COVID-19 Bulletin: June 10

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- WTI futures fell slightly yesterday while Brent stayed flat, despite a larger-than-expected inventory draw last week amid news that OPEC will not rush the easing of its pandemic-induced production caps.

- Crude futures were up in mid-day trading today, with the WTI 0.4% higher at $70.27/bbl and Brent up 0.4% at $72.51/bbl. Natural gas was up 0.6% at $3.15/MMBtu.

- The developer of the Keystone XL Pipeline has abandoned the partially-completed project, ending a years-long effort to transport more Canadian crude to the U.S.

- Pipeline leaks have caused a nearly 20% drop in Libya’s crude oil production over the past several days.

- Multiple renewable energy projects totaling 15 gigawatts are under construction in Texas, more than double the amount from three years ago.

- Analysts and investors expect Exxon Mobil to take several years to overhaul its spending and strategy after the company lost a quarter of its board seats to activist investors pushing for greater investments in lower-carbon fuels.

- Following last month’s court order that Royal Dutch Shell speed up its plans to cut emissions, the company could be forced to dramatically shrink its oil and gas business even as it appeals the order.

- Facing investor pressure to lower their environmental impact, Canada’s oil sands producers are forming an alliance to help reach net-zero greenhouse gas emissions from their operations by 2050.

- Chinese economic regulators significantly shrank the scope of the nation’s carbon-trading system that is set to launch later this month.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Nearly 2 million people in the San Francisco Bay Area have been placed under emergency water shortage restrictions amid growing drought conditions.

- Ripple effects from congestion at southern Chinese ports could spread throughout the global supply chain.

- Volkswagen is forecasting a 10% shortage in semiconductor chips over the long-term, as building up new production capacity takes up to two years.

- The White House has issued a series of recommendations on where and how the U.S. can expand domestic production of semiconductors, large-capacity batteries, critical minerals and pharmaceuticals.

- U.S. retail ports are expected to report another record month for May, with analysts forecasting a 51% increase in volume from the same time last year to 2.3 million TEUs.

- Orders for new container ships in the first five months of 2021 were nearly double the orders for both 2019 and 2020 combined, an expansion complicated by rising steel and commodity prices.

- U.S. wholesale inventories rose 0.8% in April as businesses replenished their shelves to handle a surge in demand fueled by expectations for strong growth this quarter.

- Global food import costs are expected to rise 12% to a record $1.7 trillion this year from last year, a reflection of rising commodity prices and higher demand.

- Starbucks has been forced to modify menu items as it experiences shortages of cups, cup stoppers and ingredients due to supply chain disruptions.

- U.S. truck maker Navistar revealed that it was the victim of a cyberattack last month that extracted confidential information but did not shut down operations.

- The EU and U.S. plan to meet in July to ease trade tensions and end reciprocal tariffs between the countries.

- The EU is exploring new rules that would impose tariffs based on the carbon emissions required to make imported goods, unsettling its major trading partners.

- UPS is mulling creating a same-day delivery option on some shipments, a bid to keep up with other gig-economy companies while accommodating sustained e-commerce demand.

- Kroger has begun delivering groceries by drone in southern Ohio.

- Demand for warehouses larger than 1 million square feet is surging in the U.K.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. reported 20,779 new COVID-19 infections and 432 deaths yesterday.

- Low immunization rates in some parts of the country are leading to increased hospitalization rates.

- Seattle became the first major American city to fully vaccinate more than 70% of residents.

- Researchers and epidemiologists in the U.S. are concerned about an increasing number of states slowing the pace of reporting their pandemic data, saying that the lack of up-to-date information could make it difficult to track new outbreaks.

- The White House announced plans to send 500 million Pfizer/BioNTech COVID-19 doses to 100 countries over the next year to help lessen the inoculation gap between wealthier and poorer nations, and will also work with the EU, Canada, Mexico and the U.K. on a plan to safely restart international travel.

- The U.S. eased its travel advisory for Mexico from Level 4, “Do Not Travel,” to Level 3, “Reconsider Travel.”

- The U.S. has agreed to purchase an initial batch of Merck’s unapproved oral antiviral COVID-19 treatment in case the drug is shown to work and is authorized for use.

- Last year was the deadliest in U.S. history, with fatality rates for heart disease and diabetes seeing major upticks as people deferred health maintenance.

- Most hospitals in Washington, D.C. and Maryland will require their employees to be vaccinated against COVID-19.

- Consumer prices in May were 0.6% higher over April and 5% year-over-year, with a third of the increase attributable to higher used vehicle prices.

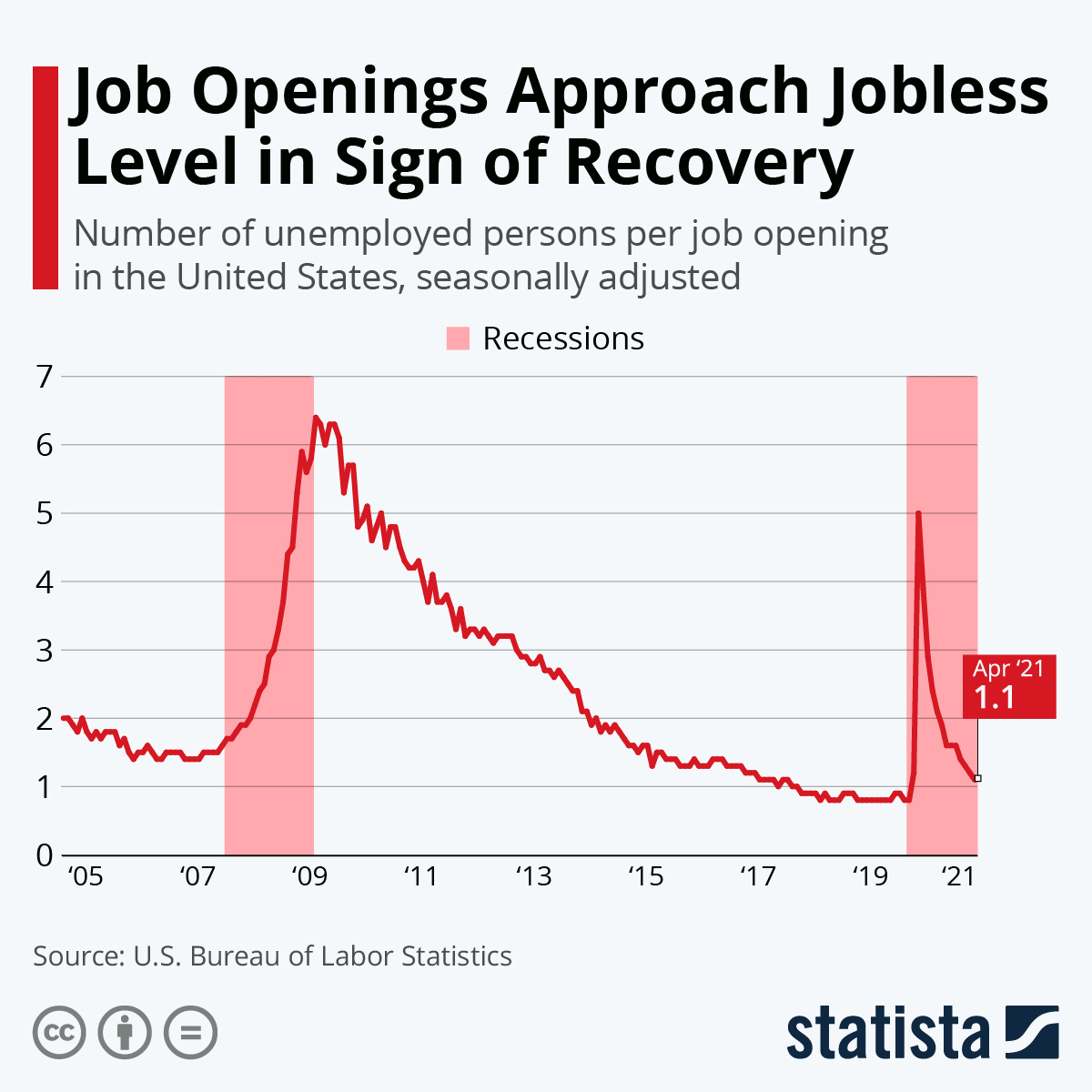

- First-time unemployment claims fell for the sixth consecutive week in May, down 9,000 from April to 376,000.

- E-commerce accounted for 13.6% of total retail sales in the first quarter of 2021, the same share as during the peak holiday season in the fourth quarter of 2020, a reflection of the permanent shift among consumers to online shopping.

- As prices for clothing, groceries and other retail goods rise, companies are disguising the practice with euphemisms to obscure the cost increases.

- U.S. bank deposits have continued to surge in 2021, rising by $41 billion to $17.1 trillion, nearly four times the average pace of the past 20 years, driving some banks to ask deposit-heavy corporate customers to invest their cash in their businesses or move it.

- New York is expecting its property tax revenue to drop by $1.6 billion in the coming fiscal year, highlighting the pandemic’s toll on the city’s commercial real estate.

- United Airlines is in talks to buy at least 100 Boeing 737 MAX jets as part of a broader fleet revamp, along with several dozen larger aircraft from Airbus.

- Airlines face a new barrier to restoring full flights: new FAA regulations forcing them to increase weight estimates for passengers by 5-10% as Americans grow heavier.

- General Motors announced it would back the White House’s plan to reduce overall vehicle emissions to fight climate change but asked the administration to give automakers greater flexibility to hit carbon reduction targets by 2026.

- A new survey is showing that the majority of U.S. consumers believe that paper-based packaging is better for the environment compared to other packaging materials, while 49% say they would buy more from brands and retailers that remove plastic from their packaging.

International

- India recorded 93,463 new COVID-19 infections yesterday. After one state dramatically revised its data, the nation also posted 6,148 virus deaths in the past 24 hours, shattering world records and confirming suspicions that the country’s overall death toll is substantially higher than reported.

- The virulent Delta COVID-19 strain first discovered in India has spread to at least 60 countries.

- Indonesia ramped up its vaccination efforts yesterday, hoping to administer 1 million shots per day by July.

- New COVID-19 outbreaks in China have prompted some neighborhoods to instate new lockdown and quarantine measures to help limit the spread.

- Japan is mulling vaccinating its 70,000 volunteers for the Tokyo Olympics and Paralympics against COVID-19, while media members, who will be placed under a mandatory quarantine upon entering the country, will be tracked by a global positioning system to help keep the event safe.

- The U.K. reported 7,540 new COVID-19 cases Wednesday, the highest increase in daily infections since February despite roughly 80% of the nation’s population having antibodies to the virus.

- Scotland will extend its COVID-19 restrictions by an additional six months after the country reported a 50% rise in cases over the past week.

- France reopened its restaurants, bars and cafes Wednesday, ending a seven-month shutdown. The nation also lifted COVID-19 travel restrictions on vaccinated travelers from 38 countries, including the U.S.

- Despite easing COVID-19 restrictions through most of the country, Portugal will continue to enforce stricter rules in Lisbon, its capital, over a recent rise in infections.

- An increase in vaccine efforts along with seasonal factors has helped slow Denmark’s COVID-19 infection numbers for the first time in nearly four months.

- Russia reported over 10,000 new COVID-19 infections on Wednesday, its highest in more than three months.

- Despite a nationwide vaccination rate over 50%, daily COVID-19 infections in Mongolia have risen more than 70% over the last two weeks, raising questions about the efficacy of the predominant China-made Sinopharm.

- After only reporting a small number of COVID-19 infections and deaths for the bulk of the pandemic, Haiti is experiencing its first serious wave of the virus, while the country has yet to inoculate a single person with a vaccine dose.

- A new study of the AstraZeneca COVID-19 vaccine shows that those who received the jab had a slightly increased risk of developing a bleeding disorder or other rare blood problems.

- A new global livability index names Auckland, New Zealand’s capital, as the world’s most livable city due in part to the strength of its response to the COVID-19 pandemic.

- The U.K. announced it will ban the sale of halogen light bulbs starting in September as the country works towards using LED-only lighting beginning in 2023.

- A new report from the International Energy Agency shows that investments in clean energy in poorer nations will need to increase to more than $1 trillion a year by 2030, up from $150 million last year, in order to meet global climate goals.

- More than 100 countries are pushing for an international plastics treaty to standardize definitions and standards for plastic recycling.

Our Operations

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- International: Director of Business Development Tracy Coifman.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Debbie Prenatt.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.