COVID-19 Bulletin: March 23

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude futures were lower in mid-day trading today, with the WTI down 3.9% at $59.16/bbl and Brent 3.5% lower at $62.33/bbl. Natural gas was 1.8% lower at $1.93/MMBtu.

- Recent upticks in travel and consumption patterns in the U.S. and China point to recovering demand for petroleum products.

- China has sharply increased imports of oil from Iran and Venezuela, a challenge to U.S. foreign-policy priorities.

- Saudi Aramco publicly announced it would prioritize energy supply to China for the next 50 years. The producer is currently China’s top supplier, with volumes up to 1.86 million bpd.

- Saudi Aramco posted a 44% decline in profits from 2019 to 2020, a positive statistic compared to other companies that fared far worse during last year’s demand slump.

- Low-rated U.S. oil firms have raised more than $20 billion on the bond market so far this year, a record, as the recovery in oil prices increases investor appetite for high-yield bonds.

- Russia expects its LNG production capacity to rise threefold by 2035 to 140 million tons per year.

- Chevron, unable to find a buyer for its 50% stake in the Kitimat LNG project in Canada as part of its global restructuring, said it would cease funding the project.

- Global spending on renewable projects in 2021 is set to rise from $224 billion last year to $243 billion in 2021, a record.

- Top U.S. oil company executives have expressed support for carbon pricing as a method of reducing greenhouse gas emissions.

- The U.K. is debating whether to include the shipping industry as part of its new carbon market, where the government instates pollution limits on utilities, factories and airlines.

- Pennsylvania, a center of coal and shale production, is installing solar arrays in six counties that will supply half of the state government’s power needs.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- The global computer chip shortage has curtailed pickup truck production for all three major Detroit automakers, while the recent fire at a chip manufacturer in Japan could further disrupt production for Honda, Nissan and Toyota, prompting a national effort to repair the facility.

- The computer chip shortage forced Volvo to cut truck production at plants in Belgium and Brazil as the company warned the shortage will impact second-quarter results.

- DHL is investing 7 billion euros over the next decade to reach climate-neutral logistics by 2030.

- Truck driver availability in the U.S. has tightened to a three-year low.

- Dollar General is expanding its private truck fleet hoping to offset high third-party logistics costs.

- U.K. food and drink exports to the European Union plunged 75.5% in January following the nation’s exit from the bloc, new data shows.

- The number of available shipping containers across China’s main ports has grown by 56% since the Chinese New Year, highlighting improvements in supply and demand.

- Container freight rates are spiking, and containership newbuild orders are surging at yards in China, South Korea and Japan.

- Crews have nearly completed dredging Charleston Harbor to 52 feet, making it the deepest port in the Eastern U.S. After regulatory clearance, the Port of Charleston will soon begin container operations at its Leatherman Terminal.

- India’s containerized trade expanded 13.2% in the fourth quarter, alongside a 36.3% jump in imports.

- Japan’s largest airline is expanding freighter services amid growing demand for cargo transportation between Asia and North America, including automobile parts from Japan and perishables from North America.

- CMA CGM is set to order 20 new container ships powered by conventional fuel and outfitted with scrubbers.

- Hyundai Heavy Industries is looking to develop fuel cells for shipping vessels.

- A shortage of corrugated material is requiring some suppliers to ship in boxes that may not be stackable. Such unstackable packaging should be clearly marked. In the interest of safety, we urge clients and our fulfillment partners to notify anyone involved in logistics operations to be mindful of the shortage and careful to heed warning labels that may appear on resin containers.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 50,584 new COVID-19 cases and 590 deaths in the U.S. yesterday. Over 126 million vaccine doses have been administered, with 13% of the population fully vaccinated.

- The U.S. seven-day average of new COVID-19 cases is up by at least 5% in 27 states, despite the accelerating pace of vaccinations.

- Highly infectious variants of COVID-19 are leading the resurgence in some U.S. areas, particularly New Jersey and Michigan.

- New Jersey’s governor is halting the state’s easing of pandemic restrictions as case counts surge to the highest in the nation.

- A top health official urged Americans to recommit to mask-wearing and social distancing to avoid a new surge of the virus.

- New York state expanded eligibility for the coronavirus vaccine to those age 50 and older.

- New York City high schools reopened for in-person learning yesterday for about 20% of students, while municipal employees will return to offices in May.

- West Virginia, Ohio and Arizona have opened COVID-19 vaccinations to everyone over the age of 16.

- U.S. health officials warned that AstraZeneca, which is seeking emergency use authorization for its COVID-19 vaccine, may have used outdated information in concluding the vaccine is 79% effective.

- U.S. officials are concerned that Johnson & Johnson won’t meet its commitment to deliver 20 million doses of its COVID-19 vaccine by the end of the month, while AstraZeneca is under pressure in Europe for its production shortfalls.

- Los Angeles will begin vaccinating family members of students early next month, an effort to convince parents to let their children return to in-person classes, while the city’s teachers union agreed to reopen schools starting in April.

- The next generation of COVID-19 vaccines could be delivered using nasal sprays instead of needles.

- Cloud computing and robust network capabilities are proving just as important to the U.S. immunization campaign as physical vaccine doses.

- Pfizer plans to expand the application of gene-based technology used in its COVID-19 vaccine to develop other vaccines and tackle more diseases.

- U.S. administration officials have crafted an early version of a $3 trillion infrastructure and economic package.

- U.S. consumers spent more on gyms, salons and spas in recent weeks than they have since the pandemic began, a promising sign for the nation’s economic recovery.

- U.S. borrowing for capital equipment rose 9% in February.

- Citicorp, to ease stress among remote workers, is banning video meetings on Fridays and encouraging employees to take vacations.

- Microsoft will ask 20% of its employees to return to offices on March 29.

- A Microsoft survey of over 30,000 people across various industries in 31 countries found that 54% feel overworked, 39% report exhaustion, and 41% are contemplating leaving their jobs, with the highest anxiety among those 18 to 25 years old.

- Krispy Kreme will give away a free doughnut anytime someone flashes their COVID-19 vaccination card, while e-commerce rewards startup Drop will give $50 in points to users who share vaccination selfies.

- The 14 biggest U.S. lenders slashed $99 billion from customer credit card spending limits last year, mostly affecting financially troubled households.

- The cruise industry is awaiting U.S. approval to sail again amid concerns that a second summer season could be lost to the pandemic.

- The number of screened air passengers in the U.S. topped 1.5 million on Sunday for the first time since last March.

- U.S. and Chinese officials will meet to discuss cooperation on climate change despite heated remarks between the two governments at a meeting in Alaska last week.

- General Motors may introduce regional inventories for its electric vehicles, allowing multiple dealerships to draw vehicles as needed, speeding up the time frame for product delivery.

- BMW and California’s PG&E are teaming up to develop a “smart charging” system that automatically charges electric vehicles during non-peak power periods.

- Electric vehicles are not as clean for the environment as carmaker advertising would suggest, with significant emissions produced in building the cars and creating the electricity used to fuel them.

- Electric vehicle adoption could be slowed by false perceptions among the public that they are more expensive to recharge than traditional vehicles are to refuel.

- Scientists in Sweden have conceived an improved “massless structural” battery that can potentially serve as the structural frame for electric vehicles, replacing heavy, traditional lithium alternatives.

- A Swiss researcher has developed an invisible lock system where switches are printed on a transparent polymer film using conductive ink.

International

- More than 500 of Brazil’s top banking and finance executives issued an open letter to the government seeking more action to combat the pandemic as the nation’s COVID-19 cases surpassed 12 million yesterday, with virus fatalities quickly approaching 300,000.

- Germany will go into “hard lockdown” for five days over Easter to reverse a third wave of COVID-19 largely spread by virulent mutations.

- Austria canceled plans to reopen its economy around Easter due to another wave of COVID-19.

- Doctors in Hungary are recruiting volunteer ward workers as a third wave of the pandemic stretches the nation’s healthcare resources.

- Confidence in China-made vaccines is plummeting in Hong Kong, where seven deaths and dozens of adverse reactions were reported following the first 160,000 doses of the Sinovac shot.

- Russia is ramping up vaccine production with an aim to inoculate 70 million people by the end of the year.

- Employment in the U.K. ticked higher for the third straight month, offering hope that the nation is emerging from its worst recession in three centuries.

- The number of people heading out to shops in the U.K. rose by 0.5% last week, the eighth rise in nine weeks as the end of pandemic restrictions draw near.

- After contracting by 11% in 2020, Spain’s economy is poised for a 7.2% GDP rebound this year, one of the largest projected gains in Europe.

- Germany’s economy is expected to shrink sharply this quarter amid continued coronavirus lockdowns affecting the nation’s services and construction industries.

- European aviation stocks took steep hits yesterday amid concern over a third wave of COVID-19 and doubts surrounding the U.K.’s plans to restore travel.

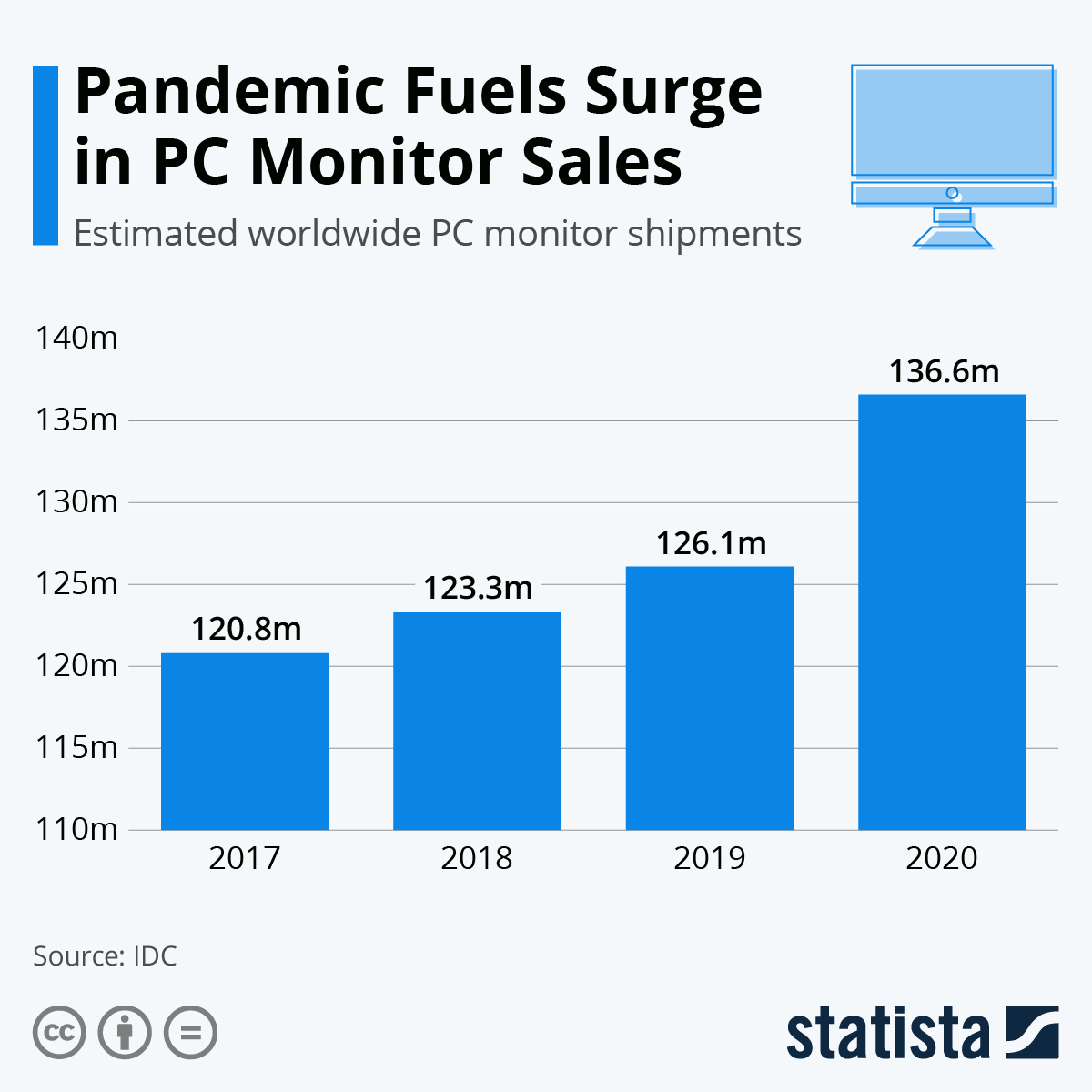

- The pandemic fueled a surge in PC sales last year:

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- M. Holland is proud to be named among the Plastics News Best Places to Work again this year. We also were recently named among the Best Places to Work by Crain’s Chicago Business.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.