COVID-19 Bulletin: February 15

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil futures surged to a 13-month high over the weekend on fears that cold weather in Texas could disrupt flows from America’s largest shale patch, tightening global supply. In early trading today, WTI was up 2.1% at $60.69/bbl, Brent was 1.5% higher at $63.36/bbl, and natural gas was up 3.2% at $3.00/MMBtu.

- Global oil demand recovery is expected to pick up speed in the second half of 2021, according to OPEC and the International Energy Agency, which both upwardly revised previous forecasts for non-OPEC production growth.

- Refineries in India are increasing spot imports of light crude from North America and Africa to offset constrained supply from OPEC.

- Propane prices are up almost 70% since late November, largely due to booming demand for patio heating and increased demand from Asia.

- China’s crude imports in January averaged 11.12 million bpd, up by nearly 18% from December.

- China’s ban on Australian coal imports is causing prices in its own market to skyrocket amid an unusually cold winter.

- Profits for China’s plastics industry rose 18% in 2020, despite a 6.5% drop in output.

- Chinese material manufacturers are ramping up development to increase output of biodegradable plastics, a result of the country’s recent ban on disposable plastic bags.

- Flash Joule heating, a new plastics recycling technique developed by Rice University scientists, rapidly turns plastic into super-material graphene, which is highly recyclable and stable.

Supply Chain

- A major winter storm with record-setting low temperatures blanketed Texas to Maine with snow on Sunday, causing winter advisories for more than 120 million Americans and widespread power outages in Texas. We are receiving reports of potential supply disruptions from various industry sources.

- A magnitude 7.3 earthquake struck Japan on Saturday off the coast of Fukushima, the same region where an earthquake triggered a nuclear reactor disaster a decade ago.

- Year over year, businesses spent nearly 12.3% more on shipping and freight in the fourth quarter, the third straight quarter of increases.

- Several Chinese container lines and marine terminals are experiencing a pre-Chinese New Year cargo rush that is backing up operations and causing congestion. Affected ports include Shenzhen, Ningbo, Shanghai, and Dalian.

- Ports are booming in France and Northern Ireland, which remains part of the European trade area following Brexit, as shippers avoid new paperwork and bureaucracy at British ports.

- The U.K.’s Royal Mail delivered 30% more parcels during the last three months of 2020 than the year before.

- German automakers fear they will experience supply disruptions from new border restrictions imposed by Germany on Czech Republic and Austria’s Tyrol region, both experiencing surges in new variants of COVID-19.

- Electric aircraft (e.g., electric drones) could account for 30% of package deliveries by 2040, according to a recent study.

- We expect logistics in the U.S. to be disrupted by the winter storm blanketing much of the country.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

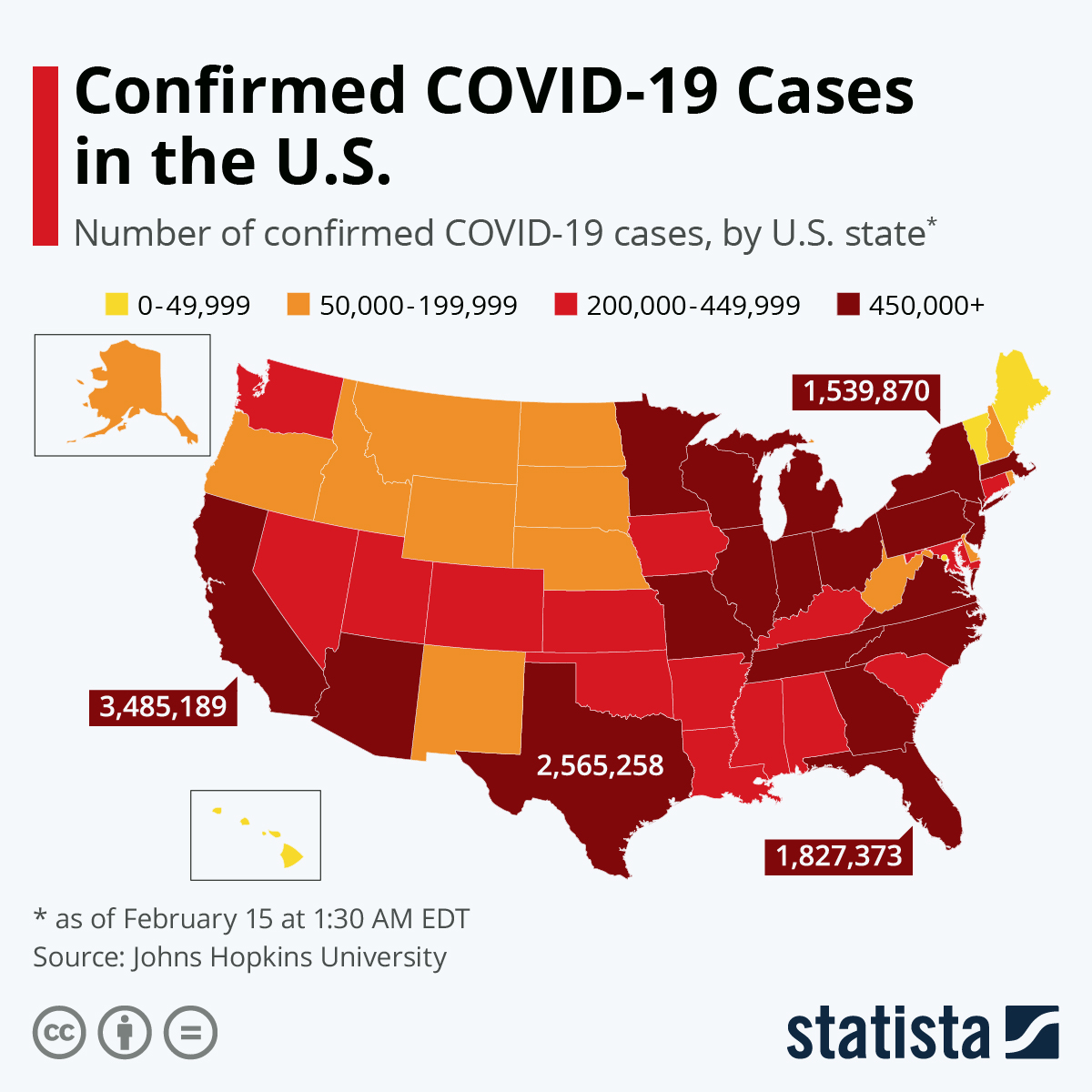

- There were 64,938 new COVID-19 cases in the U.S. yesterday and 1,088 fatalities.

- Newly reported U.S. COVID-19 cases have remained below 100,000 for six of the past seven days. Virus fatalities are also trending downward from January’s seven-day average of about 3,300 per day.

- Declining coronavirus trends are prompting several governors to roll back restrictions on leisure and economic activities, though the CDC is warning against people letting down their guard.

- U.S. states have been the source of at least seven coronavirus variants, some developing in the same manner as other strains identified in the U.K. and South Africa.

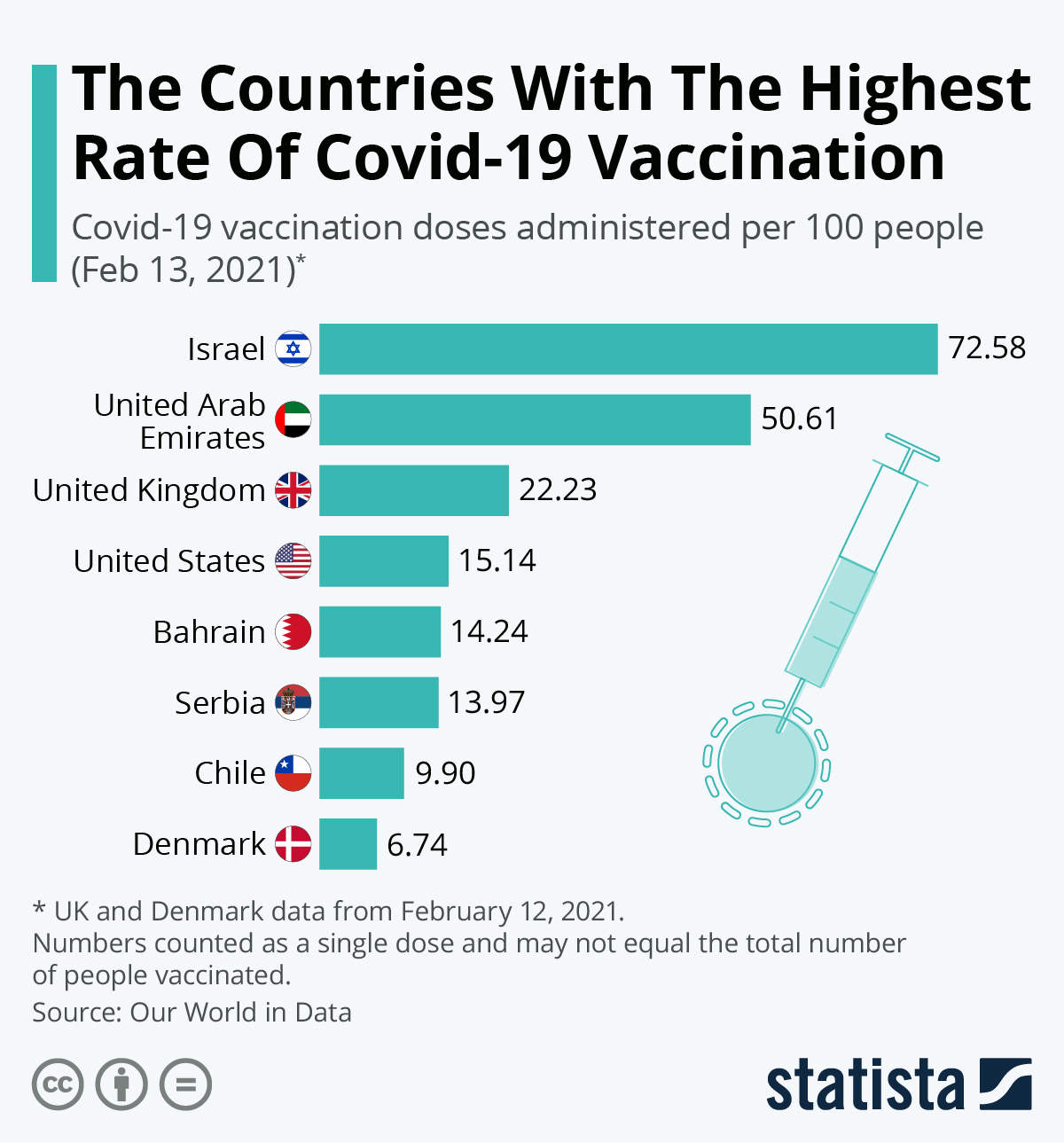

- The U.S. vaccine rollout has gained momentum with vaccinations nationally at 1.7 million a day, but states are now encountering supply constraints as they widen eligibility for shots.

- Researchers at several major COVID-19 vaccine suppliers are working on new combinations of a shot that will combat many variants of the disease at once.

- The Pentagon deployed nearly 5,000 troops to work with FEMA on establishing COVID-19 vaccination sites.

- Walmart started giving out its first COVID-19 vaccine doses on Friday, with many going to small towns that lack medical resources.

- COVID-19’s prolonged disruption of in-person schooling and sports is causing higher instances of weight gain in children.

- The CDC is urging education officials to open the nation’s elementary and secondary schools.

- Many workers’ compensation claims related to COVID-19 are being rejected by insurers due to the difficulty in proving workers were infected on the job.

- Businesses and individuals challenging pandemic lockdown rules in court have experienced high rates of defeat, yet the massive wave of lawsuits related to COVID-19 will likely prompt a review of the emergency powers of state governors.

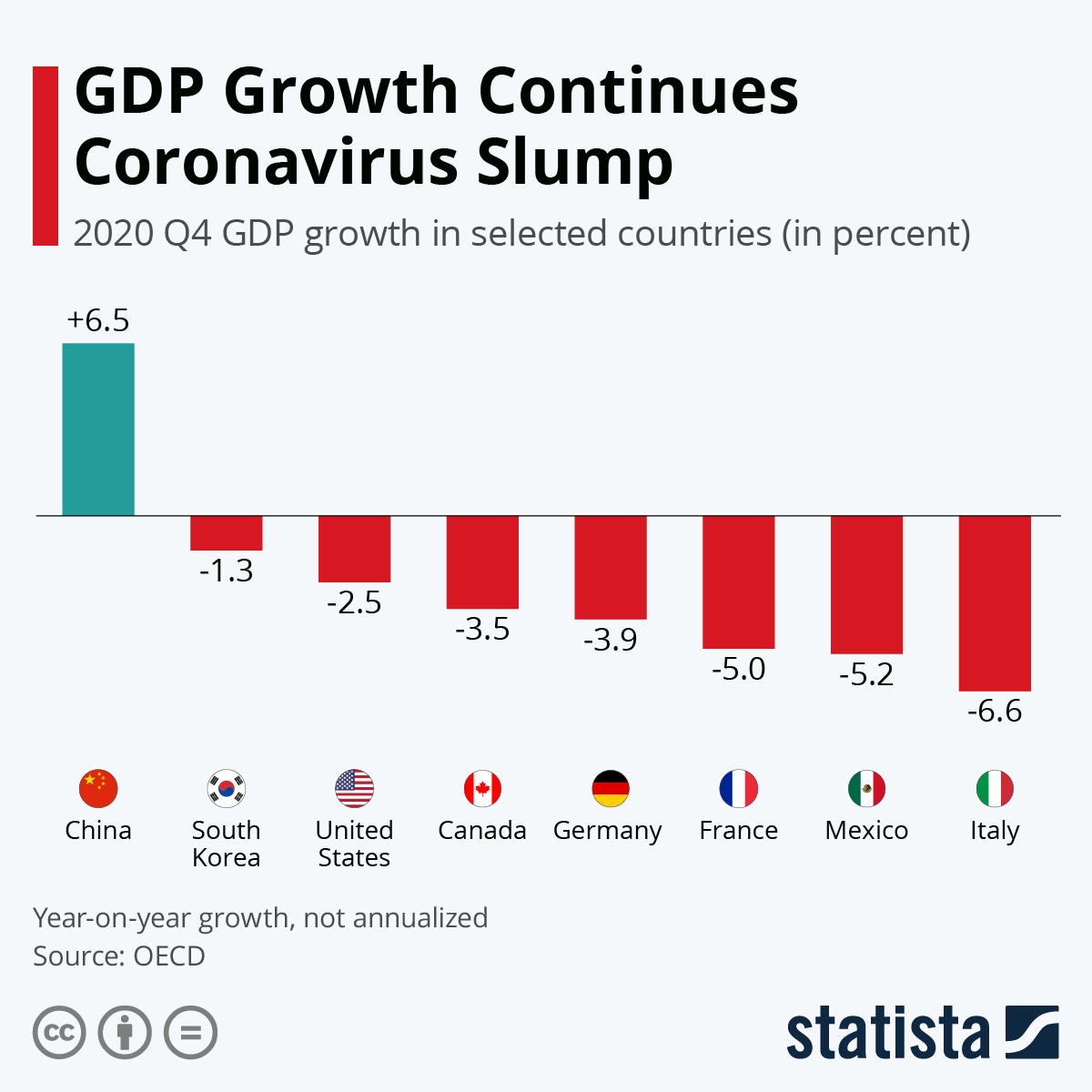

- Economic forecasts for U.S. GDP growth in 2021 were bumped up in February, a reflection of more COVID-19 vaccines being distributed and the likelihood of further stimulus efforts.

- Interest rates on corporate junk debt fell below 4% last week, a historic low, as flush lenders court even the riskiest borrowers.

- U.S. consumer sentiment dropped to 76.2 in February from 79.0 in January, largely driven by downbeat expectations among lower-income households.

- Under Armour is scaling back its retail operations to focus on direct-to-consumer commerce, with plans to pull its products out of up to 3,000 stores by the end of 2022.

- Efforts by states to shift recycling costs away from taxpayers and onto product packaging producers are gaining ground, with nearly a dozen proposed extended producer responsibility (EPR) bills introduced so far this year.

International

- Last week, COVID-19 infections fell in the U.K. for the fourth consecutive week. The nation has given out 15 million vaccines so far, a milestone that is prompting many to call for eased restrictions.

- Passengers arriving in the U.K. from coronavirus hotspots will be required to quarantine in government-managed hotel rooms for 10 days starting today.

- Life has picked back up to normalcy in many regions in India, where new coronavirus transmissions have dropped nearly 90% from peaks of just under 100,000 per day in September.

- A small outbreak of COVID-19 in a New Zealand family caused the nation’s largest city to go under strict lockdown for three days. It was the nation’s first instance of the more virulent variant of the virus first found in the U.K., though those infected have not traveled out of the country.

- Mexico, with the third-highest COVID-19 fatality rate in the world and just 0.5% of its population vaccinated, is racing to trial more vaccines to bolster meager supplies.

- Venezuela, frozen from procuring some vaccines by U.S. sanctions, received its first delivery of 100,000 Russian Sputnik-V doses on Saturday.

- Pfizer/BioNTech’s coronavirus vaccine became the first to get approval in Japan over the weekend.

- Hong Kong will begin giving out COVID-19 vaccines in early March, with the first batch of Pfizer/BioNTech shots arriving at the end of February.

- China was the among the only major economies to experience growth in the fourth quarter:

- Dubai’s international airport posted a 70% slump in traffic last year as pandemic restrictions halted travel through the Middle East’s tourism hub.

- Cinemex, Mexico’s second-largest movie theater chain, is closing its cinemas indefinitely while it works with banks to restructure $230 million in debt.

- Singapore home sales rose to a two-year high in January, an effort by many to capitalize on low interest rates before the government takes steps to cool the market.

Our Operations

- Join us this Thursday at 1:00 p.m. CT for a webinar on 2021 Drivers and Trends for the North American Plastics Market, featuring Andrew Reynolds, Director of Business Publishing International (BPI); Ray Hufnagel, President and CEO at Plastic Express; Frank LaRocque, Director of Resale Sales at M. Holland; and Mike Foldvary, Director of Distribution Sourcing at M. Holland. Click here to register.

- Our 3D Printing business unit has launched a new e-commerce site. Access the new site here.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.