COVID-19 Bulletin: June 18

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices dropped roughly 1.5% from multi-year highs yesterday. Futures were up in mid-day trading, with WTI 0.8% higher at $71.59/bbl and Brent 0.6% higher at $73.49/bbl. Natural gas was 1% lower at $3.22/MMBtu.

- Saudi Arabian crude exports fell to 5.4 million bpd in April, a 10-month low, with output edging down.

- China’s 10.2-gigawatt Wudongde hydropower plant began operating Wednesday, cementing the nation’s status as the world’s top hydro producer.

- Shell is partnering with Norwegian utilities BKK and Lyse to bid on developing two of the country’s planned offshore wind projects.

- LNG’s share of total gas consumption in India could rise to 70% from 50% over the next 10 years, the country’s top gas importer said.

- The U.K. will soon begin importing low-carbon power from Norway along the world’s longest underwater power cable.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- A weather system that could strengthen into tropical storm Claudette is expected to bring heavy rains and flooding to Mississippi, Alabama, Georgia and the Florida panhandle this weekend. The governor of Louisiana declared a state of emergency, freeing up the use of state resources to respond to weather events.

- Officials in Texas and California continue to urge residents to conserve energy this week as an intense heat wave strains the states’ power systems. California’s governor declared a state of emergency, which will ease restrictions on backup generators, auxiliary engines and other carbon-powered electricity.

- A Montana wildfire exploded to 21,000 acres yesterday, as temperatures reached triple digits across much of the West and setting several one-day records, Montana’s Robertson Draw wildfire has consumed over 20,000 acres.

- The intense Western heat wave has started to move east, with new advisories being issued in parts of Kansas, Nebraska, Iowa and Missouri.

- A power failure in Puerto Rico left more than 330,000 people in the dark yesterday, the territory’s second massive outage in just a few days.

- A tropical depression in the west-central Gulf could drop heavy rain on Central and southern Mexico starting tonight.

- Unprecedented losses in water reservoirs across the drought-stricken West are threatening hydroelectric capacity and could lead to electricity shortages this summer, officials warn.

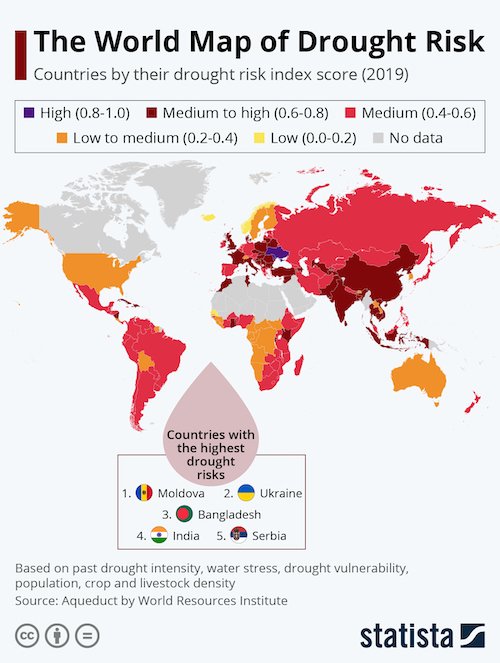

- Drought conditions in the West may be a global anomaly:

- It could take months for cargo bottlenecks at southern Chinese ports to clear as ripple effects from Yantian Port’s partial shutdown tie up trade routes and push freight prices even higher.

- North America’s share of global exports is expected to remain unchanged at 14% by 2025, while Asia’s share could grow two percentage points to 38%.

- Cardboard prices continue to rise despite higher production in the first half of 2021, threatening companies that rely on packaging to deliver goods ordered online.

- Aiming to reduce the carbon intensity of shipping by 40% by 2030, the International Maritime Organization adopted further measures to increase vessel efficiency, set to take effect in 2023.

- A biofuel-powered tanker voyage cut emissions by up to 90% from normal levels, a Netherlands-based carrier said.

- Our logistics team reports that bulk trucking firms are refusing to book long-haul, out of network loads due to extreme capacity constraints.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. reported 10,399 new COVID-19 cases and 281 deaths on Thursday, as the country’s seven-day average for daily fatalities dropped to a 15-month low of 286.

- With COVID-19 cases dropping, New York City plans to relocate 8,000 homeless people out of hotel rooms and back into shelters in July so that the hotels can reopen to the general public.

- Texas’s Dallas County may offer cash incentives to encourage vaccinations, hoping to increase its vaccination percentage by 10% this summer.

- Illinois is reporting at least 64 cases of the highly transmissible Delta variant of COVID-19.

- A recent study of Moderna’s COVID-19 vaccine found that one shot was 78% effective in preventing new infections one week after the shot and 95% effective two weeks after.

- Almost 90% of teachers in the nation’s largest teacher union have received a COVID-19 vaccine, while 76% say they are prepared to return to full-time in-person instruction.

- With U.S. tourism beginning to rebound from the pandemic, hosts of short-term rental properties are seeing a huge increase in demand, with occupancy jumping to 61.6% in April, the highest level for that month in industry history.

- The CDC changed its guidance on cruise ships from recommending that all travelers avoid cruises to just those who are unvaccinated against COVID-19.

- The U.S. will invest $3.2 billion into the Antiviral Program for Pandemics aimed at preventing future outbreaks of COVID-19 and other viruses.

- A growing trend among U.S. startups is to keep employees working from home while offering more company trips to far-flung, exotic locations.

- The shift to remote work paired with low interest rates drove a housing boom during the pandemic, with mortgage originations rising by more than 67% and refinancings by more than 150% in 2020.

- Bank of America and Blackrock will recall all vaccinated workers to the office by the end of July or just after Labor Day.

- The Dow Jones Industrial Average is headed for its worst week since January, dropping roughly 2% from Monday after the Federal Reserve indicated a potential interest rate hike by 2023.

- The Supreme Court upheld the Affordable Care Act yesterday, preserving health care for over 30 million Americans, while the just-enacted American Rescue Plan will increase ACA subsidies and expand eligibility to 3 million uninsured.

- After losing significant revenue in 2020, U.S. drugstore giants CVS and Walgreens capitalized on a growing number of Americans returning to the stores to receive COVID-19 vaccines.

- U.S. cattle ranchers and investors are pouring millions into new beef plants to help the meatpacking industry build capacity after several pandemic-induced shutdowns.

- Despite costing more up front, electric vehicles are cheaper to maintain than their gasoline counterparts, with costs averaging 6.1 cents per mile compared to 10.1 cents per mile for traditional vehicles.

- Daimler will move up its launch of electric vehicles by one year while quickening a phase-out of fossil-fuel vehicles.

- Engine maker Rolls Royce is increasing spending on decarbonization research to reach net-zero emissions by 2050.

International

- India reported 62,480 new COVID-19 cases and 1,587 deaths on Thursday.

- Indonesia reported 12,624 new COVID-19 cases Thursday, the most since January, as more than 350 doctors and medical workers were infected after receiving China’s Sinovac vaccine.

- Japan is planning to end a state of emergency for Tokyo, Osaka and seven other prefectures on June 20, a month before the Olympics begin, and plans to issue vaccine passports by the end of July to allow for overseas travel.

- Over 80% of Beijing’s adult population has been fully vaccinated against COVID-19 as China nears administering 1 billion total doses.

- Hong Kong is shortening quarantine protocols for fully vaccinated travelers.

- The U.K. reported more than 11,000 new COVID-19 cases on Thursday, with infection rates rising across all age groups. New infections and hospitalizations with the Delta variant nearly doubled this past week, including at least 84 fully vaccinated people.

- Portugal reported 1,350 new COVID-19 cases Thursday, the most since February.

- A potentially new COVID-19 variant is spreading across Moscow, as the city’s mayor expects infections on Friday to top 9,000, a record.

- The Delta variant of COVID-19 is expected to become Germany’s dominant virus strain by fall.

- France dropped its outdoor mask mandate as COVID-19 hospitalizations drop.

- COVID-19 cases in Afghanistan surged 2,400% the over the past month.

- South Africa reported 13,246 new COVID-19 infections on Wednesday, the most since January.

- The World Health Organization is urging African governments to take swift action to stop a third wave of COVID-19 as the continent’s total infections surpass 5 million.

- Colombia is facing a continued surge of COVID-19, reporting record one-day deaths earlier this week.

- Costa Rica will decline a delivery of China’s Sinovac COVID-19 vaccine over efficacy concerns.

- China could do away with all childbirth restrictions by 2025 as the country seeks to address a historic downturn of its population.

- Globally, central banks are being forced to raise interest rates as a result of higher inflation in the U.S., a potential threat to economic rebounds in lower-income nations.

- Led by Europe, investment in global equity funds jumped to the highest in three weeks amid an improved global economic outlook.

Our Operations

- It is with heavy hearts that we report that Luis Fernando Castro, our sales representative in Colombia, succumbed to COVID-19 yesterday. It is a loss to M. Holland and the industry. Our thoughts and prayers are with his family.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.