COVID-19 Bulletin: January 14

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell slightly Thursday, likely on expectations of U.S. interest rate hikes planned for this year. Futures were higher in late morning trading, with WTI up 1.1% at $83.01/bbl and Brent up 0.9% at $85.25/bbl.

- U.S. natural gas prices nosedived over 10% Thursday on government data showing rising output. Futures continued declining in morning trading, down 1.6% at $4.20/MMBtu.

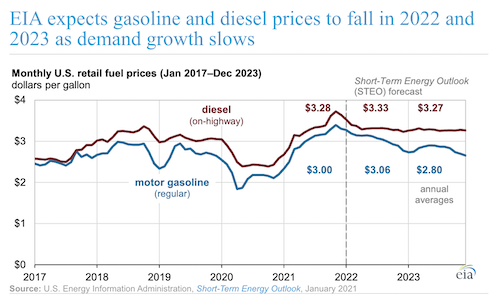

- The U.S. government expects a rise of several cents in average retail gas and diesel prices this year:

- European power prices fell 3.8% Thursday on forecasts of milder weather, the seventh day of the continent’s longest streak of declines since February of 2020.

- Indonesia began allowing some coal-carrying vessels to leave the nation yesterday for the first time since a Jan. 1 export ban.

- The French government ordered more sales of state-owned nuclear power to smaller competitors to keep energy prices from rising more than 4% this year.

- Local producers have kept Canada’s oil sands alive even as larger firms begin exiting some developments over environmental concerns.

- Oil producers struck deals worth just $9 billion in the final three months of 2021, a 50% decline from the third quarter, with soaring valuations making it difficult for buyers and sellers to agree on price.

- More than 1 million Californians could face higher costs for rooftop solar power as state officials seek ways to recover lost revenue from renewable power being metered back into the electricity grid.

- The U.S. has spent a combined $1.1 billion on 11 failed carbon capture projects at coal-fired power plants and industrial facilities since 2009.

- Indian conglomerate Reliance Industries will invest $76 billion in green energy projects over the next 15 years in a bid to reach net-zero carbon emissions by 2035.

Supply Chain

- Winter Storm Izzy is set to create travel snarls across the central, eastern and southern U.S. beginning today.

- Maersk’s latest customer advisory stressed that congestion at key shipping hubs will continue to cause delays across supply chains.

- The average price for a 40-foot container from Asia to the U.S. West Coast rose 16% last week to $14,572, roughly 169% higher than a year ago.

- Intra-North American freight shipments rose sharply to end 2021 alongside a 44% annual increase for the Cass Freight Index of expenditures, which set a record.

- Roughly 10% of a given day’s dockworkers in Southern California were out sick earlier this week with COVID-19.

- Global consequences of China’s zero-tolerance COVID policy are rising, with a week’s delay at the key port hub of Ningbo estimated to affect up to $4 billion in commerce, including more than $230 million in computer chip exports. Volkswagen and Toyota have temporarily shuttered a combined three production sites in China due to regional lockdowns.

- Taiwan’s three largest ocean liners are adding capacity for local exporters this month to meet increased demand ahead of the Lunar New Year holiday.

- After a misleading announcement Wednesday night, Canadian officials confirmed they are standing by a new requirement barring entry to unvaccinated foreign truckers, while unvaccinated Canadian truckers will lose their exemption from testing and quarantine requirements. Fears of impending border chaos are ratcheting up in already fragile logistics networks.

- A growing number of U.S. supermarkets and drugstores are being forced to trim hours and services amid rising COVID-19 infections among staff.

- The Labor Department’s producer price index rose 0.2% from November to December, the slowest pace since November 2020 on a possible sign of easing inflationary pressures in U.S. supply chains.

- Supply chain snarls pushed up the cost of romaine lettuce 61% last year, faster than any other food item tracked by the government.

- New data shows air cargo growth slowed in November to nearly half the pace of previous months on tight capacity and supply chain congestion.

- Pilot shortages forced Delta Air Lines to cut roughly 25% of possible flights in the first half of 2022 and American Airlines to cancel hundreds of flights on several regional subsidiaries.

- U.S. retail no longer has an off-season, Target’s CEO said.

- Global PC shipments likely declined 5% in the latest quarter, according to International Data Corp., as supply constraints weighed on production in the latter half of the year.

- Honda expects to sell fewer vehicles this year than in 2022 due to low inventories to start the year, a result of the global chip shortage.

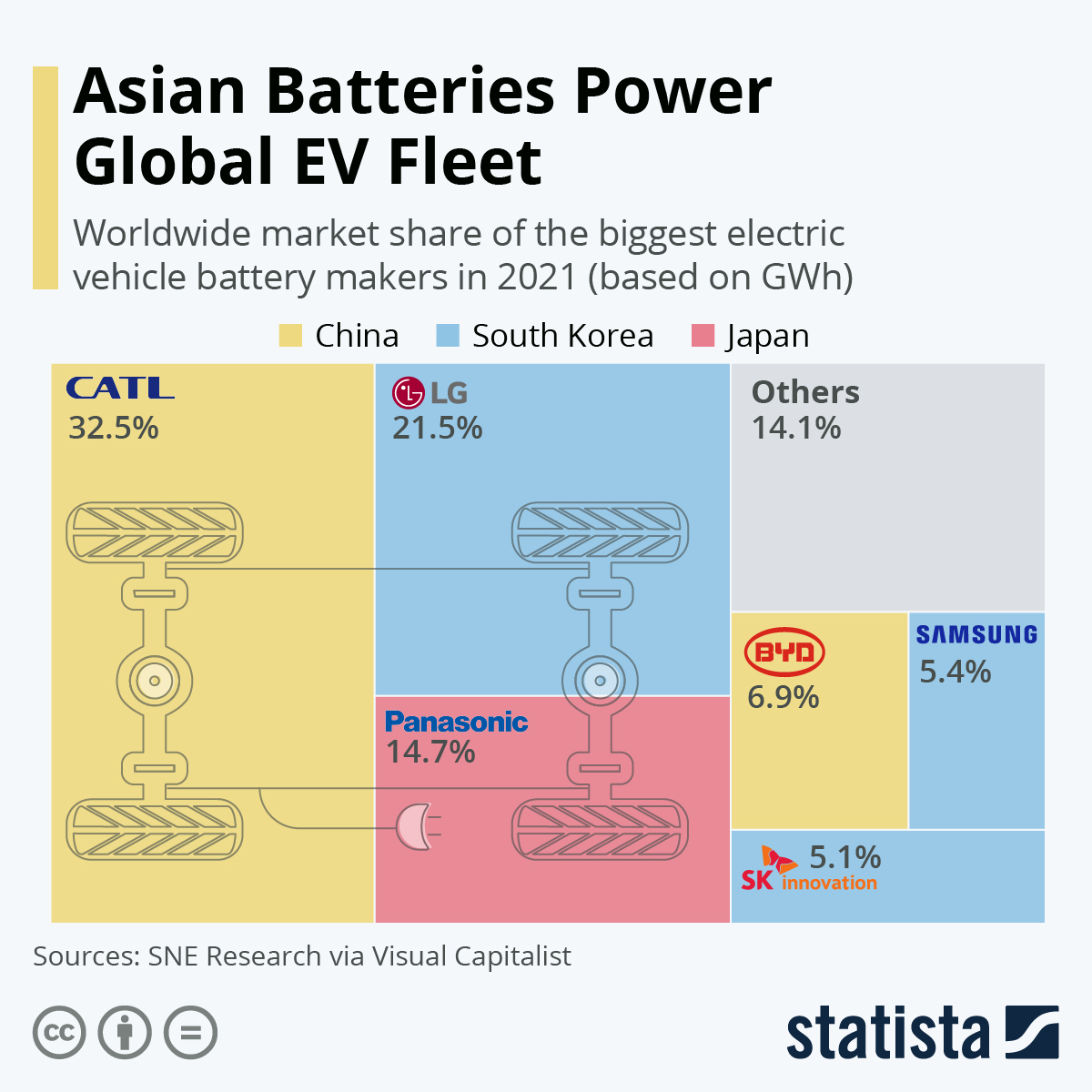

- The global supply of electric-vehicle batteries overwhelmingly comes from Asia:

- U.S. Class I railroads collected a record $1.18 billion in revenue from demurrage fees during the first three quarters of 2021.

- European regulators rejected a merger of two South Korean shipbuilding giants over antitrust concerns.

- Ohio logistics firm TRG is building a 1.6 million square-foot industrial site in Southern Dallas County.

M. Holland’s 2022 Plastics Industry Trends & Predictions

M. Holland’s market experts weigh in on what we can expect for the plastics industry in 2022. View the infographic and read more on current trends and predictions.

Domestic Markets

- The U.S. reported 776,455 new COVID-19 infections and 1,875 virus fatalities Thursday.

- In a much-awaited decision, the U.S. Supreme Court has blocked the White House’s COVID-19 vaccine mandate for large employers while upholding the measure for certain healthcare workers.

- The White House doubled its order for at-home COVID-19 tests to send to the American public to 1 billion units, which could begin shipping out as soon as next week.

- Nineteen states have less than 15% ICU bed capacity and four states have less than 10% amid the recent surge of COVID-19 patients.

- Illinois reached a record of more than 7,300 COVID-19 hospitalizations.

- Military personnel have been dispatched to hospitals in Washington to help handle surging COVID-19 patients.

- COVID-19 hospitalizations rose 76% in Alaska, 59% in Idaho and 53% in Arkansas week over week.

- Vermont’s largest hospital system has 422 staff members out sick with COVID-19.

- North Carolina registered a record 44,000 new COVID-19 cases yesterday.

- Rural America reported 393,000 new COVID-19 infections last week, shattering a previous record by more than 160,000.

- Firefighters and police officers in Houston continue to have the lowest COVID-19 vaccination rate among all city workers.

- A Texas school district is asking parents to become substitute teachers due to staff shortages caused by COVID-19.

- New COVID-19 cases are starting to decline from recent peaks in a number of states in the U.S. Northeast, including New York City and other East Coast metro areas. The presence of the virus in Boston’s wastewater has declined 50% in recent days.

- Florida reported 55,573 new COVID-19 cases Thursday, down from a near-record of more than 71,000 a day earlier.

- Arizona surpassed 25,000 COVID-19 deaths since the start of the pandemic.

- Nurses in the 175,000-member National Nurses United union went on strike across 11 states and Washington, D.C., yesterday, protesting unsafe conditions, staff shortages and a lack of critical medical supplies.

- Cruise ships will no longer have to abide the CDC’s restrictions this Saturday when pandemic safety measures turn from mandates to recommendations. Norwegian Cruise Line canceled five more sailings this week due to the COVID-19 surge.

- Goldman Sachs delayed its return-to-office plans by another two weeks to Feb. 1.

- A new California study suggests the COVID-19 Omicron variant is 91% less likely to cause death than the Delta variant.

- Pfizer’s COVID-19 vaccine was nearly 100% effective in keeping teenagers out of the ICU for COVID-19, new data shows.

- Criticism is emerging over at-home COVID-19 testing kits that do not adequately meet the needs of Americans with disabilities.

- U.S. colleges and universities are reimposing pandemic safety measures at a quickened clip this spring semester.

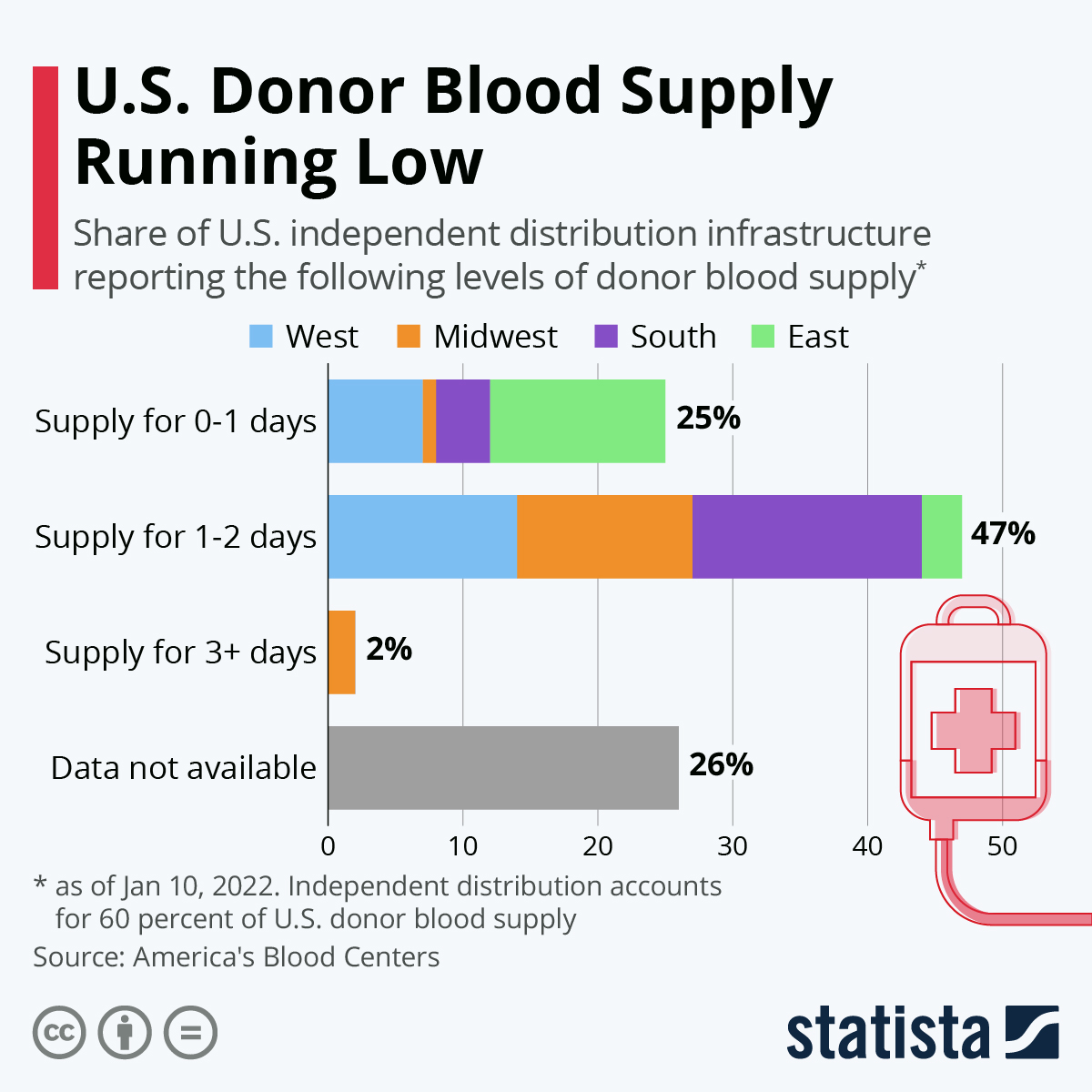

- The American Red Cross is offering Super Bowl tickets as a new incentive to overcome historically low levels of blood donations.

- Weekly U.S. unemployment claims rose by 23,000 to 230,000 last week, the most since mid-November.

- The average 30-year fixed mortgage rate rose to 3.45% this week, the highest since March 2020.

- One-third of small businesses surveyed reported decreasing revenues for the week ended Jan. 9, the most since last February as the COVID-19 Omicron variant impacted demand.

- Retail sales fell 1.9% in December, while manufacturing output slid 0.3% due to supply chain issues, the first decline since September.

- Navient, a former unit of student-loan giant Sallie Mae, said it would cancel $1.7 billion in private student debt for about 66,000 borrowers to resolve claims over deceptive lending practices. Government losses on student loan debt have climbed above $100 billion amid the pandemic’s pause on payments.

- The number of people flying in the U.S. is down 20% this month from the same time in 2019, as airlines report greater fourth-quarter losses and push back forecasts for rebounding travel until late spring and summer.

- The U.S. Department of Energy announced $13.4 million of investments into seven large-scale research projects aimed at converting plastic films into more valuable materials and making plastics more recyclable and biodegradable.

International Markets

- New COVID-19 cases across the globe rose to 15 million last week, a record, with about one-third coming from the U.S.

- The U.K. reduced quarantine periods to five days to help ease staffing shortages in hospitals, schools and businesses. The nation reported 109,133 new COVID-19 cases Thursday, a 24% drop from a week ago.

- France reported roughly 305,000 new COVID-19 infections Thursday, down from a record 370,000 the day prior. The nation’s teachers staged a walkout yesterday to protest chaotic and inadequate pandemic safety measures.

- COVID-19 hospitalizations in Spain are surging, threatening ICU bed capacity in more than half of hospitals.

- Sweden reported a record 25,215 new COVID-19 infections Thursday.

- Finland and Hungary have reduced pandemic quarantine periods.

- The Netherlands will allow non-essential stores to open this Saturday for the first time since mid-December.

- Hungary and Denmark will begin offering fourth COVID-19 vaccine doses to some people.

- German officials are overriding European regulators to recommend COVID-19 boosters for teens as young as age 12.

- China’s commitment to a zero-COVID policy could mean longer and more frequent lockdowns for millions of people soon. International flights to the nation are down to just 500 this week, compared with roughly 10,000 two years ago.

- Around 240 million COVID-19 vaccine doses purchased in North America, Asia and Europe are likely to expire unused by March. The number builds on more than 100 million doses that were rejected outright by nations due to upcoming expiration dates.

- More than 85% of the African continent’s population has yet to receive a single COVID-19 vaccine dose.

- Even mild COVID-19 has been linked to worsening mobility in adults, according to a new Canadian study.

- Tourism in Spain, one of the world’s top destinations, is set to rebound to 88% of pre-pandemic levels this year, analysts say.

- Life insurers across the globe are reevaluating risk models after larger-than-expected jumps in medical payouts since the onset of the pandemic.

- Australia’s Qantas Airways announced it would cut one-third of flights this quarter due to low demand.

- German cruise-ship builder MV Werften filed for bankruptcy.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.