COVID-19 Bulletin: June 9

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Outlook from Our Experts

- Automotive: Semiconductor shortages continue to cause intermittent supply disruptions throughout the global industry, overshadowing ongoing supply chain disruptions and parts and materials shortages. Automakers are adjusting to mitigate the impact, prioritizing their most profitable brands, building partially assembled inventory and delaying design changes. We expect many suppliers to shorten normal summer shutdowns to maximize production and take advantage of strong demand. We are seeing much development activity in the Automotive Electronics segment involving both established and new car companies introducing electric vehicles.

- Color and Compounding: The segment is struggling to deal with rising prices and material shortages across a range of industries. Supply chain disruptions, labor shortages and strong demand are stretching lead times for packaging and pulverizing services, exacerbating the challenges for compounders. We are seeing more inquiries from compounders for sustainable solutions.

- Electrical and Electronics: E&E segments are experiencing strong demand, with digital device makers benefitting from back-to-office preparations by businesses and stimulus spending by consumers. Electrical equipment manufacturers are seeing strong demand from a boom in commercial and residential construction, shifts to alternate energy and vehicle electrification. Public infrastructure investment is expected to further accelerate demand.

- Healthcare: Demand for testing kits, safety supplies and hospital disposables to fight the pandemic has softened in the U.S. but remains strong internationally. Some manufacturing of disposables has been permanently reshored to the U.S. domestically. OEMs are resuming development activity on traditional medical equipment and devices, with a focus on remote and digitized healthcare. We expect demand for medical equipment and supplies to strengthen as consumers resume health maintenance visits deferred during the pandemic. There is a strong focus on supply chain security with an emphasis on balancing foreign and domestic supply chains.

- Packaging: Force majeures and supply constraints for PE and PP are impacting both flexible and rigid packaging markets, where demand remains strong. Many manufacturers are exploring alternative products and supply sources to help meet demand. Consumer product manufacturers are hungry for sustainable packaging solutions.

- Rotational Molding: Demand for rotational molded parts remains strong in recreation, sanitation and storage tank markets. Consolidation trends continue among proprietary molders seeking to gain scale and efficiencies. The rotational molding market space is challenged with material shortages and rising prices. Lead times have been extended from service providers such as grinders and bulk truck shippers. Many molders and service providers are struggling to hire employees to address capacity constraints and increased demand.

- Sustainability: Demand for sustainable solutions is rapidly increasing, with market pull driven by major OEMs and manufacturers across virtually all industries. At the same time, demand for quality recycle and sustainable products far exceeds current supply. Our Sustainability team is busy vetting new non-wellhead suppliers and testing new products while advising clients on the range of sustainable solutions available, from product redesign to downgauging to materials alternatives.

- Wire & Cable: The outlook for Wire & Cable is promising. Power cable volume should exceed 2019 levels due to increased construction spending, power grid upgrades, facility upgrades and renewable energy investments. Despite near-term disruption from computer chip shortages, aggressive growth of hybrid and electric vehicles will drive strong long-term growth for Automotive cables; electric vehicles require twice the cables per unit compared with conventional vehicles along with remote and at-home charging stations. Remote work and increased home entertainment will be permanent vestiges of the pandemic and will continue to drive high single-digit growth for Optical and Telecom cable. We expect Telecom to be the most robust W&C segment longer term due to infrastructure stimulus, rural connectivity projects and the 5G transition.

- International: Supply chains remain chaotic in international markets, with shipping and container capacities strained. A surge in coronavirus infections and associated lockdowns in Asia has crimped the economic recovery in the region, softening resin demand and pricing. Freight rates from Asia to the Americas are as high as $12,500/container for June shipments. Demand in Latin America is softening as converters react to high prices and draw down inventories hoping to buy future replacement stock at lower prices, despite looming uncertainty about an expected active hurricane season. Social unrest in Colombia has disrupted operations at the port of Buenaventura, a major South America transshipment center, disrupting both North and South trade lanes and aggravating congestion in Asia Pacific routes. The recovery in Europe remains on track, with Middle East producers targeting European resin demand with aggressive offers.

- 3D Printing: Materials and supply chain shortages have prompted many manufacturers to explore 3D printing as an alternative for small- and medium-lot manufacturing. We are seeing strong demand for printed parts from clients considering adoption of 3D printing or seeking to supplement their internal manufacturing. We also are witnessing increasing investments in materials technology tailored to industrial applications, which we continue to vet to maintain the broadest line card in the industry. Of special note, breakthroughs in PP for additive manufacturing are permitting manufacturing that is competitive with injection molding in many applications.

Supply

- The WTI briefly inched back above $70/bbl this morning, but by mid-day was down 0.6% to $69.60/bbl, while Brent was 0.3% lower at $71.96/bbl and natural gas was up 0.2% at $3.13/MMBtu.

- U.S. crude oil exports topped 3.2 million bpd in April, up from 2.6 million bpd in March and the highest level so far this year.

- With results still being calculated, analysts expect OPEC losses last year to far exceed the previous record of $1 trillion in lost revenue accrued during the 2015 oil crisis.

- Oil tankers off Europe’s North Sea have been holding 6 million barrels of crude for weeks, signaling weak demand, especially from Asia.

- Independence Energy and Contango Oil & Gas Company announced plans to merge in a $5.7 billion all-stock deal.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Roughly 72% of Western U.S. land is covered in severe, extreme or exceptional drought, as the region experiences record-setting dryness that could prompt more wildfires than last year.

- General Motors is yanking the automatic start/stop feature on some of its most popular models due to a lack of semiconductor chips.

- Car production in Brazil has plateaued at 200,000 per month due to the chip shortage, which is expected to persist into 2022.

- Taiwan’s mayor says it is too soon to tell if the island’s major chip companies will be impacted from a recent increase in COVID-19 infections.

- Congestion at South China ports is worsening as ports in Yantian, Shekou and Nansha all report delays, with multiple shipping lines blaming COVID-19 for the backups.

- Overwhelming consumer demand for goods is having a polarizing effect on container rates, pushing freight income per TEU to new records while causing liners to lose effective capacity due to congestion.

- China’s producer inflation grew at the fastest pace in 13 years in May, bolstering fears about rising commodity costs. The surge was driven by significant price hikes in crude oil, iron ore and non-ferrous metals.

- The Senate passed a $250 billion bill to improve U.S. industrial competitiveness with China.

- Ongoing supply chain issues last quarter have prompted brands such as Levi Strauss, Lands’ End and PVH to boost their dependence on expedited freight to make sure their products remain in stock.

- Southeast Europe is experiencing a boom in new logistics and warehousing investments.

- Hapag-Lloyd has converted its 15,000-TEU Brussels Express vessel to run on LNG, the first large container ship to make the switch.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. reported a daily average of just under 14,500 new COVID-19 infections over the past week as daily case counts declined by over 5% in 44 states. The country reported 15,150 new COVID-19 cases and 380 deaths Tuesday.

- Health officials are concerned over lagging vaccination efforts in the South, saying roughly 15 states in the nation are at risk of a virus surge this summer.

- The Delta variant of COVID-19 first found in India now accounts for 6% of cases in the U.S. and up to 18% of cases in some Western states.

- Amid decreasing vaccine demand, unused shots are piling up in states across the country, with Ohio planning to scrap up to 200,000 expired doses of Johnson & Johnson’s COVID-19 vaccine.

- The White House is urging state governors to work with the FDA to extend the shelf life of Johnson & Johnson’s single-shot COVID-19 vaccine as millions of unused doses near their expiration date.

- The latest CDC study shows that the Pfizer/BioNTech and Moderna COVID-19 vaccines reduce infection risk by 91%.

- The CDC eased travel recommendations for more than 110 countries and territories, a move that could pave the way for airlines and other nations to update their restrictions as well.

- Vermont, the top-rated U.S. state in all CDC categories for COVID-19 data, is a mere few thousand vaccine doses away from completely reopening.

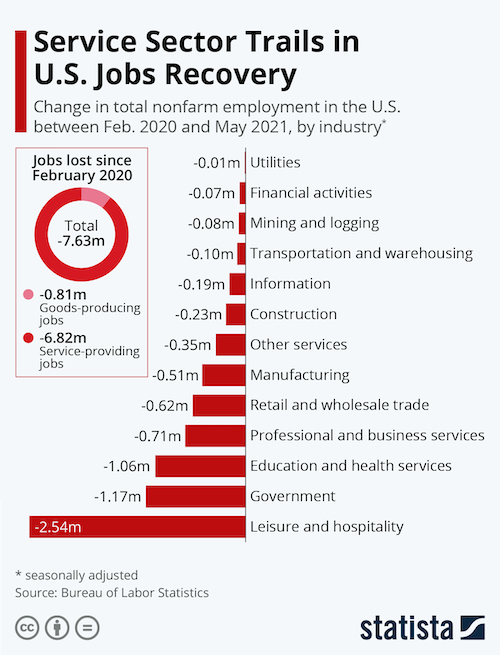

- Despite rising employment in the U.S., service sectors continue to lag in the recovery…

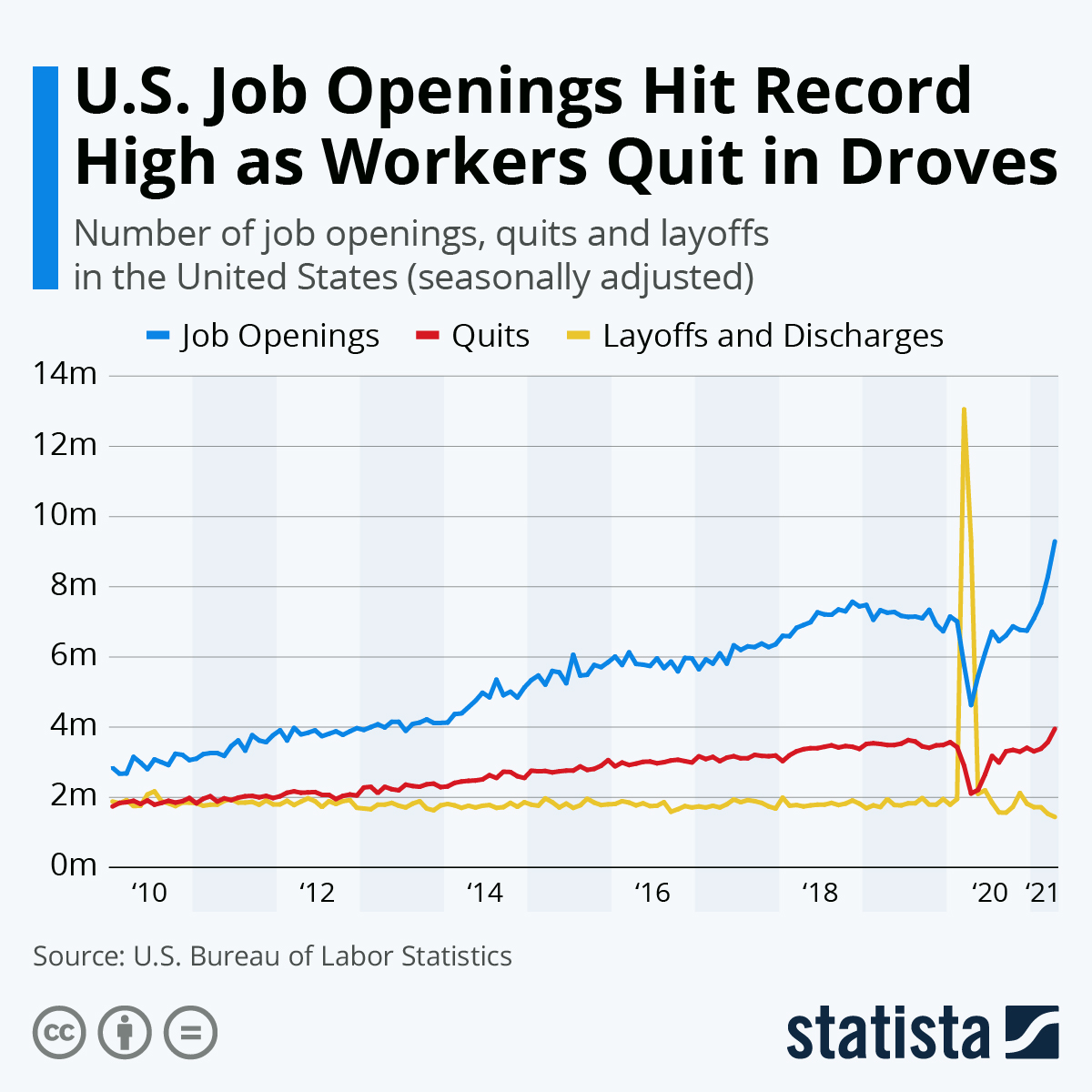

…with employees showing a growing willingness to change jobs.

- The U.S. trade deficit fell by 8.2% to $68.9 billion, its first retreat this year on higher exports and lower imports.

- Over 20% of retail space on Chicago’s Magnificent Mile is vacant, with sales tax revenues from the corridor plunging to $60 million last year from $150 million in 2019.

- Boeing is seeing its strongest commercial aircraft orders since 2018, with the company increasing its sales lead over Airbus in May with 73 orders.

- Ford Motors unveiled its new compact Maverick pickup truck yesterday, the first of its kind to be made with a hybrid engine, with plans to go on sale in the fall for around $20,000.

- With the building sector accounting for at least 40% of the world’s carbon dioxide emissions, new buildings are implementing “low-energy” design methods.

- Pivet, a smartphone accessory manufacturer, has introduced a new case that can biodegrade within two years.

- San Francisco-based waste company Brightmark is investing $680 million to build a major chemical recycling facility in Georgia.

- Much-hyped and financially troubled electric-truck startup Lordstown Motors indicated it might shut down this year without producing a single vehicle for commercial use.

International

- India recorded 92,596 COVID-19 infections yesterday, the first daily case count below 100,000 since April 6.

- The U.K. reported 6,048 new COVID-19 infections Tuesday as the country rushes to speed up vaccinations to prevent another surge.

- The Delta variant of COVID-19 first found in India is now Singapore’s dominant strain.

- Intensive-care unit occupancy in Malaysia is still over 100% despite a recent dip in COVID-19 infections.

- Melbourne, Australia, will exit a strict lockdown after containing a recent small outbreak of COVID-19.

- The International Olympic Committee is adamant about holding the Tokyo games this summer, even if Japan is still under a state of emergency. Separately, Japan will issue COVID-19 vaccination certificates to its citizens this summer, allowing them to travel abroad.

- Portugal announced plans to allow vaccinated travelers from the U.S. into the country this summer, hoping to provide a lifeline to the country’s tourism industry.

- More than 20 million people have been vaccinated against COVID-19 per day in China for the past week, shattering world records.

- The World Bank opposes waiving intellectual property rights for COVID-19 vaccines, saying it would hinder pharmaceutical innovation.

- Pfizer will enroll up to 4,500 children from multiple countries to begin testing its COVID-19 vaccine in children under 12-years-old.

- Amsterdam’s Westerdok canal has devised a “Bubble Barrier” mechanism to trap 86% of plastic waste from flowing into the country’s rivers.

Our Operations

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- International: Director of Business Development Tracy Coifman.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Debbie Prenatt.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.