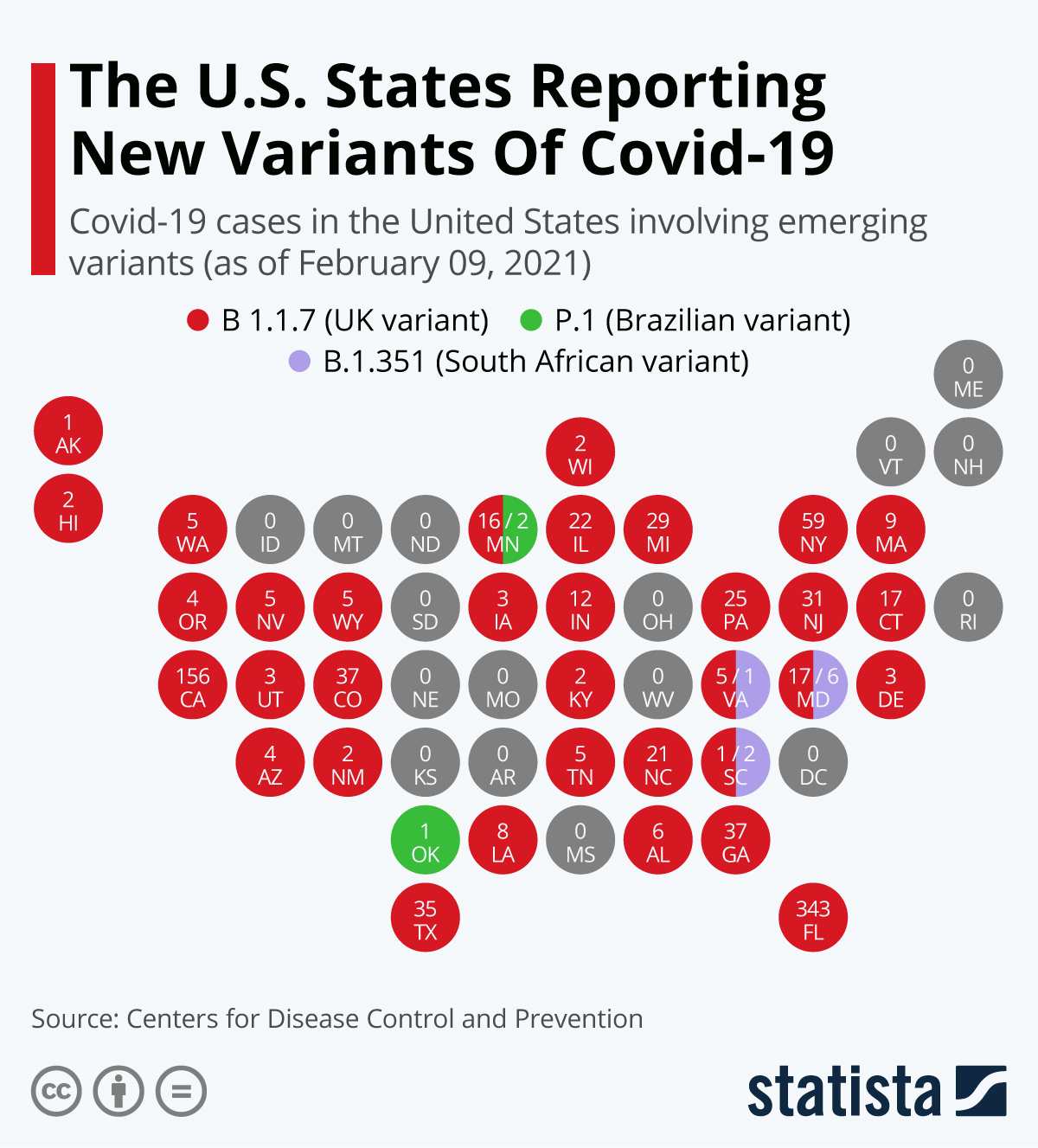

- More than 900 Americans are now infected with the virulent U.K. strain of the coronavirus, a pace far outstripping the first virus strain in the same time period more than a year ago.

- The White House is considering domestic travel restrictions as several virulent strains, including from the U.K., South Africa and Brazil, spread in Florida, threatening hard-fought progress against the pandemic.

- Wearing a double mask or fitting a single mask more closely on the face substantially reduces the risk of infection with COVID-19.

- More than 5 million COVID-19 vaccines have been distributed in California. The state reported its first two cases of a virulent strain from South Africa yesterday.

- The World Health Organization says countries should keep rolling out AstraZeneca/Oxford’s COVID-19 vaccine, including those battling the South African strain of the virus.

- Merck & Co. could begin helping manufacture COVID-19 vaccines in addition to two virus therapies currently in development.

- The White House is opening more mass-vaccination sites in Texas and New York with a focus on minority and underserved communities.

- Residents of Southern states are least committed to getting a COVID-19 vaccine, while those in the Northeast show the most willingness.

- Large New York sports and entertainment venues will reopen at limited capacity starting Feb. 23 after being closed for nearly a year.

- There were 793,000 first-time jobless claims last week, down 19,000 from the prior week.

- The Federal Reserve will continue the path of low interest rates and hefty asset purchases to bolster the economy, noting that the real unemployment rate is closer to 10% rather than the official 6.3% reported by the government. Bank officials also are calling on a “society-wide commitment” to returning employment for minorities and those terminated from lower-paying jobs during the pandemic.

- The U.S. budget gap hit a record $736 billion during 2021’s first four fiscal months, an 89% increase from the year-ago period, led by a record $163 billion deficit in January, five times the previous year, as new coronavirus relief payments were sent out.

- American goods exports to China rose 17.1% last year as the U.S. reduced its overall trade deficit in goods by 10%.

- U.S. consumer prices rose a moderate 0.3% in January, with higher gasoline prices blunted by a slump in airline fares.

- U.S. wholesale inventories increased more than initially thought in December, rising 0.3%.

- Applications to start new U.S. businesses surged by 42.6% in January.

- American businesses and consumers increased borrowing last year but paid back even more as lenders saw their loan books shrink in 2020 for only the second time in 28 years, leaving banks flush with cash and hopeful loan growth will pick up this year.

- Despite skyrocketing sales in recent quarters, Best Buy is cutting jobs and reducing hours in a transition to greater e-commerce.

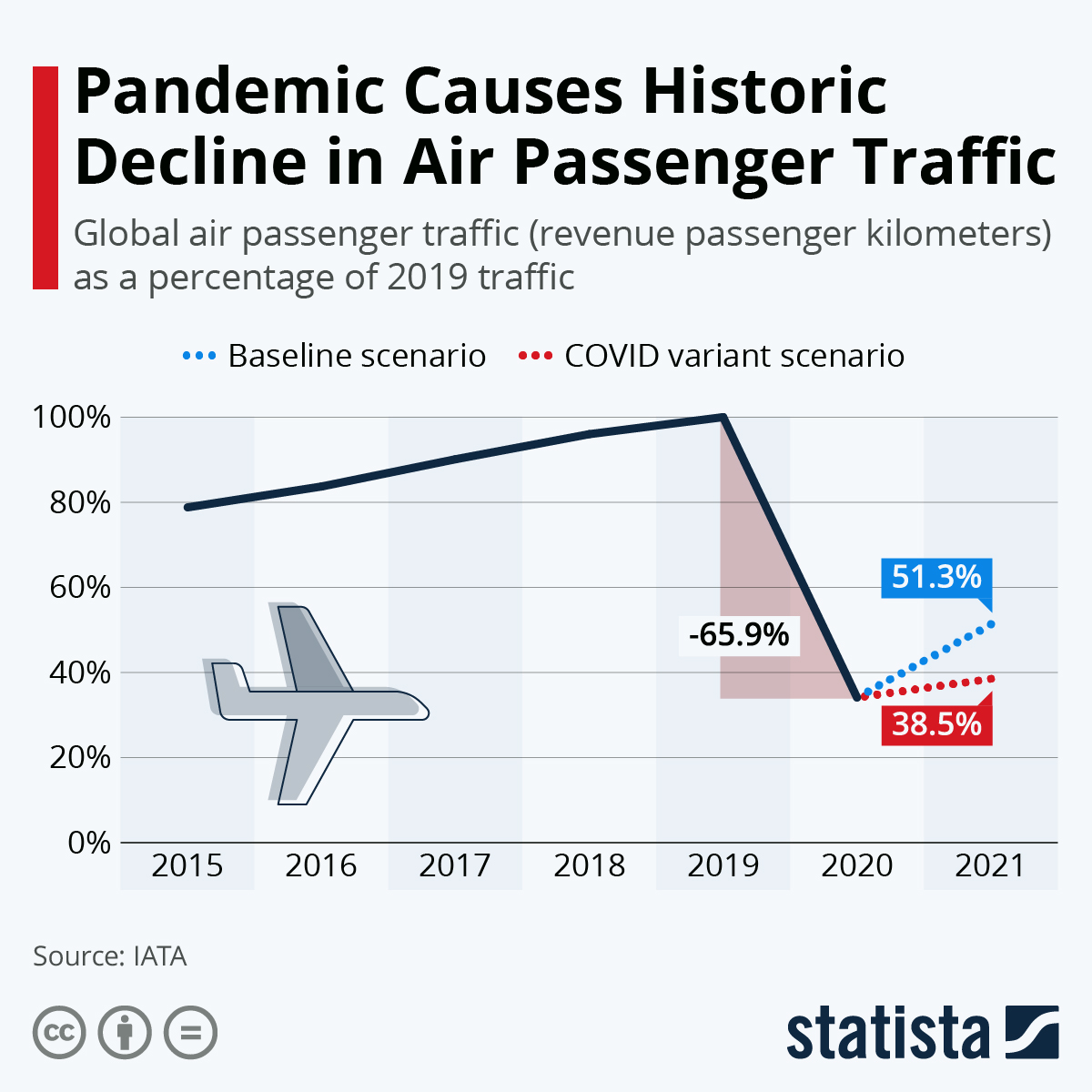

- Southwest Airlines and airline unions are asking the White House not to impose COVID-19 test requirements before domestic flights, warning about the effect on the already battered industry.

- United is the first airline to commit to the purchase of electric air taxis after electric aircraft startup Archer announced plans to go public.

- VW and Microsoft are teaming up to develop cloud-based technology to speed the transition to self-driving vehicles.

- Toyota will produce two new electric vehicle models that will go on sale next year in the U.S.

- Mercedes-Benz spinoff Daimler Trucks is investing $20 million in its Detroit Diesel plant in Michigan to make electrical powertrain parts for the North American e-truck market.

- Clorox is expanding manufacturing capacity to double its sanitary wipe production by the year’s end.

International

- Germany extended COVID-19 restrictions to March 7 over fears about virus mutations.

- Australia reported that a cluster of 11 COVID-19 cases of the virulent U.K. strain in Melbourne was caused when a person at a quarantine hotel used a medical nebulizer that also vaporized the virus.

- Coronavirus patients in Spain will have to wait six months before being vaccine eligible, the first measure in Europe that assumes reinfection with the virus is unlikely.

- About 90 people in China were infected with coronavirus-like symptoms two months before the virus broke out full force, suggesting a wider spread than first thought. The WHO’s probe into the origins of COVID-19 in Wuhan ended yesterday, with a full report expected soon.

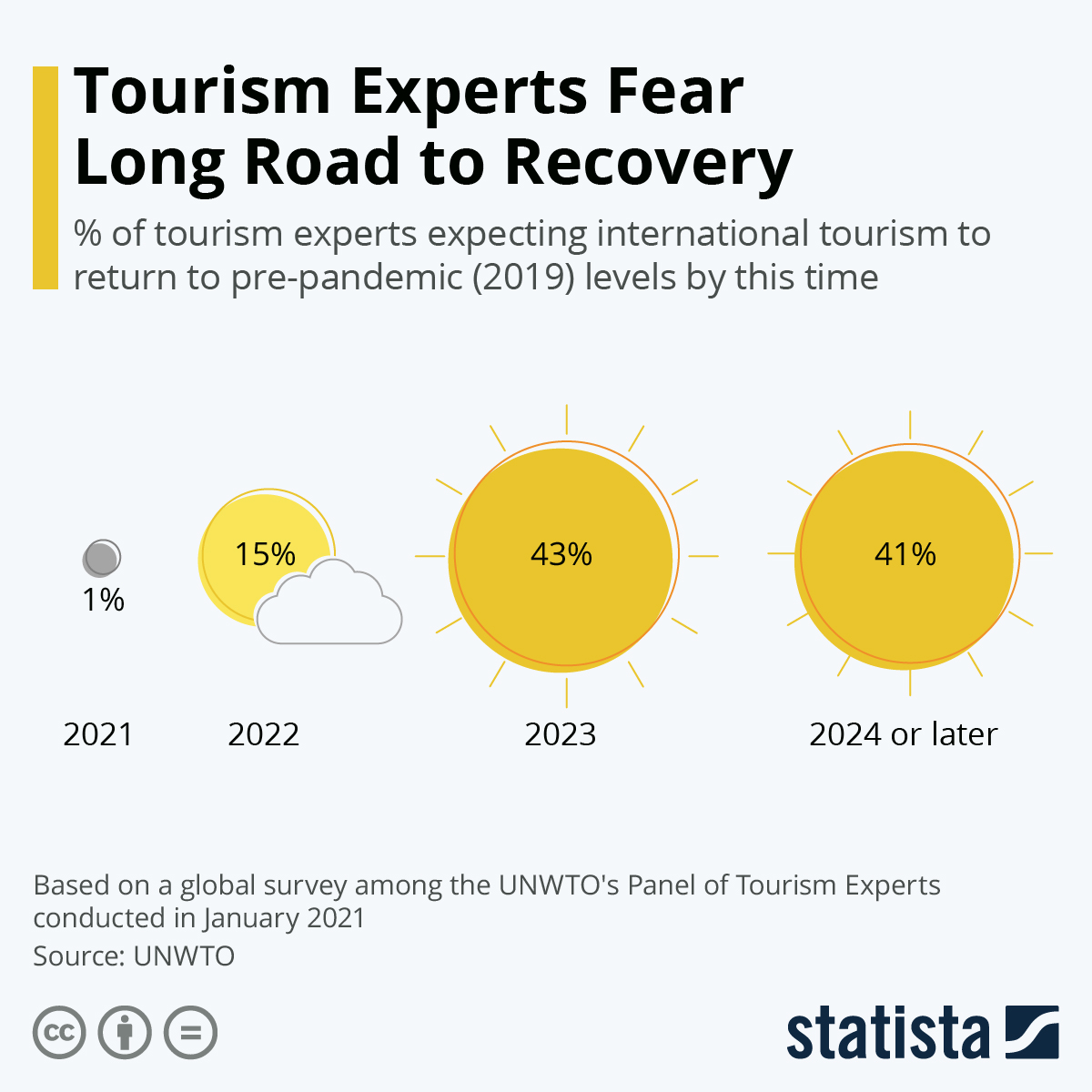

- The global travel and hospitality sectors are bracing for a slow recovery:

- Same-store sales at Mexican retail businesses fell 8.2% in January compared to the same time last year.

- France’s industrial output was weaker than expected in December, falling 0.8% from the previous month amid a 1.3% decline in fourth-quarter GDP.

- A digital currency issued by the Canadian central bank could come sooner than expected with the pandemic, although officials give no timeline.

- The European Union is asking for a two-month extension to ratify Britain’s exit from the bloc.

- Coca-Cola is beginning consumer testing in Europe on a fully recyclable beverage bottle made of plastics-lined paper.

Our Operations

- Our 3D Printing business unit has launched a new e-commerce site. Access the new site here.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.