COVID-19 Bulletin: March 12

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil held steady near $66 per barrel yesterday amid signs that fuel consumption, particularly on U.S. and U.K. roadways, is increasing. Energy prices were essentially flat in early trading today, with the WTI at $65.94/bbl, Brent at $69.54/bbl and natural gas at $2.66/MMBtu.

- OPEC inched its full-year oil demand forecast higher on expectations of increased demand in the second half. The cartel’s crude production fell by 650,000 bpd in February, largely due to the voluntary cut from Saudi Arabia.

- The U.S. must reduce its emissions by 57% by 2030 to comply with its share of cuts consistent with the recently rejoined Paris Agreement on climate change.

- Royal Dutch Shell reported that its earnings from oil trading nearly doubled to $2.6 billion last year as it follows rival BP in using trading profits to help fund its pivot to renewables. The company also reported that its greenhouse gas emissions fell 16% last year due to the pandemic.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Forty-eight container ships were anchored off Southern California ports awaiting a berth to unload on Wednesday.

- Container volume at Chinese ports was up 37.9% in February.

- Container ships stayed at northern hemisphere ports 13% longer in the second half of last year from the same period in 2019.

- There was a twelve-fold increase in the number of empty “ghost” shipping containers sent overseas in 2020.

- Cathay Pacific Airways’ cargo revenue rose 16.2% last year but was not enough to offset steep declines in passenger demand.

- U.K. exports to the European Union plunged 41% in January following Brexit, while imports from the bloc fell 29%, contributing to a 2.9% contraction of the British economy for the month. Post-Brexit congestion is causing a critical buildup of containers at British ports.

- Inventory management will look different for retailers after the pandemic, incorporating more e-commerce fulfillment while potentially stocking thinner shelves.

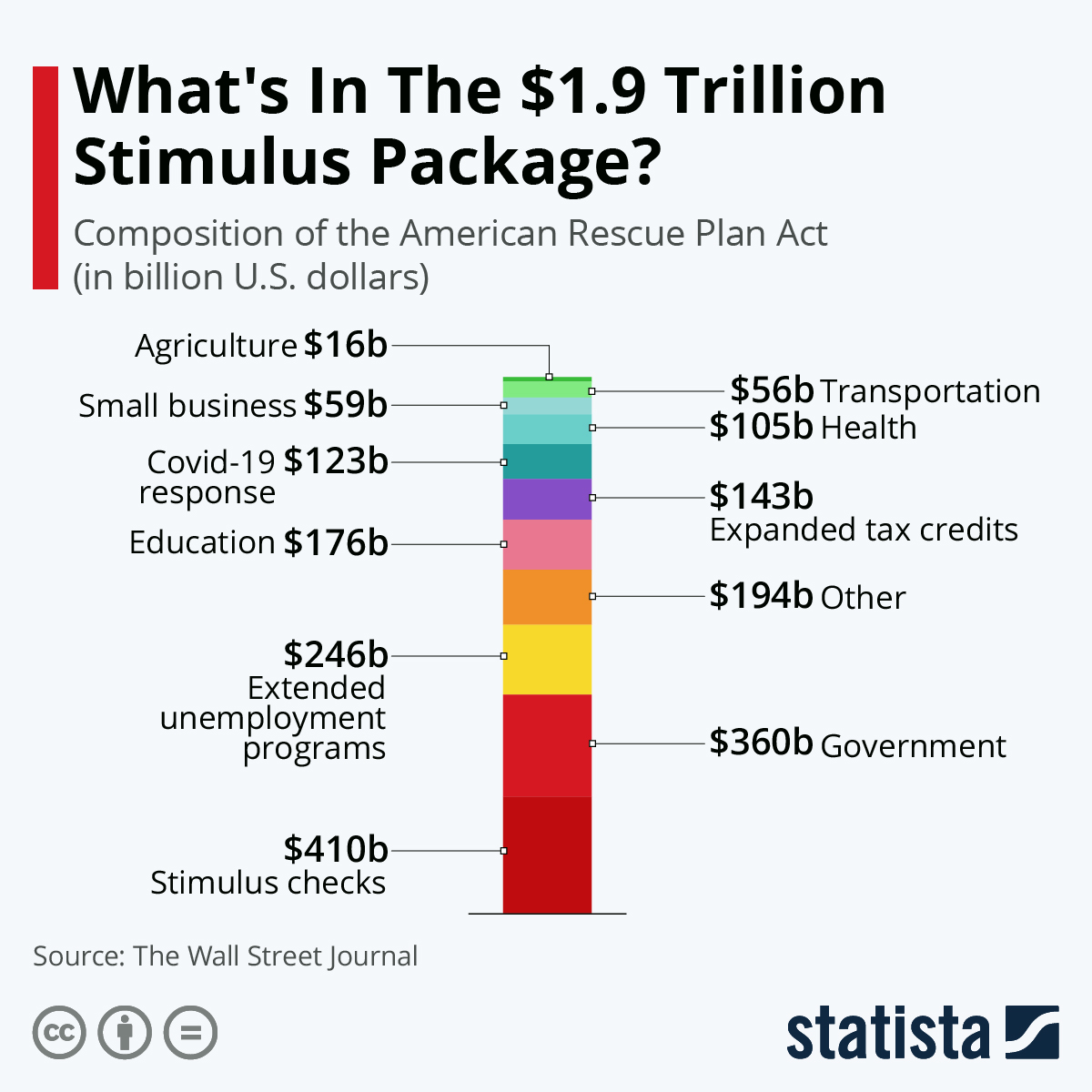

- The next round of $1,400 direct payments to Americans is likely to trigger another surge in e-commerce shipments.

- Foxconn is relocating up to 10% of its production of Apple iPhones to India, the first time the devices will be manufactured outside of China.

- Following a boost in e-commerce fueled by the COVID-19 pandemic, the stock of warehouses globally is expected to grow 20% over the next five years.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

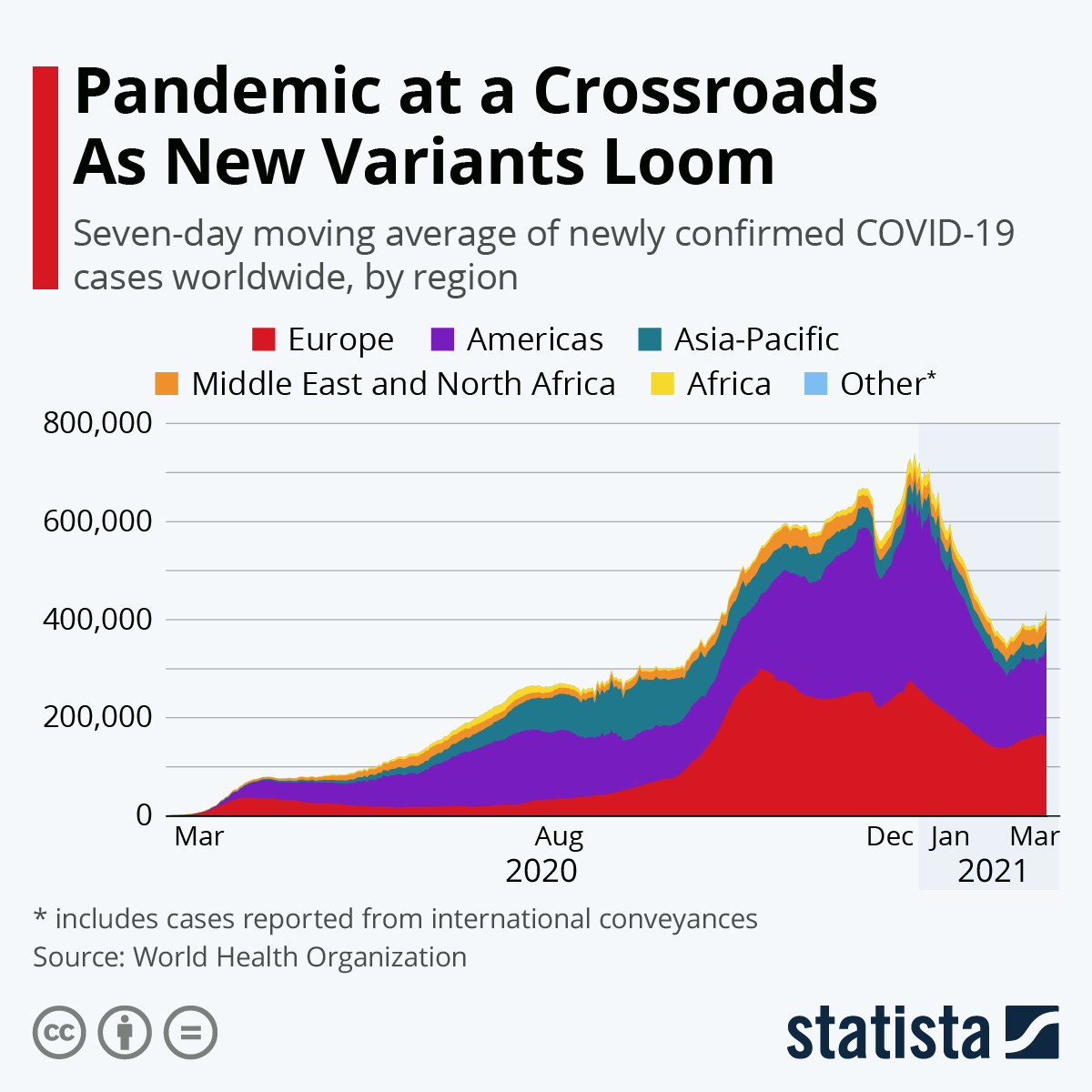

- There were 49,356 new COVID-19 cases and 1,557 deaths in the U.S. yesterday. Over 98 million vaccine doses have been administered, with 10.16% of the population fully vaccinated.

- It’s been two months since U.S. COVID-19 cases began trending downward, the point where previous recoveries stalled and resurgences began.

- Oklahoma is lifting all remaining coronavirus restrictions today.

- New York is no longer requiring domestic travelers to quarantine upon arrival in the state.

- A new study suggests the U.K. strain of COVID-19 poses a 64% higher risk of death.

- The White House requested that states make all adults eligible for COVID-19 vaccines by May 1, potentially allowing people to gather in small groups again by the Fourth of July.

- Two doses of Pfizer/BioNTech’s COVID-19 vaccine were 97% effective against symptomatic and 94% effective against asymptomatic spread of the virus in a recent study.

- Novavax’s COVID-19 vaccine was 96% effective against mild, moderate and severe symptoms of the disease in late-stage trials in the U.K. In South Africa, however, the vaccine was only 55% effective against the predominant mutation there.

- The U.S. president signed a $1.9 trillion COVID-19 relief bill into law yesterday evening. Direct $1,400 payments to many Americans could start reaching people’s bank accounts by this weekend.

- United Airlines rescinded furlough notices for 14,000 workers yesterday, one day after American Airlines canceled furloughs for 13,000 workers.

- Conflicting court rulings over the legality of the federal government’s moratorium on evictions is throwing into doubt $46.6 billion in rental assistance previously authorized by Congress.

- U.S. household net worth rose to a record $130.2 trillion in the fourth quarter.

- U.S. homeowners cashed out $152.7 billion in home equity last year, a 42% increase from 2019 and the most since 2007.

- China retook its place as the largest importer of U.S. agricultural products, with American farmers shipping record volumes of crops and meats across the Pacific.

- A global analysis of school closures urges officials to use the measure as a last resort, citing the emotional, mental, intellectual and economic toll on children and their families.

- Employers are becoming less inclined to fire employees for underperformance amid high personal stressors caused by the pandemic.

- Strong U.S. lumber demand is expected to continue through 2021, pushing up prices and the need for European imports. Some members of Congress appealed to the White House to take steps to quell the rising prices on concerns they will stunt the recovery.

- The reopening of the economy raises questions about whether distance-friendly sports can maintain their sudden popularity; golf rounds surged 27% in the second half of 2020 versus the prior-year period, while tennis participation rose 22% last year.

- Battery giant LG Chem is investing $4.5 billion over the next five years to expand battery capacity in the U.S. as major automakers announce plans to electrify their fleets.

- Researchers are warning that face masks made from plastic microfibers pose a major threat to the environment due in part to their inappropriate disposal.

- Surging frozen food purchases, often for single-serving or individually wrapped products, is leading manufacturers to innovate packaging to become more sustainable.

International

- Brazil’s COVID-19 crisis is worsening, as the country has set daily death records three times so far this month, and ICU occupancy rates are above 80% in 22 of the country’s 26 states. Scientists there have identified two cases of people being simultaneously infected by different COVID-19 variants.

- Today, India announced 23,285 new COVID-19 infections, the highest since late December, prompting renewed lockdowns.

- Chile, despite an aggressive vaccination effort, suffered 5,556 new infections yesterday, near earlier peaks, and is considering renewed restrictions.

- Italy, the first Western nation to enter lockdown last year, is again considering a lockdown of up to two-thirds of its citizens after new infections hit a three-month high this week.

- Vaccines have not helped to contain a COVID-19 wave sweeping through Eastern Europe and particularly the Czech Republic, where infections are rising 10 times faster than in Germany.

- Germany has gone from hero to zero with its pandemic response, criticized for mask and test shortages and a slow vaccine rollout.

- New Zealand’s largest city lifted all pandemic restrictions after no coronavirus infections were reported the past two weeks.

- Thailand, Norway and Iceland joined Denmark in suspending the use of AstraZeneca’s COVID-19 vaccine over concerns about side effects. Italy withdrew a batch of the vaccines following the deaths of two men who had recently been inoculated, while Romania followed suit.

- AstraZeneca will deliver less than half the planned number of COVID-19 vaccines to the European Union in the second quarter, about 76 million doses. More than 11.5 million COVID-19 vaccines delivered to the bloc have not yet been used.

- European Union regulators approved Johnson & Johnson’s one-shot COVID-19 vaccine for emergency use, with initial deliveries expected in the second quarter. The bloc also extended a mechanism that allows member states to block vaccine exports until the end of June.

- Europe’s stumbling vaccine rollout effort has provided openings for China and Russia to step in and help fill the void, with potential geopolitical consequences for the EU and safety issues for vaccine recipients.

- China is offering COVID-19 vaccines to Tokyo Olympics participants, a complicated proposal amid the regulatory differences of over 200 participating nations.

- The European Central Bank plans to increase bond purchases to suppress rising interest rates and spur a flagging economic recovery as the region fights rising COVID-19 infection rates and a slow vaccine rollout.

- The growth rate of global services trade hit a record high late last year, according to a World Trade Organization barometer, but the organization warned about the durability of the rebound.

- Australia’s federal government is funding 800,000 half-price domestic airline tickets to spur the local tourism industry.

- Major auto companies are facing tough competition from China’s ultra-cheap electric vehicle manufacturers.

- Rolls-Royce’s all-electric aircraft, known as the “Spirit of Innovation,” has completed its latest test: taxiing. According to Rolls-Royce, the aircraft’s battery pack will provide enough energy for the plane to fly 200 miles once ready for flight.

- New legislation along with pledges by companies to lower their carbon footprints has sent the demand for recycled plastics soaring.

Our Operations

- Throughout the week, Mployees have been sharing their thoughts on International Women’s Day 2021. Check out messages from them across LinkedIn, Twitter and Facebook.

- Visit our new 3D Printing e-commerce site.

- Listen to M. Holland’s 2021 Market Trends Podcast Series episodes featuring insight from our Market Managers.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.