COVID-19 Bulletin: January 6

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose more than 1% Wednesday to their highest levels in a month. Futures extended gains in late morning trading, with WTI up 2.7% at $79.94/bbl and Brent up 2.1% at $82.47/bbl. U.S. natural gas was 0.4% lower at $3.87/MMBtu.

- U.S. crude stockpiles fell 2.14 million barrels last week, the sixth straight week of declines, according to the Energy Information Administration.

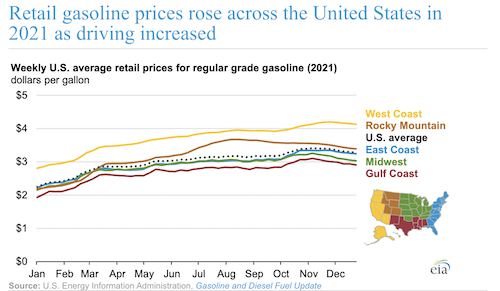

- The $3.01/gallon U.S. retail price for gasoline last year was the highest since 2014, new data shows, the result of a steady rise for most of the year:

- Saudi Arabia cut February’s selling price for all crude grades to Asia by at least $1/bbl after Middle East benchmarks and spot prices slumped last month.

- European households are paying 54% more for energy than two years ago, Bank of America said.

- Aluminum prices hit a two-month high Wednesday as more smelters delay production due to high European energy prices.

- Germany’s largest utilities are racing to secure billions of euros in credit lines to protect against volatile energy prices.

- Indonesian officials ditched a planned meeting yesterday to reconsider a recent ban on coal exports and did not provide a timeline for restarting talks.

- Exxon Mobil announced two new oil discoveries offshore the South American nation of Guyana, one of the producer’s top bets for production growth this decade. At the same time, Exxon is selling off stakes in giant Iraqi oil fields due to the nation’s output curbs.

- With resin supply improving and most 2021 force majeures lifted, we are ending our force majeure link. Please contact your M. Holland account manager if you have questions concerning availability of specific products.

Supply Chain

- Freight hubs in the Northeast could see further disruptions from winter weather in coming days after a storm slammed the region and mid-Atlantic earlier this week. Supply chain managers should expect ongoing disruption from severe weather events in the years ahead due to climate change.

- One of California’s largest utilities has been found responsible for the state’s second largest wildfire last summer, regulators said. It is unclear whether criminal charges will be filed.

- Activity in the transportation, logistics and warehousing sectors remained strong in December despite a modest slowdown from the previous month, an index of logistics managers shows.

- The Shanghai Containerized Freight Index for shipping rates out of Shanghai hit 5,046.66 for the week ending Dec. 31, the first time the pricing measure has surpassed 5,000.

- U.S. regulators are investigating Japan’s Ocean Network Express and Taiwan’s Wan Hai Lines over anti-competitive demurrage and detention fees.

- Swiss carrier Mediterranean Shipping Co. overtook Maersk as the world’s largest ocean carrier in 2021 by the slim margin of 1,888 20-foot containers.

- Alabama is partnering with Norfolk Southern to fund a $231.6 million rail corridor project that aims to connect the Port of Mobile to industrial sites in the Birmingham area.

- New Jersey is formally removing itself from the Waterfront Commission of New York Harbor, a decades-old partnership with New York state to fight organized crime in shipping.

- Hong Kong operator Seaspan secured the last bit of financing to complete its order for a whopping 70 newbuilds, including at least 10 15,000-teu LNG-powered container ships.

- More LNG-powered vessel newbuilds were ordered in 2021 than the past four years combined, new data shows.

- A German shipbuilder received an order for the construction of six mini-bulker cargo ships with wind-assisted propulsion, to be delivered in 2023.

- German car sales fell to their lowest level in three decades last year, primarily an effect of production losses from the global chip shortage.

- Walmart plans to hire 3,000 new electric-van drivers this year for its budding home delivery service.

- A Massachusetts market research firm predicts that 50% of all supply chain forecasts will be automated using artificial intelligence by 2023, with an improved accuracy of five percentage points.

Domestic Markets

- The U.S. reported 643,660 new COVID-19 infections and 1,986 virus fatalities Wednesday.

- Record daily COVID-19 case counts fueled by the Omicron variant are being reported across the nation, with the largest surges in the Northeast and mid-Atlantic.

- An average of 672 children are being hospitalized every day for COVID-19 in the U.S., more than double the average just a week ago.

- Roughly 1 in 5 U.S. hospitals are critically low on staff, new data shows, the most since December 2020.

- One in three people who test for COVID-19 in Tennessee are positive, the state’s highest rate of the pandemic.

- Massachusetts’ COVID-19 positivity rate rose to 21.6% Tuesday, the highest since April 2020, as the state saw more than 45,000 breakthrough infections the past week. The state’s hospitals are nearing full ICU bed capacity, officials report.

- Oregon is reporting record daily and weekly averages of COVID-19.

- Nearly 200 Dallas first responders are out sick with COVID-19, more than 150 of whom are fire-rescue workers.

- More than 1,000 first responders in Los Angeles are quarantined with COVID-19.

- Over 600 schoolteachers and staff in San Francisco were out sick Tuesday with COVID-19.

- COVID-19 infections are picking up in Seattle schools, with 4% of students and staff testing positive in recent days.

- Rapid at-home COVID-19 tests are selling for triple their normal retail price in some places as the U.S. test shortage continues.

- A recent study suggests that rapid at-home COVID-19 tests are highly unreliable in the early days of infection, delivering false negative results though the infected person is contagious.

- Five states have recorded cases of “flurona,” a combined infection of coronavirus and flu.

- The U.S. Supreme Court will hear arguments tomorrow in a special session called to consider challenges to the White House’s COVID-19 vaccine mandate for large businesses and healthcare workers.

- The CDC recommended Pfizer/BioNTech’s COVID-19 booster shot for kids aged 12 to 15 at least five months after receiving a second dose.

- Yale University is in quarantine until February 7 and has banned students from eating at local restaurants, including outdoor dining.

- Every cruise ship currently sailing in U.S. waters has active COVID-19 cases on-board, the CDC said.

- This year’s Grammy Awards, originally scheduled for Jan. 31, have been indefinitely postponed due to surging COVID-19 cases.

- More than 1,000 U.S. flights were canceled for the 11th day in a row Wednesday, with thousands more delayed. Carriers have now canceled more than 22,000 flights since Dec. 24.

- Walmart is cutting its medical leave for COVID-19 to one week following new CDC guidelines reducing recommended isolation times from 10 days to five.

- Traders are more confident the U.S.’s first interest-rate hike this year will come as early as March, prompting many U.S. finance chiefs to quickly refinance debts to lock in low rates.

- Economists predict the U.S. trade deficit widened in November to a record $81.5 billion, led by strong retail spending and eased port congestion.

- There were 207,000 first-time jobless claims last week, higher than expected.

- U.S. payroll giant ADP reported an 807,000 increase in private-sector jobs in December, the strongest gain since May. Early forecasts for 2022 show a modest slowdown in hiring growth, which will remain at historically high levels.

- The individual U.S. tax deadline will return to its usual mid-April date for the first time since 2019 this year, the third tax-filing season of the pandemic.

- U.S. budget airline Allegiant Air announced plans to purchase 50 new Boeing 737 MAX jets for $5.5 billion in anticipation of a post-pandemic recovery.

- Ford’s quarterly sales rose a promising 27% in the fourth quarter despite being down 6.8% for the full year, the latest data shows.

- A Michigan battery startup claims to have driven a Tesla Model S more than 750 miles on a single charge with its technology, which it aims to start selling in 2023.

- Chrysler announced plans to shift to an all-electric lineup by 2028.

- Canadian auto supplier Magna International will set up a new electric vehicle center at its U.S. headquarters in Michigan in preparation for the launch of its electric powertrain system for trucks in 2025.

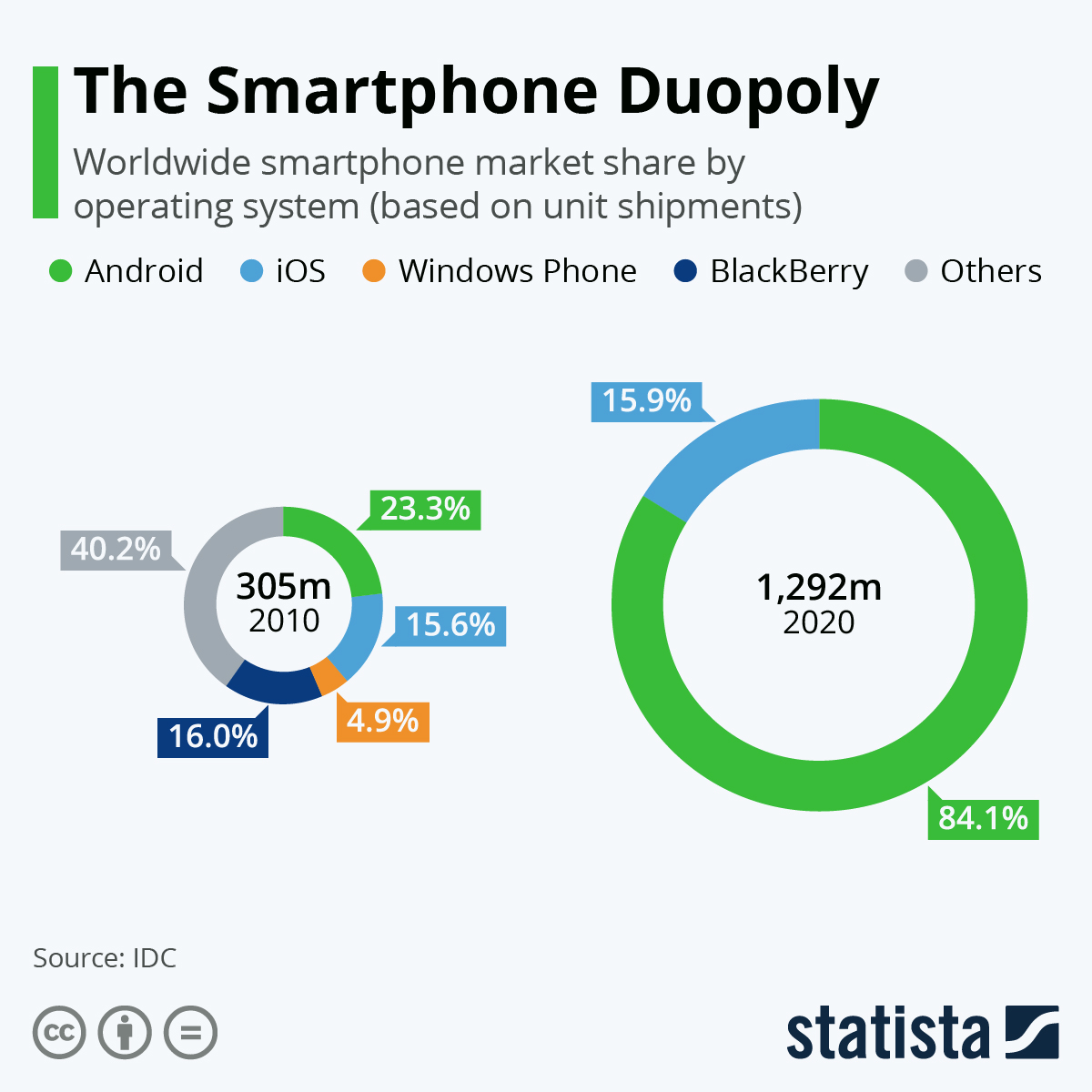

- BlackBerry cut the network capabilities of its cell phones earlier this week, the final step in the demise of a once-ubiquitous business device as the company completes its pivot to making security software for corporations and governments.

International Markets

- France and Italy reported record new COVID-19 infections Wednesday, pushing new daily cases across the EU over 1 million for the first time.

- Italy is now mandating COVID-19 vaccinations for all adults over age 50.

- Ireland dropped COVID-19 testing requirements for vaccinated incoming travelers, with officials citing widespread Omicron cases which the policy initially aimed to prevent.

- Sweden reported a record 17,320 new COVID-19 infections Tuesday.

- Half of all COVID-19 tests in Finland’s capital are coming back positive, new data shows.

- The Czech Republic is the latest nation to cut isolation requirements for people with COVID-19 amid severe labor shortages.

- The U.K. reported 194,747 new COVID-19 cases Wednesday, about 20,000 below Tuesday’s all-time high.

- Australia reported 64,774 new COVID-19 cases Wednesday, its third straight daily record.

- Hong Kong will run out of hospital capacity in as little as four days due to overwhelming numbers of COVID-19 patients, officials warn.

- Thailand raised its COVID-19 alert level, a possible precursor to imposing new restrictions.

- New COVID-19 infections in India have doubled the last four days to 58,097 on rising cases of the Omicron variant.

- Singapore is requiring COVID-19 booster doses for people to maintain their fully vaccinated status allowing them access to public businesses.

- China’s weeklong lockdown of 13 million people in Xi’an appears to have worked, with new infections dropping to 35 on Wednesday from 95 Tuesday.

- Israel reported nearly 12,000 new COVID-19 cases Wednesday, topping a previous record from September.

- With COVID-19 infections soaring in Mexico, testing centers in 13 of its 31 states are overwhelmed. Infection rates are highest in tourist areas among coastal states.

- Rio de Janeiro canceled its Carnival street parties for the second straight year due to rising COVID-19 infections throughout the city.

- The World Health Organization has dismissed concerns over a new COVID-19 variant infecting an extremely small amount of people in France.

- A new Israeli study suggests that COVID-19 boosters decrease virus mortality by 90% compared to two doses.

- The world may need an additional 22 billion more COVID-19 vaccine doses to combat the latest surge of Omicron infections, health experts say.

- Singapore’s economy grew an estimated 5.9% in the fourth quarter.

- U.S. electric vehicle maker Lucid announced plans to begin selling cars in Europe later this year.

- Daimler AG released details of a new electric vehicle concept that uses solar power and bio-based materials for a range of 621 miles on a single battery charge.

- German carmaker BMW sold a record 2.2 million vehicles in 2021, despite the global chip shortage.

- Amazon is partnering with international automaker Stellantis on a new batch of electric delivery vans and a new Amazon software system for vehicle dashboards.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.