COVID-19 Bulletin: June 23

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Energy futures were higher in mid-day trading, with WTI up 1% to $73.61/bbl and Brent up 1.2% to $75.67/bbl. Natural gas was 2.4% higher at $3.33/MMBtu.

- As oil prices continue to rise due to increased demand, OPEC+ is mulling a further easing of oil output cuts for August beyond the 2.1 million bpd it plans on returning to the market through July.

- Iran began production at a new, large reservoir in the Gulf, hoping to produce up to 10,000 bpd of crude oil from eight wells.

- BP plans to continue producing hydrocarbons for several decades, taking advantage of higher oil prices to raise more cash for building its low-carbon business.

- A large oil refinery in the U.S. Virgin Islands will shut down permanently following a number of catastrophic safety errors affecting the regional population and environment.

- Renewable energy costs are falling below the cost of coal energy, which could displace up to 800 gigawatts of global coal-fired power capacity, reducing CO2 emissions by 3 gigatonnes and saving up to $32 billion per year.

- U.S. coal stockpiles dropped by 16 million tons between December 2020 and February 2021, the largest inventory decline since July 2011.

- India’s largest utility company NTPC, which generates most of its power from coal, increased its renewable energy goal to have up to 60 gigawatts of installed renewable energy capacity by 2032.

- South Korea’s three largest non-life insurers say they will no longer provide coverage for new coal power projects amid pressure from a network of civic groups pushing for a complete coal phase-out in the country by 2030.

- Amazon has committed to buying 1.5 gigawatts of renewable production capacity, part of a push to cover all the company’s energy needs by 2025.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Another intense heat wave will move through the Pacific Northwest and western U.S. late this week into early next, with several cities already issuing heat advisories in expectation of record-setting temperatures.

- The National Weather Service issued flash flood watches for parts of Louisiana, Mississippi, Alabama, Georgia and Florida, saying that torrential downpours could last through Friday or later, causing potential delays for truckers along the Gulf Coast.

- Hot and dry conditions have sparked a number of wildfires across the western U.S., with firefighters battling blazes in Arizona, California, Oregon, Utah and New Mexico.

- Semiconductor chip lead times increased by seven days in May to a total of 18 weeks, more than four weeks longer than the previous peak lead time in 2018.

- Mazda is suspending production at a Japanese factory for 10 days in July due to the global chip shortage.

- Chipmaking giant TSMC will prioritize orders from Apple and car manufacturers in the third quarter, followed by orders from PC and server manufacturers.

- A new tech alliance between the U.S. and Europe is looking to boost mutual production of semiconductor chips and provide common standards for new technologies such as artificial intelligence.

- Port congestion and equipment shortages continue to affect the shipping industry, with vessels arriving from Asia facing delays of 20 days or more.

- The Port of Los Angeles handled more than 1 million container units last month, a record for any port in the Western Hemisphere.

- China’s Yantian port will restore full operations Thursday after a month of disruptions caused by a COVID-19 outbreak. Global delays caused by recent congestion at the port could take more than 80 days to clear.

- Hapag-Lloyd will reroute container vessels to skip Europe’s heavily congested Port of Rotterdam for seven weeks.

- The White House is mulling a ban on polysilicon from Xinjiang, China, due to concerns over the region’s treatment of labor.

- German shipper Hapag-Lloyd placed an order for six ultra-large container ships from South Korea with dual fuel engines that can operate on liquefied natural gas.

- FedEx bowed to pressure from big box retailers and reversed a decision to suspend LTL delivery service to some 1,400 customers in a move to ease congestion at its terminals.

- South Africa will overhaul its port system after a global performance report ranked its ports among the worst in the world.

- The cost of warehouse rentals in the U.S. is surging, with industrial rents up 9.7% in the first five months of 2021 compared to the same period last year.

- Grocer chain Albertsons will offer grocery delivery from 2,000 of its stores through DoorDash as the company pulls back its own delivery fleet in favor of third-party providers.

- Our logistics team reports that bulk trucking firms are often declining to book long-haul, out of network loads due to extreme capacity constraints.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The White House conceded it will miss its goal of inoculating 70% of the U.S. population by July 4, but more than 70% of people aged 30 or older have received at least one vaccine dose, a milestone. The nation reported 10,940 new COVID-19 cases and 370 deaths Tuesday.

- The highly transmissible Delta variant of COVID-19 now accounts for 14% of all new infections in the U.S., with officials calling it the greatest threat to the country’s vaccination efforts.

- New Jersey recorded its first case of the COVID-19 Delta variant, while Michigan reported 25 cases of the strain, a day before lifting its mask mandate and dropping many pandemic restrictions.

- Maryland reported zero new COVID-19 deaths for the second consecutive day Monday, with over 73% of its population having received at least one vaccine dose.

- West Virginia dropped its mask mandate with 61.5% of residents receiving at least one shot of a COVID-19 vaccine.

- United Airlines will require crew members to be vaccinated against COVID-19 for flights to high-infection nations including India, Brazil, Chile, Peru, Colombia and Argentina.

- Frontier Airlines has begun charging a “Covid Recovery” surcharge to offset pandemic related costs.

- Morgan Stanley is requiring vaccines for employees returning to its New York offices, forcing the unvaccinated to continue working remotely.

- Households are 31% more likely to test positive for COVID-19 within two weeks of someone having a birthday.

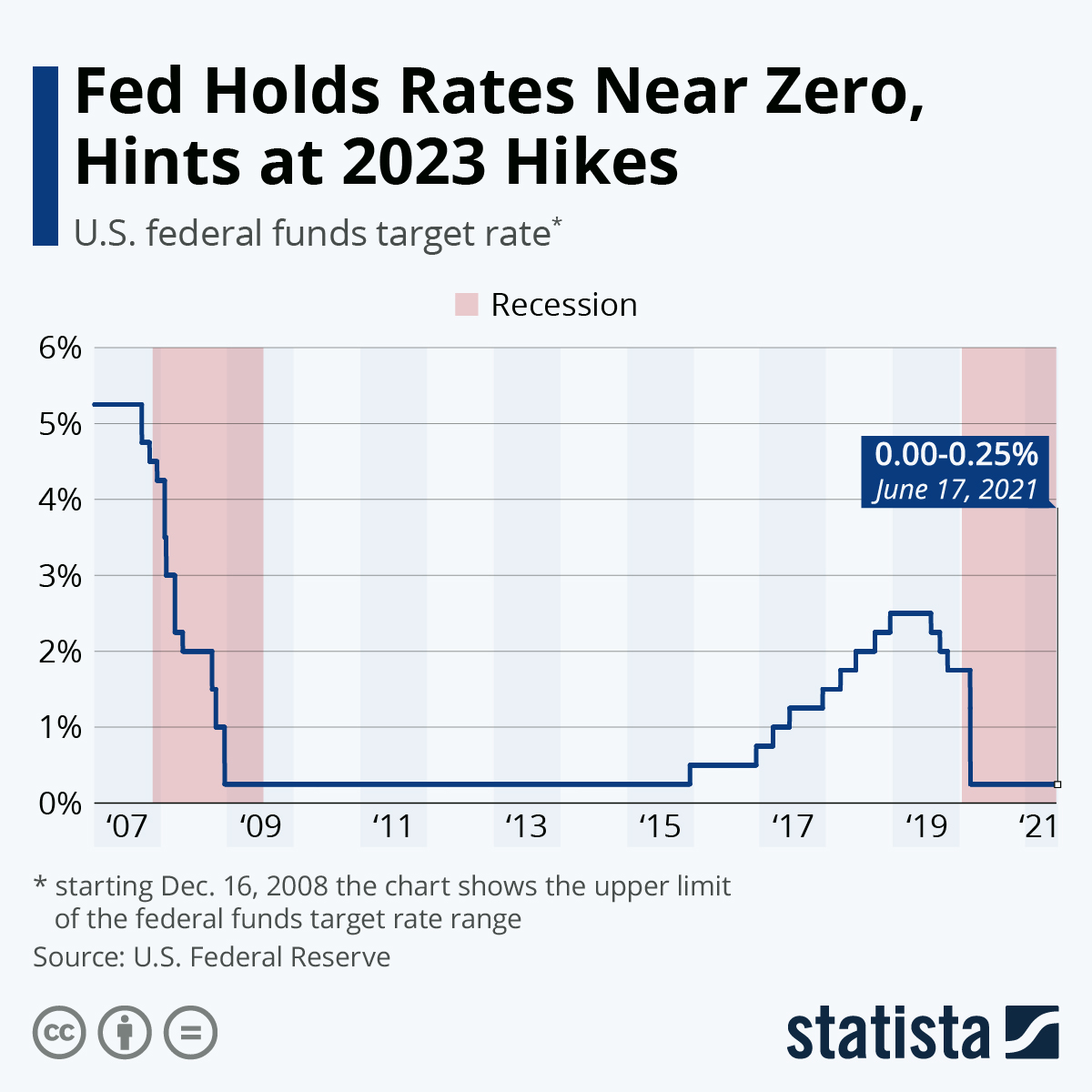

- The Federal Reserve chair downplayed the threat of rising U.S. inflation in comments before a House subcommittee Tuesday, saying the high numbers are mostly caused by products facing pandemic-induced supply shortages that will fade over time.

- Higher inflation is expected to prompt an increase in U.S. interest rates by 2023:

- U.S. births fell about 4% last year to 3.6 million, the largest decline since 1973.

- The FAA will provide the top 10 U.S. commercial airports with nearly $2.4 billion in pandemic relief funds as part of $8 billion in aid approved to help airports, restaurants and shops recover from the pandemic.

- U.S. home sales fell for the fourth consecutive month in May, dropping by 0.9% to an annual rate of 5.8 million units, while the median home price hit a record $350,000, a 23.6% increase from the same time last year.

- A trial cruise of 600 Royal Caribbean employee volunteers was the first cruise in 15 months to set sail from the U.S. Sunday.

- Carnival Corporation, the world’s largest cruise line, aims to reduce its carbon rate 40% by 2030 compared to 2008 levels and achieve net carbon-neutral operations by 2050.

- Fast-food chains are scaling back their low-cost value menus in favor of more expensive combination meals, hoping to boost sales and offset rising food costs.

- Target aims to cut its virgin plastics usage by 20% in house-brand product packaging by 2025.

- Stanford researchers have developed a new manufacturing technique that produces flexible, atomically thin transistors smaller than 100 nanometers in length, hoping to pave the way for “flextronics” capable of being implanted in the human body.

- Ernst & Young bumped up forecasts for electric vehicle supremacy, saying the vehicles will outsell traditional gasoline-powered cars in the world’s largest auto markets by 2033.

- Amazon will purchase 1,000 autonomous driving systems from self-driving truck technology startup Plus, as the company focuses more on AI-related technology.

- Electric vehicle maker Lucid Motors will unveil a new mid-sized sedan with a battery range of 517 miles on a single charge this week.

- Oshkosh Defense announced plans to build new vehicles for USPS in South Carolina with plans to hire more than 1,000 new employees.

- California-based startup Canoo announced plans to open a new facility in Oklahoma to begin building electric vehicles in 2023.

International

- India reported 50,848 new COVID-19 cases Wednesday and 1,358 deaths as health officials identified a “Delta plus” variant in nearly two dozen cases across three states. The nation vaccinated roughly 8.6 million people Monday.

- COVID-19 infections in Russia have doubled in the past month as the nation surpassed the U.K. with the most virus deaths in Europe.

- Infections with the highly transmissible Delta variant of COVID-19 have more than doubled in some European countries in recent weeks.

- Low-income Asian and African nations are facing shortages of COVAX-supplied COVID-19 vaccines, with many unsure when they will receive more shots.

- China plans to keep pandemic border restrictions in place for at least another year amid a rise in new COVID-19 variants. Flights from Shenzhen, facing a COVID-19 outbreak, and Beijing have been suspended at least until July 1.

- Scotland reported a 40% increase in COVID-19 infections over the past week.

- COVID-19 infections are surging in South Africa, with one province recording a 70% rise in cases over the past week.

- Cluster outbreaks of COVID-19 in Sydney, Australia, and New Zealand have prompted increased pandemic restrictions.

- A new study of AstraZeneca’s COVID-19 vaccine shows the shot is effective against the Delta and Kappa variants of the virus.

- Pakistan and the Philippines are threatening harsh penalties for those who refuse to get a COVID-19 vaccine.

- Switzerland is encouraging children as young as 12 to get vaccinated against COVID-19.

- Thailand is reducing quarantine requirements for incoming travelers, a bid to revive its previously thriving tourism industry:

- The U.K. will ease quarantine restrictions for fully vaccinated citizens who return from abroad starting in August.

- The euro area private-sector economy is expanding at its fastest pace in 15 years as more countries loosen restrictions, with confidence in the economic outlook rising to the highest level since 2012.

- A strengthening labor market and a faster-than-expected economic recovery is helping the U.K. lower its deficit, which stood at $33.8 billion in May compared to nearly $61 billion from the same time last year.

- Hungary became the first European nation to raise its base interest rate in response to rising post-pandemic prices.

- Europe’s central bank ordered banks to create a 10-year plan addressing environmental, social and governance risks to their bottom lines, a move to prepare for climate-related financial disaster.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.