COVID-19 Bulletin: March 1

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Winter Storm Uri

- More than half-a-million Texans remain under boil water warnings.

- The White House enlisted the Federal Emergency Management Agency to help restore services to homes and businesses in Texas’s hardest hit areas.

- The U.S. administration will revive a $40 billion loan program for energy projects for improvements to the country’s electricity grid following this month’s widespread blackouts.

- The oldest and largest power and transmission cooperative in Texas filed for bankruptcy in the aftermath of Winter Storm Uri after receiving a $1.8 billion bill from the state’s grid operator.

- A Texas retail electricity provider that gave its customers exorbitant power bills during the energy crisis has been barred from participating in the state’s power market.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply

- Boosted by prospects for further federal stimulus, crude prices jumped higher in early trading today with the WTI up 1.0% at $62.09/bbl and Brent up 1.0% at $65.04/bbl. The natural gas price followed crude, up 0.6% at $2.79/MMBtu.

- With supermajors cutting back activity in the U.S. shale industry, obscure private producers are stepping in, with closely held players running more rigs than Chevron and Exxon for the first time in modern shale history.

- Refinery closures in the U.S. have led to a collapse in exports of lower quality oil from Europe, widening the price spread between crude and higher-sulfur fuel oil.

- India’s largest oil refinery will invest nearly $5 billion in a three-year project to expand processing capacity by two-thirds to up to 500,000 bpd.

- Russian oil production dropped by 77,000 bpd in February compared to the month prior, a result of unusually cold Siberian weather that has reduced pipeline flows from some oil fields.

- OPEC+ members complied at 103% with the cartel’s oil output cuts in January, a higher-than-expected level.

- Saudi Aramco is asking banks for a year’s extension on a $10 billion loan it raised last May, suggesting rebounding crude prices are not prompting the oil giant to reduce debt in the near term.

- Mexican gas provider Cenegas has resumed gas service to Braskem Idesa after Braskem S.A. entered a memorandum of understanding with Pemex, Mexico’s state-run oil company, regarding potential amendments to an ethane supply contract that has been in dispute.

- Pemex lost $23 billion in 2020, a 38% increase compared with its prior-year deficit.

Supply Chain

- Air freight loads from China to Europe remained far higher than normal during the Lunar New Year, indicating elevated consumer demand as Chinese factories stayed open.

- Congested ports are delaying a return of shipping containers to China, delaying the nation’s exports and raising shipping costs, which have risen four-fold in the past year.

- With containership charter rates reaching a 13-year high, ship owners are eager to lock in prices on three- and five-year deals with carriers.

- The pandemic’s shift toward food delivery and pickup has pressured suppliers to innovate takeout packaging, straining supply chains with increased competition for raw materials.

- The freight trucking industry is set to undergo a shift toward digitization over the next decade, potentially requiring employees to learn new skills including crowdsourced delivery, truck platooning, predictive maintenance, smart cargo and automated driver assistance.

- Container line CMA CGM will receive the first delivery of six new LNG-powered ships to serve the China-Los Angeles route.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

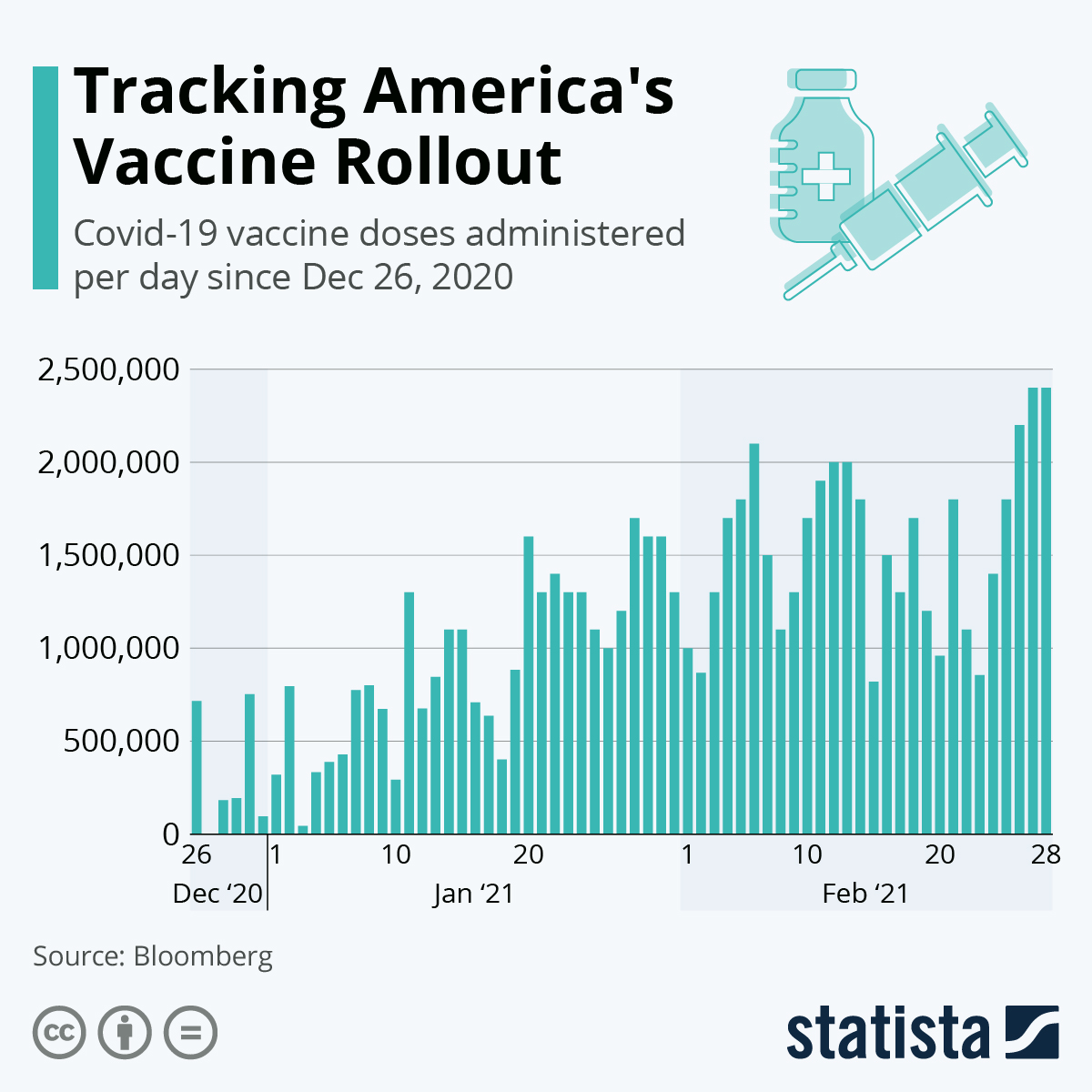

- There were 51,204 new COVID-19 infections recorded in the U.S. yesterday and 1,097 deaths; 7.6% of the population has now been vaccinated.

- Recent drops in COVID-19 cases, hospitalizations and deaths have left some U.S. health officials optimistic, while others warn that case counts are still high and public immunity is not widespread enough to drop safety precautions.

- February’s COVID-19 case count of 2.17 million was the third highest of the pandemic, but down by two-thirds from the peak levels of December and January. A recent plateauing of infection rates has experts concerned that new variants may be taking hold in the U.S.

- Johnson & Johnson’s COVID-19 vaccine was cleared for use in the U.S., providing a third shot for Americans and filling logistical holes in the nation’s immunization campaign. Compared with other approved alternatives, the vaccine requires only one dose instead of two, is as effective in staving off infection and serious symptoms and can be stored in ordinary refrigerators.

- With three shots now available, public health experts are warning people not to “shop” for any one vaccine over the others as supplies remain tight.

- Nearly half of Americans over age 65 have received the first dose of a COVID-19 vaccine. Increased COVID-19 vaccinations among the elderly has led to a steep decline in nursing home deaths in the U.S. since early January.

- Equity in the U.S.’s COVID-19 vaccine rollout is lacking, with significantly lower proportions of Black and Latino populations having received shots than other groups. The problem is compounded by the lack of primary-care doctors or doctor-affiliated hospitals for many people in medically underserved communities.

- In a recent U.S. Census Bureau survey, half of Black adults under age 40 indicated they “definitely” or “probably” won’t get a vaccine, twice the percentage of white and Hispanic respondents reluctant about inoculations.

- JBS SA, the world’s largest meatpacker, is offering free COVID-19 vaccines to 8,500 of its U.S. employees.

- COVID-19 testing has fallen 30% in recent weeks, hampered by a variety of factors including cold weather and pandemic fatigue.

- The House of Representatives passed a further $1.9 trillion pandemic-relief plan, which includes $1,400 direct checks to many Americans alongside enhanced jobless benefits and funding for vaccines and testing. The bill now heads to the Senate.

- American household income rose 10% in January from the previous month, the second-largest monthly increase on record spurred by the federal government’s $900 billion stimulus program and direct checks.

- Many U.S. companies are expecting another year of mostly remote work, bringing continued questions about compensation and benefits, including whether to reduce salaries of employees who have left high-cost cities; who should shoulder tax costs; and how to support working parents.

- U.S. farmers are expected to plant a record number of acres this year to take advantage of high agricultural prices, largely due to surging demand for U.S. soybeans from China.

- The rapid adoption of electric vehicles in the U.S. will be hindered by the lack of fast and reliable charging infrastructure, making many commonplace car trips untenable for electric vehicles.

- A new “molecular bridge” innovation could enable the use of graphene layers for use in the manufacture of printed semiconductors for electronic and optoelectronic devices.

International

- Norway’s capital is tightening lockdown measures to combat a sharp rise in coronavirus infections linked to the virulent U.K. strain.

- New Zealand’s largest city went into a second lockdown on Sunday in response to a cluster of patients infected with the highly infectious U.K. strain.

- ICU beds in Brazil’s capital are close to capacity as the city heads for a new lockdown, with total cases in the country surpassing 10 million last week.

- The U.K. has detected up to six cases of a highly infectious strain of COVID-19 first discovered in the Brazilian city of Manaus.

- Germany imposed testing requirements along its border with France to block the spread of new COVID-19 variants.

- South Africa eased some restrictions amid falling COVID-19 case counts.

- Australia has once again largely reigned in the coronavirus, as several of the country’s states lifted restrictions on dances, sporting events and home visits.

- Australia is ramping up its COVID-19 vaccination drive after doubling its supply of shots with a large delivery from AstraZeneca/Oxford on Sunday.

- Mexico’s president is expected to ask the White House to share part of its coronavirus vaccine supply at a summit between the leaders of both nations today.

- Canada authorized AstraZeneca/Oxford’s vaccine for emergency use, giving the country a way to provide more vaccines after one of the slowest rollouts in the West.

- Thailand has kicked off its COVID-19 vaccine campaign, distributing the first batches of China-developed Sinovac Biotech’s shots.

- South Korea vaccinated nearly 19,000 people against COVID-19 with Pfizer/BioNTech shots on its first day of rollouts late last week.

- Less than a third of Filipinos are willing to get vaccinated against COVID-19 due to perceptions of potential side-effects, a hurdle as the country kicks off its inoculation campaign today. The country is extending coronavirus restrictions in the capital until the end of March.

- Israel will administer COVID-19 vaccines to nearly 130,000 Palestinians who work in Israel or in its West Bank settlements. ICU beds for COVID-19 patients in the West Bank have reached 95% of capacity as schools in the region begin a 12-day closure to contain surging infections.

- Vaccine “passports” could provide a way for people to prove they have been inoculated against COVID-19, but they raise ethical concerns about excluding people from daily life. The U.K.’s government will soon hold a hearing as it considers implementing a passports plan.

- The EU purchasing managers index for manufacturing jumped to a three-year high in February. Factory costs, meanwhile, are rising at the fastest pace in a decade.

- Factory output in the U.K. grew at the slowest pace since May in the face of the pandemic and post-Brexit supply chain woes.

- The U.K. is creating a $7 billion grant program in a further round of stimulus to help businesses hard hit by the pandemic.

- Australia’s government is mulling legislation to give more monetary support to airlines that would support furloughed employees until October, when international borders are predicted to reopen.

- China’s factory activity expanded in February at a slower pace than January, hitting the lowest level since last May and missing expectations.

- Global trade flows fell by a lower-than-expected 5.3% last year, with China and other Asian manufacturing nations grabbing a larger slice of exports as world economies bounced back.

- China’s long-term economic growth will be hampered by a shrinking workforce due to a dearth of babies born last year, fewer than in any year since 1961 when the country suffered mass starvation.

- German banks, squeezed between soaring savings rates and negative interest rates charged by the European Central Bank, are discouraging deposits from customers.

- The Bank of Ireland is shuttering a third of its 257 branches after the pandemic drove customers online.

- Current governmental pledges to reduce emissions fall short of the required 45% carbon dioxide cut needed by 2030 to limit earth’s warming to 1.5 degrees Celsius, considered a tipping point for the most severe forms of environmental damage.

- European consumers are buying electric vehicles (EVs) at the world’s fastest pace, encouraged by government subsidies and increased availability of new EV models. Last year, the bloc passed China as the world’s largest EV market.

Our Operations

- Listen to our 2021 Market Trends Podcast Series episodes featuring insight from our market managers.

- Visit our new 3D Printing e-commerce site here.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.