COVID-19 Bulletin: March 16

Hello,

Today marks the one-year anniversary of this Bulletin — 253 editions later.

When we initiated this endeavor, we expected it would be a weeks-long project. The coronavirus had other ideas. As we transition from the dark uncertainty of the pandemic’s peak to brighter days of recovery, we hope and trust our efforts have been of value to you. Thank you for your support and readership.

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices ended lower yesterday, likely due to news of potential U.S. tax hikes and their effect on corporate growth.

- Crude futures were lower in early trading today, with the WTI down 1.1% at $64.70/bbl and Brent 1.1% lower at $68.12/bbl. Natural gas was 0.9% higher at $2.50/MMBtu.

- Having already increased 14% from February to March, U.S. gas prices could reach $4 per gallon this summer in the wake of rising crude prices.

- The U.S. has overtaken Saudi Arabia as India’s second-largest crude supplier after exports to the country surged 48% from January to February.

- U.S. exports of liquefied natural gas to Asia rose 67% in 2020 despite record-low demand and prices last summer due to the pandemic.

- U.K. lawmakers are mulling a ban on new offshore oil and gas exploration licenses.

- New solar installations increased 43% globally last year, a record growth rate.

- Michelin is partnering with a Canadian startup to employ microwave technology to recycle polystyrene back into base monomers.

- Total’s latest green investments include funding for a startup that turns carbon emissions into high-protein animal feed.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

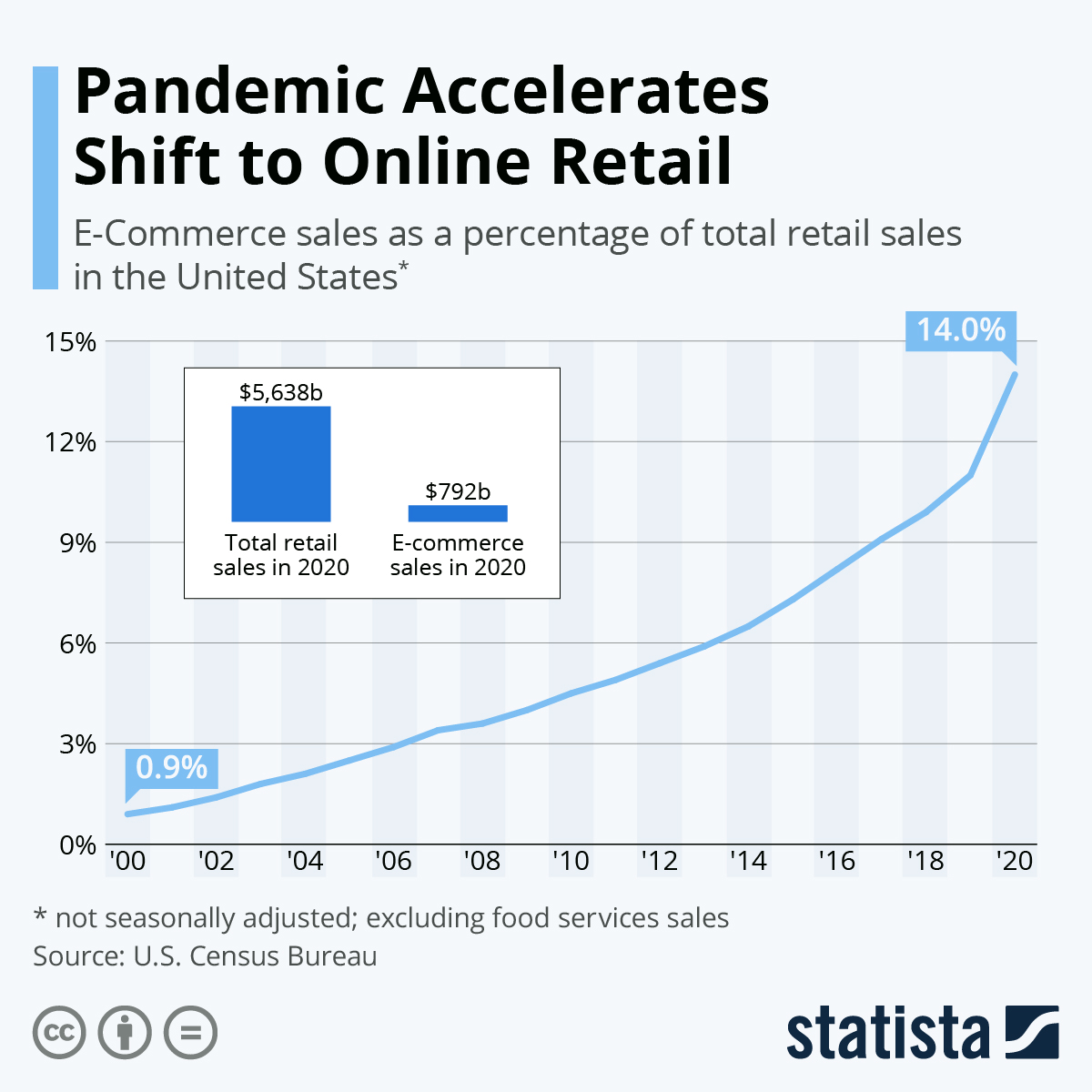

- To keep up with current levels of e-commerce demand, 125 million square feet or more of new warehousing will be needed each year until 2025 in the U.S. and Europe.

- E-commerce is expected to remain popular post-pandemic, with 77% of consumers indicating they want to continue online shopping.

- The U.K.’s Royal Mail service will test Sunday deliveries to meet surging e-commerce demand.

- Cardboard prices have increased tenfold in the U.K. due to high demand from Amazon and e-commerce merchants.

- Due to the global semiconductor chip shortage, General Motors is building some 2021 full-size pickup trucks without a fuel management module, hurting the vehicles’ fuel economy. The company also announced the temporary shutdown of a plant in Lansing, Michigan.

- The ongoing chip shortage left Volkswagen unable to produce 100,000 cars in 2020, and it will not be able make up for the loss in 2021.

- The computer chip shortage has impacted global car production by 933,000 vehicles to date.

- Outdoor-equipment manufacturer Yeti is eyeing moving its import operations to Port Houston to avoid port congestion in Southern California.

- Denmark joined several other countries in backing a new $5 billion proposal for decarbonizing the shipping industry.

- A shortage of corrugated material is requiring some suppliers to ship in boxes that may not be stackable. Such unstackable packaging should be clearly marked. In the interest of safety, we urge clients and our fulfillment partners to notify anyone involved in logistics operations to be mindful of the shortage and careful to heed warning labels that may appear on resin containers.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

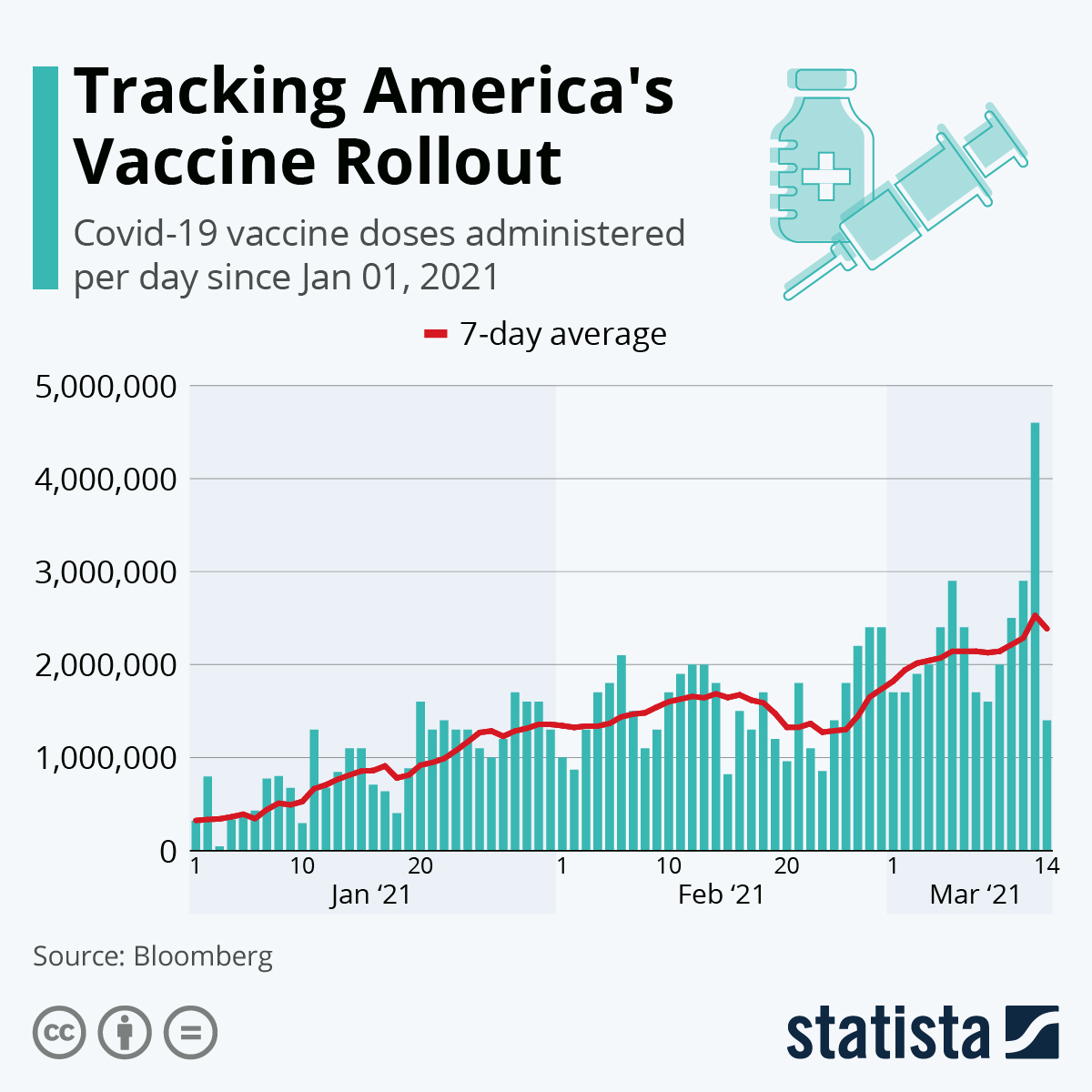

- There were 56,649 new COVID-19 cases and 740 deaths in the U.S. yesterday. Over 109 million vaccine doses have been administered, with 11.28% of the population fully vaccinated.

- COVID-19 is claiming more younger members of the Hispanic population, with over five times as many deaths among Hispanics compared with Caucasians in the 35-49 age bracket.

- Mississippi and Connecticut followed Alaska in expanding COVID-19 vaccine eligibility to people aged 16 and older.

- Moderna announced plans to test its vaccine on children as young as six months old.

- The White House is mulling the nation’s first major tax hike since 1993 as part of a long-term economic program following the most recent $1.9 trillion pandemic aid bill. Early estimates indicate the tax increases would have the largest effect on those earning $400,000 or more per year.

- U.S. banks are expected to turn historic profits this year as they free up tens of billions of dollars in reserves that were originally set aside to cover expected pandemic-induced loan losses that never materialized.

- Retail sales fell a higher-than-expected 3.0% in February as lockdowns and inclement weather interrupted January’s strong rebound.

- Wholesale prices rose a modest 0.5% from January to February after a record jump at the start of the year.

- Mortgage rates continued their slight gains from the historic lows of last summer, reaching 3.05% for the week of March 11. Sales of previously owned U.S. homes surged to their highest level in 14 years last year and are expected to rise again this year.

- More companies are touting remote work as a perk of employment in job ads.

- In reporting a larger-than-expected fourth-quarter loss, Delta Air Lines said it expects a daily cash burn of $10-$15 billion in the current quarter but anticipates airline industry fortunes will improve as the year progresses.

- Airport passenger volumes hit their highest levels in a year last weekend, shooting airline stock prices up and bringing hope for air travel’s recovery as soon as this month.

- FAA regulators are extending a “zero-tolerance” policy against passengers who refuse to wear face masks on flights.

- Boeing is investigating a new potential manufacturing flaw in cockpit windows on its 787 Dreamliner, which has been under a delivery suspension since October for other issues.

- Hotel occupancy rates reached 49% the week ending March 6, near the pandemic high of last October.

- With ports closed to cruise ships, cruise companies are offering “land cruises” by train or motor coach in Alaska to recoup pandemic losses as the summer travel season approaches.

- Amazon is “quietly” building a national grocery chain, with plans to add more than two dozen new Amazon Fresh supermarkets in California, New Jersey and Washington.

- A spate of electric vehicle startups promises investors huge revenues in record-setting time frames that surpass even Google’s and Uber’s early growth, prompting skepticism among some analysts.

- Hasbro announced plans to phase out the use of plastic packaging for new products over the next two years.

- Data transmission using ultrathin plastic polymer could transmit information 10 times faster than copper.

- ICON, a leader in the brand-new market of 3D-printed houses, just completed four homes in East Austin, Texas, while a competitor draws up designs for a community of 15 3D-printed homes in Rancho Mirage, California.

- While most of the world saw a drop in air pollution during the pandemic, pollution in American cities increased due to historic wildfires in the Western U.S.

International

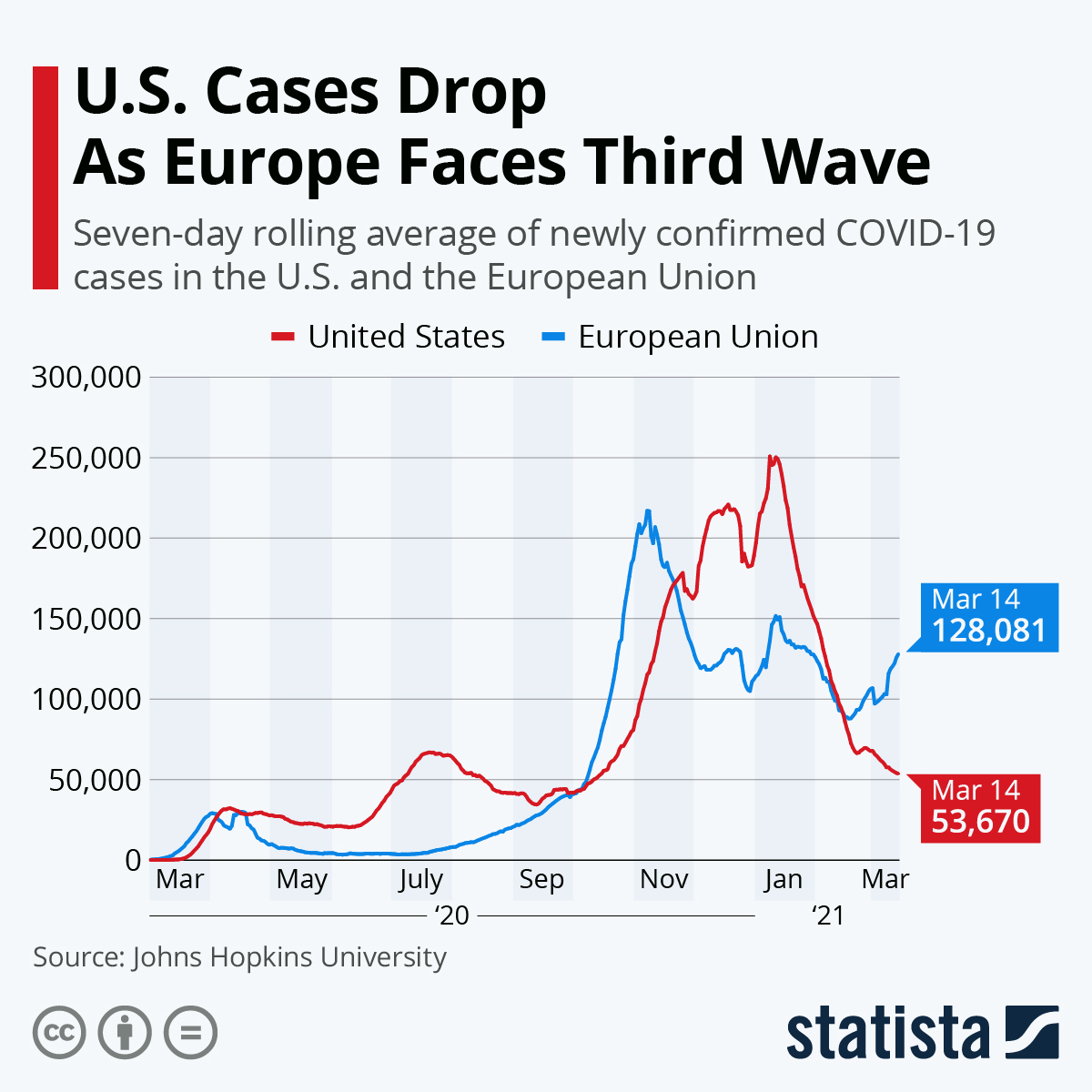

- Global coronavirus transmissions increased 11% last week, raising concerns that pandemic restrictions may be breaking down just as vaccinations are increasing.

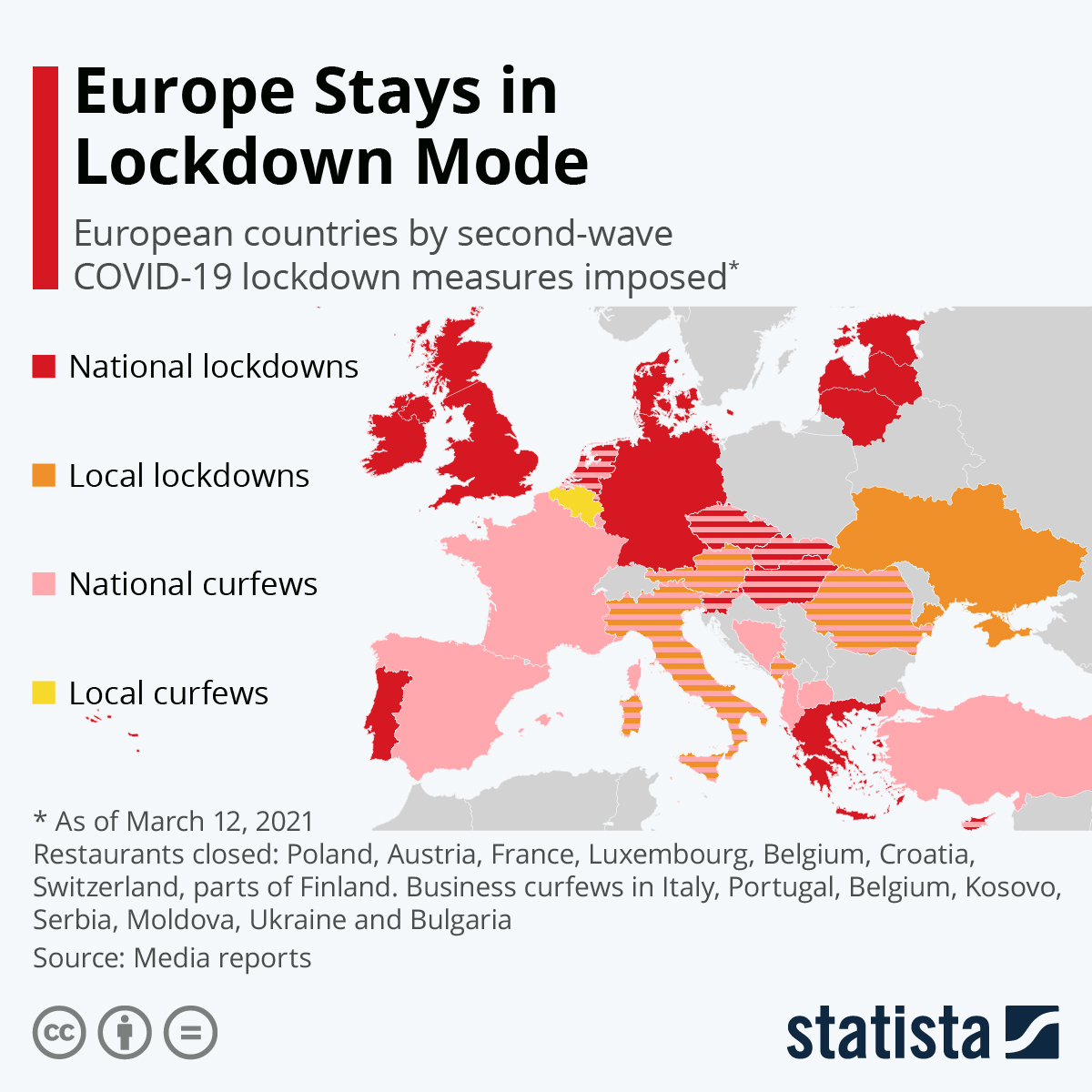

- There are growing concerns that Europe could be entering another COVID-19 wave:

- New COVID-19 infections in Germany rose 20% over the past week, prompting warnings the country could be on the cusp of a third wave as it lifts restrictions.

- A spike in COVID-19 cases in Ontario shows early signs of a third wave of the virus there, the region’s hospital association is warning.

- Hong Kong required all staff from its U.S. consulate to undergo COVID-19 testing after two workers there became ill with the virus.

- Malaysia recorded its lowest number of new COVID-19 cases in 2021 yesterday.

- Germany, Italy, France and Spain have temporarily halted use of AstraZeneca/Oxford’s COVID-19 vaccine, citing concerns over potential blood clots caused by the shots. Venezuela, Indonesia, Portugal and Cyprus have either blocked authorization of the shots or suspended their use.

- Australian officials ruled out halting the use of AstraZeneca’s COVID-19 vaccine.

- Mexico is asking the U.S. to share doses of AstraZeneca’s COVID-19 vaccine it has in stock pending regulatory approval.

- China pledged to donate 300,000 COVID-19 vaccines to United Nations peacekeeping troops, adding to a 100,000-dose donation from India to protect officers deployed in peace missions around the world.

- The World Health Organization predicts six to eight new COVID-19 vaccines will come to market by the end of the year.

- Brazil appointed its fourth health minister during the pandemic amid increasing infection and fatality rates and a slow vaccine rollout.

- The prime minister of Estonia is the latest world leader to test positive for COVID-19.

- In the first two months of 2021, China’s economy expanded by 35% from the year-ago period and nearly 17% from the first two months of 2019. China’s central bank expects GDP growth of just over 6% in 2021, a lower-than-expected gain as the nation becomes the first major economy to phase out pandemic stimulus measures.

- Volkswagen announced plans to build six electric vehicle battery factories in Europe by the end of the decade as the company undergoes a massive shift toward electric cars. The company expects to sell a million electric vehicles this year and ascend to global leadership by 2025.

Our Operations

- Visit our new 3D Printing e-commerce site.

- Listen to M. Holland’s 2021 Market Trends Podcast Series episodes featuring insight from our Market Managers.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.