COVID-19 Bulletin: March 25

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude prices fell 2% Thursday after the EU failed to agree to a Russian energy boycott and reports surfaced that storm-damaged pipelines in the Black Sea could resume flows faster than expected.

- In mid-morning trading today, WTI futures were down 1.8% at $110.30/bbl, Brent was down 1.8% at $116.90/bbl and U.S. natural gas was up 1.6% at $5.49/MMBtu.

- The U.S. and its allies are considering another potential release of oil from strategic reserves to help calm global markets.

- More oil news related to the war in Europe:

- EU leaders will unveil a plan today to jointly buy more U.S. gas as they seek to cut reliance on Russian fuels. U.S. exporters have already shipped record volumes of LNG to Europe for three straight months.

- Canada aims to boost oil and gas exports by 300,000 bpd this year to help nations distancing themselves from Russian energy.

- Germany, Poland and Italy firmly rejected Russia’s demand to pay for Russian gas in rubles, creating uncertainty about some orders. Britain is considering the measure.

- Germany unveiled a second relief package to provide cash to households and subsidize fuel costs to help consumers cope with surging power and heating costs. The nation’s utilities are calling for an automatic emergency support system triggered if gas imports suddenly decline.

- OPEC officials weighed in against a potential European ban on Russian energy imports.

- Rystad Energy predicts India and China will import more discounted Russian crude to boost their output of refined products.

- U.S. fuel oil imports from the Middle East are set to rise to 17% of April purchases from 5% last year as refiners look to make up lost Russian supplies.

- Uzbekistan plans to increase natural gas production more than 20% by the end of the decade but will keep most of the extra output at home, despite rising European demand.

- Ecuador’s state oil firm declared force majeure on two Russian diesel cargoes after banks declined to finance their purchase.

- Indian fuel retailers have raised gas and diesel prices three times so far this week.

- British officials will unveil a plan by the end of the month to boost domestic nuclear and wind capacity.

- Despite the rapid growth of renewables, the Energy Information Administration predicts that oil and gas will comprise the largest portion of energy sources in the U.S. in 2050.

Supply Chain

- Terminals in Europe and North America have been told to brace for disruption from delayed shipments out of COVID-hit China.

- Mazda is suspending some Japanese production next month due to ripple effects from China’s COVID-19 outbreak.

- Cargo airlines say Hong Kong’s strict testing measures for air crews are reducing flights to and from the island.

- Trans-Pacific container lines are signing service contracts with small and midsize shippers at much higher rates than large retailers secured just months ago.

- Record high diesel prices are particularly hurting independent truckers and smaller fleets as shippers push back on rate increases.

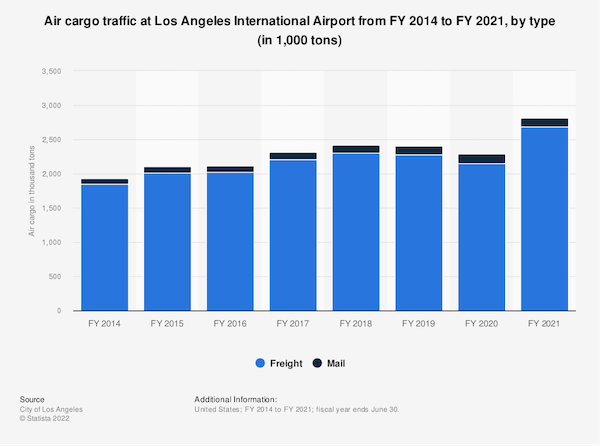

- Over 2.9 million tons of cargo passed through Los Angeles International Airport last year, up more than 20% from the previous year and shattering the previous record.

- The U.S. administration will make available another $2.9 billion in infrastructure dollars next week for port and freight projects.

- Massachusetts’ Port of New Bedford secured contractors yesterday for a $27 million expansion project.

- Nikola expects to deliver up to 500 of its long-awaited electric big rigs by year’s end.

- Construction is finished on Navistar’s new $250 million San Antonio commercial truck plant, which can produce 110 vehicles per day, including electric models.

- Maersk signed a five-year deal with Sweden’s Einride to electrify at least 300 heavy-duty trucks for use in the shipper’s North American warehousing, distribution and transport business.

- The U.S. Postal Service doubled its orders for electric vehicles yesterday alongside a new $3 billion order for 50,000 vehicles made by Oshkosh.

- Norfolk Southern is working with Wabtec to extend the lives of another 330 locomotives for 20 years, adding to some 500 modernizations already completed.

- A Maersk vessel lost some containers Monday in a northern Pacific storm.

- The U.K. is holding talks to formalize a post-Brexit trade deal with Canada, impacting some $25 billion in annual trade.

- A Hong Kong tech group is expanding its blockchain logistics software to European operators.

- Taiwanese freight forwarder Dimerco more than doubled its annual profit last year to over $81 million.

- More supply chain news related to the war in Europe:

- At least five merchant vessels have been hit by projectiles — with one of them sunk — off Ukraine’s coast, as 100 more remain stranded without a maritime corridor allowing them to escape.

- Freight forwarders are increasingly rejecting rail cargo between China and Europe, imperiling over 1 million containers that may now have to find new routes by sea.

- Sumitomo Electric Industries, a Japanese maker of wire and optical fiber cables, is transferring auto parts production from Ukraine to Romania and Morocco.

- The White House is warning of impending global food shortages while urging countries to drop trade restrictions that could limit food exports. Fertilizer costs are four times higher around the globe than they were in 2020.

- The London Metal Exchange is struggling to implement new daily price limits imposed last week after it was forced to suspend nickel futures trading when prices jumped 250%.

- U.S. oat production declined almost 40% last year on a record-low harvest, with effects rippling through the global food supply chain.

Domestic Markets

- The U.S. reported 44,134 new COVID-19 infections and 1,033 virus fatalities Thursday.

- Widespread immunity from the U.S.’s record number of COVID-19 infections last winter could blunt a possible surge of the more transmissible BA.2 subvariant, officials say. Cases of the so-called “stealth” subvariant jumped 130% in Los Angeles last week.

- New York City public schools saw over 1,400 new COVID-19 infections last week, the biggest weekly gain since the peak of Omicron in January. The city administration said it would not rehire the roughly 1,400 unvaccinated workers who were fired earlier this year.

- Cornell University elevated its pandemic warning level to yellow as it experiences a renewed uptick in COVID-19 infections.

- Wyoming and Mississippi have the U.S.’s only COVID-19 vaccination rates below 60% of eligible residents.

- Free COVID-19 testing for uninsured Americans ended yesterday as federal pandemic relief winds down.

- COVID-19 vaccination substantially reduces the risk of catching long-COVID symptoms, new research suggests.

- The CDC removed over 72,000 COVID-19 fatalities from its database, citing a coding error.

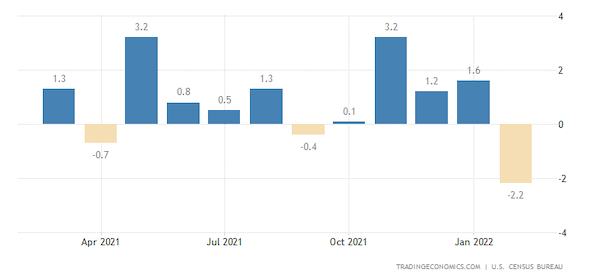

- U.S. core capital goods orders fell 0.3% in February, the first decline in a year following a 1.3% gain in January, while new orders for durable goods unexpectedly fell for the first time in five months:

- S&P Global’s composite purchasing managers index for U.S. services and manufacturing activity is at an eight-month high of 58.5 so far in March, while a measure of input prices accelerated to a near-record 76.8.

- The average U.S. mortgage rate hit 4.42% this week, the highest level since January 2019. Declining mortgage applications suggest the U.S. housing boom will cool over the coming months, according to Pantheon Macroeconomics.

- Apple is working on a subscription service for the iPhone and other hardware products, which could make device ownership similar to paying a monthly app fee.

- The percentage of new vehicles leased has dropped to 19% of overall auto sales, the lowest level since 2009, due to a severe shortage of dealer inventories.

- Uber is partnering with New York City Taxi to list all available taxis in the city on its mobile app, part of an effort to reduce driver shortages and curb high fares.

- Toyota is testing autonomous ride-hailing vehicles equipped with Aurora Innovation software in Texas.

- LG Energy Solution will invest $1.4 billion to build a battery factory in Arizona by 2024.

- Hertz has begun adding Tesla vehicles to its fleet following a disclaimed report last year about a supply deal with the automaker.

- Japan’s Hitachi is building a $70 million plant in the U.S. to make subway cars for the D.C. regional transit system.

International Markets

- The BA.2 “stealth” subvariant of Omicron now accounts for 86% of global COVID-19 infections, the World Health Organization said.

- China has reported over 1,000 new COVID-19 infections per day since March 12, with cases surging 60% yesterday to 1,609 in Shanghai alone, where food shortages are rising for locked-down residents. Economists forecast a potent economic hit from the nation’s hampered factory activity.

- Australia will begin rolling out fourth COVID-19 vaccine doses next month.

- More news related to the war in Europe:

- The U.S. announced a new package of sanctions on Russian elites, lawmakers and dozens of defense companies yesterday. Similar measures were taken by the U.K.

- Calls are rising among Western allies to boot Russia from the G20 major global economies.

- The World Health Organization warned that Russia’s invasion of Ukraine brought COVID-19 vaccinations there to a halt and decimated the nation’s healthcare system.

- The United Nations lowered its forecasts for global economic growth this year from 3.6% to 2.6%, with much of the slowdown pegged for the eurozone. An index of European services and manufacturing activity fell by a point to 54.5 so far in March.

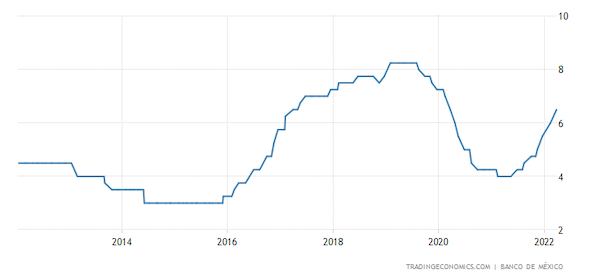

- Yesterday, Mexico’s central bank raised interest rates by half a percentage point to 6.5%, the highest level of the pandemic and its seventh consecutive rate hike.

- The United Nations will publish its first ever report focused on emerging carbon removal technology this April.

At M. Holland

- Our next Plastics Reflections Web Series is Wednesday, March 30 at 1:00 pm CT. This event focused on the current and future state of the North American plastics industry will feature panelists from Business Publishing International, Jabil (Inc), LyondellBasell and M. Holland. Click here to learn more and register.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.