COVID-19 Bulletin: March 18

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices jumped 8% Thursday, extending a series of wild daily swings on renewed fears of supply shortages from Russia. In mid-day trading today, WTI futures were up 1.9% at $104.40/bbl, Brent was up 1.3% at $108.00/bbl and U.S. natural gas was down 2.4% at $4.87/MMBtu.

- More oil news related to the war in Europe:

- European natural gas futures were trading around 105 euros per megawatt-hour today, almost 70% below a record-high of 345 euros last week.

- A near-record number of LNG tankers are loading or waiting to unload in the Gulf of Mexico amid surging demand for U.S. exports.

- Spain and Portugal will propose a Europe-wide cap on electricity prices when member nations meet next week for a planned summit.

- The U.K. plans to more than double offshore wind capacity by the end of the decade as it weans itself off Russian fossil fuels.

- Belgium could defer its planned exit from the nuclear sector in 2025 due to lower energy supplies from Russia.

- Germany’s largest refiner reports seeing little disruption in supplies from Russia so far.

- Norway said it would offer new licenses to drill for oil and gas in its oceans, a welcome development for Western nations looking to reduce imports of Russian energy.

- A new Texas law prohibits state agencies from investing funds in financial companies that boycott energy firms.

- Exxon Mobil and BHP Group are investing a combined $291 million to increase gas output off southeast Australia.

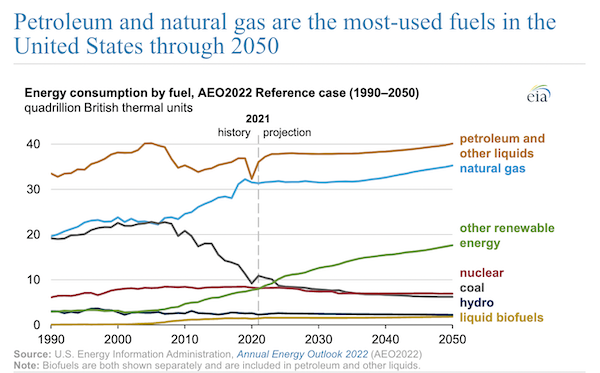

- Petroleum and natural gas are expected to remain the U.S.’s largest sources of energy as consumption grows through 2050, the Energy Information Administration predicts:

- Many large, publicly traded U.S. energy companies have been cautious about ramping up drilling activity amid investor pressure for dividends and share buybacks, paving the way for windfalls for small operators.

Supply Chain

- The U.S. West is facing another spring and summer of dwindling water resources and rising temperatures, extending drought conditions that have covered over half the continental U.S. since the summer of 2020.

- In a rare break with its strict COVID-19 lockdown policies, China is allowing some companies in Shenzhen to restart factories shut down since last Sunday.

- The Port of Los Angeles handled a record 857,764 TEUs last month but expects volumes to soften this spring due to COVID lockdowns in China.

- The Port of Dover, Britain’s busiest maritime gateway, will see disruption after a regional ferry operator laid off more than 800 employees and suspended crossings for the next few days in a controversial cost cutting move.

- More than 40 Taiwan-based makers of semiconductors and other electronic components have said they are suspending work in Shenzhen and nearby Dongguan due to strict pandemic controls.

- Auto chip supplier Renesas is suspending production at three Japanese plants due to disruption caused by Wednesday’s 7.4-magnitude earthquake.

- Toyota cut its April production target by 150,000 vehicles, or 17%, due to continued semiconductor shortages. The automaker now exports vehicles made at its Burnaston plant in the U.K. to Europe by rail rather than truck, cutting lead times by 50%.

- Intel says it will invest $100 million in education in Ohio to develop skilled workers for a $20 billion chip plant it plans to build outside Columbus.

- The Cass Freight Index for expenditures rose to 4.453 in February, up 42.2% from the year before and 10.6% from January.

- Freight forwarder Flexport estimates it still takes more than 100 days to move a container from Asia to a U.S. destination through the West Coast, up from less than 50 days two years ago despite a recent cooling of U.S. port backlogs.

- U.S. trucking customers are consolidating more loads and switching modes to avoid surging fuel prices.

- Cargo theft in the U.S. and Canada fell 15% in 2021, new data shows.

- J.B. Hunt plans to grow its intermodal container fleet 40% to 150,000 units over the next five years.

- Dollar General faces a cost squeeze after growing its private fleet, which is expected to comprise 40% of the tractors used to transport its goods from distribution centers to stores this year, up from 20% at the end of 2021.

- FedEx’s revenue rose 10% in the fiscal third quarter despite a decline in parcel volumes, with higher rates causing operating income to nearly triple.

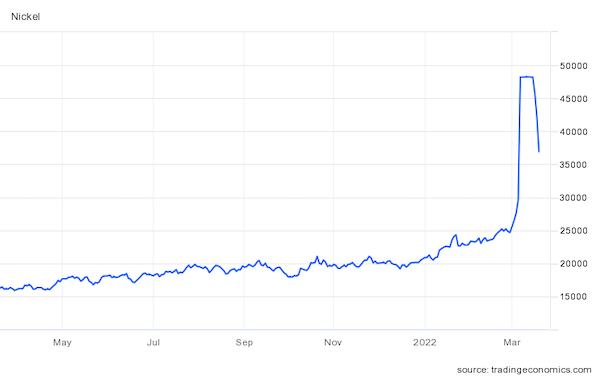

- Nickel futures fell by 12% before hitting their daily trading limit for the third time in a row when the market opened today:

- The effects of months-long worker stoppages at Finnish paper mills are creating a growing shortage of shipping labels.

- DHL ordered five new B777 freighters to boost air cargo capacity out of Singapore.

- Key Apple supplier Foxconn has recruited over 100 Japanese companies to help it develop electric vehicles.

- Microsoft invested $34 million into a technology firm that promises to boost vessel efficiency with artificial intelligence.

- Wheat planting season in Minnesota and North Dakota will be delayed this spring due to flooding in the Red River Valley, bolstering fears of global food inflation.

- Shortages of Ukrainian agriculture exports are forcing the EU to revamp its farming policies.

Domestic Markets

- The U.S. reported 52,884 new COVID-19 infections and 1,685 virus fatalities Thursday.

- Top U.S. health officials are warning that the recent rise in COVID-19 cases in Europe could soon spread to the U.S., especially as Congressional pandemic funding dries up and more programs are cut.

- Moderna is asking the FDA for emergency authorization of a second COVID-19 booster dose for all adults.

- A new state law in Connecticut will allow most employees to telecommute as many as four days a week.

- Most of last month’s rise in U.S. retail sales was due to higher prices, as unit sales of general goods declined in nine of the 10 weeks from Dec. 26 to March 5.

- U.S. factory output jumped 1.2% in February, the largest gain in four months.

- The typical U.S. home value rose over $52,667 last year, a figure slightly higher than the median U.S. full-time salary of $50,000, Zillow says.

- The average U.S. mortgage rate is above 4% for the first time since May 2019, according to Freddie Mac.

- New U.S. home construction rebounded 6.8% last month, its strongest pace since 2006.

- Delta Air Lines is raising wages 4% across-the-board as flight demand continues to rebound.

- Amazon closed its $8.5 billion acquisition of the MGM movie and television studio Thursday, even as the Federal Trade Commission continues to examine the deal.

International Markets

- More news related to the war in Europe:

- Lawmakers in the U.S. House voted overwhelmingly to strip Russia and Belarus of their preferential trade status yesterday, which could result in higher tariffs on imports from the nations.

- Hopes for a cease-fire between Russia and Ukraine rose on Thursday, according to Turkish officials.

- Russia managed to make good on over $100 million in payments to overdue bondholders due this week, averting default on its foreign debt for now.

- Italian tire maker Pirelli is halting investments and curtailing factory activity in Russia, the source of 10% of its total output.

- Bank of New York Mellon halted new banking business in Russia and suspended investments into Russia securities.

- Restaurant Brands International is disposing of its ownership interest in a Burger King joint venture in Russia after facing difficulties in getting the nation’s 800 restaurants to suspend operations.

- Bucking the trend of Western companies withdrawing from Russia, Kansas- based Koch Industries said it will continue operating its two glass plants in Russia.

- A quarter of all Americans have donated to charity and aid efforts in Ukraine, according to a new study.

- The Western Pacific, including South Korea and China, saw the globe’s largest rise in COVID-19 stats last week, with infections up 25% and fatalities up 27%.

- China reported over 2,300 new COVID-19 cases Thursday, almost double the count of a day earlier, as its president reaffirmed the nation’s zero tolerance policy against the virus.

- COVID-19 infections in Hong Kong have now surpassed 1 million. Almost 95% of the city’s COVID-19 fatalities have come in the past month, with new estimates suggesting at least half the island’s 7.4 million people have been infected.

- Canada will end its COVID-19 testing mandate for fully vaccinated incoming travelers starting April 1.

- Italy announced plans to end all pandemic restrictions on May 1.

- At least 35 drugmakers are working to produce low-cost versions of Pfizer’s COVID-19 antiviral pill for use in low-income nations.

- New research from the U.K. suggests even mild cases of COVID-19 can have lasting impacts on memory and decision-making.

- JPMorgan and Credit Suisse said the recent COVID-19 surge in China will have minimal impact on the nation’s GDP.

- China asked U.S. regulators to allow flights from New York to Shanghai to land in alternate airports to avoid strict COVID-19 lockdowns in the financial hub.

- Britain’s central bank raised its key interest rate for the third time in a row Thursday.

- The Turkish economy grew 7.4% year over year in the third quarter despite the nation’s budding currency crisis.

- European car sales fell 5.4% to a record-low 804,028 units in January, the eighth straight month of declines.

- South Korea’s SK Innovation plans to build an automotive battery plant in Turkey with Ford and local group Koc Holding.

- Volkswagen, the world’s number two car marker, is stepping up efforts to source materials sustainably.

- Speculation is rising that Japan’s Mitsubishi Corp. will see losses after winning bids to develop three offshore wind projects in Japan at extremely low costs feed-in tariff bid prices.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.