COVID-19 Bulletin: March 24

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- The U.S. crude price slid 6% yesterday and Brent fell 5% on concerns about rising COVID-19 infections and renewed lockdowns.

- Energy prices were higher in mid-day trading today, with the WTI up 5.2% at $60.75/bbl and Brent up 5.1% at $63.91/bbl. Natural gas was up 4.4% at $1.98/MMBtu.

- U.S. gasoline prices averaged $2.88/gallon last week, up 30% from a year ago, as prospects improve for a busy summer driving season.

- Indian refiners doubled their purchases of U.S. oil in January as the government urges them to reduce their reliance on OPEC+ crude sources.

- Deprived of oil supplies from Venezuela and confronting reduced supplies from OPEC+, U.S. refiners have quietly turned to Russia, now the country’s third largest oil supplier, despite federal government policy favoring energy independence and urging Europe to limit Russian supplies.

- Europe’s oil majors are far outpacing their U.S. rivals in investing in green energy.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- It could take days to remove a giant container ship that ran aground in the Suez Canal, blocking traffic in both directions on one of the world’s busiest trade routes.

- The worldwide computer chip shortage affecting the automotive industry will impact overall global production by 1.5 million units.

- Taiwan, among the world’s leading computer chip producers and fighting a severe drought, reduced water supplies to semiconductor-producing regions but said the cuts will not impact production.

- The computer chip shortage is prolonging a months-long inventory squeeze for auto dealerships, with little near-term relief in sight.

- Intel plans to build a $20 billion semiconductor factory in Arizona and enter the computer chip foundry business, serving as a contract manufacturer for third parties.

- A new interactive map released by the California Geological Survey shows that ports in Los Angeles and Long Beach are particularly vulnerable to tsunamis.

- Port congestion and equipment shortages have led to supply chain bottlenecks for companies across multiple industries, causing the inventory-to-sales ratio to drop to 1.26 in January, the measure’s lowest level since 2012.

- Manufacturers and suppliers are scaling up the use of tracking technology to ensure critical medical shipments arrive on time and intact, citing new urgencies created by the pandemic.

- A new report shows surging growth of e-commerce-only warehouses, now comprising more than 27% of the industrial real estate market in the top 22 U.S. markets.

- The volume of cargo handled at ports in Brazil is expected to grow by 4% this year.

- Coffee is the latest victim of container shortages and supply chain disruptions, with U.S. supplies shrinking and wholesale prices rising.

- Fourteen months into its two-year commitment to buy more goods from the U.S., China is importing less than a third of its ambitious targets.

- A.P. Moller-Maersk A/S wants to increase the number of senior female managers to at least 35% in 2021, up from 30% in 2020, as the industry struggles to recruit women for top jobs.

- A shortage of corrugated material is requiring some suppliers to ship in boxes that may not be stackable. Such unstackable packaging should be clearly marked. In the interest of safety, we urge clients and our fulfillment partners to notify anyone involved in logistics operations to be mindful of the shortage and careful to heed warning labels that may appear on resin containers.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 52,878 new COVID-19 cases and 894 deaths in the U.S. yesterday. Over 128 million vaccine doses have been administered, with 13.2% of the population fully vaccinated.

- More than 25% of the U.S. population has received at least one COVID-19 vaccination dose.

- More states are expanding COVID-19 vaccine eligibility to all adults.

- Michigan’s COVID-19 infections were up 300% last week compared with the prior-month period, and its testing positivity rate has risen to 9%, raising concerns among health officials that the state could be a bellwether for the nation.

- In a role reversal from early in the pandemic, the U.S. has become the envy of Europe for its aggressive vaccination campaign and surging economic recovery.

- A new study by Northwestern University reveals that 85% of COVID-19 “long haulers,” those suffering prolonged symptoms after recovering, experience at least four neurological symptoms, which could include brain fog, headaches, numbness or tingling, and loss of taste and smell.

- Researchers at Northwestern University recently developed “electronic skin” made from polymers connected to a circuit that can monitor the wearer’s vital signs and detect possible early signs of COVID-19 infection.

- AstraZeneca hopes to release updated test data within 48 hours after U.S. health officials questioned results earlier this week showing the company’s vaccine is 79% effective.

- New late-stage trial data show that the COVID-19 antibody cocktail made by Regeneron and Roche cut hospitalization and death rates by 70% compared to the placebo.

- Costco, 1 of 11 grocery chains participating in COVID-19 vaccine distribution, has expanded its vaccination effort to five more states, bringing the total number of states served to 12.

- Pfizer began phase 1 testing of a pill-based COVID-19 treatment employing technology like that used to treat HIV.

- Food delivery app DoorDash will begin delivering same-day COVID-19 test kits capable of providing test results within 24 to 48 hours.

- The U.S. extended the sign-up period for the Affordable Care Act to Aug. 15, citing the needs of those recently unemployed due to the pandemic.

- The IRS has issued guidance on a new unemployment tax break that will allow workers to exclude jobless benefits from their calculation of modified adjusted gross income, allowing more people to qualify.

- The White House is considering extending a federal moratorium on evictions through July.

- February orders for U.S. durable goods, which were expected to rise by 0.8%, instead fell by 1.1%.

- Austin, Texas has become the number one destination for potential investment in commercial real estate as more millennials as well as major tech firms relocated to the area during the pandemic.

- Aging and abandoned golf courses have become hot properties for developers in search of land to build e-commerce warehouses.

- A limited study suggests that Americans gained an average of two pounds a month during lockdowns.

- Amazon is requiring that its delivery drivers consent to providing biometric information as a condition of employment.

- Regal Cinemas announced plans to reopen 500 movie theaters at limited capacity on April 2 for the first time in six months.

- Tesla announced it will accept bitcoin as payment, saying it will use internal and open-source software to process the payments.

- A new executive order signed by Virginia’s governor will phase out single-use plastics at state agencies, colleges and universities over the next 120 days.

- Congress will consider a bill that requires plastic packaging companies to pursue and fund plastics recycling, with support from some packaging companies.

International

- COVID-19 fatalities are on the rise again globally, following a recent increase in infections, with Europe and the Americas experiencing the steepest spikes.

- Germany backed off its controversial plan for a five-day lockdown surrounding Easter.

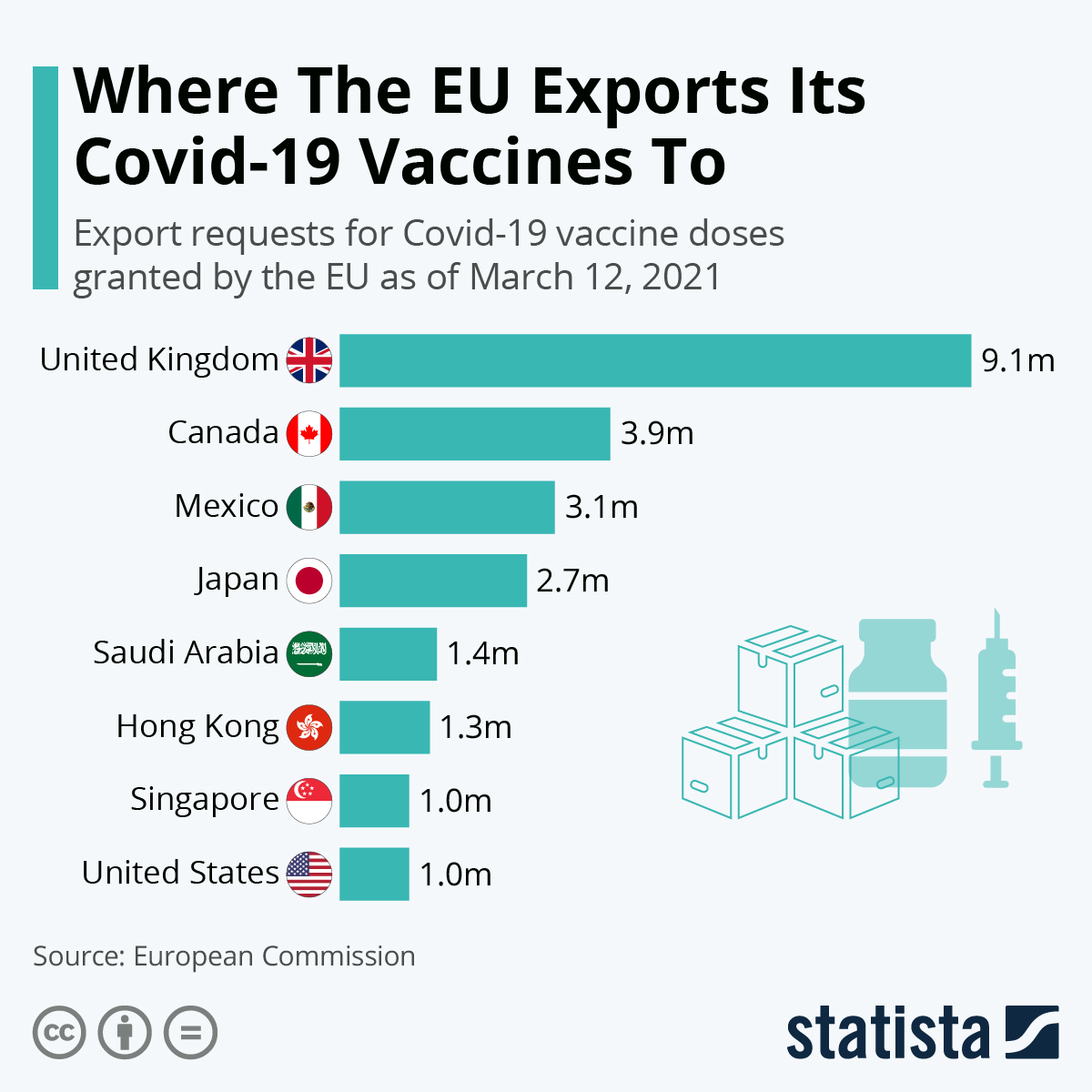

- The European Union, fighting an aggressive spike in COVID-19 infections, plans to tighten restrictions on the export of vaccines, threatening to disrupt global supplies.

- France’s culture minister was hospitalized with COVID-19 yesterday.

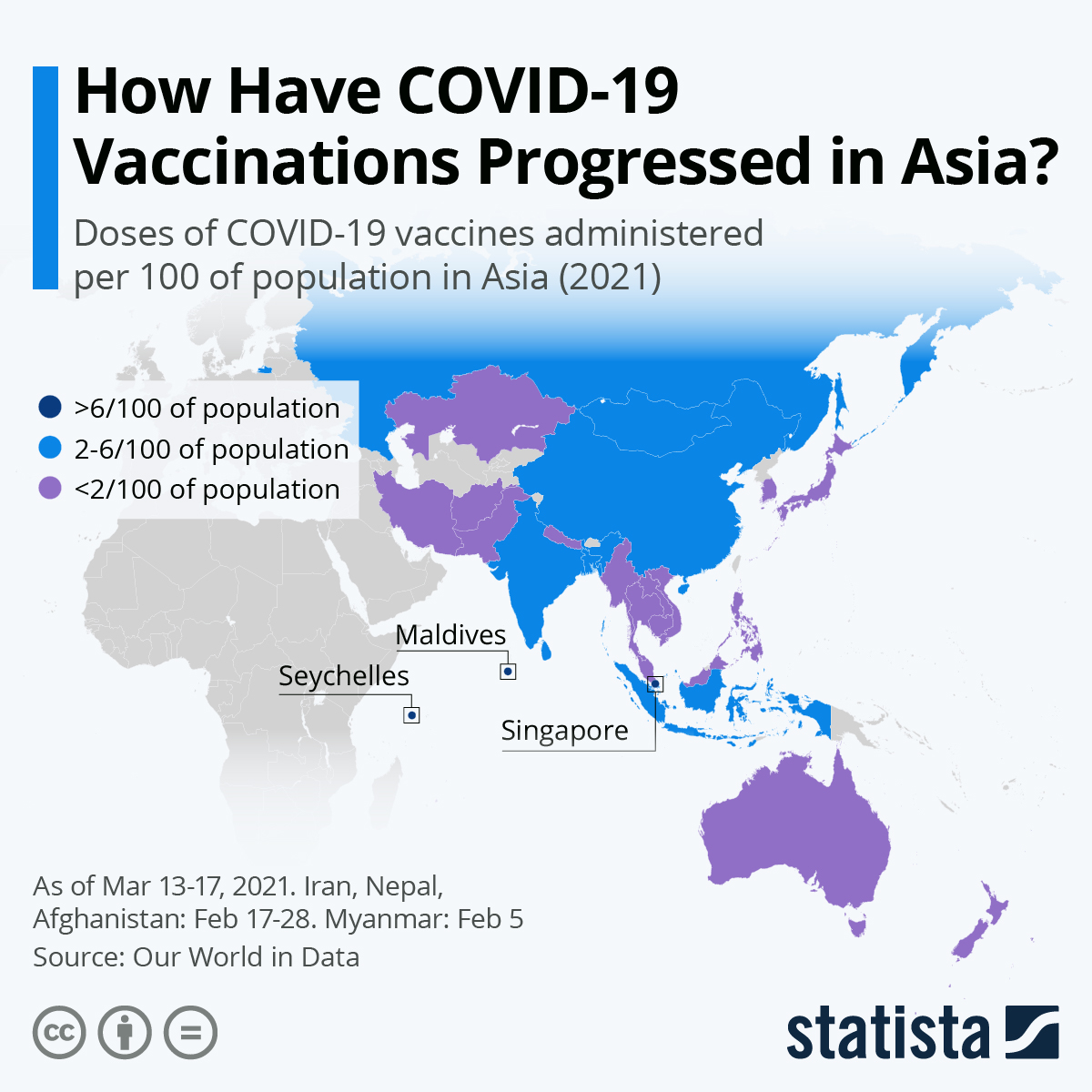

- Vaccination efforts in Asia are trailing those in the West, with most countries having inoculated less than 6% of their populations.

- Hong Kong suspended the use of BioNTech vaccines because of quality issues.

- Indonesia is struggling with its ambitious vaccination campaign, plagued by infrastructure limitations, misinformation and other constraints.

- Creating a coronavirus passport system is proving to be a technical challenge, as systems must be secure, privacy protective and able to communicate with other platforms.

- There are growing concerns that vaccine passports allowing access to public venues could further disadvantage and isolate the poor, who may lack access to inoculations and mobile passport apps.

- Germany will borrow nearly $290 billion this year and lift constitutional borrowing limits for a third straight year in 2022 to counter the economic impact of the persistent pandemic.

- Private sector economic activity rose in Europe for the first time in six months in March, with a boom in manufacturing activity offsetting the lagging services sector and contributing to the highest rise in input costs in a decade.

- German manufacturing activity rose at a record pace and its services sector grew for the first time in six months.

- The Purchasing Managers’ Index (PMI) for France hit a better-than-expected 49.5, still below the threshold of 50 indicating economic growth, with strength in the manufacturing sector offset by moribund activity in services.

- The composite PMI for the U.K. hit a seven-month high of 56.6, well above expectations, as business confidence improved due to an aggressive vaccine rollout.

- As the affluent gained wealth in 2020, they fueled record sales for luxury carmakers who are experiencing even stronger demand so far this year.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- M. Holland is proud to be named among the Plastics News Best Places to Work again this year. We also were recently named among the Best Places to Work by Crain’s Chicago Business.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.