COVID-19 Bulletin: March 4

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude prices were higher in early trading today, with the WTI up 1.2% at $61.99/bbl and Brent 1.2% higher at $64.85/bbl. Natural gas was 1.9% lower at $2.76/MMBtu.

- U.S. crude oil stockpiles surged by more than 21 million barrels last week, a record, as refineries took steep hits after mid-February’s Texas freeze.

- Gasoline stockpiles fell by 13.6 million barrels last week, the biggest drop since 1990, which could push pump prices above $3/gallon for the first time since 2014.

- Last week, the Baker Hughes count of active rigs in the U.S. increased by five to 402 from the prior week but remained well below the 790 active rigs in the prior-year period.

- Exxon predicts carbon capture will be a $2 trillion market by 2040 and that it is the cheapest way to address emissions, as the company makes plans to commercialize the technology in a new business unit. Exxon plans to constrain capital spending and maintain oil production at this year’s level in coming years in order to focus on debt reduction and achieving emission targets.

- With increasing investments into renewable energy, BP, Shell and Total are diving into a fast-growing market dominated by utility companies.

- A revised ethane agreement between Pemex and Braskem Idesa ties pricing to the international reference price, reduces the term to through 2024, and calls for cooperation between the firms in setting up a gas import terminal.

- The European Union approved a 17.5 billion euro Just Transition Fund to help communities impacted by the transition to clean energy industries.

- Green energy, which accounts for a fifth of the demand for copper, is getting more expensive as copper prices soar.

- EnergySage, an online solar installation marketplace, saw registrations spike 335% in Texas the week after the recent winter storm that caused widespread power outages.

Supply Chain

- Container lines are running out of ships in Asia as port congestion on the West Coast causes vessel turnarounds to take more than 11 days in most instances.

- Prices for used container ships have doubled in the past year and are up as much as four-fold in the past five years.

- Nearly a quarter of FedEx Express shipments did not arrive on time at its Memphis hub, a result of continued backlogs and delays after last month’s deep freeze.

- LATAM Cargo ordered four more Boeing 767 freighters as the company seeks to meet surging Latin American cargo demand.

- The U.S. Postal Service is mulling whether to partner with private commercial services for last-mile deliveries of goods to international destinations, potentially moving ahead with plans by the end of the month.

- FedEx announced a $2 billion plan to electrify its vehicles on a path toward carbon neutrality by 2040.

- BMW will begin using trucks powered by liquefied natural gas to deliver engines to an assembly plant in Germany, part of the company’s goal to make all the cargo transport for its operations carbon neutral by 2050.

- General Motors is extending production cuts at three North American plants due to a continuing global shortage of semiconductor chips.

- The computer chip shortage has stalled deliveries of Class 8 trucks, which are in short supply due to red hot freight markets.

- Texas’s grid operator released the names of eight more energy companies that have failed to pay nearly $1 billion for power and services during February’s cold front. Meanwhile, the state’s electricity regulator ordered further cuts to emergency fees paid to generators, potentially protecting consumers from exorbitant bills received after the storm.

- A second Texas power retailer has been barred from the state’s power market for failure to make more than $230 million in payments to generators and others.

- ERCOT, operator of the Texas power grid, fired its CEO yesterday as the fallout continues from the mid-February winter storm.

- Injection molder Confer Plastics announced 40 layoffs due to raw material shortages attributed to the recent winter storm that crippled Gulf Coast resin production coupled with the prioritization of limited available supplies to essential products.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

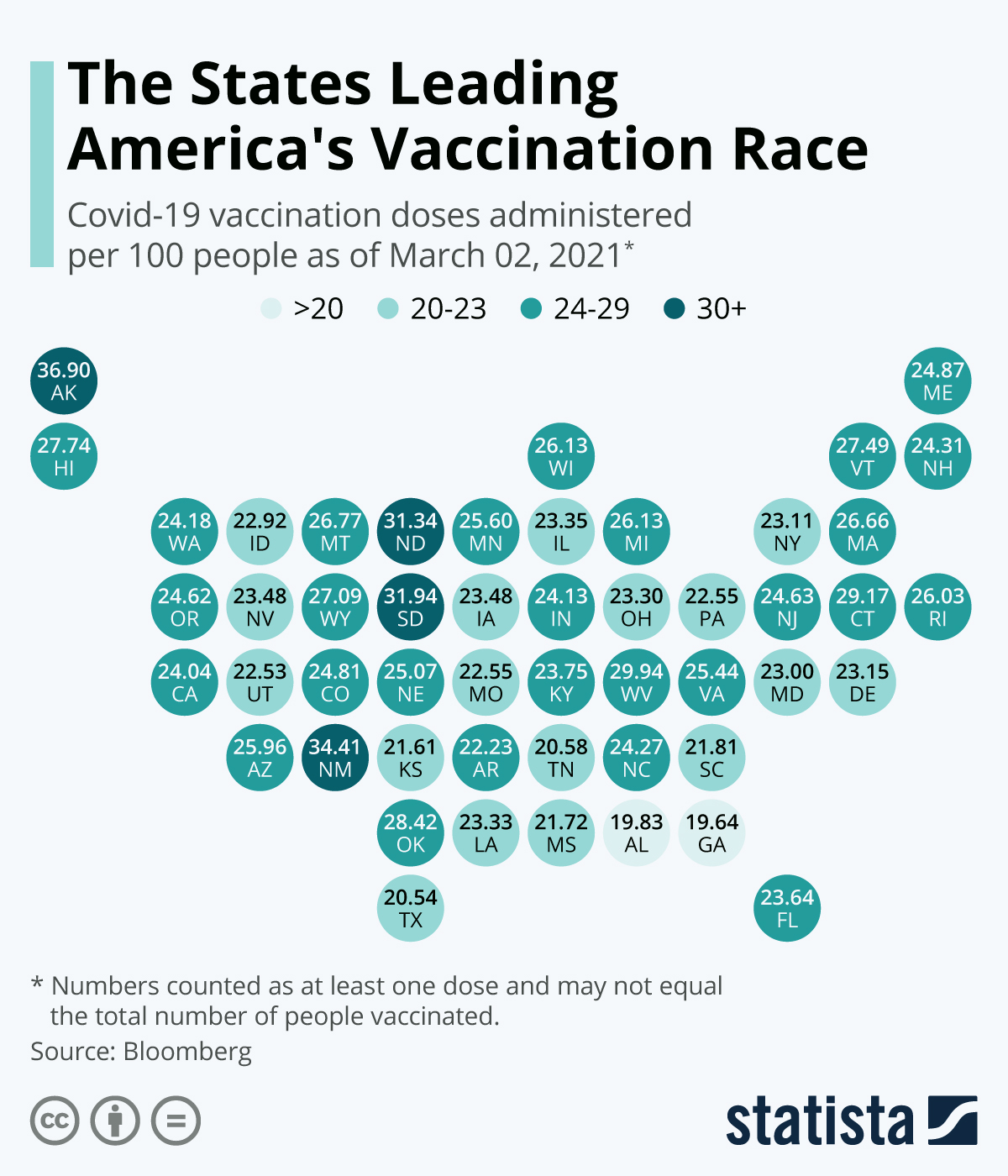

- New COVID-19 cases in the U.S. increased yesterday to 65,909, while deaths also jumped to 2,468. Over 80 million vaccine doses have been administered, with 8.2% of the population fully vaccinated.

- The pace of U.S. COVID-19 vaccinations topped 2 million daily doses for the first time yesterday.

- Buoyed by a surge in vaccine shipments, states and cities are rapidly increasing eligibility for COVID-19 shots to teachers, Americans over 50 years old and other non-prioritized workers.

- Mississippi followed Texas in rolling back most COVID-19 restrictions, including eliminating mask mandates and allowing businesses to operate at full capacity.

- Some of the biggest U.S. retail, theater, hotel and restaurant chains will continue to require mask-wearing in their Texas locations after the state drops COVID-related restrictions next week.

- The federal government is mandating that masks be worn on all freight and passenger rail operations, a supplement to the White House’s recent directive to require mask-wearing at airports and on planes.

- U.S. commuting is slowly increasing, reaching its highest level since March 2020 last week.

- New York City says COVID-19 vaccines will be available to all adults as soon as late April.

- More than a dozen U.S. health-insurance providers are providing 2 million of America’s most vulnerable seniors with COVID-19 vaccines.

- Researchers are quickly developing a method of administering COVID-19 vaccines without the use of a syringe and needle, garnering significant investment dollars and big-name partners in the process.

- The world’s fastest-developed vaccine prior to COVID-19 took four years to create, while new mRNA technology allowed Pfizer and other companies to produce coronavirus shots in mere months.

- American Airlines and United Airlines will begin providing workers with Johnson & Johnson’s one-shot COVID-19 vaccine at Chicago’s O’Hare airport.

- Thousands of California farmers, many of whom are undocumented, are being pulled into pop-up vaccination clinics hosted by their employers as agriculture growers seek to immunize an essential part of their workforce.

- A study of Vir Biotechnology’s COVID-19 antibody drug has stopped enrolling volunteers over concerns about the treatment’s effectiveness.

- In its review of a proposed $1.9 trillion coronavirus stimulus package, the U.S. Senate is limiting eligibility for $1,400 direct payments to some Americans, which could affect millions of U.S. households. The Senate is expected to vote on the bill during a session this weekend.

- U.S. economic activity continued to grow modestly in the first several weeks of 2021, according to the Federal Reserve’s Beige Book compendium of anecdotes about the economy.

- First-time jobless claims in the U.S. rose slightly to 745,000 last week.

- U.S. private payroll jobs increased less than expected in February, rising by only 117,000 compared to the 195,000 jobs gained in January, according to ADP.

- The average wage in the U.S. rose last year after the pandemic took a disproportionate toll on lower-wage jobs.

- The U.S. birth rate could fall by 300,000 this year due to the pandemic, mirroring a drop in fertility rates in other industrialized countries that could portend long-term social and economic consequences.

- Disney will close 60 North American retail stores, a fifth of its global network, as it shifts to e-commerce.

- German meal-kit company HelloFresh more than doubled its sales in the fourth quarter, a result of the continued trend of cooking more meals at home during coronavirus-related lockdowns.

- After a four-year stall, the U.S. administration is readying more than $40 billion in stocked up funds to boost the nation’s transition to clean energy.

- The SEC plans to increase examinations of socially responsible fund managers to ensure they are really making investments consistent with environmental, social and governance (ESG) principles. For example, the largest ESG fund in the U.S. has no direct investments in renewable energy.

International

- After weeks of decline, global COVID-19 infections rose 7% last week, causing concern for the World Health Organization.

- Brazil set a daily record for COVID-19 deaths for the second consecutive day as the virus rages in Sao Paulo, the nation’s largest city.

- India’s Bharat Biotech COVID-19 vaccine is 81% effective, a boon for one of the world’s most populated countries.

- French health authorities are urging that AstraZeneca/Oxford’s COVID-19 vaccine be made available to all people over 65 years old after the country largely restricted the vaccine’s use to only a fraction of its population.

- German lawmakers agreed to a phaseout of COVID-19 curbs yesterday, a five-stage plan beginning with easing household gathering limits on March 8.

- Research in the U.K. showed Pfizer/BioNTech’s and AstraZeneca/Oxford’s COVID-19 vaccines reduced the risk of hospitalization for COVID-19 by 80% in elderly patients.

- Thailand is set to reopen tourism with a vaccine passport system in the works.

- The European Union and China are both moving ahead with plans for vaccine passports that would declare a person’s vaccination status or recent test results.

- Mexico’s peso is expected to fluctuate erratically next quarter amid uncertainty caused by the administration’s push toward increasing state control over its electricity industry. The country’s GDP is expected to rise nearly 5% this year, higher than initially predicted after suffering its steepest recession in almost 90 years in 2020.

- Brazil’s GDP shrank by 4.1% last year, its worst drop in decades.

- Thai Airways will cut 50% of its workforce and significantly reduce its aircraft in operation due to the continued downturn in air travel.

- After reporting the biggest loss in its history, Lufthansa remained pessimistic about prospects for the airline industry, forecasting continuing struggles this year and no return to pre-pandemic demand until 2025.

Our Operations

- Listen to M. Holland’s 2021 Market Trends Podcast Series episodes featuring insight from our Market Managers.

- Visit our new 3D Printing e-commerce site.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.