COVID-19 Bulletin: March 10

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- A larger-than-expected build in crude inventories last week pushed oil prices down yesterday. Crude futures were lower in mid-day trading today, with the WTI down 0.5% at $63.69/bbl and Brent 0.4% lower at $67.24/bbl. Natural gas was 0.6% higher at $2.68/MMBtu.

- The Energy Information Agency (EIA) raised its 2021 forecast price for WTI by 14% to $57.24/bbl based on continuing production constraints agreed to by OPEC+. U.S. crude production is expected to decline less than previously forecast this year, according to the EIA.

- U.S. crude production fell by 1 million bpd last year, the largest decline in history.

- Libya seeks to raise oil production by 150,000 bpd to 1.45 million bpd by the end of this year. The country previously surprised markets by rebounding from 100,000 bpd to 1.25 million in just two months late last year.

- The U.S. administration is poised to consider permanently halting new oil and gas leases on federal land and water.

- E-commerce firm Shopify became the first customer to buy carbon removal units from Canada-based Carbon Engineering, whose technology sucks 2,000 pounds of CO2 out of the sky per day to convert to fuels.

- China’s nascent carbon market could reach $25 billion over the next decade, a 30-fold expansion.

- An oversupply of oil tankers is causing losses of $7,000 per day for vessels on a benchmark Middle East-to-China route.

- Chevron’s low-carbon investments remain shy of 1% of its project spending, as the company released a plan to expand oil and gas production by 2025.

- After years of pressure from students and staff, Rutgers University will divest its fossil fuel investments. In a recent referendum, 90% of students voted for divestment.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

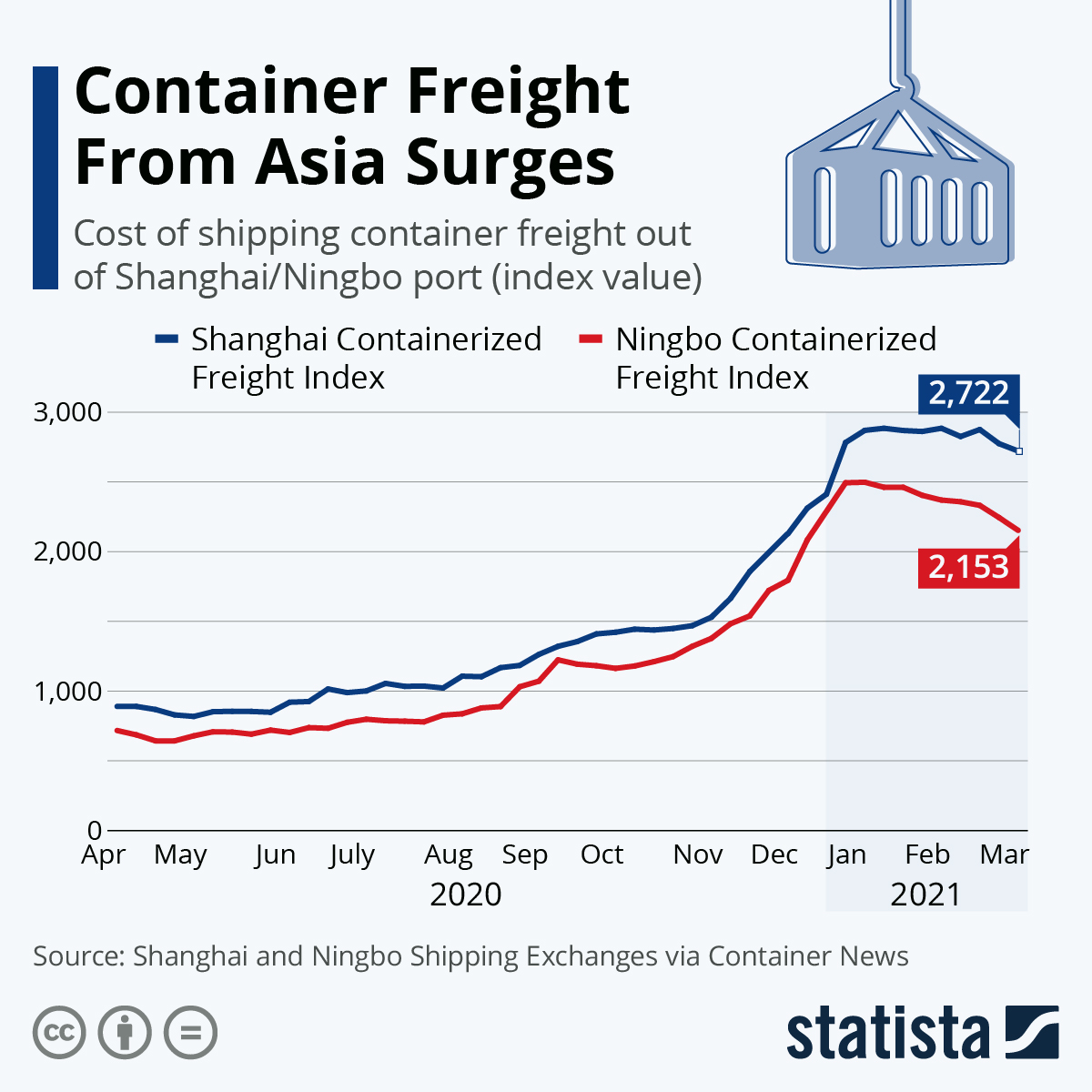

- Global container volumes fell 5.7% from December to January, most likely the result of price increases caused by congestion rather than increased demand.

- 2M partners Maersk and MSC will divert routes from the U.S. to North Europe to avoid congestion problems at Southern California ports.

- The European Union’s top competition official will begin reviewing severe congestion in the container shipping industry.

- Countries and state-backed companies in Asia are taking extraordinary steps to ease a shipping container shortage threatening their exports to the West, providing free transport of empty containers to be refilled and adding or repurposing ships for local movement of containers.

- Despite rising fuel costs, U.S. freight trucking conditions are among the best ever for carriers.

- Demand for roller skates is the highest since the 1970s, but shipping bottlenecks and high prices for raw materials are delaying deliveries by six months or more.

- Shares of online fashion seller Stitch Fix fell more than 25% yesterday on an underwhelming holiday quarter created by shipping delays, the company said.

- Amazon is making further investments in its captive air fleet and plans to open a $1.5 billion air hub in northern Kentucky later this year.

- A new survey highlights that women are showing an increased interest in trucking industry careers as the industry moves toward more autonomous and electric vehicles.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- New COVID-19 cases in the U.S. increased yesterday to 57,417, while deaths also jumped to 1,947. Over 92 million vaccine doses have been administered, with 9.56% of the population fully vaccinated.

- The two-week rolling average for new U.S. coronavirus cases is down almost 14%.

- The lifting of mask mandates and occupancy limits in Texas take effect today.

- New research suggests there may be predictable patterns of recurring symptoms for COVID-19 “long haulers,” who report up to 100 lingering physical and neurological aftereffects from the virus.

- New York expanded COVID-19 vaccine eligibility to people age 60 and older.

- Alaska became the first state to lift all eligibility requirements for COVID-19 vaccines, making shots available to anyone over 16 years of age.

- A flood of vaccine misinformation is causing hesitancy to receive shots for millions of U.S. agricultural workers.

- Retail pharmacy network capacity is a critical but overlooked component of the U.S.’s COVID-19 vaccine rollout. Walgreens’ vaccine-booking system shut down for several hours yesterday, preventing people from making appointments.

- An emerging platform will match healthcare providers with people on standby for surplus COVID-19 vaccine doses.

- The House of Representatives is expected to approve the Senate’s version of a $1.9 trillion economic stimulus bill today. The changes from the House’s original draft of the bill includes extended unemployment benefits and narrower eligibility for $1,400 checks.

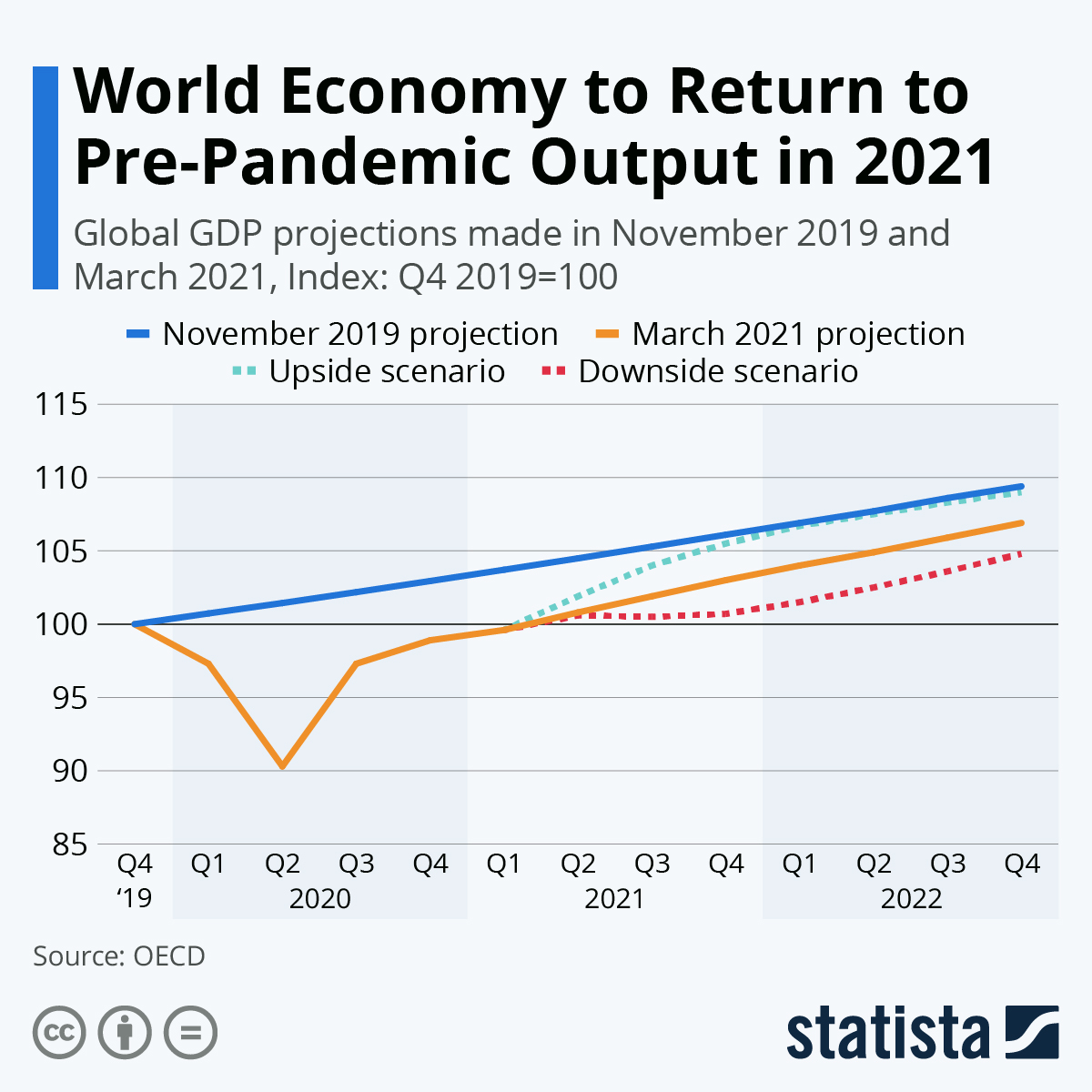

- Upward-revised projections of U.S. economic growth this year could unbalance weaker economies, particularly in the developing world.

- Boeing delivered 22 jets in February, its first positive month of net orders in more than a year.

- A potential merger between AerCap and General Electric’s Capital Aviation Services, two of the world’s biggest aircraft leasers, could lower jet costs for airlines but increase pricing pressures for Airbus and Boeing jets.

- Budget carriers are expected to bounce back from the pandemic quicker than larger airlines thanks to lower-cost structures and a focus on domestic leisure travel.

- Airlines cut more than $1 billion of expenses per day last year to cope with a slump in passengers, a major factor behind ultra-low fares.

- Disney’s streaming service signed up more than 100 million subscribers in its first 16 months as consumers sought stay-at-home entertainment.

- Fourth-quarter sales at Dick’s Sporting Goods rose 20% from a year earlier, although the company expects a slowdown in 2021 from the pandemic-fueled spike.

- Hyundai and the National Highway Traffic Safety Administration confirmed which vehicles and how many are being recalled over a faulty battery pack.

- Kia is recalling 380,000 vehicles in the U.S. and warning owners to park the vehicles outside due to fire risk, while Nissan is recalling 854,000 vehicles for faulty brake lights.

- Amazon-backed EV maker Rivian is set to unveil three new electric truck models this year.

- The U.S. remains largely reliant on China for lithium used in electric vehicle batteries, which could change as American companies look to boost domestic production.

- To become carbon neutral by 2030, Formula 1 announced that staff will no longer use single-use plastic bottles for water and that official passes will now be made from recycled material.

International

- ICU patients with COVID-19 in France hit the highest level since November.

- Italy became the second European nation behind the U.K. to surpass 100,000 COVID-19 deaths.

- Palestinian ICU beds have reached 100% capacity as a COVID-19 wave spreads through the West Bank.

- Denmark is reopening some schools and easing restrictions on large shops amid declining COVID-19 infections.

- Mexico ordered 22 million doses of China-developed coronavirus vaccines after the White House ruled out sharing shots with the nation in the near term.

- Leading business associations in Germany are pushing companies to expand coronavirus testing until vaccines become widely available.

- Partners Pfizer and BioNTech could have the capacity to produce three billion doses of their vaccine by next year, according to BioNTech’s CEO.

- Russia’s Sputnik V COVID-19 vaccine could be produced in western Europe following an Italian-Swiss production deal with Moscow’s sovereign wealth fund.

- China is launching a digital COVID-19 vaccination certificate for citizens who travel across borders.

- Brazil’s services sector posted a larger-than-expected rise in January, a contrast to recent indicators showing Latin America’s largest economy is faltering.

- Argentina’s total stock market valuation has collapsed from $350 billion in 2018 to just $20 billion last year, with a years-long recession exacerbated by the pandemic.

- Volkswagen unveiled new details on its plans to produce fully autonomous commercial vehicles. The company hopes to test prototypes in Germany over the summer with a public release scheduled in 2025.

- In reporting a $2.8 billion 2020 loss, Cathay Pacific Airways painted an uncertain outlook for the global airlines industry and said it is maintaining executive pay cuts and extending a third voluntary “special leave program” for employees.

- LATAM Airlines Group, which filed for bankruptcy reorganization early in the pandemic, lost nearly $1 billion in the fourth quarter in the face of a second COVID-19 wave in the region, raising total losses last year to $4.6 billion.

- German airline Lufthansa is partnering with a railway to replace all short-haul domestic flights to its Frankfurt hub with train journeys.

- Australia’s new National Plastic Plan, in addition to banning some single-use packaging and plastics on beaches, includes the phase out of biodegradable plastics.

Our Operations

- Visit our new 3D Printing e-commerce site.

- Listen to M. Holland’s 2021 Market Trends Podcast Series episodes featuring insight from our Market Managers.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.