COVID-19 Bulletin: February 24

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

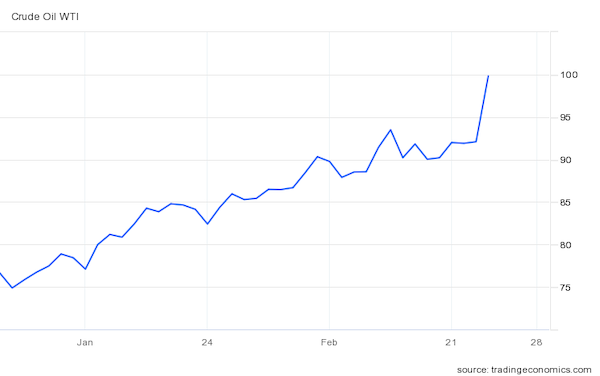

- Oil futures stayed flat Wednesday before surging overnight as Russia invaded Ukraine. In mid-morning trading today, Brent rose 6.4% to $103.72/bbl, WTI rose 7.1% to $97.97/bbl, and U.S. natural gas was up 4.0% to $4.81/MMBtu.

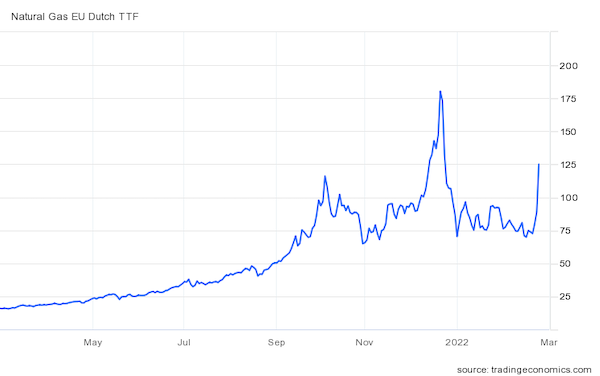

- European natural gas futures skyrocketed 31% on news of Ukraine’s invasion by Russia, the world’s single-largest exporter of the fossil fuel and the source of roughly one-third of European imports.

- Dutch commodities trader Vitol Group says oil prices could stay above $100/bbl for up to nine months as demand continues to outpace supply.

- U.S. crude inventories rose a larger-than-expected 6 million barrels last week compared to a 1.1-million-barrel draw the previous week, according to the American Petroleum Institute.

- The U.S. Permian Basin could have up to 400 operational rigs by year’s end, up from the current 300, as more producers seek to capitalize on high oil prices.

- U.S. gasoline consumption is nearing pre-pandemic levels despite prices averaging over $3.50/gallon for the past several days, the highest since 2014. Prices in California, already at a record high, are expected to top $5/gallon soon, with the price in downtown Los Angeles already topping $6/gallon.

- Libya’s National Oil Corporation is warning of lower output over the coming days due to poor weather.

- Houston-based LNG developer Tellurian narrowed losses last year to $114.7 million, down from $210.7 million in 2020.

- Independent U.S. refiner HollyFrontier saw larger-than-expected quarterly losses due to maintenance and weather-related downtime.

- Exxon Mobil slashed its global workforce by more than 9,000 people last year as part of continued restructuring and cost-cutting efforts during the pandemic.

- The U.S. Secretary of Agriculture joined the EPA in endorsing increased biofuel mandates for U.S. refiners as the industry awaits specific goals from the White House.

- China’s state-owned oil producer won the first contract for well drilling at Ecuador’s Ishpingo field, a key part of the South American nation’s plan to ramp up exploration and output this year.

- German energy powerhouse Uniper lost nearly $5 billion last year after placing wrong-way bets on the price of European power.

- The impending merger of Bluesource and Element Markets will create North America’s largest originator and marketer of carbon credits.

- The International Energy Agency said Wednesday that its forecasts for energy-related methane emissions may be 70% lower than actual levels.

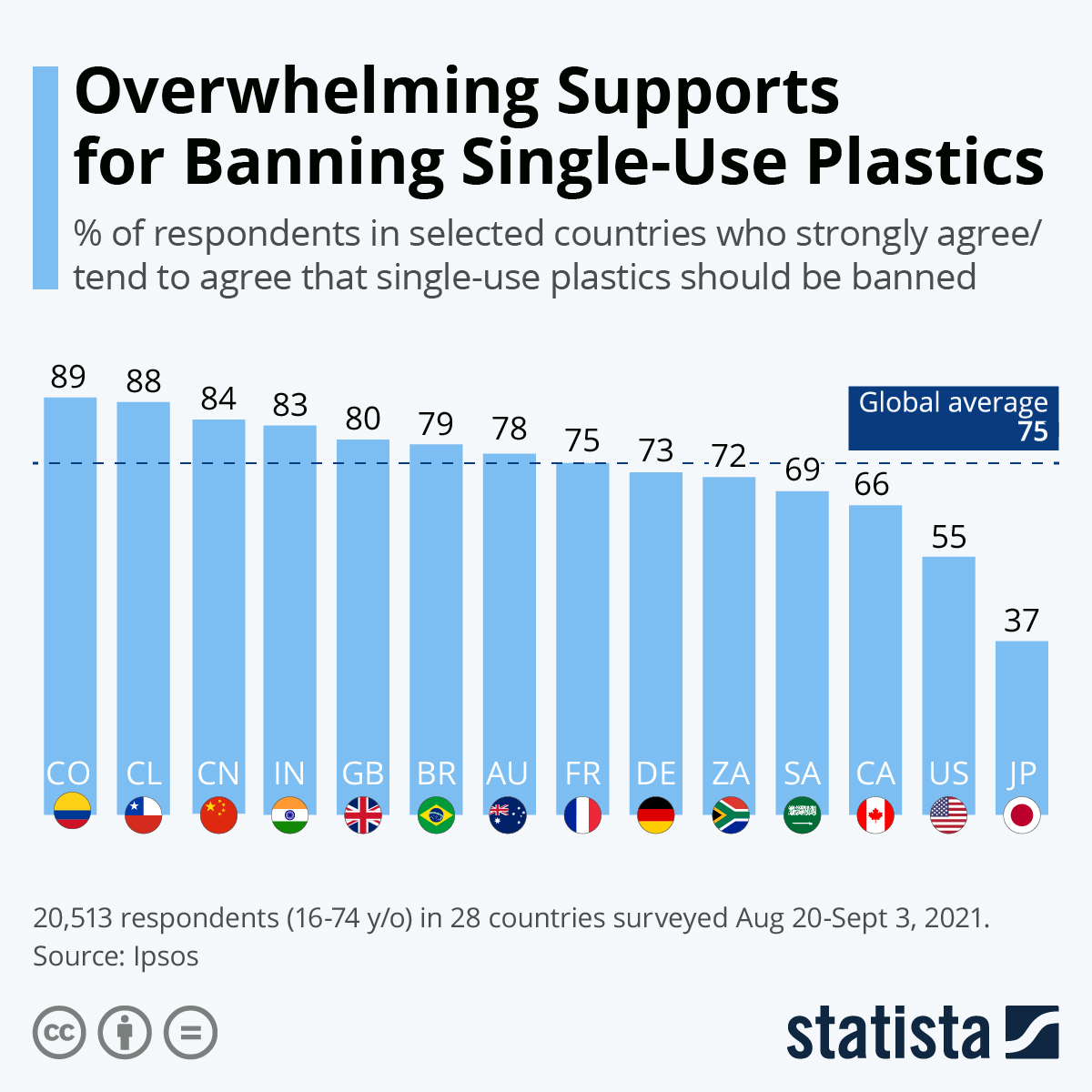

- Three-quarters of the world’s population favor a ban on single-use plastics:

Supply Chain

- A second severe winter storm will begin traveling from Texas to the mid-Atlantic and U.S. Northeast today, on the heels of a separate system that dropped up to 30 inches of snow in some parts of the Midwest earlier this week.

- Russia’s attack on Ukraine raised prices for aluminum and nickel — of which Russia is a major producer — to decade-highs and pushed wheat and corn futures to multiyear highs. Potential blockades of Ukraine, a hub of Black Sea trading activity, could lead to even higher commodity prices, while firms with operations in the country are expecting significant disruption.

- At $41,000 per day, Greek shipper Euroseas’ new long-term charter of a 1,439-TEU boxship is 257% higher than the previous price.

- The U.S. administration unveiled sweeping new measures and recommendations yesterday following a year of official inquiry into pandemic-battered supply chains. Included is a “Buy American” plan that will allow the U.S. government to pay more for certain critical domestic-made products, as well as a $35 million investment into North America’s only rare earth processing site to meet higher demand for electric vehicles and renewables technology.

- Several Chicago suburbs are looking to stop a planned merger between Canadian Pacific and Kansas City Southern over concerns of disruption and environmental harm to communities.

- A shortage of metal castings will delay contractor Raytheon’s shipment of 70 jet engines to Airbus this quarter.

- France’s Faurecia, the world’s seventh-largest auto supplier, expects easing chip shortages to push full-year sales over $20 billion this year, up from $17.6 billion last year.

- Canadian trucking blockades in the nation’s capital and on the border with the U.S. have been fully cleared, officials say, prompting the nation’s prime minister to revoke emergency powers granted to police. Meanwhile, small convoys in the U.S. have started a cross-country journey to Washington, D.C., ahead of the State of the Union address next week.

- The U.S. Postal Service will replace its aging fleet with nearly all gas-powered vehicles built by Oshkosh Corp., bucking a push by the White House to boost electric-vehicle adoption.

- Singapore-based Vallianz will build the world’s first all-electric harbor tug for use in Indonesian shipyards.

Domestic Markets

- The U.S. reported 84,793 new COVID-19 infections and 2,825 virus fatalities Wednesday, as the death rate remains near the highest of the pandemic. Since mid-January, average daily COVID-19 cases are down from 800,000 to 84,000 and total hospitalizations are down from 159,000 to 66,000.

- Chicago will scrap its indoor masking and proof-of-vaccine requirement next week, while New York City will likely do so within the next few weeks. Plans for masking in schools are less clear, with most major metro areas keeping the requirement for the near future.

- Los Angeles County may soon lift indoor mask requirements for venues that require COVID-19 vaccination.

- New Jersey’s governor will cease his regular COVID-19 briefings on March 4, two years to the day after the first virus infection was detected in the state.

- Daily COVID-19 cases in Nebraska are down to one-fifth of levels seen just two-and-a-half weeks ago.

- Target lifted all mask mandates for employees and customers across the U.S.

- Google is giving employees in California the option of returning to the office.

- A 50,000-member union for U.S. flight attendants is calling on the White House to extend mask mandates for airports and airplanes, citing COVID-19 risks to medically vulnerable passengers.

- An eight-week interval between first and second COVID-19 vaccine doses could boost efficacy and reduce the risk of rare heart inflammation for certain groups, the CDC says.

- Children expel about a quarter of respiratory droplets compared with adults, which may account for the lower COVID-19 transmission rate among minors, according to a new study.

- Thermo Fisher signed a long-term contract to help produce and package COVID-19 vaccine doses for Moderna, whose shot has been cleared for use in 70 nations.

- Goldman Sachs economists expect U.S. wages to rise 5% this year amid a shortage of some 4.6 million workers, the most since World War II.

- Luxury home listings are falling sharply as more people try to lock in low interest rates amid already low inventory levels.

- Growth is slowing for online car seller Carvana as the tailwinds it rode early in the pandemic — rising used-car prices, low interest rates and an early-mover advantage — begin ebbing.

- Rental-car companies, who shrank their fleets early in the pandemic, say they expect shortages to continue in the coming months as travel picks up and inventories remain limited.

- Grubhub is partnering with quick commerce startup Buyk on a new service in New York and Chicago that aims to deliver items within 15 minutes.

- Lowe’s raised its full-year guidance after beating quarterly revenue estimates on a 23% increase in sales to professional customers.

International Markets

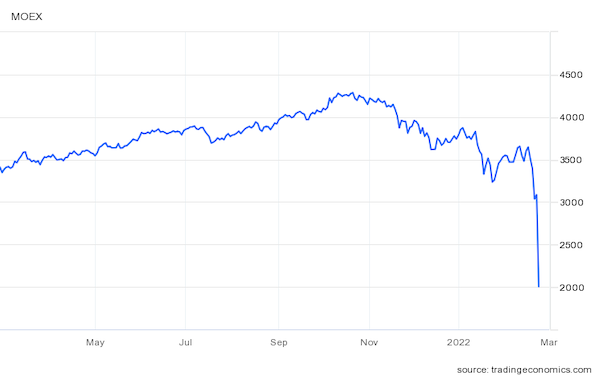

- Russia’s invasion of Ukraine sent global stock markets into retreat in early trading today, with Russia’s stock market falling 30% before trading was suspended.

- South Korea reported more than 171,000 new COVID-19 cases Wednesday, a 40-fold increase from mid-January. The nation’s researchers say people infected with Omicron are 75% less likely to be seriously ill or die than with Delta.

- New COVID-19 cases are surging again in Western Australia, more than doubling from Tuesday to Wednesday.

- Hong Kong’s proof-of-vaccine requirement for indoor public venues began today, as health experts say the island’s worst-ever COVID wave could peak by early March.

- Singapore delayed plans to begin easing pandemic restrictions.

- China is testing hundreds of thousands of residents in Wuhan after the city reported 14 new COVID-19 cases in recent days.

- Thirteen countries and territories in the Americas have yet to reach the World Health Organization’s goal of vaccinating 40% of their population against COVID-19.

- Finland and Iceland will lift all remaining COVID-19 restrictions in the coming days.

- Poland will lift most pandemic restrictions beginning March 1.

- Italy will let its pandemic state of emergency expire at the end of March, citing a successful COVID-19 vaccination campaign.

- Lower testing levels throw doubt on the 20% decline in global COVID-19 cases reported this week, the World Health Organization said.

- While vaccine uptake across the West has slowed, some companies are still working on new shots to be used as boosters or to ease rollouts in low- and middle-income countries that lack proper storage infrastructure.

- The World Health Organization set up a new hub in South Korea to export COVID-19 vaccine manufacturing technology to low- and middle-income nations.

- The Omicron variant could be capable of infecting the same person multiple times, new research in Denmark suggests.

- Russia’s invasion of Ukraine poses immediate risks for rising global inflation, economists say, as the price of oil and the commodities shoot upward.

- Russia’s Moscow Exchange has lost almost $260 billion and counting as Western allies impose wide-ranging sanctions on the nation’s economic interests, while the price of the ruble sank to a record low.

- British bank Barclays posted record annual profit last year on the back of a 27% rise in banking fees and higher mergers and acquisitions activity.

At M. Holland

- M. Holland just published a 2022 Logistics Outlook examining continued trucking, ocean freight and rail challenges, plus key takeaways for plastics companies. Read it here.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.