COVID-19 Bulletin: March 7

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- The second full week of war in Eastern Europe began with heavy hits to global energy markets:

- Crude prices rose 25% last week with U.S. benchmark WTI closing Friday at $118.11/bbl, the highest level since 2008.

- In mid-morning trading today, Brent futures were up 4.4% at $119.20/bbl, WTI was up 3.7% at $122.50/bbl and U.S. natural gas was 2.4% lower at $4.90/MMBtu.

- U.S. administration officials are seriously weighing a ban on Russian oil imports as talks are held to lift some sanctions on Venezuela, a potential recourse for lost Russian supplies.

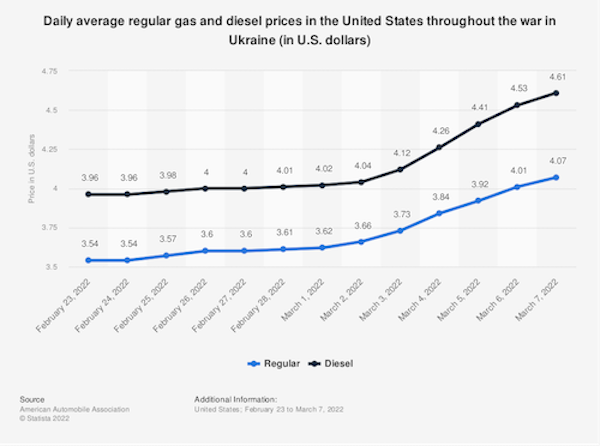

- The average U.S. gasoline price surged 11%, or 40 cents, since last week and is set to surpass 2008’s record-high of $4.11 a gallon within the coming days after hitting $4 on Sunday. Gas prices have already risen to nearly $7 a gallon in parts of Los Angeles County.

- Europe paid roughly $722 million each day to Russia last week for gas imports, three times the pre-war level, as surging energy prices caused a scramble to build new LNG projects and reduce reliance on Russian gas.

- Shell said it would donate profits on Russian oil to Ukraine following public outcry over the company’s bid on a cargo of Russian crude late last week.

- Oil major Petrobras is seeking government approval to raise wholesale fuel prices at its Brazil refineries amid a global surge in global oil prices.

- A growing number of U.S. households are investing in insulation to help cool surging energy prices, as a new forecast from the U.S. Energy Information Administration projects that heating oil expenditures will rise 43% this winter compared to last.

- International producer Neptune Energy is building two carbon capture and storage plants to trap over 9 million tonnes of CO2 per year by 2030, more than its projected emissions, the company claims.

- Honeywell is stepping up its battery storage business after landing the contract for a battery system at a 20 MW solar farm north of Albuquerque.

Supply Chain

- Logistics fallout from the Russia-Ukraine conflict is reverberating across the globe:

- Around 140 vessels — including cargo ships, oil tankers and dry bulkers — were trapped off the coast of Ukraine late last week, with at least five ships blown up in the region since Feb. 24.

- Russia has blocked more than half its aircraft fleet from flying on international routes due to the likelihood of plane detentions or seizures in foreign skies.

- FedEx upped its earlier suspension of inbound service to Russia to include all package movements, including domestic deliveries, in Russia and Belarus.

- Sanctions are disrupting deliveries of medical supplies to Eastern Europe despite global pacts that mandate the continued flow of those goods.

- The prices for nickel (+37%) and palladium (+57%) are up sharply since Jan. 1 on supply disruption from major exporter Russia. Companies warn that short supplies will deal a major blow to automotive supply chains, especially for electric vehicles.

- Similar shortages of copper and aluminum are expected to drive up construction costs in the U.S., analysts say, although temporary relief could be found in increased metals shipments from China.

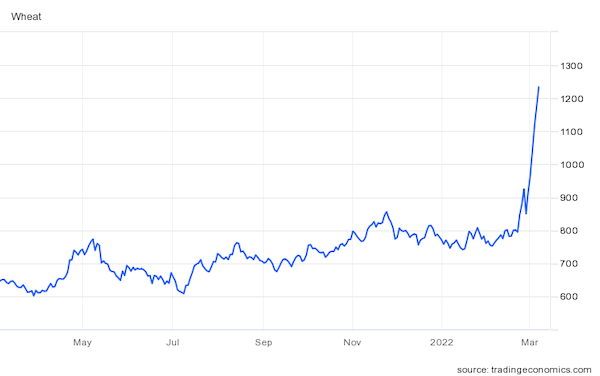

- Global food prices — already up 20.7% year over year — will likely rise after Russia’s trade ministry called for a broad suspension of fertilizer exports.

- Wheat futures in Chicago jumped by the maximum daily limit for the sixth straight session, rising 7% to $12.94 a bushel on Sunday to build on a massive 49% surge last week. Ukraine, a major exporter, said it would immediately transfer shipments to railcars after its Black Sea ports were shut down, while China said it would reduce exports after suffering a rain-delayed planting season.

- Dwell times for containers at the congested Port of Houston are up to 11 days.

- Emirati port operator DP World is expanding its inland distribution in Europe to capitalize on significantly higher intra-European trade values compared to European export values.

- High container freight rates prompted the first modification of a multi-carrying vessel into a container-carrying vessel.

- A new White House rule will require goods purchased with taxpayer money to contain 60% U.S.-made content by October, up from the current 55%, with the requirement increasing to 75% by 2029.

- Expeditors International, one of the world’s largest logistics operators, forecasts significant damage to revenue and cash flow and will delay filing its annual financial report due to a cyberattack that shut down its global networks over a week ago.

- Walmart’s third-party fulfillment business launched in 2020 saw 500% growth in merchandise volume last year, the company said.

Domestic Markets

- The U.S. reported 5,740 new COVID-19 infections and 184 virus fatalities Sunday.

- Under the CDC’s new masking guidance, 90% of Americans can now ditch face coverings, up from 70% just a week ago.

- The divide in COVID-19 vaccination rates between urban and rural populations has more than doubled since April of last year, new data shows.

- Proposed legislation would fund more research for long-COVID symptoms and assist patients in finding better treatment options.

- From the February U.S. jobs report:

- Employers added a robust 678,000 jobs, the most since July, while the unemployment rate dropped from 4% to a pandemic low of 3.8%.

- Hourly earnings remained mostly flat, translating to a pay cut when adjusting for inflation.

- More than 300,000 people joined the workforce, and the ranks of people who reported being unable to work because of COVID-19 fell by 1.8 million.

- Hotels, restaurants, amusement parks and other hospitality industries led the hiring surge.

- The U.S. has just 2.1 million jobs to go before hitting the February 2020 level of employment and recouping all positions lost in the pandemic.

- The average monthly gain for jobs in the trucking industry has been around 5,400 since the beginning of 2021, with about 119,000 jobs added since the start of the pandemic. Driver demographics are changing dramatically, with almost half of applicants under age 40 last quarter.

- More than 156,000 people became realtors in 2020 and 2021, a 60% increase from the two years prior to the pandemic.

- The average monthly payment on a 30-year mortgage is up 36% year over year to a record $1,230.

- A barometer of business activity in the Chicago area fell to an 18-month low.

- The most recent weekday passenger counts at the nation’s five largest commuter railroads ranged between 25% and 55% of pre-pandemic levels, suggesting a potential permanent shift in ridership.

- Boeing is reporting more demand for its medium-haul passenger jets and plans to boost production of its 737 narrowbody to around 47 per month by the end of 2023, almost double current levels.

International Markets

- More news related to the war in Europe:

- Russia’s stock market will remain closed through at least Tuesday, an almost two-week stretch since Feb. 24. The government began imposing restrictions on retail purchases and controls on price markups amid dwindling supplies of goods.

- A spate of payment firms suspended operations in Russia, including PayPal, American Express, Visa and Mastercard.

- Samsung, the top seller of smartphones in Russia, suspended all shipments to the nation.

- Prada, Puma, and most upscale retailers are shuttering operations in Russia.

- S&P Dow Jones upped its restrictions and will remove all Russian stocks from its standard equity indexes this week, while FTSE Russell is dropping all Russian bonds from its fixed-income indexes.

- U.S. officials say they are working on legislation that will modify Russia’s status as a favored trading partner in the World Trade Organization.

- Moody’s downgraded Russia’s credit rating to the second lowest on its ratings ladder after central bank moves increased the likelihood it would default on foreign debt.

- Economists at JPMorgan Chase expect at least a 7% contraction in Russia’s economy this year due to sanctions. The risk of a global recession is also higher, according to market analysts.

- Roughly 1.5 million people have been displaced just ten days into Russia’s invasion of Ukraine, the largest movement of people in Europe since WWII. Agreements to evacuate civilians have collapsed due to Russian aggression.

- Global COVID-19 deaths topped 6 million, with 1 million fatalities in the past 125 days.

- South Korea reported over 210,000 new COVID-19 cases Monday, its fourth straight day of virus cases topping 200,000.

- Long-protected New Zealand’s COVID-19 wave is growing, with case counts exploding from less than 1,000 per day to more than 22,000 per day in just two weeks.

- Roughly 15% of Hong Kong’s 7.4 million people have now tested positive for COVID-19, as authorities prepare for several days of strict lockdowns that will require every resident to be tested multiple times. The island’s medical resources are stretched to the brink, with ambulances taking more than a day to respond in some cases.

- China recorded 526 new COVID-19 cases Monday, its largest one-day tally since the Wuhan outbreak at the start of the pandemic over two years ago.

- Japan lifted its COVID-19 quasi-emergency protocols in 13 prefectures Monday as the country reported administering over 1 million COVID-19 booster shots per day for the first time at the end of February.

- China expects slower GDP growth of 5.5% this year as economic headwinds — notably a downturn in the nation’s property sector — gather strength.

- China’s strong export growth slowed in the first two months of 2022, rising a better-than-expected 16.3% from a year earlier but slower than its nearly 21% year-over-year increase in December.

- The European Central Bank is more likely to hold off on its first interest rate hike in a decade until the final quarter of this year due to the Russia-Ukraine crisis, even as consumer prices continue to rise, forecasters say.

- Economists predict Mexico’s inflation rate hit 7.23% in February, the first increase since November and up from 7.07% in January.

- India’s economy grew a disappointing 5.4% in the December quarter.

- British supermarket Tesco became the first major retailer to ban the sale of plastic wet wipes.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.