COVID-19 Bulletin: June 14

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices closed at multi-year highs on Friday, with Brent crude up 1% on the week to $72.69/bbl and WTI up 1.9% to $70.91/bbl.

- Energy prices were higher in mid-day trading today, with the WTI up 0.7% at $71.43/bbl and Brent up 0.8% at $73.28/bbl. Natural gas was flat at $3.30/MMBtu.

- The number of active oil and gas rigs rose to 461 last week, the highest level since April 2020 and the sixth gain in seven weeks.

- Labor negotiations have resumed with 650 striking workers at Exxon Mobil’s third-largest U.S. refinery, picking up after six weeks as managers and replacement workers continue to operate the 369,024 bpd site.

- Canada’s Newfoundland and Labrador province has declined to purchase an equity stake in the Terra Nova offshore oilfield, putting thousands of oil jobs at risk.

- Over 1,000 union workers in Norway are threatening to go on strike, potentially affecting oil projects but not expecting to drop the country’s output in the near future. The nation will continue extracting oil and gas past 2050, the government said, despite greater investments in clean energy.

- Citing environmental damage, Canada will not approve any new thermal coal mining projects or expand existing mines.

- The U.S. will auction off eight leases for offshore wind development between New York and New Jersey, part of plans to double the nation’s offshore wind capacity by 2030 and decarbonize the power sector by 2035.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Weather alerts are in effect for roughly 36 million people in the southwestern U.S. with record-breaking heat expected this week while power prices spiked to their highest levels since February’s winter storm.

- With roughly 85% of California under extreme drought, utility company PG&E is expecting to cut power to customers more frequently than last year to reduce wildfire risk.

- A growing COVID-19 spike in Taiwan is threatening further disruption to the global supply of semiconductors, with one company putting more than 2,000 workers in quarantine over an outbreak among 200 staff members. Risks to the supply chain are heightened due to the region’s low vaccination rates.

- Hyundai will shut down an Alabama plant for a week due to the chip shortage.

- Higher prices and shipping volumes for semiconductor chips has boosted distributors’ bottom lines by 10% or more.

- Class 8 truck orders fell 32% from April to May largely due to production delays caused by supply chain disruptions. Orders were still nearly 2.5 times higher in May than the same time last year.

- The latest in supply chain news stemming from surging consumer demand:

- Consumers are waiting longer for deliveries, as even companies with strong, largely domestic supply chains are struggling with goods and labor shortages.

- Companies that stretched payments to preserve cash during the pandemic are continuing the practice, stretching days to pay to 58 in the first quarter, versus 55 in the first quarter of 2020.

- Hampered by global shipping disruptions, Home Depot has contracted a container ship solely dedicated to transporting its goods.

- Facing higher costs for a wide range of ingredients, J.M. Smucker is considering a second price hike on nearly 90% of its goods.

- Two shipping carriers will skip calls at Singapore’s port into July as congestion at southern Chinese ports related to recent COVID-19 outbreaks ripples through the region.

- The U.S. is partnering with Norway and Denmark to develop zero-emissions fuel options for ships to help decarbonize the industry by 2050.

- Germany passed a law that could cost companies up to 2% of global revenue for violating regulations to prevent human rights and environmental abuses in their global supply chains.

- Royal Dutch Shell is mulling selling its shares of Permian Basin shale assets as the company faces continued pressure to cut its carbon emissions.

- J.B. Hunt will test self-driving freight trucks hauling goods on I-45 between Houston and Fort Worth, Texas.

- Connecticut lawmakers passed a miles tax for heavy trucks starting in 2023, a measure proponents say will ensure electric vehicles — which do not pay fuel taxes — contribute their fair share to support the state’s highway trust fund.

- The U.S. Department of Agriculture will invest over $4 billion through the Build Back Better initiative, hoping to improve supply chains, aid food production and processing, improve food distribution and storage and ensure equitable market access for food producers.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

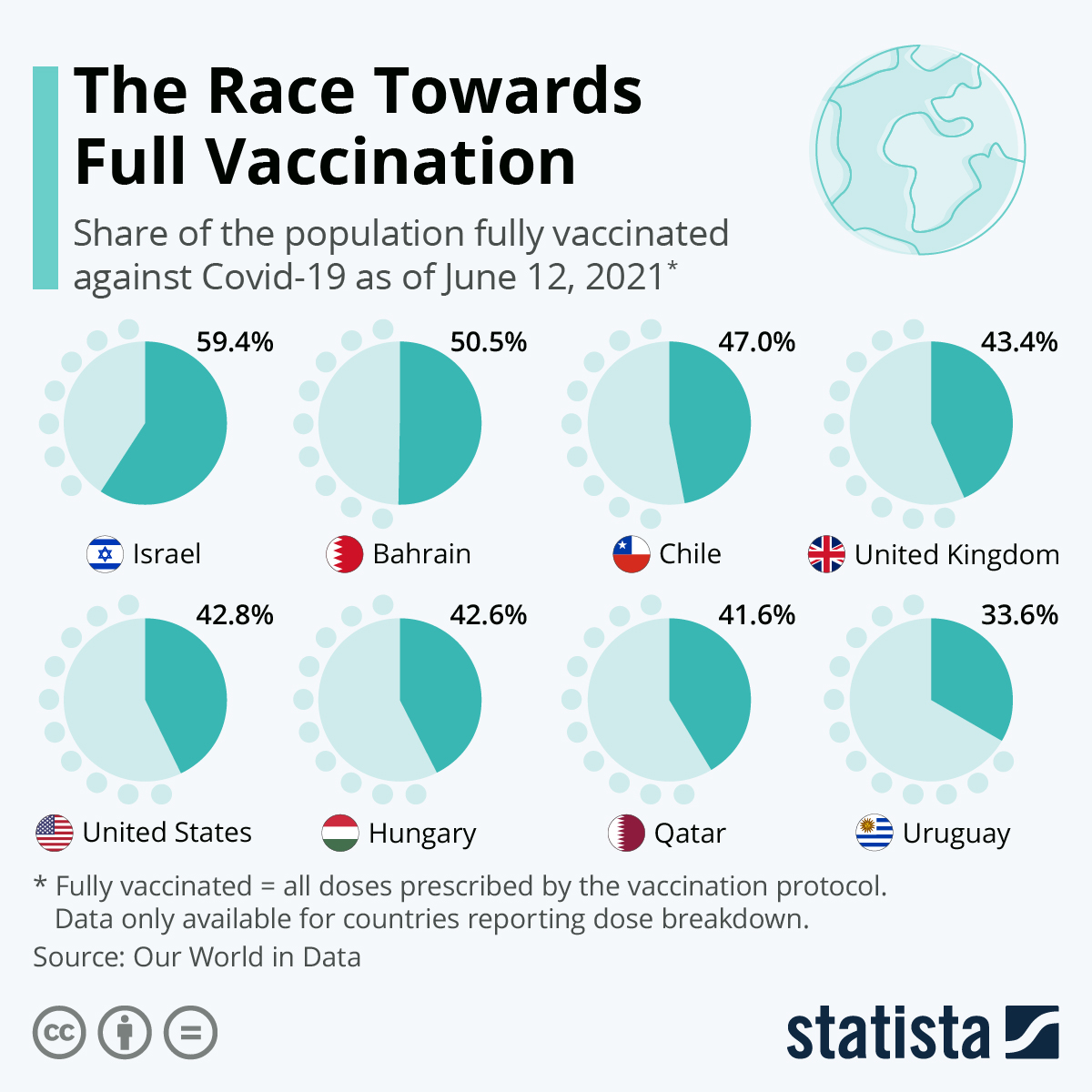

- COVID-19 infections and deaths continue to decline in the U.S., with just 8,207 new cases and 192 deaths on Saturday and 4,575 cases and 105 deaths reported Sunday. More than 309 million vaccine doses have been administered with 43.9% of the population fully vaccinated.

- Vaccination rates are lagging the national average in Alabama, Arkansas, Missouri, Nevada, Texas, Utah and Wyoming. In Hawaii, the seven-day average infection rate is on the rise.

- Roughly 2% of COVID-19 tests in the U.S. are registering positive, the lowest rate since the pandemic began.

- Illinois lifted nearly all its COVID-19 restrictions Friday as Chicago became the largest city in the country to fully reopen.

- Novavax said its two-shot COVID-19 vaccine, which can be stored at normal refrigerator temperatures, was more than 90% effective in Phase 3 trials.

- A federal judge upheld a Houston hospital’s vaccination mandate for employees in a closely watched lawsuit.

- A faster-than-expected economic recovery has strengthened payroll taxes that support the Social Security system, beating analysts’ odds who expected the program to falter from the pandemic.

- U.S. jobless claims of 376,000 last week marked a pandemic low for the second consecutive week, as companies laid off fewer workers amid a broadening economic rebound.

- The share of employees quitting their jobs is at a 20-year high, with 2.6% of U.S. workers leaving jobs in April, up from 1.6% a year earlier.

- Border restrictions and visa backlogs are hampering U.S. businesses that depend on foreign professional workers, forcing amusement park Cedar Point to close two days a week and causing Lenox’s Danish CEO to resign.

- The University of Michigan’s consumer sentiment index rose to 86.4 in the first half of June from 82.9 in May, reflecting reduced fears over inflation and increased household optimism.

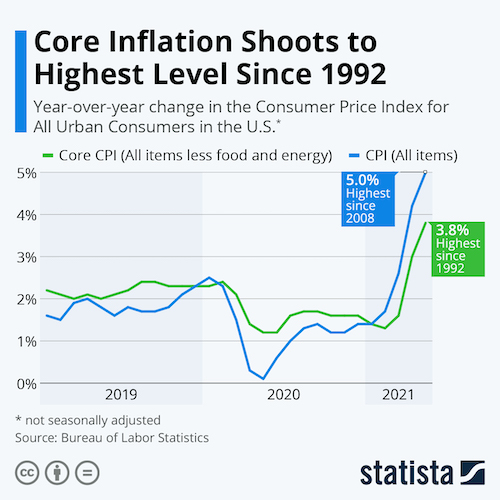

- U.S. inflation recently reached its highest rate in 13 years:

- Mortgage applications fell 3.1% last week from the prior week, while refinancing hit its lowest level since the start of last year, suggesting a cooling in the housing market.

- The White House is extending the deadline beyond June 30 for hospitals to spend $187 billion in pandemic emergency funding.

- The TSA screened over 2 million travelers on Friday, the most since early March 2020.

- With COVID-19 vaccines fueling a global travel rebound, Boeing has managed to sell all but 10 of its 737 MAX jets, a striking turnaround from the 100 aircraft in storage last July.

- Spending by older consumers is expected to surge post pandemic, fueled by an expected doubling of those over age 65, pent-up demand for healthcare and leisure activities and growing comfort with online commerce.

- The hospitality industry is eyeing permanent changes to its business model as it emerges from the pandemic and encounters labor shortages, potentially scrapping daily room cleanings and free breakfasts to reduce labor costs.

- Mall operator Washington Prime Group, which owns 102 properties, filed for bankruptcy protection yesterday, citing pandemic pressures for its failure.

- A legal battle is growing between southern port states and the federal government over COVID-19 vaccination requirements in the cruise industry.

- U.S. state and national parks are brimming with visitors as people leave their homes for the first time in more than a year, with several filling capacity before 9 a.m. each day.

International

- After facing the world’s most intense COVID-19 surge in recent months, India is building up oxygen plants and new virus treatment centers in preparation for future outbreaks. On Sunday, the nation reported 70,421 new cases and 3,921 deaths.

- Great Britain’s Prime Minister is expected to announce today an extension of lockdown restrictions beyond their scheduled July 21 expiration as the virulent Delta strain of COVID-19 raises infection rates to their highest levels since February.

- Russia reported 12,505 new COVID-19 infections Friday, the largest increase since February.

- Germany will end its general travel warning for most countries starting July 1 and may free communities to set local mask-wearing mandates.

- Switzerland and Iceland are set to ease most pandemic restrictions by the end of June.

- Nearly 2.4 billion vaccine doses have been administered globally.

- The EU does not expect Johnson & Johnson to meet its goal of delivering 55 million COVID-19 vaccine doses by the end of June over fears of a contaminated batch from a U.S. factory.

- The EU’s drug regulator has added another rare blood condition as a possible side effect of AstraZeneca’s COVID-19 vaccine while also examining cases of heart inflammation associated with other COVID-19 shots.

- Slow vaccine rollouts and economic reopenings in Europe have forced several governments to continue pandemic assistance beyond that of the U.S. and China. The bloc’s central bank announced plans to keep its aggressive monetary stimulus in place, including interest rates of minus 0.5%.

- G7 nations could reallocate up to $100 billion from the International Monetary Foundation to speed up pandemic aid distribution to low-income countries.

Our Operations

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- International: Director of Business Development Tracy Coifman.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Debbie Prenatt.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.