COVID-19 Bulletin: June 1

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Despite dipping on Friday, oil prices posted a gain of more than 4% on the week and month heading into Memorial Day weekend.

- U.S. crude futures hit their highest price in over two-and-a-half years following a forecast of a tightening global market by the OPEC+ alliance, with WTI briefly rising 3.2% from Friday’s levels and Brent topping $70 for a sustained period. Oil futures remained higher in mid-day trading, with WTI up 2.2% at $67.75/bbl and Brent up 1.2% at $70.21/bbl. Natural gas was up 4.2% at $3.11/MMBtu.

- Energy futures were higher in mid-day today, with WTI up 2.9% at $68.22/bbl and Brent 2.2% higher at $70.82/bbl. Natural gas was up 2.7% at $3.07/MMBtu.

- On Friday, Colonial Pipeline experienced its second network disruption since a ransomware attack shut down operations last month. The company restored service by the end of the day, reporting that the issue was not associated with malware.

- India’s gasoline and diesel fuel sales fell 20% in May versus April during a COVID-19 surge and associated lockdowns.

- Germany announced plans to use up to $10 billion in federal and state funds to build 62 large-scale hydrogen projects with the goal of becoming a global leader in hydrogen technologies.

- China’s carbon emissions will more than double by 2035, fueled by its booming tech sector.

- Arizona, Texas, Oklahoma, Tennessee, Kansas and Louisiana have enacted laws that ban prohibitions on the use of natural gas, a response to recent restrictions imposed by major U.S. cities, including San Francisco, Seattle, Denver and New York City.

- Southeast Asia is set to become the fastest-growing region for LNG imports over the next 10 years, industry analyst Poten & Partners predicts.

- Calgary-based Pembina Pipeline plans to acquire Canada’s Inter Pipeline in a $6.9 billion merger, topping a rival bid by Brookfield Infrastructure made in February.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- India’s COVID-19 surge is taking its toll on multiple industries and regions throughout the world, with some businesses halting production of oxygen so that it can be reserved for the country’s sick patients. Indian car maker Mahindra & Mahindra does not expect the nation’s car sales to return to pre-pandemic levels until 2023 at the earliest.

- More than 235,000 acres of agricultural land was flooded last week after a super cyclone battered the Eastern Indian state of West Bengal, pushing up food prices in the region. Three drill platforms were grounded and port operations were temporarily suspended due to the cyclone’s impact.

- A COVID-19 outbreak in northern Vietnam is threatening the region’s technology supply chain, which includes suppliers to Apple and Samsung, as multiple factories operate below capacity.

- Nissan plans to temporarily halt production at three Mexican plants over several days in June due to the ongoing semiconductor shortage.

- The CEO of computer manufacturer Logitech says that the global chip shortage could last another 3 to 6 months, with some industries being impacted for up to a year. Separately, executives at Intel predict it could be several years before the global shortage is permanently resolved with greater production capacity.

- Along with stimulus spending and easy monetary policies, rising U.S. inflation could also be a result of increased tariffs on large swaths of foreign goods since 2016, manufacturers say.

- The global market for warehouse automation services is set to double by 2025, with the strongest growth in the Americas and Europe.

- German shipper Hapag-Lloyd recently ordered an additional 60,000 TEUs for its container fleet in response to a sharp increase in demand, bringing its total investment in new capacity to 210,000 TEUs since the beginning of the pandemic.

- Truck carriers are increasing investments in capacity-as-a-service, ranging from vehicle telematics, blockchain technology, digital freight brokering integrations and trucking optimization platforms.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. recorded 11,976 new COVID-19 cases Saturday, the lowest since March 23, 2020, which was just 12 days after the World Health Organization officially declared a global pandemic. Infections fell further on Memorial Day, with just 5,735 new infections and 138 deaths.

- With over 30.6 million confirmed cases of COVID-19 in the U.S., about 1 in 10 Americans has tested positive for the virus, while roughly 1 in 600 has died.

- More than 1.9 million air passengers were screened Friday at the start of Memorial Day weekend, the most since the pandemic began. The rebound in travel is a boom for airlines, which, on top of much larger expenses, spent nearly $13 billion last year on cash refunds to customers for canceled flights.

- Maryland reached its goal of administering at least one dose of a COVID-19 vaccine to 70% of its adult population by Memorial Day, more than a full month ahead of the White House’s goal of having at least 70% of U.S. adults partially vaccinated by July 4.

- While continuing its stance against a federal vaccine requirement, the U.S. administration is mulling the creation of a vaccine passport strictly for use in international travel, allowing Americans to meet entry requirements of foreign countries.

- Southern states have seen lower transmission of COVID-19 during the winter and spring months due to warmer weather, with more people gathering in the open air where contagions disperse more easily.

- Virginia removed all of its COVID-19 social distancing and capacity restrictions ahead of Memorial Day weekend.

- CVS Health announced it will allow those who receive a COVID-19 vaccine at one of its pharmacies to enter into a sweepstakes giveaway, offering a plethora of prizes ranging from a cruise trip to Super Bowl tickets.

- The Equal Employment Opportunity Commission said that employers can require COVID-19 vaccinations and offer incentives to employees to get shots.

- The World Health Organization today gave new, simpler names to COVID-19 variants, with the U.K., South Africa, Brazil and India variants now assigned the Greek letters Alpha, Beta, Gamma and Delta, respectively.

- The CDC revised its guidelines for summer camps, saying that vaccinated adolescents do not need to wear masks while allowing younger campers who have not received vaccines to disregard their face coverings when outdoors.

- U.S. orders for durable goods fell 1.3% in April from March, largely a result of declining vehicle production due to the chip shortage. With transportation excluded, new orders rose a healthy 1.1% during the same period.

- The White House’s proposed $6 trillion budget for fiscal year 2022 is roughly 50% larger than pre-pandemic federal spending plans, despite only modest projections for economic growth in the years ahead due to an aging population and a plateauing workforce.

- The U.S. labor market recovery is spreading unevenly, with less populated regions having up to five job openings for every unemployed worker, while some urban areas and tourist hubs still have high jobless rates.

- U.S. household spending increased in April, up 0.5% following a 4.7% jump in March, while personal consumption expenditures rose by 0.7%, the largest monthly advance since October 2001.

- With a federal moratorium on evictions set to expire at the end of June, large U.S. banks are taking different approaches on restarting foreclosures for the nearly 4 million homeowners delinquent on payments or in forbearance.

- Pending U.S. home sales fell by 4.4% month over month in April, reflecting a months-long surge in home prices amid tighter supply.

- A new report from Pew Charitable Trusts shows that only 16% of older Americans plan to delay their retirement due to COVID-19, while 11% of individuals aged 55 to 75 withdrew extra money from their retirement accounts.

- Shortages of popular U.S. foods have prompted the owner of Arby’s, Panera Bread and Taco Bell to begin storing extra food in refrigerated trucks outside its venues.

International

- Southeast Asian countries including Thailand, Vietnam, Cambodia, Laos and East Timor have all seen total COVID-19 cases double in the past month, as Malaysia’s per capita infection rate soared past India’s.

- Malaysia is set to enter a two-week nationwide lockdown, while the country is investigating new reports of some recipients of AstraZeneca’s COVID-19 vaccine being underdosed with the jab.

- Vietnam has detected a new, highly transmissible COVID-19 mutation that combines features of existing virulent strains from the U.K. and India. The nation’s business hub of Ho Chi Minh City went into a two-week lockdown last week as the Vietnamese administration scrambles to secure more vaccine doses from Moderna.

- India reported 152,734 new COVID-19 cases Monday, the lowest daily rise since April 11, while virus deaths rose by 3,128. The country saw three consecutive days of significantly declining infections.

- Since March, India’s COVID-19 surge has killed more than 500 doctors.

- Myanmar’s healthcare system is floundering under a new wave of COVID-19, with a recent military coup in the country prompting widespread disruption at hospitals and testing clinics. The surge has prompted officials to suspend some domestic flights and impose new restrictions on townships.

- Australia’s Victoria state recorded five new COVID-19 cases Saturday, bringing the latest virus cluster to 35, as residents were sent into a strict, week-long lockdown.

- China reported 18 new local cases of COVID-19 in the city of Guangzhou Sunday, prompting flight cancellations and regional lockdowns.

- Brazilians took to the streets in 16 cities Saturday, protesting the government’s response to COVID-19 as the nation’s total virus death toll topped 460,000.

- Peru increased its tally of COVID-19 fatalities to over 180,000, two-and-a-half times the prior official death toll, a result of past misclassification. The nation now has the highest per capita death rate from the virus in the world.

- Half of COVID-19 infections in Glasgow are of the more virulent Indian variant, prompting a continuation of the city’s Phase 3 lockdown as the rest of Scotland begins to reopen.

- South Africa is raising its alert level and implementing new restrictions after a sustained rise in COVID-19 cases the past two weeks.

- Denmark unveiled a new digital COVID-19 passport that will enable holders to travel abroad and access various indoor activities.

- The U.K. has approved use of Johnson & Johnson’s single-shot COVID-19 vaccine, the country’s fourth authorized shot. New COVID-19 cases in the country stabilized last week following a sharp increase the previous week, while the government scrapped plans to require COVID-19 passports for large events.

- While 60% of adults in Canada have had at least one dose of a COVID-19 vaccine, only about 5% are fully vaccinated, with the country planning to broadly administer second doses starting Aug. 9.

- Several countries posted data on manufacturing activity in recent months:

- China’s Purchasing Managers’ Index inched down to 51.0 in May from 51.1 in April, reflecting a rise in the cost of raw materials and its effect on output from small and export-oriented firms.

- Factory output in Japan grew 2.5% from April to May on higher production of general-purpose and electrical machinery despite a slowdown in output of cars and transportation equipment.

- South Korea’s factory output unexpectedly dropped 1.6% from March to April, yet increased 12.4% year over year in April, the fastest yearly expansion since 2018.

- The global economy could grow by 5.8% this year and 4.4% next year, according to the Organization for Economic Cooperation and Development, which upped earlier forecasts from March.

- The household cost of COVID-19 treatment in low-income nations is threatening to deepen inequality, as members of newly formed middle classes are driven back into poverty.

- Remittances, or funds that migrant workers send back to their home countries, dropped only 2.4% globally last year, less than half the drop recorded in the aftermath of the 2008 financial crisis and significantly below the World Bank’s prediction of a 20% drop.

- Two-thirds of British retailers could be subject to closures and aggressive legal action to recover unpaid rent once the country’s pandemic-induced moratorium on debt collection ends July 1.

- Economists expect job losses and medical expenses from India’s recent COVID-19 surge to significantly cut into GDP growth in the second quarter, after the nation posted a 1.6% gain in the first quarter.

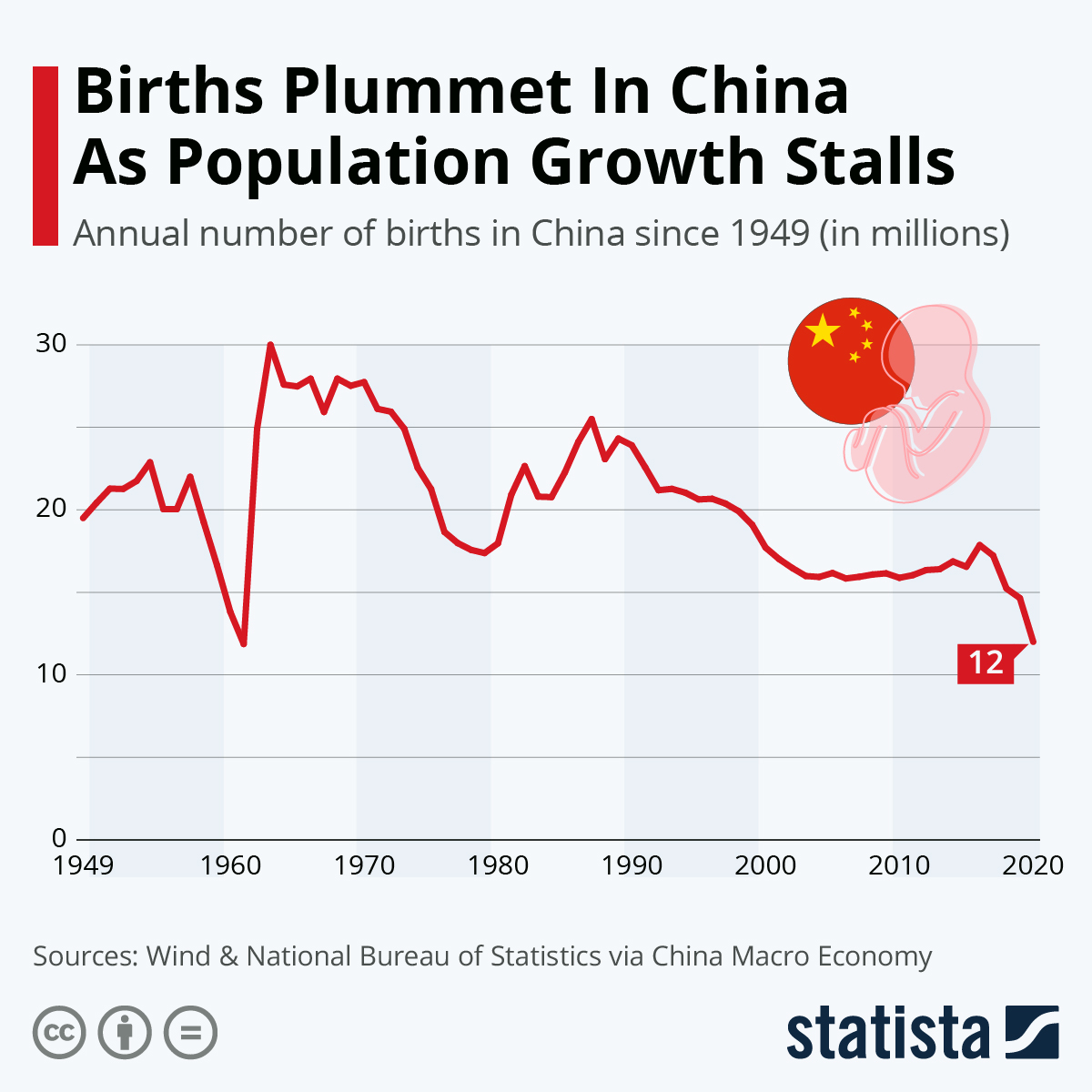

- In a historic announcement, China will allow all married couples to have as many as three children, reversing existing child limits in response to a population decline that threatens to halt the nation’s long-term economic growth.

- The U.K. is urging members of the G-7 to force companies to be more transparent when it comes to detailing their climate-related risks as part of a push toward net-zero emissions.

- The U.K. city of Cambridge is starting trials of fully driverless electric shuttle buses in June, which will take passengers on a 20-minute, two-mile route between a bus stop and Cambridge University.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.