COVID-19 Bulletin: February 25

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- War in Eastern Europe is rippling through global oil markets:

- Brent surpassed $105/bbl for the first time since 2014 yesterday before settling at $99.08/bbl. WTI reached an intraday high above $100/bbl and closed 0.8% higher at $92.81/bbl. In mid-morning trading today, Brent futures were down 1.9% at $97.17/bbl, WTI was down 1.3% at $94.60/bbl, and U.S. natural gas was 4.4% lower at $4.44/MMBtu.

- The White House is working with other countries on a combined release of more crude from strategic reserves as supplies from Russia, the world’s third-largest oil producer and second-largest exporter, remain uncertain.

- Analysts say Brent crude is likely to remain above $100/bbl until significant alternative supplies become available from U.S. shale or Middle East producers, although key OPEC officials indicated they see no immediate need to increase production due to the situation’s volatility.

- $100+/bbl oil prices threaten significant inflationary pressures around the world, but especially on Asia, which imports most of its energy needs.

- Oil importers in China, the world’s biggest buyer of Russian crude, are briefly pausing seaborne purchases as they await clarity on cargo financing and payments.

- Tanker owners are avoiding picking up Russian oil barrels due to potential liabilities for breaching impending sanctions against the country.

- Benchmark European gas futures spiked 62% Thursday, the largest increase in over 15 years, while German power prices for March delivery rose as much as 58%.

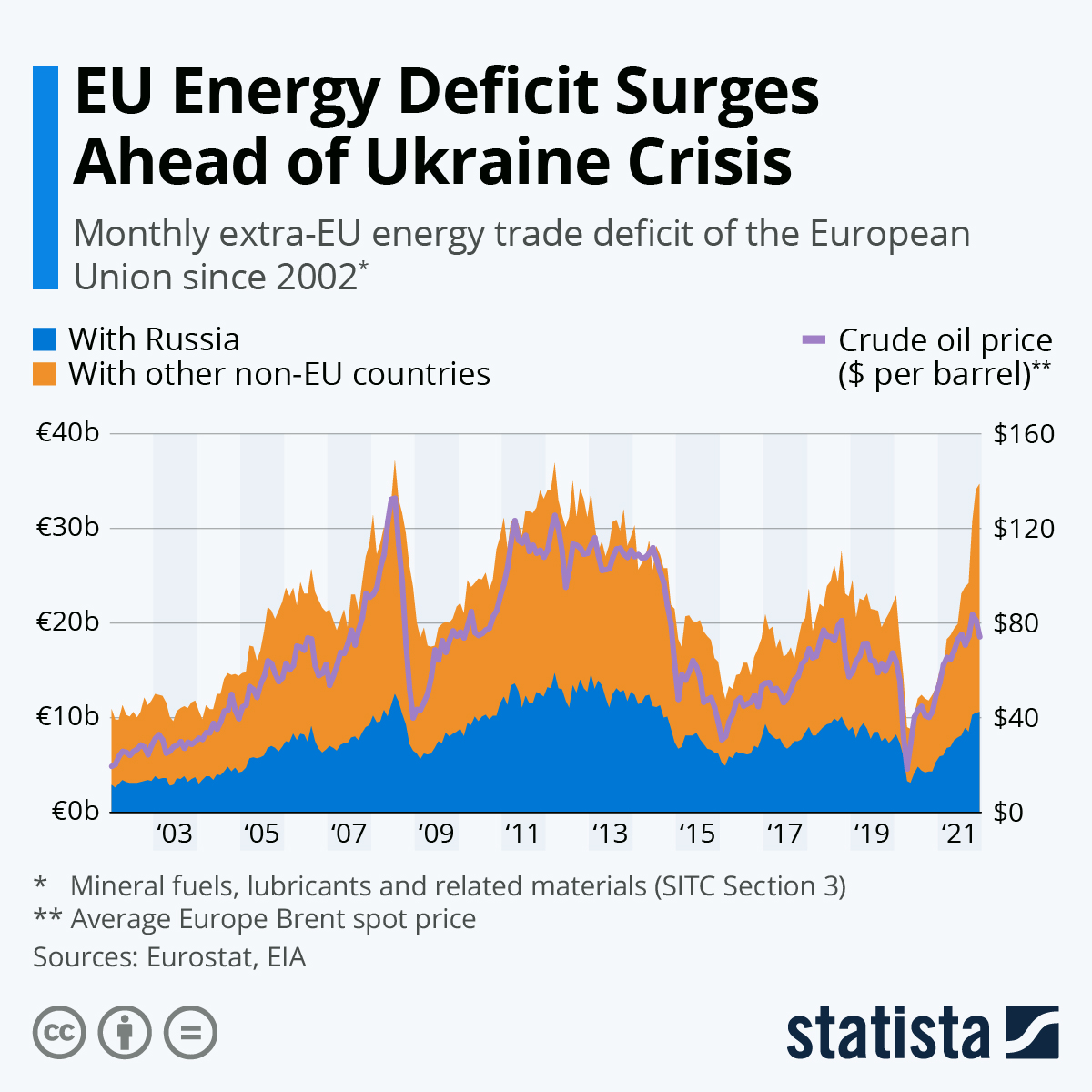

- Europe’s energy deficit, already near a record high at the end of 2021, is expected to grow as crude prices increase:

- Spain and Portugal are calling for European unity on energy supply management in a bid to combat lost imports from Russia.

- Poland’s state-owned gas firm says imports from its eastern border with Russia have continued uninterrupted.

- Higher oil and gas prices will push up the cost of resins, analysts say.

- U.S. crude inventories rose a surprise 4.5 million barrels last week to 416 million, the Energy Information Administration said.

- The U.S. administration delayed decisions on new oil and gas drilling on federal land after a federal court blocked the way officials were calculating the real-world costs of climate change.

- The U.S. surpassed Qatar in December as the world’s biggest LNG exporter for the first time, primarily on shipments to Europe — to which at least 11 tankers diverted from planned destinations in Asia between Dec. 17 and Jan. 10.

- Shell expects global LNG demand to nearly double by 2040 compared to 2021 levels, with about 70% of the increase coming from China.

- Houston-based LNG exporter Cheniere Energy raised its earnings outlook by 20% on expected volume gains from new production capacity.

- TotalEnergies and partner APA Corporation announced a significant discovery in the Guyana-Suriname Basin offshore South America, one of the hottest basins for major oil finds in recent years.

- Houston-based private equity firm Quantum Energy Partners is dedicating $2.25 billion in financing for U.S. oil and gas firms looking to shift toward more sustainable energy.

- Green investors are making paradoxical bids to take over carbon-emitting power companies to profit on their eventual, although speculative, transition to renewables.

- Europe installed a record 17.4 GW of wind power capacity in 2021, an 18% increase from installations the prior year.

Supply Chain

- War in Eastern Europe is rippling through global supply chains:

- Hundreds of ships are stuck in and around Ukraine as Russia’s invasion put an immediate halt on most commercial shipping activity, including the closure of several ports. Freight costs for cargoes loading from the Black Sea have tripled as shippers shun the region due to security risks.

- Maersk halted all Ukrainian port calls until at least Feb. 28 and will stop accepting new orders until further notice.

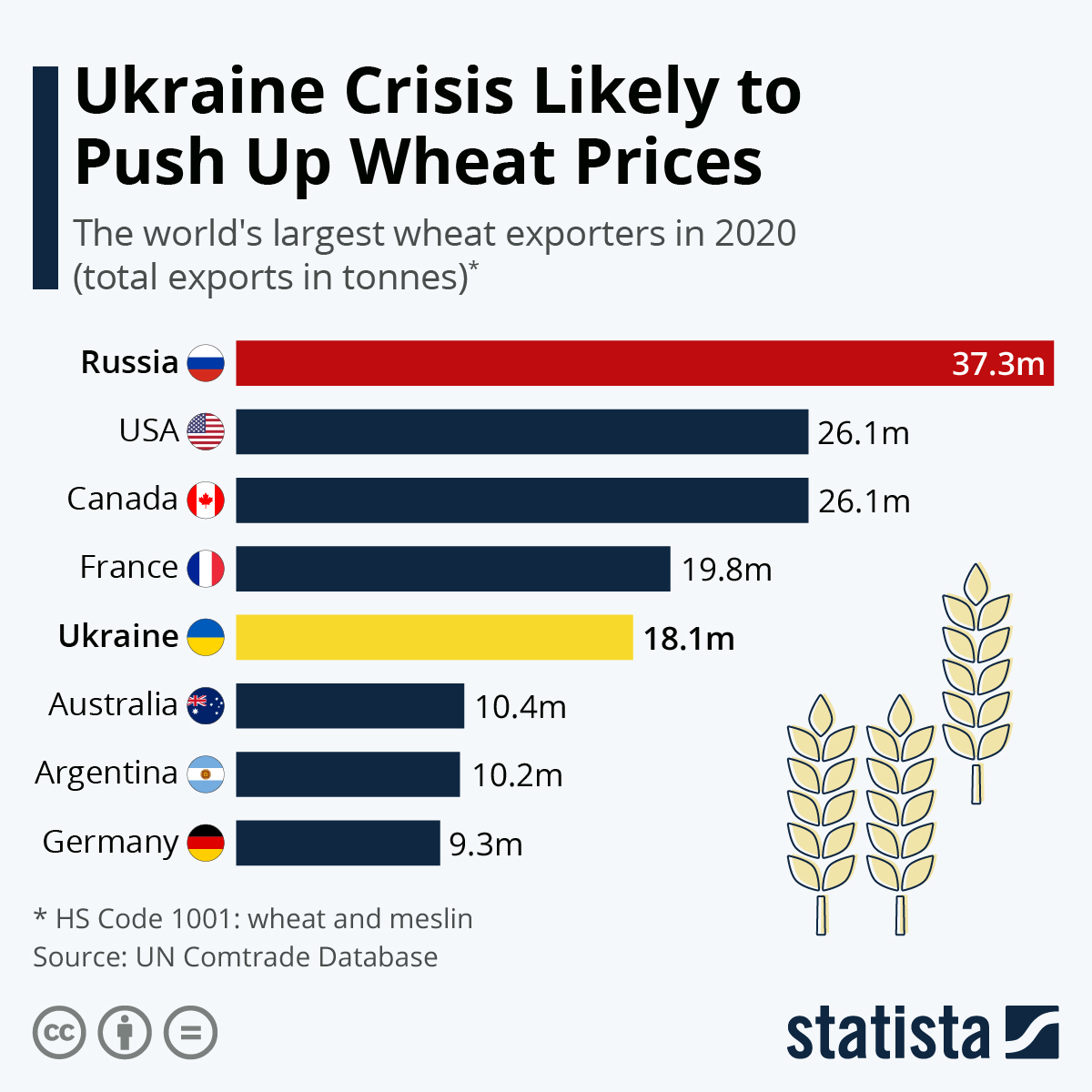

- Swaths of commodity benchmarks soared on Thursday in response to Russia’s invasion of Ukraine. In the agriculture sector — in which Russia and Ukraine account for nearly 30% of global wheat exports and 20% of corn exports — prices for wheat on the Chicago Mercantile Exchange reached their highest level in more than nine years, while European wheat futures climbed to a new record.

- The global chip shortage could worsen as Ukrainian supplies of neon and other rare metals disappear from markets.

- The numbers of container ships queuing at the Port of Houston (19) and the Port of Charleston (33) are at all-time highs.

- Industry stakeholders expect a record average price of between $7,000 and $8,000 to move a 40-foot box from China to the West Coast when yearlong freight contracts start renewing next week, higher than last year’s average of around $5,500.

- The share of container ships arriving on time in 2021 was down to 35.8% from 78% in 2019, according to industry data provider Sea-Intelligence.

- Flexport said in its Ocean Timeliness Indicator report for last week that it took an average of 109 days to deliver a container from Asia to the U.S. West Coast, up from between 40 and 50 days days pre-pandemic.

- The average container was moved 17.8 times last year, down from 20.1 moves in 2018, according to Drewry Shipping Consultants.

- California added six “pop up” storage yards, enough to store 20,000 shipping containers, to help ease congestion at overwhelmed ports.

- South Korea’s Sinokor recently landed the container segment’s “deal of the year” with the sale of four boxships between 4,000-7,500 TEUs for $350 million, a 613% increase in value. Separately, Navios Maritime Partners agreed to sell two 16-year-old 8,204-TEU ships for a combined $220 million, as the container segment starts off 2022 with record sales.

- Businesses need more cash as inventory remains clogged in transit for months, pushing buyers and suppliers to extend payment terms and obtain new financing that expands the cost of carrying inventory.

- Higher material and labor costs are pushing contractors to charge more for construction, reducing the number of projects that the U.S.’ $1 trillion infrastructure bill can realistically finance.

- A measure of confidence in the $900 billion equipment leasing sector declined this month from January, the Equipment Leasing & Finance Foundation said.

- Canada suspended the operating authorities of a dozen trucking operators for their role in recent blockades of Ottawa and the U.S.-Canadian border.

- Thousands of striking mill workers in Finland are disrupting global paper supplies for packaging and publishing.

- International rubber prices are at their highest in almost a year and rising.

- The U.S.’s largest Burger King franchisee is cutting portions and raising menu prices to offset rising inflationary pressures.

- Walmart saw $400 million in unexpected supply chain costs last quarter, the retailer said.

- Luxury-good suppliers are raising prices to combat inflation and facing little resistance from shoppers, with industry sales expected to rise 15% this year, according to some forecasts.

- Lufthansa’s cargo unit will begin using Airbus A321 converted freighters for medium-haul service in Europe and North Africa. The news comes as supply chain snags hamper Airbus’ efforts to boost production of the jet.

- U.S. electric-truck startup Nikola said it would start full-scale output of battery-electric big rigs next month and deliver between 300 and 500 to customers this year.

- TotalEnergies has chartered its first LNG-powered very large crude carrier, part of the firm’s long-term efforts to lower maritime emissions.

Domestic Markets

- The U.S. reported 65,491 new COVID-19 infections and 2,941 virus fatalities Thursday. The nation’s vaccination drive has dipped to its slowest pace since shots became available, with the lowest rates in Wyoming, Mississippi, Louisiana, Idaho and Indiana.

- The CDC is lifting indoor mask guidelines for most Americans today.

- New York state hospitals are set to resume elective procedures after three months of delays caused by surging COVID-19 patients.

- Los Angeles removed indoor mask mandates for vaccinated people yesterday.

- New Hampshire schools are no longer able to mandate mask-wearing under a rule that took effect this week.

- Oregon will lift its masking requirements two weeks earlier than planned on March 19, officials said.

- COVID-19 hospitalizations in Maine are down to their lowest level since last October.

- Moderna beat Wall Street estimates with $7.21 billion in quarterly revenue, most of which came from vaccine sales. The drug maker expects sales to rise in the second half of the year as people begin getting COVID-19 shots on an annual basis.

- Consumer spending rose a higher than expected 2.1% in January, while capital goods orders rose 0.9%, the highest pace in four months.

- Over 60% of U.S. workers who telecommute are doing so by choice, according to a new Pew Research Center survey, signaling that reluctance to return to the office is less about COVID than it is about convenience.

- Americans are venturing out to the gym again, with Planet Fitness recently surpassing pre-pandemic levels of membership with 15.6 million active customers.

- TJ Maxx missed quarterly earnings estimates by a wide margin and reported as much as $1.61 billion in lost sales last year due to COVID-19-induced store closures.

- New jobless claims in the U.S. fell by 17,000 to 232,000 for the week ended Feb. 19, while continuing claims — a proxy for the total number of Americans on state unemployment rolls — dropped to the lowest level since 1970.

- The U.S. economy grew at a 7% annual rate in the fourth quarter of 2021, slightly higher than the Commerce Department’s initial estimate of 6.9%, new data shows.

- The cost of U.S. imported goods rose in January at the fastest pace in 11 years.

- Single-family home sales dropped 4.5% in January, new data shows, the first decline in three months. Meanwhile, the average rate on a 30-year fixed mortgage dipped slightly to 3.89% this week but remains more than half-a-percentage-point higher than Jan. 1.

- Booking.com’s gross travel bookings were up 160% last quarter from the same time a year ago as revenue nearly doubled, while staying below pre-pandemic levels.

- Budweiser brewer Anheuser-Busch InBev reported higher fourth-quarter sales, buoyed by drinkers returning to bars and buying pricier beers.

- Mercedes-Benz is looking to roll out fully autonomous driving technology in the U.S. for traffic-jam and heavy traffic situations by the end of this year.

- Autonomous vehicle startup Motional is on track to launch fully driverless taxi rides late next year in Las Vegas, the firm said.

- Kraft Heinz, one of the nation’s largest food companies, said it would set a virgin plastic reduction goal within a year.

International Markets

- South Korea saw a second straight day of record COVID-19 infections above 170,000.

- Hong Kong posted a record 8,674 new COVID-19 infections Wednesday, the first day that proof-of-vaccine requirements for indoor venues took effect. The island started bringing in doctors from mainland China to help with overwhelmed hospitals.

- Japan is set to boost the daily cap for incoming travelers and reduce other travel restrictions as it exits its sixth wave of the pandemic.

- Taiwan will allow business travelers to return and shorten its mandatory quarantine period starting in March.

- The U.S. administration unveiled harsh new sanctions against Russia, imposing measures to impede its ability to do business in the world’s major currencies along with penalties on banks and state-owned enterprises. Europe and other allies imposed similar measures.

- European vehicle sales fell to a historic low for the month of January, leading Italy to consider a financial rescue package for its automobile industry.

- Tesla could start construction on a new Shanghai plant as soon as next month as part of efforts to double production capacity in China.

- Thailand is reducing import duties on electric vehicles by as much as 40% this year and next in a bid to boost adoption among consumers.

At M. Holland

- M. Holland just published a 2022 Logistics Outlook examining continued trucking, ocean freight and rail challenges, plus key takeaways for plastics companies. Read it here.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.