COVID-19 Bulletin: July 7

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell from six-year highs by multiple percentage points Tuesday amid uncertainty over OPEC’s deadlock on expanding oil output for the coming months.

- Energy futures slid further in late morning trading today, with the WTI down 2.4% to $71.64/bbl, Brent down 2.1% to $73.00/bbl and natural gas 2.5% lower at $3.55/MMBtu.

- The U.S. Energy Secretary discussed the possibility of oil prices hitting $100 a barrel because of continued tension between Saudi Arabia and the United Arab Emirates.

- U.S. gas demand likely reached 9.6 million bpd for the week up to July Fourth, the highest since September 2019 as Americans return to pre-pandemic travel habits.

- Royal Dutch Shell is reportedly mulling an exit from its joint venture with Exxon named Aera Energy, one of California’s largest oil and gas producers. This move would align with Shell’s planned transition away from fossil fuels.

- Shell signaled it will boost shareholder returns through stock buybacks and/or dividends to 20%-30% of free cash flow beginning in the second quarter.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Tropical storm Elsa regained hurricane-level strength roughly 100 miles off the west coast of Florida yesterday and will make landfall in the state this morning. The storm is not likely to have a significant impact on the region’s power demand or energy grid.

- Last month was the warmest June on record for North America and the second warmest for Europe.

- Alaskan highway and airport infrastructure is breaking down at a rapid pace under rising temperatures caused by climate change, with high replacement costs expected in the next two decades.

- In a controversial trend, some California water agencies are installing meters on agricultural wells as the state’s drought and water shortage intensifies.

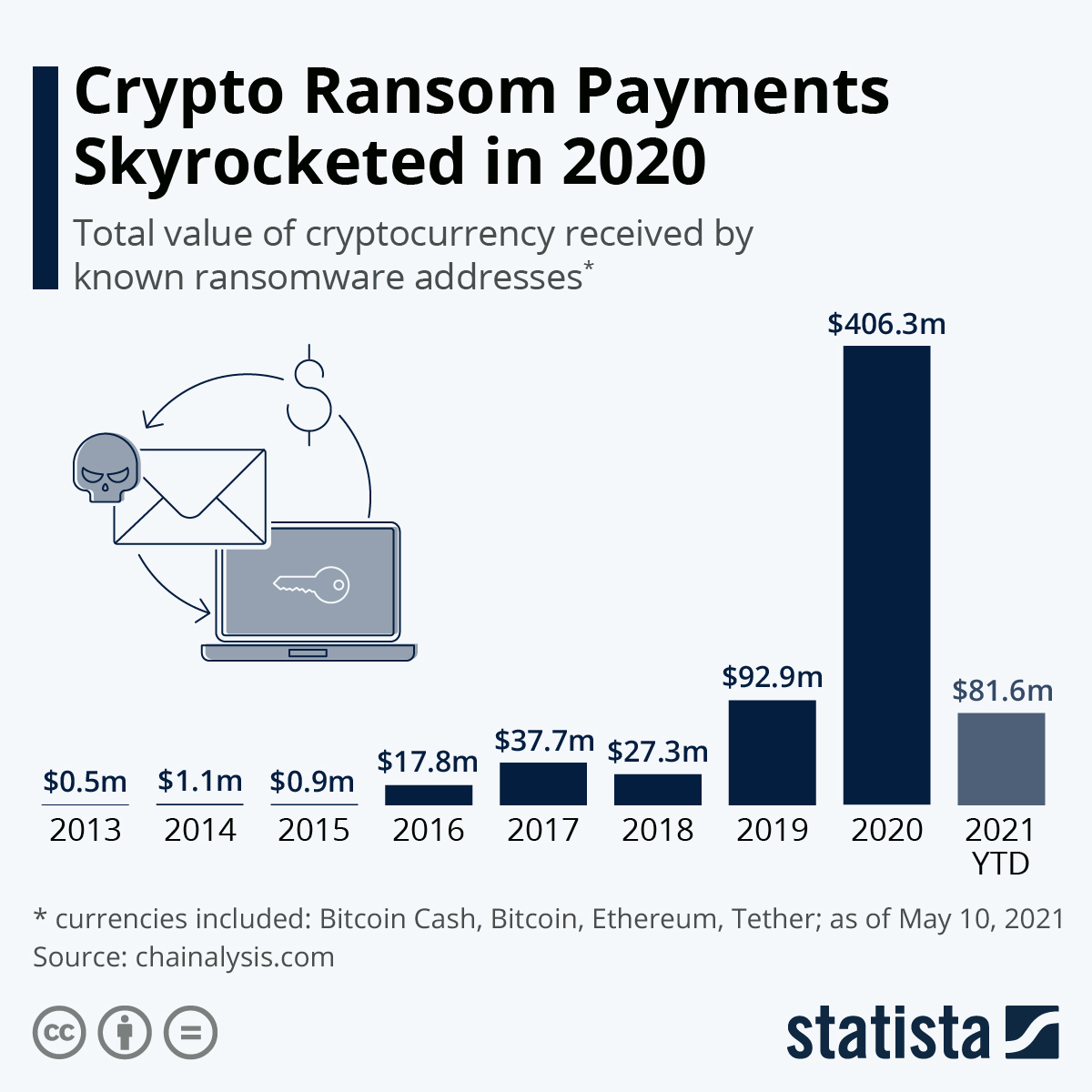

- The massive ransomware attack on IT services firm Kaseya followed similar attacks in recent weeks that forced meatpacker JBS to pay an $11 million ransom and caused Colonial Pipeline to temporarily shut down, leading to panic buying, price spikes and gas shortages on the East Coast.

- Perpetrators of the ransomware attack on Kaseya are demanding $70 million, the largest demanded payment ever, to restore data breaches that have temporarily shut down hundreds of small businesses around the world.

- “K” Line, one of Japan’s oldest and largest shipping companies, suffered its second cyberattack in three months Tuesday, resulting in the public release of customer data online and some service disruptions.

- The payouts for ransomware attacks have grown in recent years:

- BMW outsold its luxury car rivals in the U.S. in the second quarter as it more effectively managed its semiconductor supplies, nearly doubling vehicle deliveries from a year ago.

- Despite high unemployment and weak economic conditions at home due to a COVID-19 surge, Taiwan’s semiconductor and electronic components exports are expected to rise 30% this month, marking 26 consecutive months of growth, the longest growth cycle in 16 years.

- Container line earnings could reach $100 billion this year on a 10% rise in volumes combined with record rates.

- Trucker Knight-Swift Transportation Holdings is buying Southeast and Midwest regional operator AAA Cooper Transportation, giving the nation’s largest truckload carrier a foothold in the expanding less-than-truckload business.

- North American heavy-duty truck orders rose 13% month over month in June, reflecting continued strength in U.S. logistics demand in line with analysts’ expectations.

- The Ever Given container ship that blocked the Suez Canal for nearly a week in March will finally be allowed to set sail again after reaching a compensation deal with Egypt’s canal authority.

- Retailers and distributors in the U.K. took up more than double the amount of warehouse space in the first half of 2021 compared to the previous, record-setting year.

- The U.S. has vaccinated more than 20,000 people as part of a special program for international seafarers on vessels docked at U.S. ports.

- Our logistics team reports that bulk trucking firms are often declining to book long-haul, out of network loads due to extreme capacity constraints.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 24,224 new COVID-19 cases and 334 deaths in the U.S. yesterday.

- The COVID-19 Delta variant accounted for more than half of U.S. infections between June 20 and July 3, and more than 80% of infections in Iowa, Kansas, Missouri and Nebraska.

- Wyoming is among the low-vaccination states experiencing spiking COVID-19 cases of the highly transmissible Delta variant, creating concerns about a resurgence of the virus.

- The federal government sent a public health surge team to Missouri, which has the second-highest COVID-19 caseload in the country, as the hospital system in Springfield ran out of ventilators amid a recent spike in virus patients.

- One hundred percent of June COVID-19 deaths in Maryland were among unvaccinated people.

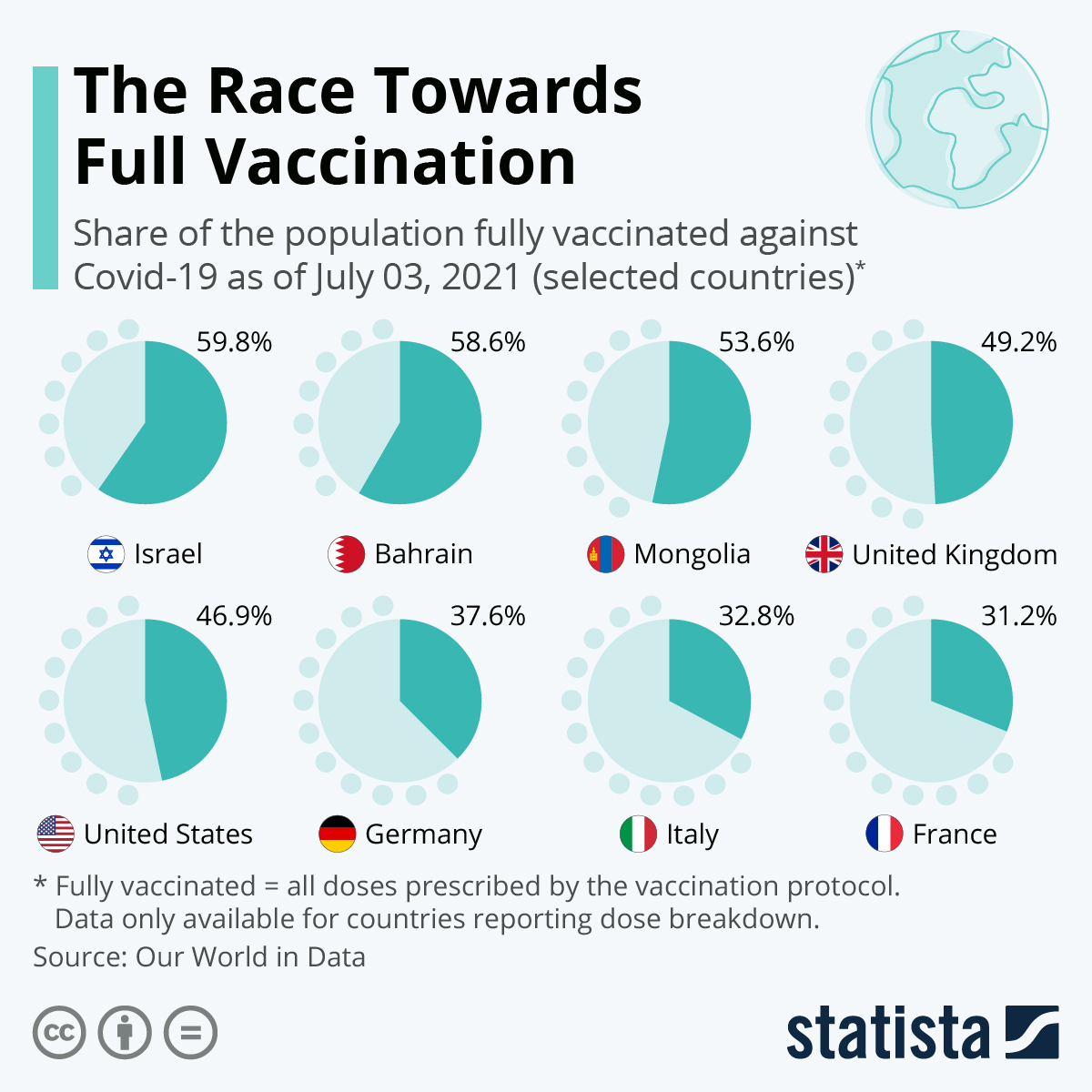

- A recent study from Israel, which leads the world in vaccinations, shows Pfizer/BioNTech’s COVID-19 vaccine provided only 64% protection against the Delta variant, while the shot remained over 90% effective at preventing severe illness from the strain.

- Lawmakers and federal health officials will have to accommodate an onslaught of new disability costs arising from COVID-19 “long-haulers,” who suffer for months with fatigue, respiratory problems, brain fog and gastrointestinal issues, among other symptoms.

- The White House is shifting its COVID-19 vaccine campaign to provide more shots to doctors’ offices and pediatricians, hoping to boost inoculations in widely under-vaccinated young populations.

- Activity in the U.S. services sector grew at a moderate pace in June, still well into expansion territory but falling several index points below a record reading in May.

- Job openings in the U.S. rose to 9.2 million in May, setting a record high for the third straight month.

- Low-income households that lost jobs during the pandemic were able to maintain spending for an additional 43 weeks as a result of U.S. stimulus payments.

- Roughly 16.4% of office space across the U.S. was empty at the end of the first quarter, up from 13% a year earlier as the amount of space that became vacant significantly outpaced the amount of space that was leased.

- Public storage facilities have provided the biggest returns to investors in public real-estate stocks this year, as more people moved or looked for extra space to store their belongings during the pandemic.

- Large U.S. firms are taking starkly contrasting approaches on bringing employees back to the office, balancing the comradery of in-person work with the pandemic-tested proof that companies can deliver record-setting results despite full remote working.

- Tesla nearly doubled its sales of electric vehicles in the second quarter compared to a year ago, in line with an expected 50% increase in vehicle sales for all of 2021.

- Samsung, the world’s largest chipmaker, reported a 53.4% gain in second-quarter profits from the previous year.

- The e-commerce surge is driving new trends in packaging, including pushes for more sustainable materials, minimalistic packaging, story-driven packages and increased use of QR codes.

- Maine and Oregon legislatures have passed what could become the nation’s first comprehensive extended producer responsibility laws that would force companies to pay directly for recycling plastic, paper and other packaging.

- Colorado will ban single-use plastic bags and polystyrene packaging starting in 2024 under new legislation signed into law Tuesday.

International

- Officials fear new COVID-19 cases in the U.K. could reach 100,000 per day this summer once the nation relaxes all pandemic restrictions. More than 28,700 new infections were reported Tuesday, the most since January.

- COVID-19 cases rose 75% week over week in Greece, largely due to the infectious Delta variant.

- Lawmakers in France are considering mandating that healthcare workers be vaccinated as the country braces for an expected fourth COVID-19 wave this summer.

- South Korea reported 1,212 new COVID-19 cases yesterday, tying a previous record set on Dec. 25.

- Indonesia recorded 34,379 new COVID-19 cases and 1,040 deaths yesterday, both records, with the daily death toll doubling in the past week.

- Sydney, Australia — home to a fifth of the nation’s population — has reported 330 new COVID-19 infections in the past three weeks, prompting officials to extend a strict pandemic lockdown.

- South Africa, source of 30% of Africa’s COVID-19 infections, is experiencing record new case rates as the virulent Delta variant spreads.

- Mexico’s health ministry acknowledged the country is experiencing a third COVID-19 wave after infections rose 53% and deaths jumped 42% from May to June.

- Mexican officials are proposing a city-by-city plan to reopen land borders with the U.S. for non-essential travel.

- The OECD reports that the pandemic cost the world’s developed countries 22 million jobs in 2020, only half of which have come back.

- The European Commission raised its 2021 growth forecast for the bloc to 4.8% from 4.3% and also hiked its projection for 2022.

- Consumer spending is lagging throughout much of Asia as the region struggles with rising COVID-19 infections and low vaccination rates.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.