COVID-19 Bulletin: February 9

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- The WTI crude price broke $58.00/bbl yesterday, marking its full price recovery from the pandemic. Gasoline prices in the U.S. also hit pre-pandemic levels, with an average price of $2.46/gallon.

- Crude prices were steady in early trading today, with the WTI at $58.03/bbl and Brent at $60.75/bbl. Natural gas was down 2.4% at $2.81/MMBtu.

- Saudi Aramco remained the second most valuable brand in the oil and gas industry last year with a value of $35.7 billion, ranking only behind Royal Dutch Shell.

- Loading very large crude carriers in the U.S. Gulf is likely to remain “inefficient” for the next two years, as new terminal projects are canceled or delayed due to pandemic-induced reductions in the nation’s oil exports.

- Qatar will spend $29 billion to expand its liquid natural gas capacity to defend its position as the world’s largest producer as it faces growing competition from Australia and the U.S.

- Total’s earnings fell 66% in 2020, but the company beat analyst estimates for the fourth quarter and full year. The company plans to raise capital spending on renewables by 20% this year.

Supply Chain

- Shipping lines are starting to move some operations to smaller ports, or canceling sailings altogether, to avoid backups at main trade gateways in Southern California.

- The Federal Maritime Commission is mounting an investigation to determine whether enforcement actions are warranted as it wrestles to deal with unprecedented port congestion.

- More than 3,100 trucking fleets shut down last year, a 185% jump from 2019, led by record failures in the second quarter when freight volumes plummeted amid widespread lockdowns.

- Once unleashed, pent-up consumer demand is set to boost commodity prices that are already at their highest level in six years, with rallies in everything from iron ore to soybeans, copper and corn.

- Starting in 2023, new International Maritime Organization standards known as EEXI are poised to tighten efficiency and emissions standards by 15% to 20%. This is expected to impact the supply of tonnage in the tanker and bulker markets.

- China is holding firm on a ban of Australian coal, with many stranded vessels now being diverted to other Asian ports in Vietnam, India, South Korea, Malaysia and Thailand.

- The warehouse vacancy rate in Europe is below 5%, a record low, due to soaring e-commerce activity, prompting a surge in regional investment.

- More than half of logistics professionals recently surveyed do not expect a full global recovery until 2022-2024, with Africa and Latin America the last regions to rebound.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

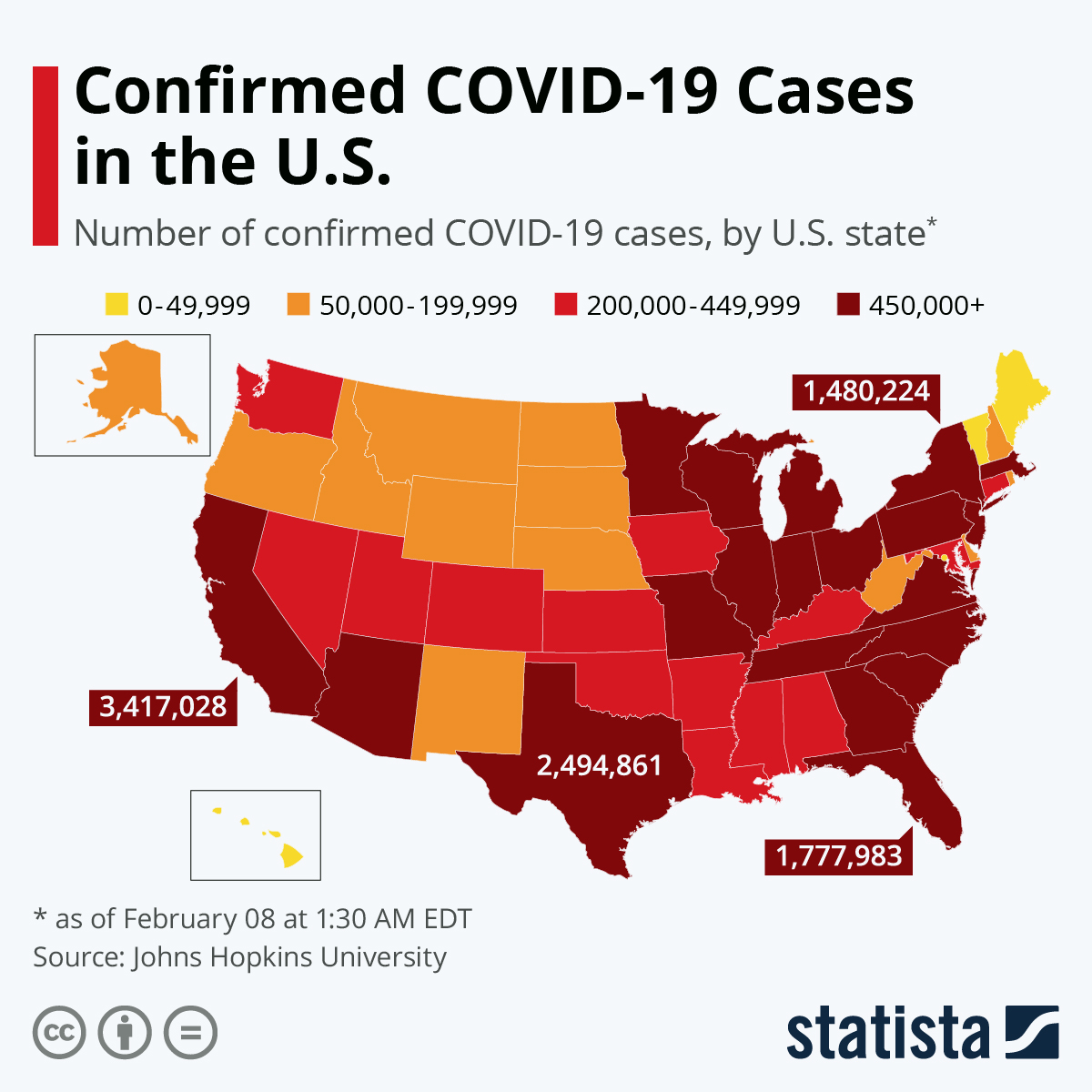

- There were 89,727 new COVID-19 infections yesterday in the U.S. and 1,596 fatalities.

- Texas Rep. Ron Wright became the first sitting member of Congress to die of COVID-19.

- Florida already had the highest circulation rate of the virulent U.K. variant of COVID-19, a risk now exacerbated by extensive get-togethers in the state following the Tampa Bay Buccaneers’ Super Bowl victory.

- Since December, Pfizer and Moderna have supplied about 60 million doses of COVID-19 vaccines to the U.S., nearly one-third of the 200 million promised by the end of March, as states increasingly compete for a share of the shots.

- Pfizer/BioNTech’s COVID-19 vaccine is likely to reduce viral shedding and therefore lessen the spread of the virus among the population.

- The World Health Organization says AstraZeneca/Oxford’s COVID-19 vaccine is still worth using in areas with mutated strains of the virus, despite South Africa’s recent decision to halt use of the shots.

- The coronavirus has killed Blacks, Latinos, Native Americans and Pacific Islanders at double the rate of Asian Americans and whites, prompting an increased focus by the federal government on distribution of vaccines to underrepresented populations.

- More than 130 meatpacking workers died in 2020 from COVID-19. Now, many states have placed the workers on the next round of people eligible for vaccines.

- Line-of-duty deaths among the nation’s police officers last year nearly doubled from 2019, making it the deadliest year since 1974, with COVID-19 accounting for more than half of the 264 fatalities nationwide.

- As scientific understanding of the coronavirus has grown, there are now a mix of different quarantine and notification protocols recommended by the CDC, depending on different kinds of contact with infected persons and types of symptoms.

- Several avenues are open to lessen pandemic-fueled pressure on mothers, who are apt to shoulder extra loads of home and childcare amid increasing burnout rates and work demands.

- The U.S. federal budget deficit widened in January to an estimated $165 billion due in part to the distribution of $600 stimulus checks, a sharp increase over the $33 billion deficit of the previous year.

- Help wanted advertising in the U.S. returned to pre-pandemic levels in January, led by openings in the warehouse, construction and delivery services sectors.

- U.S. small business optimism slipped to an eight-month low in January, falling for a third straight month.

- More than 1.3 million U.S. households will see mortgage forbearance agreements negotiated as part of the CARES Act expire over the next four months.

- New York City is reopening indoor restaurant dining at 25% capacity Friday, two days earlier than previously announced in preparation for Valentine’s Day festivities.

- Stock markets rose to record highs Monday ahead of a new batch of government coronavirus relief expected to be finalized by the end of February.

- U.S. heart surgeries were down 53% last year, and healthcare spending fell for the first time in 60 years as people deferred medical visits, prompting concerns about a derivative health crisis from the pandemic.

- GM is extending production cuts at three plants through mid-March and parking partially assembled vehicles at two plants due to a global shortage of computer chips that is hobbling the automotive industry. Honda and Nissan will sell a combined 250,000 fewer cars than earlier projections this year due to the chip shortage.

- American Airlines is phasing out Embraer 140 aircraft, its smallest, from its fleet in favor of larger regional jets. The planes, known for their two-seat/one-seat row configuration, will be fully retired by May.

- The rise in e-commerce is prompting innovations in packaging design, including product packaging that can serve as shipping packaging, improved closures to withstand the jostling of parcel shipping, and custom-sized packages to fit specific product dimensions.

- Henkel’s redesigned bottles for toilet bowl cleaner contain 50% to 75% post-consumer polyethylene and are 11% lighter than the bottles they replaced.

- To improve interpersonal communications in a face-masked era, Ford is introducing clear face masks that provide medical-grade protection.

- Amazon concluded a deal for its largest renewable energy project to date, a wind farm in the Netherlands with an expected total capacity of 759 MW once completed in 2023.

International

- Five-hundred cases of the South Africa variant of COVID-19 were detected in Austria, prompting officials to warn against domestic travel.

- Russia’s 162,429 COVID-19 fatalities in 2020 were nearly three times higher than official numbers reported by the government.

- Nearly 46% of fatalities in England and Wales were attributed to COVID-19 the week ended January 29, the highest percentage of the pandemic.

- A third Chinese COVID-19 vaccine, developed by the Chinese military and private firm CanSino Biologics, was 65.7% effective at preventing symptomatic cases of the coronavirus. The nation pushed back its target to inoculate 50 million people by two months over supply shortages and hesitancy among the population to receive shots.

- Shipments of AstraZeneca/Oxford’s COVID-19 vaccine have started to arrive in Europe after weeks-long delays.

- Children and staff at French daycare centers that stayed open during the country’s first national lockdown had low rates of COVID-19, giving support to global efforts to reopen preschools and other educational settings.

- European Central Bank officials predict the bloc’s recovery will pick up in the summer.

- U.K. retail sales slumped in the nation’s most recent lockdown as worker confidence faded, with only 40% of Britons confident about their job security.

- Canadian consumer bankruptcies fell last year to their lowest level in two decades, with government support measures and creditor deferral programs allowing borrowers to keep making monthly payments.

- The average price of a home in Toronto is set to top C$1 million this year as a pandemic-induced frenzy in home-buying shows no signs of stopping.

- Nearly 30% of global commercial airplanes remain in storage, while expectations for an industry recovery this year have diminished. Scrambling for passengers, airlines are rerouting many flights to leisure destinations and away from business hubs.

- Singapore Airlines deferred $3 billion in new jet orders to Airbus and Boeing.

- Australian power company CEP Energy is building the world’s largest mega-battery with a capacity of 1.2 gigawatts, four times the size of the world’s largest current battery at the Moss Landing facility in California.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.