COVID-19 Bulletin: March 14

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- More oil news related to the war in Europe:

- Oil prices finished higher Friday but ended the week down 5%, the steepest weekly decline since November, on signs of potential output increases from OPEC.

- The potential for a diplomatic solution in Ukraine caused oil prices to drop by around $7 per barrel Monday morning, with WTI futures falling 6.9% at $101.80/bbl, Brent dipping 6.5% at $105.40/bbl and U.S. natural gas down 2.7% at $4.60/MMBtu in mid-morning trading.

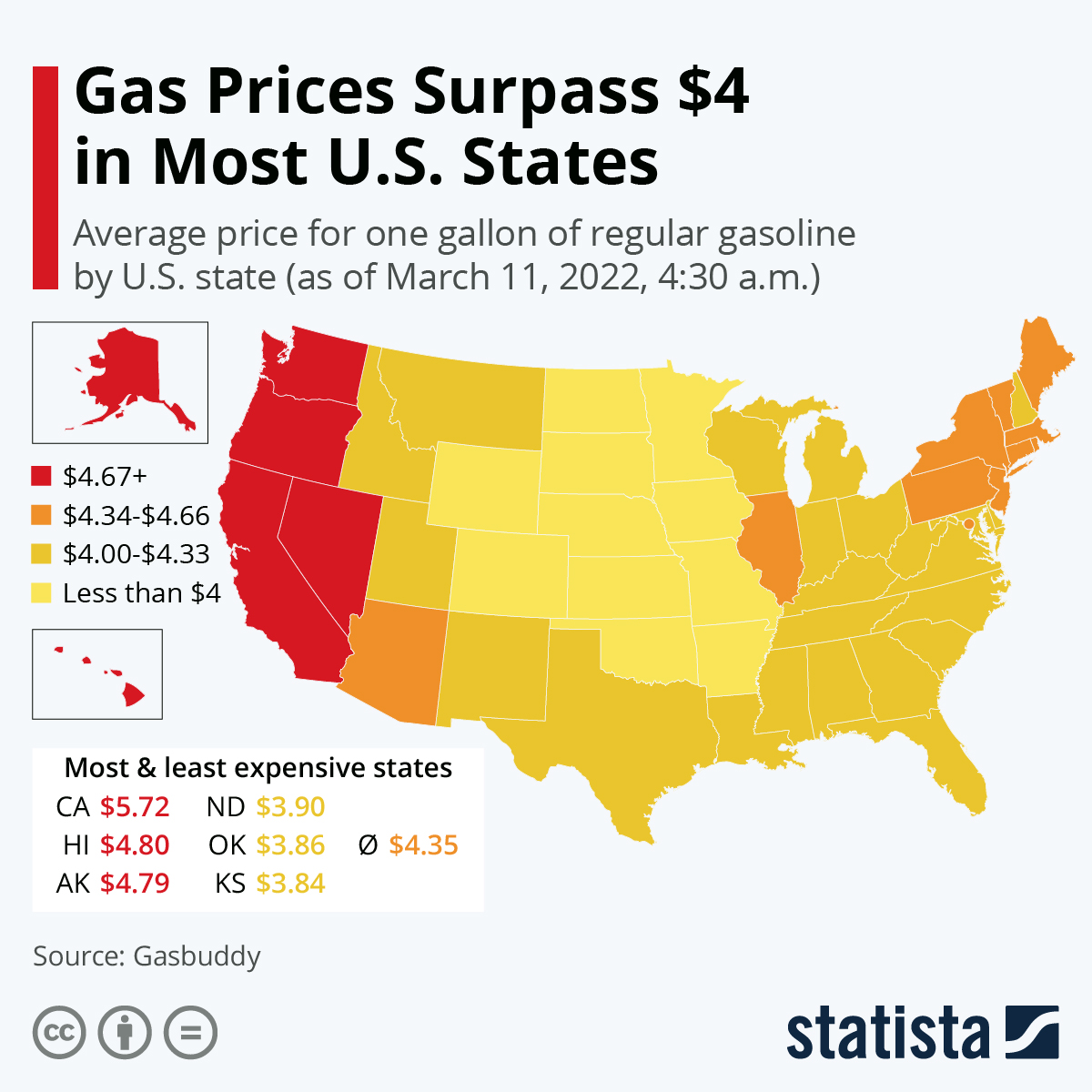

- The average U.S. gasoline price hit a record $4.43 Sunday, up 79 cents over the past two weeks. Gasoline accounted for about one-third of the nation’s record 7.9% increase in consumer prices last month.

- Several Russian oil tankers have been idling along European and North American coasts for over a week as traders refuse to deal with the nation’s crude.

- The UAE reaffirmed its position that OPEC should consider increasing monthly output to account for Russian losses, as the U.K. urged Saudi Arabia to boost production.

- The EU is preparing a fourth round of sanctions to deny Russia resources supporting its war on Ukraine, including a ban on new investment in the nation’s energy sector.

- Europe could burn up to 51% more coal this year as it reduces reliance on Russian natural gas. With Russia being Europe’s largest supplier of coal, most new shipments will likely come from Colombia, South Africa, Australia, Indonesia and the U.S.

- Poland’s largest refiner said it would continue to buy Russian crude to ensure supply.

- India’s top oil refiner has purchased 3 million barrels of Russian crude for delivery in May, its first purchase of oil from the nation since the invasion of Ukraine.

- The German unit of Russian-based energy company Rosneft fell victim to a cyberattack over the weekend.

- TotalEnergies is facing pressure from an activist investor to boost sanctions and completely exit operations in Russia, which makes up 24% of the company’s proven reserves and includes a stake in gas producer Novatek.

- Talks to revive the U.S.’s 2015 nuclear deal with Iran and bring more of the nation’s oil to market have stalled over Russia’s involvement as an original member of the pact. The U.S. said Sunday it would not negotiate further so long as Russia is included in the talks.

- The U.S. administration is facing blowback over talks to import more crude from Venezuela, a Russian ally.

- New Zealand is considering temporarily lowering its fuel taxes to help lower gasoline prices in the nation amid surging global oil prices.

- Global stocks of diesel and other middle distillates have fallen to the lowest seasonal level since 2008, with consumption consistently outpacing supply.

- Solar installations in the U.S. jumped 19% last year to a record 23.6 GW, of which nearly three quarters were large installations for utilities and other big firms. Installations will decline this year due to inflation and supply chain disruption, analysts say.

Supply Chain

- More supply chain news related to the war in Europe:

- The EU banned imports of Russian iron and steel goods over the weekend, the source of billions of euros of Russia’s export revenue.

- A new White House order will ban $550 billion of American luxury goods exports to Russia and $1.2 billion of Russian imports of seafood, vodka and diamonds per year.

- Latvia-based vodka distiller Stolichnaya will stop sourcing ethanol from Russia and will change its name to Stoli as part of an increased effort to remind customers that it does not come from the nation.

- Low-sulfur bunker fuel prices hit $987 per metric ton in Singapore last Tuesday, up from $580 at the end of December, according to S&P Global Platts.

- U.S. ports are barring entry to a growing number of Russian and Ukrainian seafarers despite valid U.S. visas, fearing they may overstay their visas.

- Resource-rich nations and aggressive trading firms stand to reap windfalls on the war-induced surge in commodities prices.

- Chicago wheat futures ended last week 8.5% lower, the worst weekly fall since 2014, but almost 75% higher than the same time last year. With Ukraine’s normally plentiful exports expected to drop sharply this year, food deprivation will spread and global food prices could rise 22%, the United Nations warns.

- Trading in nickel, a key component in electric vehicle batteries and stainless steel, remained suspended on the London Metals Exchange as JPMorgan and other major banks negotiated with a major Chinese metals producer caught in a margin squeeze over hedging contracts. The price of nickel soared to over $100,000/metric ton last week, more than twice the previous record high set in 2007.

- Two years of building inventories and combating disruption will mitigate the effect of Russia’s invasion on semiconductor supply chains, despite the possible loss of key chip making materials from Eastern Europe.

- China placed 17.5 million residents of the southern city of Shenzhen into lockdown for at least a week, a move likely to cause disruption and production delays at one of the world’s largest ports and technology hubs. Apple supplier Foxconn will halt operations at its plants in the city, one of which produces iPhones.

- Prioritization of 5G chips by manufacturers in China and Taiwan is lowering prices and driving the production of budget 5G-capable devices faster than any previous network innovation.

- Lead times for semiconductor deliveries rose by three days to 26.2 weeks in February, a disappointing reversal from the prior month, which was itself the first improvement in lead times since 2019.

- Ford will begin selling some of its Explorer SUV models at a discount and without some of the electronics required for certain vehicle features amid the ongoing global semiconductor shortage.

- Container freight rates from North Asia to the U.S. West and East Coasts pulled back modestly last week.

- U.S. ports handled 2.6 million TEUs in January, up 3.6% from December and 5.2% year-over-year, with imports expected to remain at near-record levels this spring and summer.

- Supply chain problems continue to slow deliveries of new Boeing jets.

- Brazilian plane maker Embraer launched a passenger-to-freighter conversion program for a pair of its regional jet offerings.

- American grill maker Weber is raising prices for the third time this year as freight costs rose from 3% of sales to 10% over the past two years.

- Hapag-Lloyd warned of a cyber phishing attack that directs users to a fake copy of its website to steal their login information.

Domestic Markets

- The U.S. reported 5,736 new COVID-19 infections and 168 virus fatalities Sunday.

- More than a dozen governors are calling on the federal government to extend the nation’s public health emergency to give more time to wind down pandemic-related services and benefits.

- Oregon and Washington state lifted their statewide mask mandates Saturday, a turning point for two of the most cautious states for pandemic-related health measures.

- New York City is preparing to end its school mask mandate for children under age 5.

- Alaska has only recovered about 7,000 of the 27,000 jobs it lost during the first year of the pandemic.

- Pfizer’s CEO says that COVID-19 will be present for years and people will need a second booster shot this year.

- The University of Michigan’s index of consumer sentiment fell to 59.7 in March, its lowest reading in over a decade, while year-ahead inflation expectations hit a four-decade high.

- Goldman Sachs says the probability of a U.S. recession in the next year could be as high as 35%.

- Pandemic-induced cash buildups at large U.S. banks will likely make them hesitant to pay companies more for their deposits despite an expected rise in interest rates later this month.

- U.S. rental prices are up about 18% on average over the past two years, Redfin says, with over a dozen states considering new rent controls that would cap price hikes to as little as 2% in some cases.

- Nearly 78% of all U.S. vehicles sold last year were SUVs and trucks, up from 55% a decade ago, as buyers struggle to find fuel efficient alternatives in a world of high gas prices.

- A proposed EPA rule would require power plants to reduce nitrogen-oxide emissions 29% by 2026 alongside a 15% reduction from other industrial sources. The agency is currently awaiting a Supreme Court decision over whether it has the authority to regulate those emissions under the Clean Air Act.

International Markets

- More news related to the war in Europe:

- The G7 affluent democracies agreed Friday to cut Russia’s favored-trade status, effectively putting Russia on economic par with North Korea and Iran. Each G7 nation will follow its own domestic process to reflect the change, with U.S. lawmakers set for a vote this week.

- Further commitments from the G7 nations include curbing Russia’s access to funds from the International Monetary Fund and the World Bank.

- Russia has lost about half its $640 billion in reserves due to sanctions, a state official said. The nation is edging closer to default and will attempt to fulfill its debt obligations with the plunging ruble, despite contract agreements for dollar payments.

- Moscow’s stock market will remain closed for a third straight week, delaying what is likely to be a painful reckoning for investors in Russian stocks.

- Deutsche Bank became the latest major bank to unwind its Russian operations.

- About half of Russian commercial aircraft have lost their legal certificate to fly after being removed from the internationally recognized Bermuda registry.

- Safran SA, one of Europe’s biggest aerospace firms, halted all activities in Russia.

- Russian prosecutors are reportedly telling large Western firms that corporate leaders will be arrested for criticizing the government and company assets seized upon withdrawal from the nation.

- Russia banned the use of Instagram and Facebook for allowing critical commentary about its invasion of Ukraine and brought a criminal case against parent company Meta Platforms as an “extremist organization.”

- Cargill, the U.S.’s largest privately held corporation, is scaling back some Russian operations but will continue operating food and animal-feed facilities in the nation.

- Concerns are growing about rising COVID-19 infections in Europe, despite the recent slide in cases globally:

- The seven-day average COVID-19 infection rate in Germany hit a record 1,543 per 100,000 people today as the country experiences another virus surge coinciding with its winding down of pandemic protocols in mid-February.

- COVID-19 cases are rising in the U.K. again, with Scotland seeing its highest infection rate of the pandemic over the weekend.

- New COVID-19 cases in France are up 20% week over week, just as the nation drops all remaining pandemic restrictions.

- New COVID-19 cases in China doubled to more than 3,100 Sunday, its worst outbreak in two years, as officials lock down a growing number of virus hot spots.

- Hong Kong mortuaries are overflowing as the nation battles its worst wave of the COVID-19 pandemic, with more than 3,200 fatalities and 600,000 cases reported since January.

- South Korea reported over 300,000 new COVID-19 cases for a third consecutive day today.

- Ontario, Canada, will drop its universal mask mandate on March 21.

- New estimates show that blocked imports from Russia could cost Germany up to 3% of its GDP.

- China led the world with exports of 500,000 electric vehicles in 2021.

- Ford is stepping up e-vehicle plans for Europe, with plans to introduce seven new models, add battery manufacturing in Europe and form a nickel cell joint venture in Turkey.

- Italy announced that it will offer $6,570 in subsidies to buyers of new electric vehicles in the nation in a bid to support its transitioning auto market.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.