COVID-19 Bulletin: February 16

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- A swatch of Arctic air pushed down to the Gulf of Mexico yesterday, causing severe power outages, extreme cold temperatures and shutdowns of wells and refineries:

- The cold shut down oil wells and refineries, causing record-high electricity rates and power demand.

- The storm knocked out 1.7 million bpd of crude production and as much as 3 million bpd of processing capacity as many midstream players declared force majeure.

- Brent crude closed at a 13-month high yesterday and was down slightly in mid-day trading today at $63.07/bbl, while the WTI price was 0.2% higher at $59.64/bbl. Natural gas futures topped $3/MMBtu this morning, up 4.2% at $3.03/MMBtu.

- Natural gas prices for physical delivery soared to as high as $500/MMBtu on spot markets on two Central U.S. trading hubs.

- Frozen turbines on windmills have contributed to the power crises in Texas, where wind now comprises 25% of the energy mix.

- Saudi Aramco shut its Port Arthur complex, site of the nation’s largest refinery, and Exxon closed facilities in Baytown and Beaumont, Texas, home to a fifth of domestic oil refineries.

- Flint Hills declared force majeure on polypropylene products due to the storm.

- ExxonMobil warned that the inclement weather may affect availability of polyethylene at its Texas facilities.

- Formosa has temporary closed its Fort Comfort, Texas, site due to the storm.

- INEOS declared force majeure on polypropylene products due to the storm.

- LyondellBasell declared force majeure on polyethylene and polypropylene products due to the storm.

- Royal Dutch Shell temporarily halted 310,000 bpd of crude distillation at its Deer Park refinery after a seal failed on a feeder pump.

- The White House canceled plans to lease 78.2 million acres for oil and gas exploration in the Gulf of Mexico as part of a review of new drilling activities on federal land and in offshore waters.

- Coal consumption by India’s power industry shrank for the second consecutive year in 2020, signaling that demand for the country’s most polluting fuel may have peaked.

- BP and Chevron yesterday announced they are embracing geothermal energy with an investment in Eavor, an early stage Canadian company attempting to scale geothermal for wide-scale use.

Supply Chain

- The winter storm that blanketed much of the country wreaked havoc in its wake:

- Port of Houston terminals are closed today.

- Some of our logistics partners in Missouri, Tennessee and Texas are shut down today.

- Texas deployed national guard troops to assist with emergency services after millions of residents lost power when the state’s grid manager initiated rotating outages.

- Southwest Power Pool declared an energy emergency and ordered utilities to start rolling blackouts in 14 states, spanning North Dakota to Oklahoma.

- More than 5 million people in Northern Mexico were left without power Monday.

- The Department of Energy issued an emergency waiver of pollution ceilings to permit Texas utilities to crank up power plants to maximum production.

- A tornado killed three people and injured at least 10 this morning.

- Nearly two-thirds of small British manufacturers are facing higher costs for parts and raw materials as a result of post-Brexit trade restrictions.

- Less-than-truckload carriers are receiving more and more freight as companies reset their supply chains to meet growing e-commerce activity.

- We expect continuing logistics disruption in the U.S. from severe winter conditions blanketing much of the country.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- COVID-19 cases and hospitalizations are falling dramatically, offering hope that the U.S. is inching toward herd immunity with nearly 27 million Americans having recovered from the virus and nearly 40 million more having received at least one vaccine shot.

- There were 53,883 new COVID-19 infections in the U.S. yesterday, the lowest number since October, and 941 deaths.

- A significant portion of COVID-19 rapid tests distributed late last year by the federal government still have not been used, a result of logistical hurdles and lower-than-expected demand.

- Children under 18 years accounted for just 8% of all COVID-19 infections last year, despite comprising 29% of the world’s population.

- The most recent COVID-19 surge has seen more infected children critically ill with multisystem inflammatory syndrome in children (MIS-C), a still rare but potentially deadly affliction that shows up several weeks after recovery from the virus.

- COVID-19 “long-haul” victims, some approaching a year since first infected, face a grab bag of unpredictable symptoms, with every day delivering anxiety and uncertainty.

- Long-haul symptoms of COVID-19 can put a heavy strain on employees expected to return to full workloads, though the lack of commutes and flexibility of remote schedules can aid in gradual reintegration.

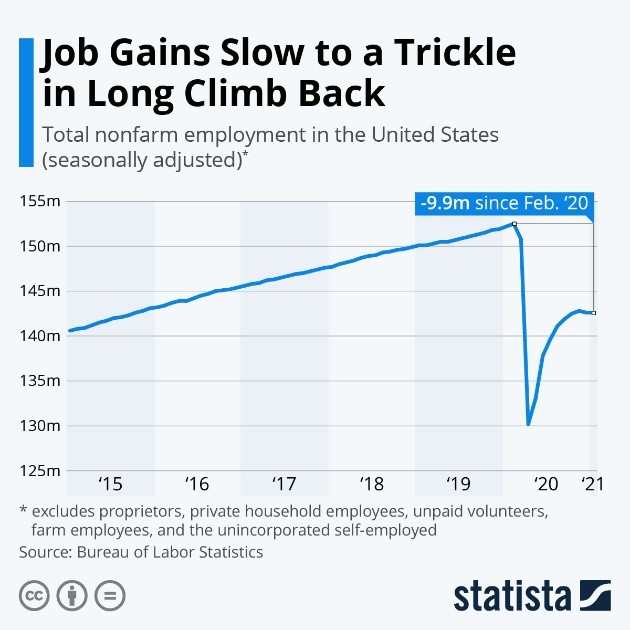

- Growth in non-farm employment has stalled in the U.S…

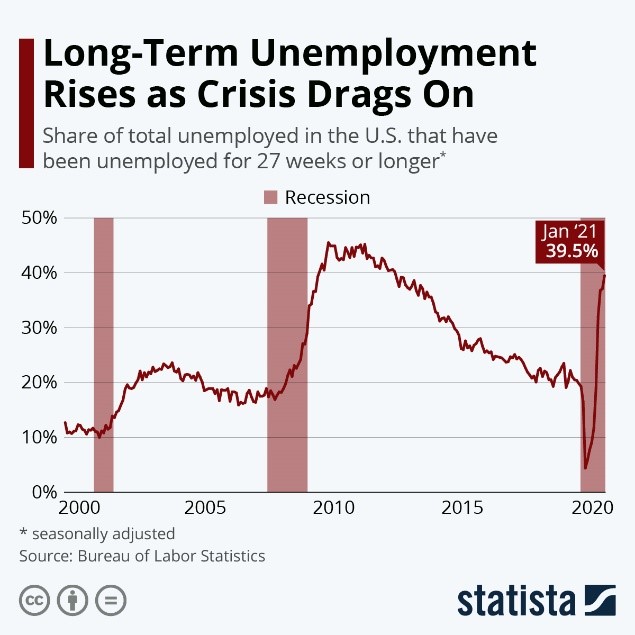

- …while long-term unemployment levels are approaching highs of the Great Recession:

- The virtual closure of U.S. borders to immigrant workers during the pandemic left companies that depend on them struggling, as unemployed Americans shunned the lower-wage openings.

- Households with incomes below $60,000 boosted spending by 20% upon receiving the last round of federal $600 relief checks, spending most of the funds almost immediately in early January.

- Growing optimism about falling COVID-19 infection rates and the economic outlook sent the U.S. dollar to a three-week low against a basket of foreign currencies.

- The Federal Reserve is beginning “stress tests” on the biggest American banks to gauge their viability in case of a severe, unexpected economic downturn. In two rounds of testing last year, the Fed concluded that banks were strong enough to withstand the pandemic.

- Jaguar intends to make all its Jaguar-branded luxury cars entirely electric by 2025, while e-models of Jaguar’s entire lineup, which includes Land Rovers, will be available by 2030.

- Pandemic lockdowns have prompted new trends in interior design, including “peacekeeping” screens, tucked-away TVs, handsome air purifiers, “wombs within rooms” and fancy yard tents.

International

- Israel, with the most aggressive vaccination campaign globally, reports a 94% drop in COVID-19 infections among those who received two shots.

- Britain is preparing to gradually lift pandemic restrictions on socializing, shopping and traveling to work, with schools set to reopen as early as March 8.

- Hong Kong is easing restrictions as COVID-19 cases recede.

- The World Health Organization authorized AstraZeneca/Oxford’s COVID-19 vaccine for emergency use. The drugmaker also began running clinical trials for its vaccine on children under the age of 17 in Britain.

- Mexico started a second wave of vaccine rollouts focused on the elderly yesterday but was caught with early snags that kept many people waiting for hours to receive shots.

- Colombia is set to begin vaccinating citizens against COVID-19 tomorrow using a first batch of Pfizer/BioNTech doses.

- South Korea will buy COVID-19 vaccines for 23 million more people in a deal for doses from Novavax and Pfizer/BioNTech.

- Australia and New Zealand received their first deliveries of COVID-19 vaccines and will begin rolling out shots in the coming week.

- China is donating 800,000 Sinopharm coronavirus vaccines to Zimbabwe, with the first shipment delivered yesterday.

- With a lab set to receive a batch of Russia’s Sputnik V COVID-19 vaccines for commercial sale, Pakistan will soon become one of the first countries to market shots privately.

- More than half of Japanese companies want the Tokyo Olympic Games canceled or postponed again from their set date in summer, as the nation’s vaccination program has fallen behind Western counterparts.

- Japan’s economy expanded more than expected in the fourth quarter, up 3.0% over the prior quarter, the second consecutive quarterly increase.

- The population in the Gulf Cooperation Council member states dropped 4% in 2020 from 2019 as expatriates returned in droves to their home countries at the start of the pandemic.

- In a bid to diversify its economy, Saudi Arabia said it will no longer enter contracts with firms that do not have a regional headquarters in the country after 2023.

- Despite a 0.6% contraction in GDP in the fourth quarter, the European Community saw a 0.3% increase in employment, the second consecutive quarterly increase.

- Nations where the automotive industry comprises a high percentage of GDP, such as Germany and Mexico, face the greatest economic risk from a global shortage of computer chips.

- Lufthansa, Europe’s largest airline, is in talks with Airbus and Boeing to swap large jet orders for smaller aircraft as it adapts to the post-pandemic travel market.

Our Operations

- Join us this Thursday at 1:00 p.m. CT for a webinar on 2021 Drivers and Trends for the North American Plastics Market, featuring Andrew Reynolds, Director of Business Publishing International (BPI); Ray Hufnagel, President and CEO at Plastic Express; Frank LaRocque, Director of Resale Sales at M. Holland; and Mike Foldvary, Director of Distribution Sourcing at M. Holland. Click here to register.

- Our 3D Printing business unit has launched a new e-commerce site. Access the new site here.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.