COVID-19 Bulletin: January 19

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- U.S. benchmark WTI rose almost 2% Tuesday to settle at $85.43/bbl, a seven-year high, over supply concerns sparked by a Yemeni rebel attack on the UAE. Futures gained in late morning trading, with WTI up another 2.3% at $87.35/bbl and Brent up 1.6% at $88.88/bbl. U.S. natural gas dipped 3.2% lower at $4.15/MMBtu.

- OPEC is sticking to its forecast for robust growth in global oil demand next year despite planned U.S. interest rate hikes and the potential for rising COVID-19 cases. The cost of $100/bbl Brent call options for December hit a record high yesterday as more traders bet that the price will hit triple digits this year.

- The U.S. administration’s November sale of 18 million barrels of strategic oil reserves will be delivered to the market in February and March, officials say.

- Exxon Mobil plans to shut the second-largest crude distillation unit at its 560,000-bpd refinery in Baytown, Texas, later this week, after an explosion last month disrupted operations.

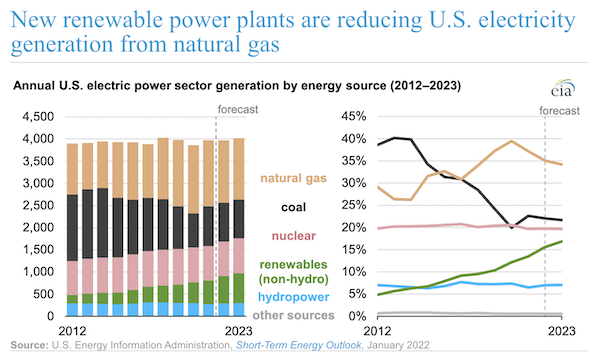

- The forecast share of electricity generation from non-hydropower renewable sources in the U.S. has grown from 13% in 2021 to 17% in 2023:

- Chinese diesel exports were down more than 75% year over year in December amid diminishing export quotas and curbed refiner activity due to lagging domestic demand. Total refined fuel exports were down 45% for the month.

- Electric vehicles need to comprise 63% of vehicle sales in China by 2030 and 87% of sales by 2035 for the country to meet its long-term net-zero emissions targets, analysts say.

- A consortium of oil majors is expanding its Northern Lights carbon capture project off the coast of Norway.

- U.S. refiners might only realize half of the government’s hoped-for production of green diesel by 2025 due to policy and feedstock constraints.

Supply Chain

- The cost of shipping produce from the western U.S. to Canada rose 25% last week after Canada pushed forward with a measure requiring incoming truckers to be vaccinated against COVID-19.

- Shippers should expect peak less-than-truckload rates into at least March of this year, analysts say.

- 40-foot container spot rates topped $20,000 at their peak last year, up from just $2,000 several years ago, launching full-year profit estimates for ocean-freight carriers to a record $150 billion.

- Hong Kong consumer prices are forecast to rise at a faster clip this year as airlines slash cargo flights over the city’s zero-COVID strategy, Citigroup warned. Cathay Pacific Airways is offering bonuses up to $3,700 to pilots willing to endure the island’s ultra-strict quarantine regime in a bid to get more planes in the air.

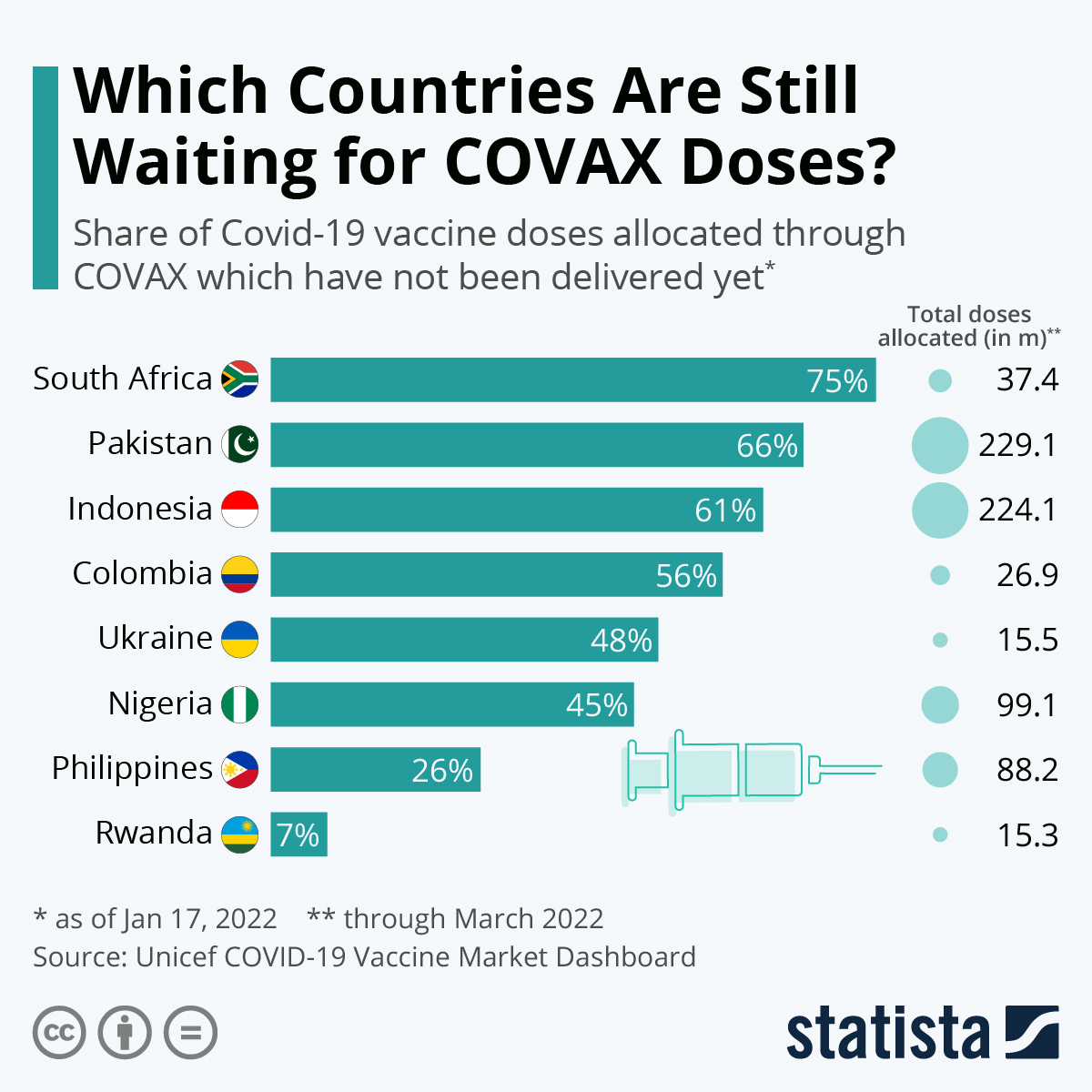

- The logistics of getting COVID-19 vaccines to far-flung and underserved populations across the globe could prolong the pandemic by making it more likely that new variants will emerge.

- Chinese postal workers have been ordered to disinfect all international mail parcels over fears of importing COVID-19. The nation is facing a twin virus threat, as cases have emerged of both the Delta and Omicron variant as the Olympics approach.

- Up to 2,000 trucks are backed up at the Argentina-Chile border due to stricter COVID-19 testing protocols imposed by Chile.

- The Port of Boston received its first ever ultra-large container ship call last weekend following the completion of an $850 million port expansion project.

- Auction prices for secondhand freight trailers doubled in 2021, while new trailer orders fell an annual 40% in December on supply disruptions and labor shortages.

- UPS expects a 10% year over year increase in holiday-related returns.

- Volkswagen has resumed production at a facility in northern China after a three-day shutdown caused by a COVID-19 outbreak.

- Toyota expects to miss annual production targets by another 150,000 vehicles this year due to the global computer chip shortage, with most of the lost output coming from facilities in Japan.

- Volkswagen is partnering with auto supplier Bosch to equip battery cell factories across Europe and help make the continent self-sufficient in battery production.

- GM will install electric-vehicle chargers made by Blink Charging at its U.S. and Canadian dealerships.

- Discount retailer Big Lots plans to open more than 500 new stores over the next several years following a decade of plateauing growth.

- Walmart is testing temperature-controlled “smart” delivery boxes in Florida.

- Japan’s Mitsubishi Heavy Industries ran a successful test run of the world’s first fully autonomous car ferry.

- A new partnership between the International Chamber of Shipping and the International Renewable Energy Agency will promote “future fuels” such as green hydrogen and ammonia for both nation states and the global shipping industry.

M. Holland’s 2022 Plastics Industry Trends & Predictions

M. Holland’s market experts weigh in on what we can expect for the plastics industry in 2022. View the infographic and read more on current trends and predictions.

Domestic Markets

- The U.S. reported more than 1 million new COVID-19 infections and 1,896 virus fatalities Tuesday. One in every five Americans has now been infected at some point, new data shows, while the COVID-19 Omicron variant accounts for 99.5% of all new infections.

- The U.S.’s COVID-19 surge will continue to expand despite cases plateauing in several large East Coast cities, federal health officials say.

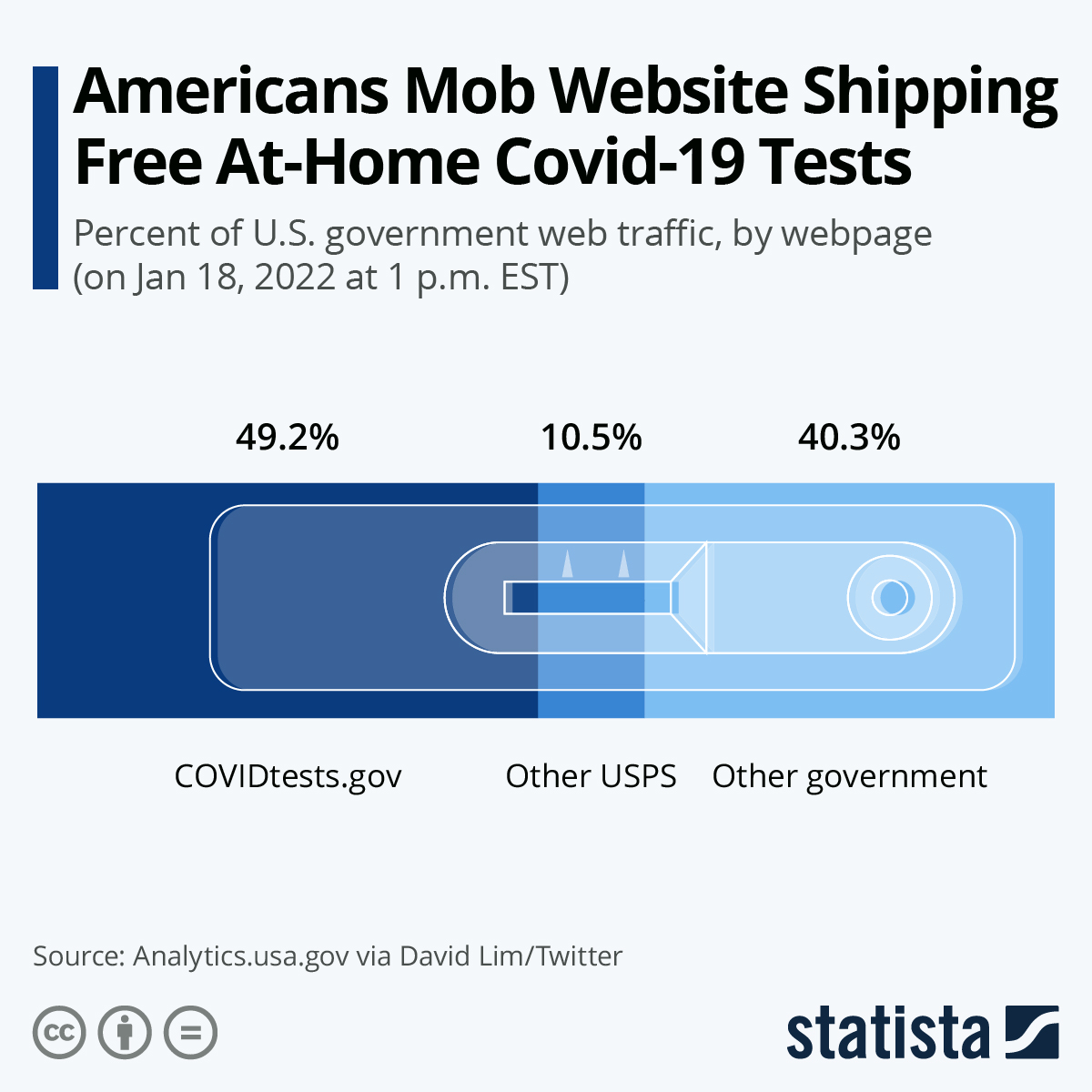

- The federal website for ordering free at-home COVID-19 testing kits is now live at www.covidtests.gov.

- The White House also announced it would make 400 million highly protective N95 masks available for free at pharmacies and community health centers across the nation.

- California surpassed 7 million total COVID-19 infections since the start of the pandemic yesterday, just one week after hitting 6 million.

- Colorado’s hospital system is at a breaking point due to COVID-19 patients, a leading group of physicians said.

- Oklahoma City’s four major hospital systems have run out of ICU beds amid a surge in COVID-19 patients, officials say.

- Kansas will halt COVID-19 contact tracing next month to reduce strain on the state’s healthcare system.

- Houston temporarily shut down public schools due to a surge in COVID-19 infections.

- New York state reported just 22,000 new COVID-19 cases Monday, a 75% drop from two weeks ago.

- New COVID-19 cases in New Jersey are down almost 40% from a week ago.

- Cruise lines are canceling more voyages on fears of on-board COVID-19 outbreaks.

- The CDC issued new advisories against travel to 22 nations due to rising COVID-19 cases, including Australia, Israel, Egypt and Argentina.

- Doctors and other healthcare professionals will need to be vaccinated against COVID-19 by Feb. 14 in at least 24 states, the U.S. administration said.

- New research suggests Paxlovid, a new COVID-19 antiviral pill made by Pfizer, was effective against the Omicron variant. The pill is currently authorized for people with high risk of severe infection.

- Nearly one-third of United Airlines’ workforce at Newark Liberty International Airport called out sick with COVID-19 on a single day, as Omicron-induced staffing shortages continue to spread.

- Delta Air Lines expects to spend an extra $60 to $70 million on COVID-19-related costs in the first quarter.

- The NHL will stop testing players who are asymptomatic for COVID-19 next month as only one player in the league remains unvaccinated.

- Inflation fears resurfaced Tuesday after JPMorgan Chase’s CEO predicted as many as seven interest rate hikes before the end of this year. The yield on 10-year Treasuries hit a two-year high, sending stock markets lower.

- Goldman Sachs kicked off this week’s earnings slate with a weaker-than-expected fourth-quarter report, sending its shares down 7%.

- Procter & Gamble reported a 6% rise in sales in its latest quarter driven by higher pricing.

- Americans will get an average 3.4% raise this year to ward off inflationary pressures and labor shortages, a survey of U.S. employers shows. Bigger contributions to retirement accounts are trending as employers seek more ways to recruit and retain talent.

- The federal government ran a $21 billion deficit in December, the smallest monthly gap in two years as higher tax revenues offset narrower gains in spending.

- Puerto Rico received court approval to leave bankruptcy through the largest restructuring of U.S. municipal debt ever at more than $30.5 billion, ending five years of conflict caused by high joblessness, outward migration and unsustainable borrowing.

- The most recent data shows women and minorities are making substantial gains in leadership representation at large U.S. firms.

- Microsoft agreed to buy video game maker Activision Blizzard for around $70 billion, the tech giant’s largest acquisition ever and the highest deal valuation so far in the video game industry.

- The widespread out-migration of urban dwellers during the pandemic is expected to reverse this year, causing higher prices for single-family homes, co-ops and condos in large U.S. cities.

- AT&T and Verizon announced they would further delay the rollout of some 5G networks near U.S. airports after airlines warned for the third time in less than two months of severe schedule disruption from the technology. Many domestic and international airlines began canceling flights today.

International Markets

- Global COVID-19 cases surged 20% last week with nearly 19 million reported cases, according to the World Health Organization.

- Germany reported more than 110,000 new COVID-19 infections the past 24 hours, the first daily tally north of 100,000.

- France reported 464,769 new COVID-19 cases Tuesday, smashing its previous record. The nation’s total virus fatalities since the start of the pandemic surpassed 100,000.

- Russia is shortening mandatory quarantine periods for people infected with COVID-19 to seven days.

- While new COVID-19 cases in the U.K. subside, the nation reported more than 430 virus fatalities Tuesday, an 11-month high. The nation’s prime minister is facing calls to resign after hosting a party during the first week of the nation’s most recent lockdown.

- Total active COVID-19 infections in Mexico have surged more than sixfold since the start of the year.

- COVID-19 cases in Japan ticked up by a near-record 20,000 Monday, prompting officials to order new social restrictions in 16 regions starting at the end of the week.

- COVID-19 infections in India hit an eight-month high Wednesday.

- Australia reported a record 74 single-day COVID-19 fatalities yesterday, while the nation’s Victoria state declared a state of emergency to help its healthcare system combat a crush of virus patients.

- The next batch of 1 billion COVID-19 vaccine doses for low-income nations is expected to be delivered within the next five months, less than half the time it took to deliver the first billion doses.

- Pfizer’s Paxlovid antiviral pill for COVID-19 was granted approval in Canada.

- New research out of South Africa suggests people with the COVID-19 Omicron variant were less likely to later become infected with the Delta strain.

- South Korea raised interest rates to their pre-pandemic level to fight inflation and signaled that more increases could be coming later in the year, the first developed economy in Asia to do so during the pandemic.

- The U.K. is joining a growing number of nations experimenting with a four-day, 32-hour workweek to boost productivity and employee welfare.

- IKEA’s carbon emissions fell 6% last year from pre-pandemic levels despite record sales, as the home goods retailer seeks to become climate-positive by 2030.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.