COVID-19 Bulletin: March 2

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Winter Storm Uri

- Texas’s grid operator is short nearly $345 million in payments from retail power providers after electricity prices skyrocketed earlier this month, bringing the total energy crisis shortfall to nearly $2.5 billion.

- Plumbing suppliers in Texas are seeing record sales to meet a surge in demand for replacement pipes, valves and fittings damaged in this month’s winter storm.

- Some Mississippi residents remain under a boil water notice more than two weeks after the winter storm.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply

- Oil prices inched higher in mid-day trading today, with the WTI up 0.3% at $60.82/bbl and Brent up 2% at $63.80/bbl. Natural gas was up 2.2% at $2.84/MMBtu.

- Saudi Arabia’s unilateral cut in production in February sent OPEC’s monthly production down 870,000 bpd, the first monthly drop in the cartel’s output since June last year.

- Rallying oil prices in recent weeks are raising the possibility that OPEC+ will decide to put more oil on the market in April when it meets this week to consider production levels. Saudi Arabia and Russia may be at odds, with the latter pressing for opening the spigots and the former advocating caution.

- Crude shipments from the Louisiana Offshore Oil Port dropped to zero from a record high in January as Asian buyers, flush with inventory, scaled back imports.

- The American Petroleum Institute, the oil industry’s top lobbying group, is set to endorse prices on carbon emissions, the industry’s strongest signal yet that producers will accept governmental efforts to confront climate change.

- The U.S. administration is signaling it won’t try to increase the federal fuel tax as a long-term solution for funding transportation and infrastructure.

- Exxon, acquiescing to pressure from activist investors demanding more transparency about its carbon footprint and energy transition strategy, added two new directors to its board on Monday.

- After falling in the first half of 2020, carbon emissions are on the rise, up 2% in December compared with the prior-year period.

- BP and SABIC are partnering at a German production site to increase production of circular products that use mixed plastics as feedstock, reducing the amount of fossil resources needed in the petrochemical process.

Supply Chain

- Long-term container shipping contract rates are rising to historic highs, jumping 9.6% month-over-month in February following January’s 5.9% increase.

- Container-line scheduling reliability hit another record low for the sixth straight month, falling to just 34.9% in January.

- U.S. imports continue to surge, up 12.5% in January, while exports fell 7.5%, highlighting an imbalance in global trade resulting from COVID-19.

- While the rollout of COVID-19 vaccines is expected to eventually tame high shipping costs, the industry may still fare better than in previous down cycles as new vessel orders remain relatively light.

- The White House indicated willingness to continue hardline policies against China’s trade practices as it conducts a comprehensive review of its trade policy with its main economic rival.

- Chinese semiconductor manufacturers are buying used chipmaking machines in a rush to produce homegrown products, driving equipment prices up to 20% higher in Japan’s secondary market.

- Taiwan factories are grappling with the worst supply chain delays on record as shipping disruptions clash with surging demand.

- German exports to the U.K. continue to drop following Brexit, with a nearly 30% plunge in January, almost double the 15.5% decline for all of 2020. The 2020 decline was the largest annual drop since the 2009 financial crisis.

- A pair of South Korean battery makers are asking the White House to lift trade sanctions from a dispute with rival LG Chem to clear a path to complete a factory under construction near Atlanta, Georgia, a key facility for future mass production of electric cars for Ford and Volkswagen.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

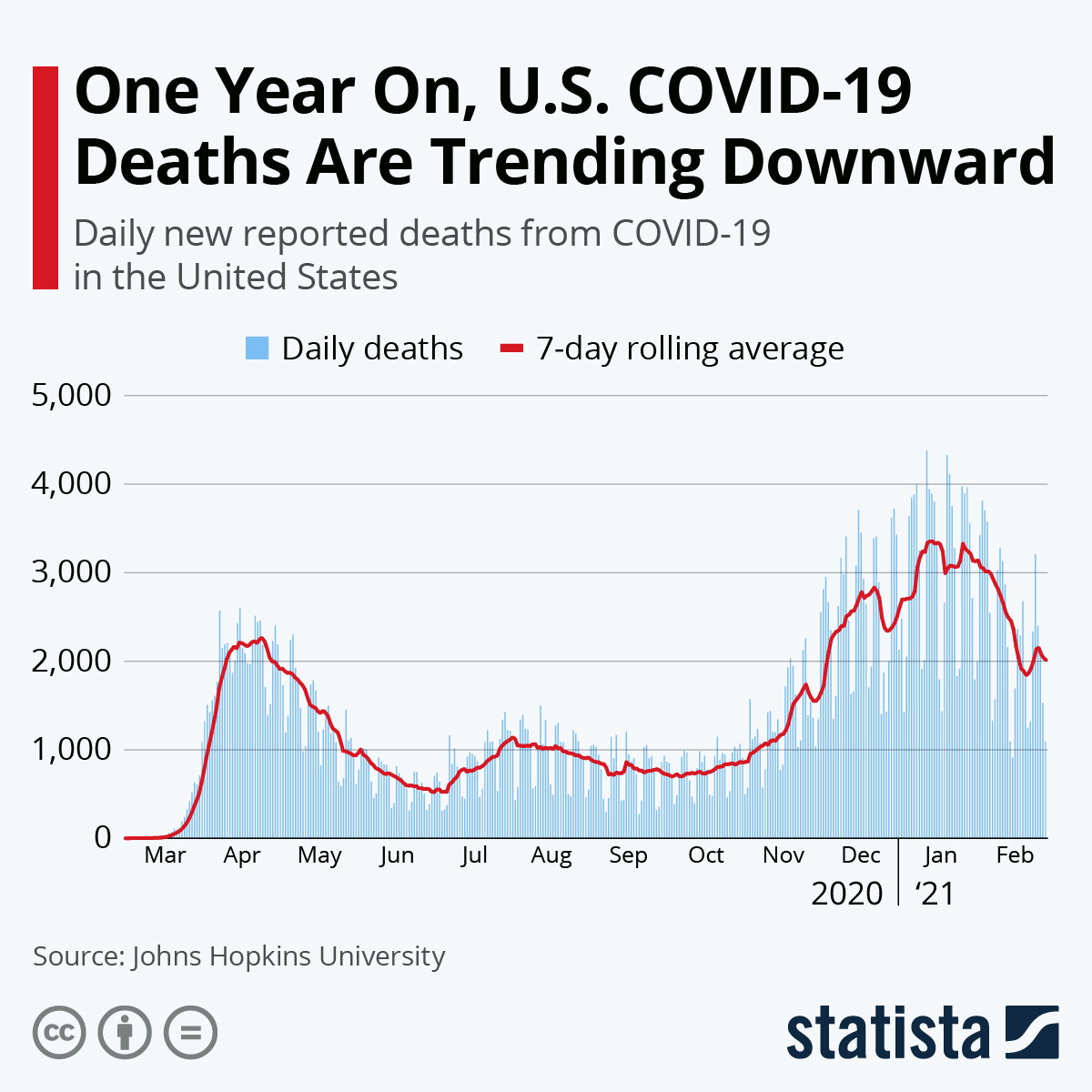

- There were 58,812 new COVID-19 infections yesterday in the U.S. and 1,566 deaths.

- The U.S. has now recorded 735 cases in 14 states of a virulent coronavirus strain first identified in New York, one of five strains being tracked nationally by health officials.

- New COVID-19 infections in Florida rose by only 1,700 yesterday, the smallest daily increase in nearly five months.

- California is spending $6.6 billion in incentives to encourage public schools to reopen to in-person instruction by April.

- New York state marked its one-year anniversary of the first confirmed COVID-19 case within its borders. Since that time, the state has suffered nearly 30,000 virus fatalities and more than 1.6 million infections.

- Authorities in Florida are planning to crack down on an expected influx of spring breakers in crowded vacation spots that will likely become COVID-19 super-spreader events.

- Johnson & Johnson has started shipping doses of its newly authorized single-shot COVID-19 vaccine to the U.S. government, with the first shots expected to be administered today.

- Researchers studying COVID-19 vaccines are seeing breakthroughs in the fight against other long-term infectious diseases, leading many to believe gene-based technology will be able to protect against all manners of outbreaks in the years to come.

- Tyson Foods plans to vaccinate 13,000 employees for COVID-19 at facilities in Iowa this week.

- The U.S. Senate is moving ahead on approving the next $1.9 trillion economic stimulus package after scrapping a contentious provision to raise the national minimum wage.

- U.S. stocks surged to their best day in nearly nine months yesterday after a weekslong advance in government-bond yields stalled, quelling fears about rising interest rates.

- U.S. inflation is near a decade low and well below the 2% level the Federal Reserve targets as ideal, yet long-term inflation rates could exceed 2% in the aftermath of the next $1.9 trillion stimulus plan and shifting political priorities toward reducing economic disparities.

- A surge in new orders in February pushed U.S. manufacturing activity to a three-year high as industry faces labor shortages and higher costs for raw materials.

- The total value of U.S. homes was up 10% in January from the year-ago period, while the median price for a home increased 14.3% to around $330,500, the biggest yearly rise since at least 2013.

- United will buy 25 new models of the embattled Boeing 737 MAX jet, a sign the airline is positioning for a rebound in passenger air travel this year.

- Disney’s CEO expects a permanent shift in the movie industry toward streaming launches, adding further weight to the possibility of a future without movie theaters.

- Several companies have begun adding carbon labels to packaging so consumers can understand the full impact of the products they’re using.

International

- The number of new COVID-19 infections across the globe rose last week for the first time in seven weeks, as the World Health Organization warned countries not to relax pandemic restrictions despite rising vaccinations.

- Several European countries are seeing slight upticks in daily COVID-19 cases due to virulent new strains, prompting calls to accelerate the pace of vaccinations and testing.

- Austria is loosening restrictions on its economically vital hospitality industry as infection rates decrease slightly.

- The U.K. reported its lowest daily death toll and new case count since October.

- Twenty-nine percent of Londoners have tested positive for COVID-19 antibodies, the highest rate of any U.K. region, due to the rapid spread of the highly infectious U.K. variant of the virus.

- Researchers in the U.K. found a single dose of Pfizer/BioNTech’s or AstraZeneca/Oxford’s COVID-19 vaccines reduces virus hospitalizations by 80% for those over 70 years of age.

- France approved AstraZeneca/Oxford’s vaccine for those over age 65, as the country reported the highest number of virus patients in intensive care units since Dec. 1.

- India entered the next phase of its COVID-19 vaccine rollout yesterday, opening access to shots at private hospitals and expanding the pool of eligible people.

- Four recent studies found coronaviruses similar to COVID-19 in species of bats and pangolins in Southeast Asia and Japan, suggesting the pathogen is more widespread and better at evolving than previously known.

- While global spread of COVID-19 might become more controlled, the pandemic is not likely to end in 2021, the World Health Organization warned.

- China’s currency has been steadily rising in value the last six months as the country experiences the world’s best economic recovery to date. Since June, the yuan has risen 9% against the U.S. dollar on higher exports and massive investment flows.

- Canada’s GDP is estimated to have dropped by more than 5% in 2020, a steeper drop than the U.S. suffered, because of the country’s strict lockdown measures.

- India’s GDP saw 0.4% growth in the fourth quarter of 2020, yet economic disparities between the ultra-rich and poor are growing at a faster pace than ever.

- The U.K. housing market saw continued strength in January, with nearly 100,000 homebuyers securing mortgages, far more than the six-month average of 67,900 new mortgages per month in the leadup to the pandemic.

- Lockdown measures from COVID-19 have caused Germany’s unemployment rate to rise for the first time in eight months, pushing the jobless ranks to 2.75 million and further straining Europe’s largest economy.

- Tesla’s market share in Europe saw a sharp decline in January as China assumed the top spot in the global electric vehicle market.

- Volvo announced plans to go fully electric, phasing out production of all other vehicles by 2030, including hybrids, and to sell cars only online.

- Commercial vehicle manufacturing in the U.K. fell more than 30% in January due to computer chip shortages, the pandemic and the fallout from Brexit, while more than half the vehicles produced were exported.

Our Operations

- Listen to M. Holland’s 2021 Market Trends Podcast Series episodes featuring insight from our Market Managers.

- Visit our new 3D Printing e-commerce site.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.