COVID-19 Bulletin: July 2

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose above $75/bbl yesterday after OPEC+ leaders Saudi Arabia and Russia tentatively agreed to boost oil production by roughly half a million bpd starting in August, but delayed a final decision until today.

- Energy futures were mixed in mid-day trading today, with WTI down 0.1% to $75.17/bbl, Brent up 0.3% to $76.05/bbl, and natural gas up 0.8% at $3.68/MMBtu.

- U.S. gas prices are the highest in nearly seven years heading into the busy July Fourth weekend, with the average gallon costing $3.12 as of Thursday, almost $1 higher than a year ago.

- Several indicators point to growing investor concern over tight supply in the U.S. crude market, potentially causing inventories to decline as the nation’s refiners work at near-100% capacity to accommodate surging demand.

- High temperatures across the globe are pushing natural gas prices to multi-year highs, with liquefied natural gas cargoes sent to Asia rising above $13/MMBtu, the highest for this time of year since 2013.

- Chevron is looking to sell two of its oil assets in the Permian Basin with a value up to $1 billion.

- Indian state refiners sold 2.1 million tonnes of gasoline in June, up 29% from May, while the country’s factory activity contracted for the first time in nearly a year after several months of strict pandemic restrictions.

- The White House signed a bill repealing a rollback of regulations on methane emissions, hoping the new measure will help further limit the effects of climate change.

- The European Bank for Reconstruction and Development (EBRD) will stop investing in upstream oil and gas projects and begin supporting the climate change goals of the Paris Agreement by the end of 2022.

- Spain’s carbon emissions fell 13.7% from 2019 to 2020, roughly 6.4% lower than the 1990 level.

- China scrapped plans to provide $3 billion in funding for a new coal-fired power plant in Zimbabwe, as the number of nations willing to fund Africa’s fossil-fuel projects gets smaller and smaller.

- The U.S. administration is urging countries building new fossil-fuel plants to use enough technology to eventually achieve net-zero emissions.

- U.S. regulators are conducting an environmental review for Dominion Energy’s 205-turbine, 2.6-gigawatt offshore wind project in Virginia.

- London startup FabricNano is working to commercialize biodegradable polyester made through “cell-free biomanufacturing,” which could make bioplastic that is cost competitive with petroleum-based material.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Elsa became the first Atlantic hurricane and fifth named storm of the season, prompting hurricane warnings through the Caribbean as it heads toward the U.S.

- This week’s heat wave in Oregon, California, New Mexico and other states continues to strain the U.S. West’s power grid, as operators seek to bolster their equipment ahead of more regular extreme weather events.

- Oregon is reporting 63 deaths from this week’s Pacific Northwest heat wave.

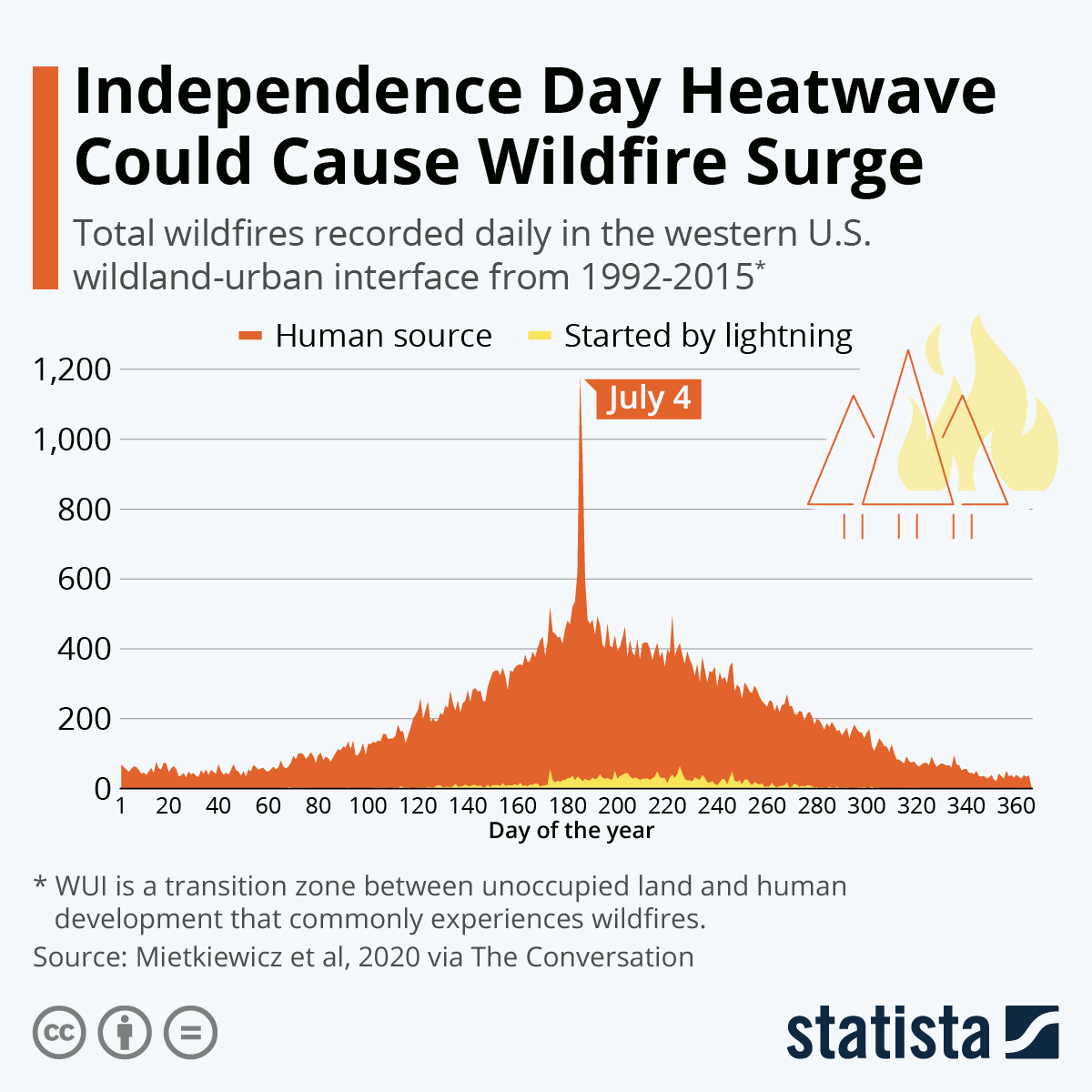

- Wildfires in the U.S. West are starting to contaminate water supplies, a problem exacerbated by severe drought conditions at an unusually early time in the season. Researchers have started using drones to help identify more areas susceptible to blazes.

- Canada saw its highest temperature ever of 121.3°F in the Pacific Northwestern town of Lytton, whose residents were evacuated due to wildfires in recent days.

- Severe thunderstorms are set to hit the U.S. Northeast before temperatures cool from a recent heat wave heading into the July Fourth weekend.

- Current extreme weather conditions are not limited to the U.S., with China, Argentina, Uruguay and several other countries facing high heat, tropical storms and the related impacts on power grids.

- Brazil reported the most wildfires in the Amazon rainforest for the month of June in 14 years, with officials worrying that extreme droughts in the region could cause even more fires in the coming months.

- Maersk will build the first container ship powered by carbon neutral methanol, part of its long-term goal of achieving a carbon neutral fleet by 2050.

- The ongoing global chip shortage is expected to weaken supply of EMV chips needed to manufacture payment cards.

- Meat demand is down more than 12% from a year ago in the U.S., causing ripples in the global food supply chain.

- The U.S. and Mexico agreed to create a new toll-based border crossing along the California/Baja California border, the busiest crossing area in the Western Hemisphere, that will cut wait times to 20 minutes.

- Warehouse managers are turning to “exosuits,” wearable robotic devices designed to help workers lift items and reduce the risk of injuries.

- Our logistics team reports that bulk trucking firms are often declining to book long-haul, out of network loads due to extreme capacity constraints.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The seven-day average of COVID-19 cases in the U.S. rose 10% this week as the highly transmissible Delta variant continued to spread.

- The U.S. reported 14,463 new COVID-19 cases and 305 virus deaths on Thursday, while new data shows that the Delta variant accounts for roughly 40% of COVID-19 test samples and is now being reported in all 50 states and Washington, D.C.

- The White House will deploy COVID-19 response teams across the U.S. to work with high-risk communities, focusing on increasing vaccination numbers and combatting the spread of the Delta variant.

- Roughly 1,000 counties across the U.S. have COVID-19 vaccination coverage of less than 30%.

- A new poll shows that despite life returning to pre-pandemic normalcy, half of U.S. adults are concerned that another surge of COVID-19 infections could threaten the country’s progress against the virus.

- Oregon ended its mask-wearing and social distancing mandates.

- Los Angeles County recommends people resume wearing masks indoors as California adds roughly 1,000 new COVID-19 cases daily, up 17% over the last two weeks.

- Early data show Johnson & Johnson’s COVID-19 to be effective against the highly transmissible Delta variant, as the company plans for clinical trials of its COVID-19 vaccine on children as young as 2.

- Some people who received Johnson & Johnson’s single-shot COVID-19 vaccine are choosing to get second jabs of Pfizer’s or Moderna’s shots.

- A common virus known as respiratory syncytial virus (RSV) is beginning to take hold in the southern U.S. as people take fewer precautions amid lowered pandemic restrictions.

- A record number of U.S. companies restated their financials in the first three months of 2021, a result of updated SEC guidance on the hottest sections of the market.

- The U.S. economy’s quicker-than-expected rebound from the pandemic is putting the country on track to regain all of the jobs lost during the pandemic by the middle of 2022, while federal spending will push the deficit to $3 trillion for Fiscal Year 2021.

- Nonfarm payrolls increased by a higher-than-expected 850,000 in June, while wages were up 3.6% year over year, in line with expectations. The unemployment rate was up, rising from 5.6% in May to 5.9% last month.

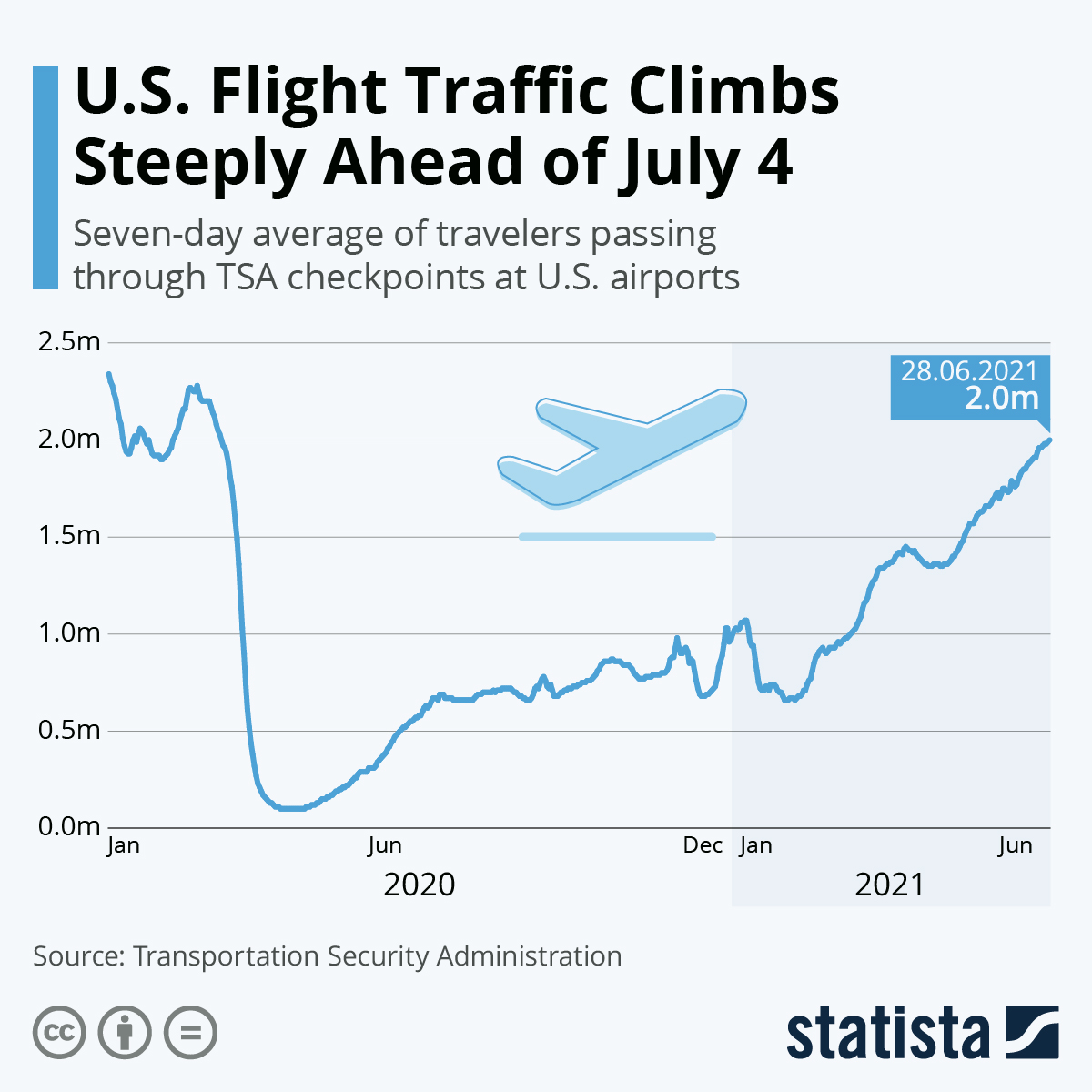

- Labor and fuel shortages among airlines are frustrating travel for many of the 3.5 million people expected to fly over the July Fourth holiday.

- Royal Caribbean will require all unvaccinated travelers on cruises to purchase COVID-19 insurance for potential costs resulting from quarantines and mass evaluations onboard if there is a virus event.

- Walgreens expects to administer far fewer COVID-19 vaccines in the fourth quarter, just 7 million, compared to 17 million in Q3.

- Auto sales saw a substantial increase in the second quarter, with GM and Toyota reporting 40% increases in sales from a year ago, and Hyundai and Kia reporting increases of 70% compared to last year.

- Ford’s unit sales were up 9.6% in the first quarter year over year, but down 26% in June due to the global chip shortage. Sales of the company’s F150 truck were off 30% in June.

- U.S. sales for Stellantis were up 32% in the first quarter, led by a 40% jump in sales of Ram pickup trucks.

International

- India reported 46,617 new COVID-19 cases and 853 deaths Friday, as more than 40,000 infected people continue to suffer from a rare fungal infection that can cause blindness. The country’s total virus death toll surpassed 400,000 yesterday, although the real number is suspected to be much higher.

- India is just one of several Asian nations facing new COVID-19 outbreaks due to the highly transmissible Delta variant, with Australia and South Korea hitting record one-day case counts.

- Indonesia will enact strict new pandemic restrictions through July 20 in response to rising COVID-19 cases.

- The U.K. reported nearly 28,000 new COVID-19 cases Thursday, a rise of 72% compared to the previous week. The nation has seen more than 50,000 cases of the highly transmissible Delta variant over the past week.

- Italy is barring U.K. travelers from entry to a major sporting event over fears of spreading the COVID-19 Delta variant.

- The increased spread of the Delta variant is quickly dampening hopes of a tourism revival in the E.U. this summer, with crowds gathering for European Championship soccer games already fueling a surge in infections throughout the bloc.

- Germany expects the COVID-19 Delta variant to account for 80% of infections in July.

- Moscow will start offering COVID-19 booster shots amid a rise in infections.

- Each of Europe’s approved COVID-19 vaccines offer protection against new variants of the virus, officials say.

- German biotech company CureVac is struggling to deploy its COVID-19 vaccine after trials show a mere 48% efficacy across all age groups.

- Swiss drugmaker Novartis is mulling the development of future mRNA vaccines after the method proved effective in preventing COVID-19.

- Nine European countries will begin accepting Covishield COVID-19 vaccines from India’s Serum Institute as part of an approved list for quarantine-free travel.

- Officials from 130 countries are backing a U.S. proposal for a global minimum tax rate of 15% for corporations, a bid to overhaul the taxing of international companies.

- Eurozone producer prices rose a larger-than-expected 1.3% on the back of higher energy costs.

- South Korea’s SK Innovation will increase its annual battery production capacity to 200 gigawatt-hours (GWh) in 2025, up 60% from a previously announced goal of 125 GWh.

- Remittances to Mexico from citizens working abroad, the country’s second highest source of foreign currency behind auto exports, jumped 31% in May, the 13th consecutive year-over-year increase.

- France’s top court is giving the country’s government nine months to lower its greenhouse gas emissions or risk potential fines.

Our Operations

- M. Holland will be closed Monday in observance of the July Fourth holiday. We wish all subscribers a safe and happy holiday weekend.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.