COVID-19 Bulletin: June 11

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose Thursday amid improved U.S. unemployment claims, with Brent crude hitting $72.77/bbl, its highest level since May 2019, while WTI hit $70.47/bbl, its highest level since October 2018.

- Energy futures were higher in mid-day trading today, with the WTI up 0.7% at $70.75/bbl, Brent up 0.3% at $72.70/bbl and natural gas 4.1% higher at $3.28/MMBtu.

- OPEC’s crude oil production increased by 390,000 bpd in May to 25.5 million bpd as it continued easing production cuts.

- Exxon Mobil struck oil at the Stabroek Block offshore Guyana, further adding to the country’s status as a hot spot for oil exploration.

- An improved economic recovery is helping China overtake Japan as the world’s largest importer of LNG, ahead of analysts’ projections for the switch to occur in 2022.

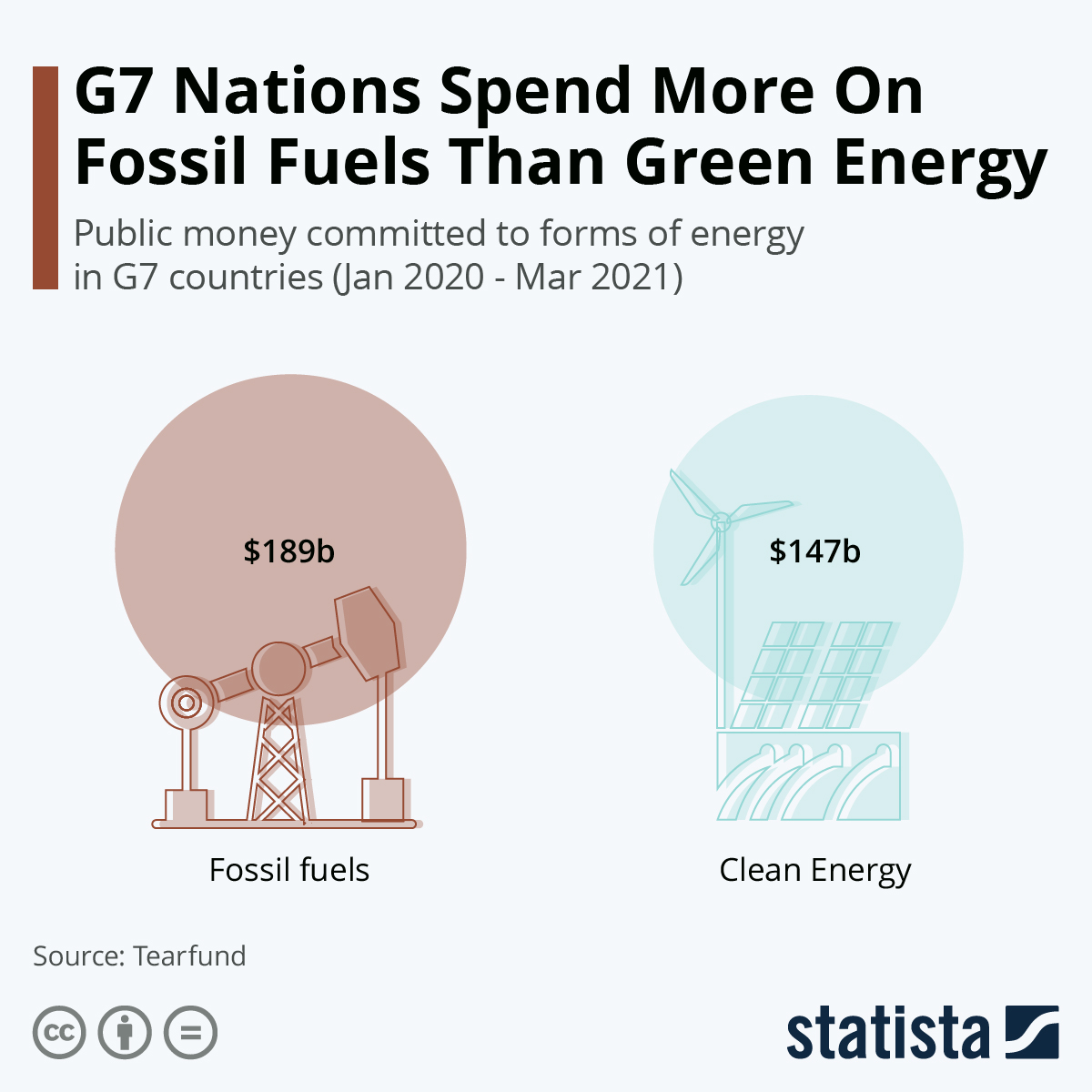

- G7 nations’ public investments in fossil fuels remain significantly larger than those into renewables…

- Russia’s Nord Stream 2 gas pipeline, which runs under the Baltic Sea, is set to fill its first line with natural gas and begin deliveries to Germany.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- The Southwestern U.S. is bracing for the first extreme heat wave of the year next week, with large portions of Arizona, California and Nevada already under warnings for temperatures above 120 degrees Fahrenheit.

- “Exceptional” drought conditions have grown to cover 26% of the West, including roughly 143 million people. Arizona’s Lake Mead, the U.S.’s largest water reservoir, has dropped to its lowest level ever.

- Congestion at container shipping ports in southern China is worsening after the key manufacturing and exporting hub of Guangdong recorded more than 150 coronavirus cases, causing the biggest backlogs since 2019.

- The price of shipping a 40-foot container from China’s Yantian port to the U.S. West Coast has jumped to $6,341, with some ships waiting weeks to take on cargo due to congestion.

- The Port of Los Angeles became the first port in the Western Hemisphere to process 10 million TEUs over a 12-month period.

- The spending bill to bolster U.S. competitiveness passed by the Senate Tuesday includes $52 billion to support domestic semiconductor manufacturing.

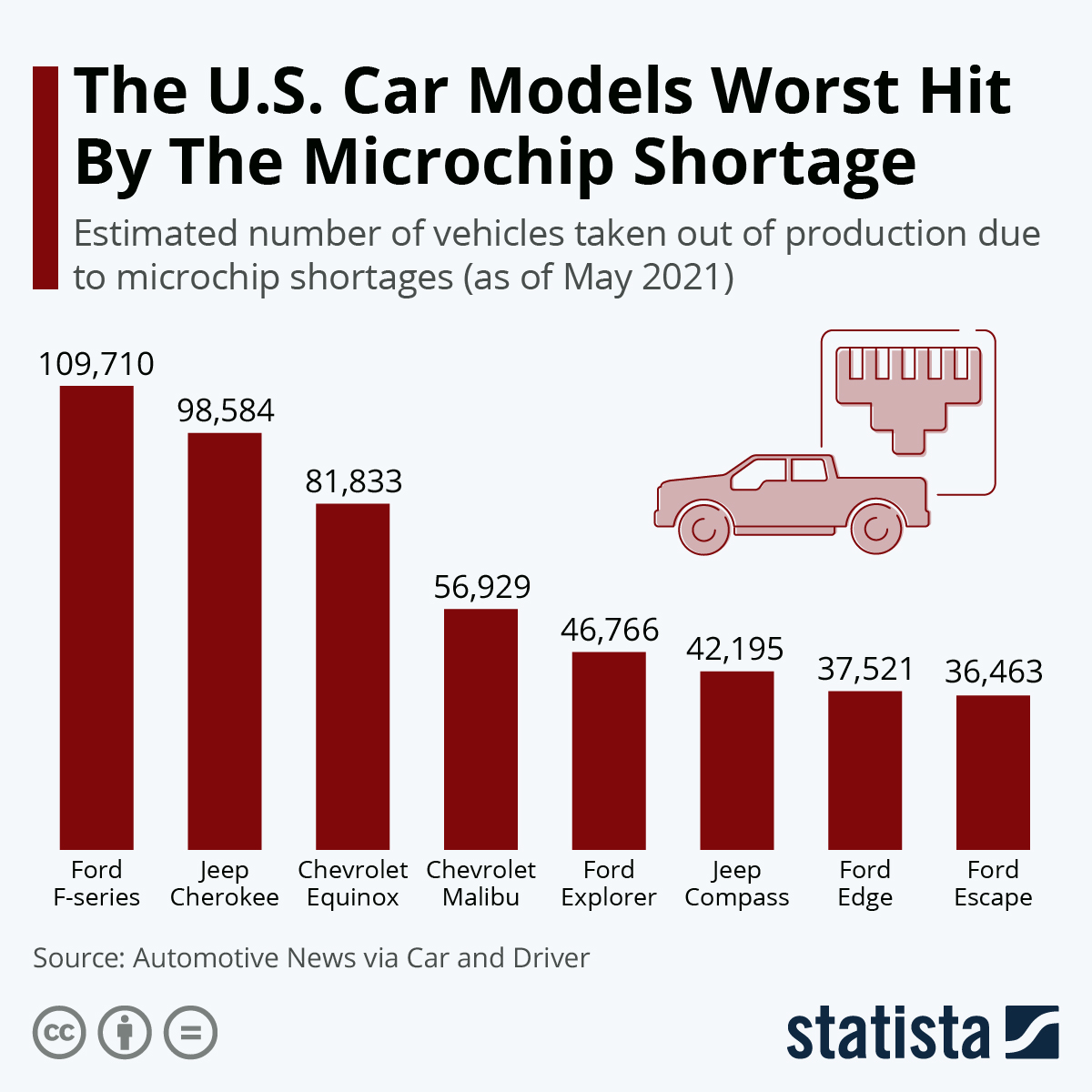

- Ford’s F-series trucks have been hit hardest by the global chip shortage…

- Germany’s Bosch has opened its own $1.2 billion chip factory in eastern Germany to help supply the growing demand for semiconductors as the company aims to rely less on third-party manufacturers.

- Air cargo volume increased by 41% year over year in May, down 4% compared to May 2019, while capacity levels were down 21% compared to the same time in 2019 but up 42% year over year.

- Steel prices in the U.S. have tripled over the past year, eclipsing gains for copper and crude oil as some mills have stopped taking spot orders.

- The China Photovoltaic Industry Association says that Chinese solar power companies should stop hoarding polysilicon to prevent an imbalance in the supply chain that has caused the cost of the material to more than triple since the end of last year.

- Corn supplies are at their tightest levels since 2013, with prices recently reaching an eight-year high, further stoking fears of inflation.

- The U.S. and the U.K. signed a new Atlantic Charter yesterday committing to their collective security and free trade.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 14,417 new COVID-19 infections in the U.S. yesterday, as the nation’s pandemic death toll approaches 600,000.

- Despite U.S. deaths from COVID-19 declining by 90% since January, hundreds of people are still dying from the virus daily, with roughly half of the deaths reported in individuals aged 50- to 74-years old.

- Fully vaccinated Californians will be able to forgo mask-wearing in most situations starting June 15 alongside a broader reopening of the state’s economy.

- The White House is cutting its $4 billion commitment to the COVAX vaccine-sharing program, instead pledging $3.5 billion to pay for 500 million doses of Pfizer’s COVID-19 vaccine to be shipped to lower-income nations. G7 countries as a whole are pledging to distribute at least 1 billion doses to low-income countries this year.

- The White House lifted capacity limits for the number of on-site workers at federal agencies, a relaxing of earlier guidance that limited capacity to 25%.

- The FDA extended the shelf life of Johnson & Johnson’s single-shot COVID-19 vaccine by 50%, now saying the doses can be kept in a refrigerator for four-and-a-half months.

- Moderna has filed for U.S. authorization to administer its COVID-19 vaccine to adolescents aged 12- to 17-years-old.

- Heart inflammation in younger people who received a second COVID-19 vaccine dose is higher than expected, prompting a CDC review of the issue next week. Some people have also developed diabetes after having COVID-19.

- A growing body of data suggests up to 20% of children who contract COVID-19 suffer from “long haul” symptoms of the virus. A top FDA adviser is urging COVID-19 vaccinations for children, estimating that 300 have died so far from the virus.

- Two people have tested positive for COVID-19 on North America’s first cruise since March of last year, despite all passengers being required to be fully vaccinated.

- Goldman Sachs, Carlyle, Warburg Pincus and Solomon are among Wall Street firms requiring employees to be vaccinated against COVID-19 as they return to offices.

- Facebook announced that it will expand remote work eligibility to employees at all levels of the company beyond a planned return-to-office date in October.

- With the world’s 500 wealthiest individuals worth a collective $8.4 trillion, up more than 40% since the global pandemic started, G7 leaders are expected to endorse a new plan to significantly increase corporate tax rates.

International

- Globally, nearly 1.9 million people have perished from COVID-19 this year, more than in all of 2020.

- India reported 92,291 new COVID-19 infections and 7,374 deaths yesterday.

- Malaysia is extending its national lockdown until June 28.

- Singapore will ease some pandemic restrictions amid a decline in COVID-19 cases.

- Australia and Singapore are working together to set up a quarantine-free travel corridor, while a planned travel bubble between Singapore and Hong Kong remains on hold until July.

- Amid a decline in COVID-19 cases, Japan will lift its state of emergency in three prefectures starting Sunday.

- With only 2.8% of its population vaccinated against COVID-19, the African continent recorded 94,000 new infections last week as fears spread over a growing outbreak. Nearly all African countries are expected to miss a goal of vaccinating 10% of their populations by September.

- South Africa recorded 8,881 new COVID-19 infections yesterday, its biggest jump since January.

- The U.K. is likely to delay its final stage of ending pandemic restrictions on June 21 amid rising cases of the Delta COVID-19 strain.

- Swedish officials issued public warnings as the country experiences rising cases of the Delta COVID-19 variant.

- As COVID-19 cases continue to spread, Chile is down to just 30 available ICU beds for a population of 8 million.

- COVID-19 cases in Iran crossed the 3 million mark Thursday, with the country reporting 12,398 new infections over the last 24 hours.

- The EU has opted not to buy an additional 100 million doses of Johnson & Johnson’s single-shot COVID-19 vaccine and may donate another 100 million doses to other countries, highlighting a drop in confidence in the vaccine due to safety and supply concerns.

- The European Parliament is pressing the EU to reverse its position and support a temporary lifting of intellectual property protections for COVID-19 vaccines that would allow more manufacturers to produce shots.

- Germany began its rollout of digital COVID-19 vaccination passes yesterday.

- After rising for 13 consecutive months, China’s auto sales fell 3% in May from the same time last year.

- Unilever plans to introduce its first paper-based bottle for laundry detergent next year in Brazil.

- Chinese e-commerce company Alibaba announced plans to develop self-driving trucks with its logistics arm Cainiao.

- Despite its plan to develop the world’s first zero-emission commercial aircraft by 2035, Airbus said that most of its fleet will be using traditional jet engines until at least 2050.

- Ahead of a global climate summit this November, the Alliance of CEO Climate Leaders has published an open letter to government leaders calling for more ambitious greenhouse gas emissions targets and ending support for fossil fuels.

- The European Commission announced plans to establish a “climate action social fund” if moves to introduce carbon pricing on road transportation and buildings takes hold, hoping to provide financial help against rising fuel and heating bills.

Our Operations

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- International: Director of Business Development Tracy Coifman.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Debbie Prenatt.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.