COVID-19 Bulletin: June 7

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Brent crude closed above $70/barrel last week for the first time in two years. Energy prices were off in mid-day trading today with the WTI down 0.4% to $69.36/bbl, Brent down 0.4% to $71.63/bbl and natural gas 0.5% lower at $3.08/MMBtu.

- Diesel prices increased for the fifth consecutive week last week, with the national average reaching $3.30/gallon.

- BP’s CEO expects the rebound in oil demand to last for the foreseeable future, with U.S. shale producers showing restraint.

- The rise in oil prices has sparked a boom in sales of oil and gas acreage in the U.S., with land sales through five months of 2021 almost as high as sales in all of 2020.

- Exxon shareholders filled a third seat on its board with a candidate nominated by an activist investor that is pushing for greater focus on climate change.

- A Dutch court’s ruling ordering Shell to quicken its carbon emissions cuts could have significant ripple effects on other oil majors, making climate-change lawsuits more likely.

- With more than 800 utility-scale solar projects under contract in the U.S., opposition is growing from environmental activists and residents who support clean energy but are concerned about protecting endangered species and scenic views.

- Soybean futures rose to an all-time high Friday and are up 70% year to date, a surge fueled by the biofuels industry.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- The U.S. is experiencing its first major heat wave of the year, with record-breaking temperatures spreading across the Northeast and Midwest expected to extend through the week. Two wildfires in Arizona have scorched over 60,000 acres and forced the evacuation of hundreds.

- The latest news related to the global semiconductor shortage:

- Recent outbreaks of COVID-19 in Taiwan and Vietnam are threatening to worsen the global chip and component shortage, with a major Taiwanese semiconductor supplier suspending production for two days due to a virus cluster among employees, while two more tech suppliers experience employee outbreaks.

- An estimated 49,000 vehicles were taken out of North American production schedules last week due to the semiconductor shortage.

- General Motors has been able to pull some semiconductor deliveries into the second quarter and is boosting vehicle deliveries to dealerships to restock record-low inventories. Most of the company’s U.S. plants will not take traditional summer shutdowns.

- Nissan is delaying the launch of its new flagship electric vehicle to this winter, citing production problems caused by a lack of chips.

- The chip shortage is helping push costs higher for consumer electronics including laptops, smartphones and home appliances, with several major manufacturers raising selling prices in the first quarter. HP and Dell are adjusting their supply chains and changing lead times to help offset the continued disruptions.

- Conditions in U.S. logistics markets remained tight in May, while warehousing capacity fell for the ninth-straight month despite high pricing.

- Continuing strength in freight markets has pushed the orderbook for new container ships to a five-year high. Mediterranean Shipping Co. has ordered four additional extra-large container ships from Chinese shipyards to add to a previous order of six vessels placed in December 2020.

- Container ship spot charter rates are at record highs.

- More shipping lines, including Maersk, MSC, ONE and Hapag-Lloyd are dropping calls at China’s Yantian port due to worsening congestion that has started spreading to nearby ports, including Shekou and Nansha.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. reported 5,395 new COVID-19 cases and 251 deaths on Sunday as the nation continues its recovery from the pandemic.

- Cash and other giveaway incentives appear to be spurring more COVID-19 vaccinations in the U.S., with a 10 percentage-point surge in inoculations among 18- to 24-year-olds in the past month. Roughly 63% of Americans have received at least one COVID-19 dose, as the nation surpassed 300 million total inoculations.

- Florida officials will stop publishing daily COVID-19 reports on the state’s infections, hospitalizations and deaths.

- The U.S. has authorized use of Regeneron’s COVID-19 antibody cocktail administered via low-dose injection rather than intravenously with a high dose.

- Improved antigen tests and increasing COVID-19 vaccinations among 12- to 17-year-olds are paving the way for U.S. schools to return to in-person learning in the fall. Some school districts expect to see falling graduation rates due to student struggles with nearly a year of online learning.

- Families separated during the pandemic are urging the U.S. to drop border restrictions with Europe after the EU opened its borders to U.S. citizens.

- An index of services activity in the U.S. rose from 62.7 in April to 64 in May, the highest level in the measure’s 24-year history, indicating quickening growth.

- The share of teenage U.S. workers hit a 13-year high in May, as employers offer better incentives for lower-paying jobs to help offset a continued labor shortage.

- Unemployment rates for Black and Hispanic Americans dropped in May, a promising sign for populations that have lagged in job gains during the U.S. pandemic rebound.

- Connecticut is offering $1,000 bonuses to people who get a job after being on unemployment benefits for 12 weeks or longer.

- Having saved much of the last rounds of stimulus payments, Americans are unleashing pent-up demand as lockdowns ease, with Bank of America reporting consumer spending of $1 trillion so far in 2021, 20% more than in the same period in 2019.

- High housing prices and bidding wars from over-competitive buyers are discouraging some people from selling their homes, despite a red-hot seller’s market.

- Airlines are junking fewer planes now than before the pandemic due to a lessened need for spare parts and a desire to keep capacity available for the expected industry recovery.

- United is the second major U.S. airline behind Delta to require new employees to show proof of a COVID-19 vaccination.

- Between 20% to 30% of dry cleaners are expected to disappear as the hard-hit industry faces permanent challenges, with many employees continuing to work remotely post-pandemic.

- Hoping to increase the U.S.’s footprint in the electric vehicle market, the White House aims to increase domestic recycling of batteries to reuse lithium and other metals.

International

- Several regions in India are preparing to loosen pandemic restrictions after the nation reported 114,460 new COVID-19 infections Sunday, the lowest in two months.

- Previously coronavirus-free areas in China’s Guangzhou and Australia’s Victoria state are seeing upticks in local virus clusters, prompting swift lockdowns.

- As Indonesia experiences a rise in COVID-19 infections, authorities have called in more doctors and nurses to help overwhelmed hospitals that are nearing capacity.

- The U.S. will send 1 million doses of Johnson & Johnson’s single-shot COVID-19 vaccine to South Korea, hoping to boost the Asian nation’s low vaccination rate of just 9% of its population.

- Thailand is accelerating vaccinations to 500,000 shots per day beginning today, hoping to inoculate 70% of its population before the end of the year.

- With less than 3% of its residents vaccinated against COVID-19, a virus outbreak continues to spread in Taiwan, with 472 new infections reported Friday and 510 cases reported Saturday. The U.S. will send 750,000 vaccine doses to the nation.

- Nepal is asking its hospitals to reserve beds for children, fearing that a new surge in COVID-19 infections will hit the demographic particularly hard.

- U.K. officials are uncertain whether the nation’s latest lockdown will end as planned on June 21, citing a recent rise in COVID-19 infections from the Delta variant first identified in India. The country’s researchers say the Delta variant is roughly 40% more transmissible than the existing U.K. variant.

- Switzerland has approved use of the Pfizer/BioNTech COVID-19 vaccine for 12- to 15-years-olds, with plans to start inoculating them as soon as July. The country also plans to issue “COVID-19 certificates” starting next week to those who have been vaccinated, tested negative or recovered from the virus, hoping to make travel easier across the EU.

- The State of Mexico and Mexico City were moved to green today on the country’s COVID-19 stoplight system, the first time in over a year.

- Japan saw a record-low 840,832 newborns in 2020 in data reaching back to 1899.

- China is the first country to authorize one of its COVID-19 vaccines for children as young as three.

- Canada’s economy shed 68,000 jobs in May while the unemployment rate rose to 8.2%, as the country imposed widespread restrictions to battle a third wave of COVID-19.

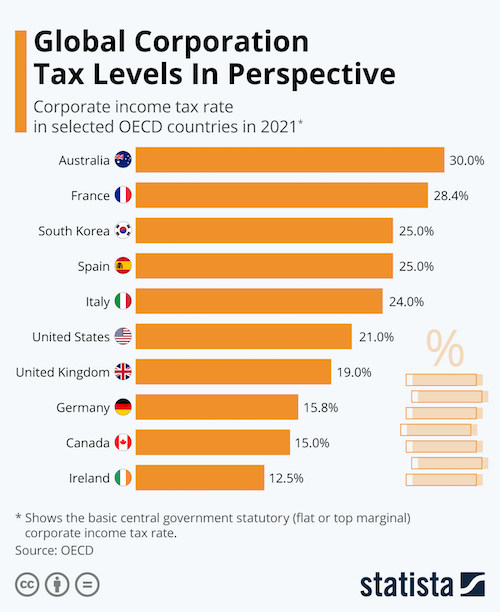

- G-7 member nations including Canada, France, Germany, Italy, Japan, the U.K. and the U.S. have agreed that international businesses should pay a minimum tax rate of at least 15% in each of the countries in which they operate.

- China’s Yuan is at its strongest point against the dollar since 2018 and approaching a record high.

- The U.K. has inked a new trade deal with Norway, Iceland and Liechtenstein, part of its efforts to forge new relationships following Brexit.

- Food supply disruptions caused by global pandemic lockdowns have boosted China’s development of high-tech greenhouse facilities to grow its own food.

- Swedish-Swiss power and automation firm ABB plans to electrify its fleet of more than 10,000 vehicles by 2030.

- China’s orders of Tesla vehicles fell by almost 50% in May as the country intensifies its scrutiny of the car maker.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.