COVID-19 Bulletin: February 17

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose over 1% Wednesday as Saudi Arabian officials say they won’t pump more oil to ease prices, despite calls for more crude from both the U.S. and the International Energy Agency. Futures fell in late-morning trading today, with WTI down 2.4% at $91.42/bbl and Brent down 2.3% at $92.64/bbl

- U.S. natural gas futures jumped almost 10% yesterday to a two-week high on forecasts for much colder weather and higher than expected heating demand through early March. Futures were 6.3% lower in late-morning trading at $4.42/MMBtu.

- JPMorgan predicts oil prices could rise to $125/bbl in the second quarter on lagging production from OPEC and tight global supplies. Dated Brent, the price of cargoes bought and sold in the North Sea, has already surpassed $100/bbl for the first time since 2014.

- The spread between oil prices for delivery in April and those for delivery in May surged above $2/bbl, the highest since 2018, suggesting traders are worried over declining U.S. inventories. Crude stocks at Oklahoma’s Cushing hub saw a 1.9-million-barrel draw last week despite a surprise 1.1-million-barrel build nationwide, according to the Energy Information Administration.

- The average U.S. price for a gallon of diesel broke $4 last week for the first time since March of 2014.

- Gasoline prices in California hit an all-time high yesterday of $4.72/gallon.

- Strong winds in Europe this week will drive wind power generation to new records, offering a brief reprieve to the continent’s persistent energy shortfalls.

- Europe’s energy crisis has been a boon for natural gas producers in the U.S., which became the world’s largest LNG exporter in December, as buyers look toward long-term contracts to secure the fuel.

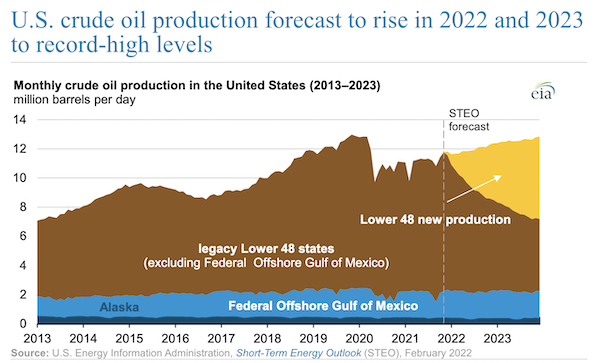

- Rising output from the U.S. Permian Basin is driving the federal government’s forecasts for growth in crude production to a record-high 12.6 million bpd in 2023.

- U.S. shale producer Devon Energy expects costs to rise 15% this year due to inflation and supply chain constraints.

- Thousands of renewable energy projects with a combined 225,000 MW of capacity are waiting for approval from the U.S.’s largest grid operator, a sign of the sector’s struggle to adapt to the rapid expansion of solar and wind power.

Supply Chain

- Police in Ottawa, Canada, are stepping up enforcement measures to end a trucker blockade disrupting the city’s main services.

- Toyota reports that production has resumed at U.S. and Canadian plants disrupted by recent blockades on the border.

- The Cass Freight Index, a barometer of freight volumes and market conditions, fell 10.8% to 1.078 in January, its lowest level since July of 2020.

- Major U.S. ports are projected to see 2.04 million TEUs of loaded container imports this month, an 8.7% increase over February 2021 and the lowest monthly forecast for the first half of the year.

- The Ports of Los Angeles and Long Beach further postponed container dwell fees first announced last November to Feb. 18.

- Record production of shipping containers last year brought down prices for new containers from $4,000 to $3,400 per TEU, still significantly higher than the $2,000 historical norm.

- Hapag-Lloyd will launch a new weekly service connecting Southern China to Northern Europe this April.

- The operator of a large Indian port in the western city of Mumbai will spend $115 million to increase handling capacity by 10% to 2.18 million TEUs.

- A Latvian contract carrier is aiming to be the largest operator of Airbus’ new A321 converted freighters, recently completing a deal to fly six of the jets for DHL’s short-haul and regional service.

- The intersection of I-95 and SR 4 in Fort Lee, New Jersey, was named the most congested bottleneck for trucks in the U.S. for the fourth straight year.

- Supply chain constraints stand in the way of U.S. trucking companies’ plans to boost capital expenditures by as much as 100% this year for new trucks and trailers.

- Google’s self-driving unit Waymo will work with C.H. Robinson to run tests of autonomous freight trucks in Texas over the next several months, potentially the beginning of a long-term strategic partnership.

- Dry bulk shipper Golden Ocean Group saw earnings rise to a record $203.8 million last quarter, helping reverse early pandemic losses for a strong full-year profit.

- Tanker carrier Scorpio Tankers saw a net deficit of $234.4 million last year on low oil demand, with rates remaining weak industrywide to start 2022. Swedish tanker operator Concordia Maritime also recently announced an $8.9 million loss on an operating basis last year.

- Israeli shipping line Zim is chartering 13 container ships from Greece’s Navios Partners in a deal worth roughly $870 million.

- Siemens is selling its mail and parcel handling automation business to German technology group Koerber in a $1.31 billion deal.

- The White House will allocate $1 billion of its massive infrastructure plan to cleaning up Great Lakes industrial toxin sites, officials said.

Domestic Markets

- The U.S. reported 136,488 new COVID-19 infections and 3,083 virus fatalities Wednesday.

- Virus fatality rates were up at least 10% in fifteen states the past week, including California and Texas, as CDC models project fatalities will fall substantially in coming weeks. The CDC reported that “excess deaths” during the pandemic have exceeded 1 million.

- The CDC could lower masking guidelines by next week, officials said.

- Philadelphia lifted its COVID-19 vaccine mandate for indoor dining Wednesday.

- New York City businesses are being urged to recall workers to the office amid declining COVID-19 numbers.

- Stockpiles of Pfizer’s new COVID-19 antiviral pill are building as demand for treatment decreases in major metropolitan areas.

- Over 50 million American households have received free at-home COVID-19 testing kits that started going out in late January, according to the White House.

- First-time unemployment claims last week unexpectedly rose by 23,000 to 248,000, the first increase since mid-January.

- Reports suggest the U.S. Federal Reserve could raise interest rates more aggressively than initially planned in March, with some traders pointing to the first back-to-back, half-percentage-point rate hikes in almost 30 years by May.

- Higher interest rates may not be a primary concern for CFOs of American firms after two years spent loading up on liquidity and locking in lower rates, economists say.

- U.S. manufacturing activity rose a modest 0.2% in January as automobile output fell for a second straight month.

- A gauge of manufacturing selling prices in New York state rose to a two-decade high last month.

- Consumer spending in the U.S. hospitality industry is rising sharply.

- One study shows that China bought none of the $200 billion in U.S. goods promised under an agreement with the former U.S. administration.

- The average U.S. mortgage loan is up to a record-high $453,000 as interest rates rise.

- A measure of U.S. homebuilder sentiment is down to a four-month low as supply shortages and high labor costs continue to plague the housing industry.

- Disney announced plans to build residential developments at locations throughout the U.S.

- Shares of e-commerce software provider Shopify tumbled 16% Wednesday on signs of slowing e-commerce activity this year.

- California materials firm Original Materials is putting $750 million toward a new biomass facility in Louisiana capable of turning wood residue into key plastics manufacturing chemicals.

- Waste Management officially rebranded itself “WM” to boost public perception of its sustainability role.

- Walmart’s direct-to-fridge delivery service is testing reusable tote bags as part of an effort to reach zero waste in its operations by 2025. The company’s same-store sales jumped 5.6% year over year in the latest quarter, with most of the growth derived from physical stores.

- American graphics chip giant Nvidia signed a new deal to provide computer technology for Jaguar Land Rover vehicles starting in 2025.

International Markets

- New COVID-19 cases across the globe dropped almost 20% last week, led by a 31% decline in the Americas. Virus fatalities continue to rise in many nations, according to the World Health Organization.

- New COVID-19 cases in Hong Kong exploded to more than 6,000 yesterday, a 60-fold increase from the start of the month, as the island announced plans to test all of its more than 7 million residents in early March.

- South Korea posted a record 93,135 new COVID-19 cases on Thursday, the second straight day above 90,000.

- Malaysia saw 27,831 new COVID-19 cases Wednesday, a pandemic record.

- Japan will ease its strict border controls starting next month, officials said.

- Vietnam will fully reopen its borders to international travelers in mid-March, three months earlier than planned.

- The Beijing closed-loop Olympic bubble recorded zero new COVID-19 cases for the first time yesterday.

- Germany laid out plans for relaxing most pandemic restrictions over the next several weeks as signs point to a peak in the latest Omicron wave.

- Switzerland lifted the bulk of its COVID-19 restrictions Wednesday, citing reduced strains on hospitals from the milder Omicron variant.

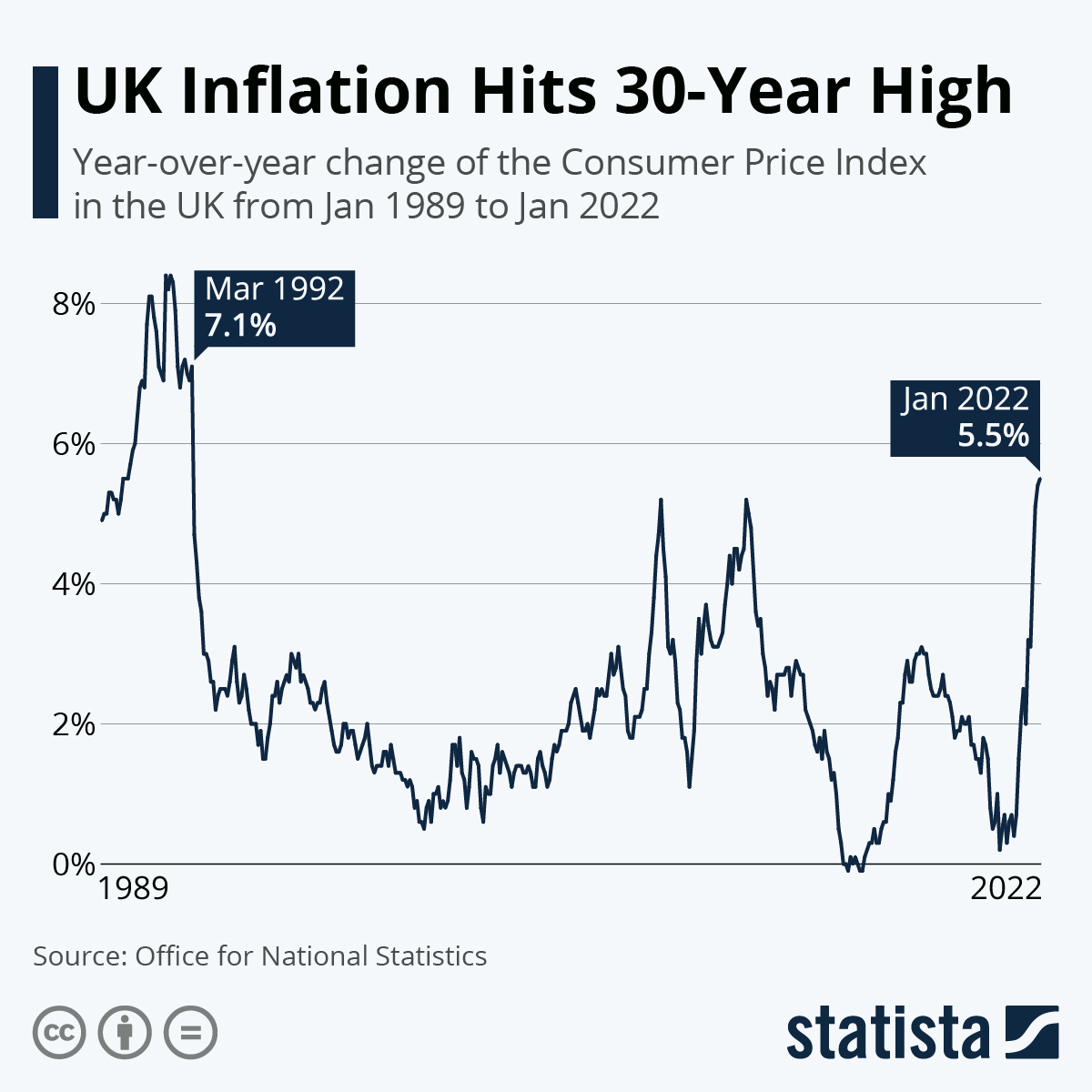

- British inflation hit 5.5% in January, the highest since 1992:

- Britain’s auto industry is calling on lawmakers to mandate electric vehicle charging infrastructure targets and standards.

- Volkswagen will ramp up vehicle production in the second half of this year when computer chip shortages are expected to ease. The automaker also received approval for a $3.3 billion electric vehicle plant for its Audi brand in China.

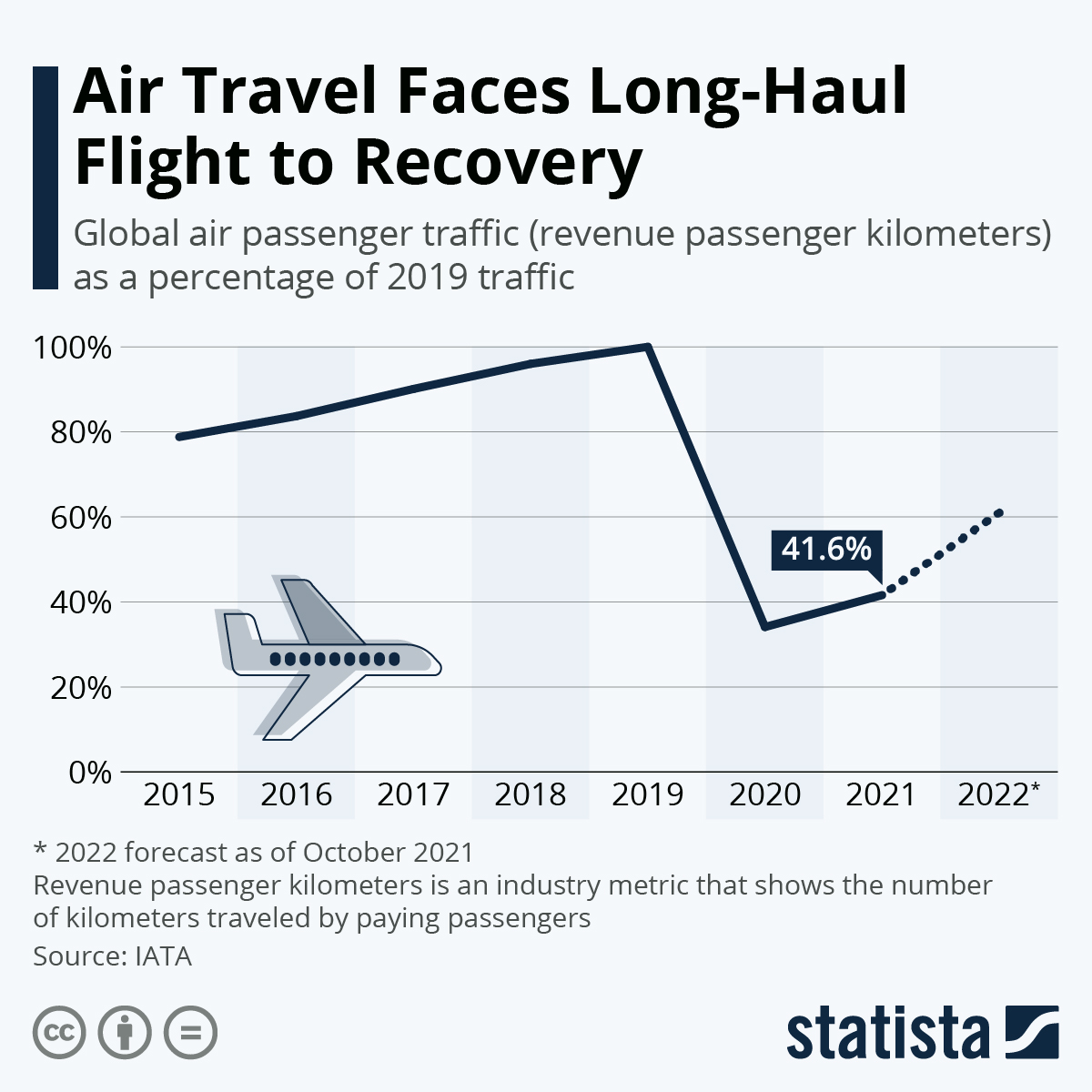

- The latest data shows that global passenger airline volumes are still down significantly from pre-pandemic levels:

- Poland is calling on the EU to introduce new measures that would curb financial speculation in the bloc’s carbon market.

At M. Holland

- Check out M. Holland’s 2022 Logistics Outlook examining continued trucking, ocean freight and rail challenges, plus key takeaways for plastics companies.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.